NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

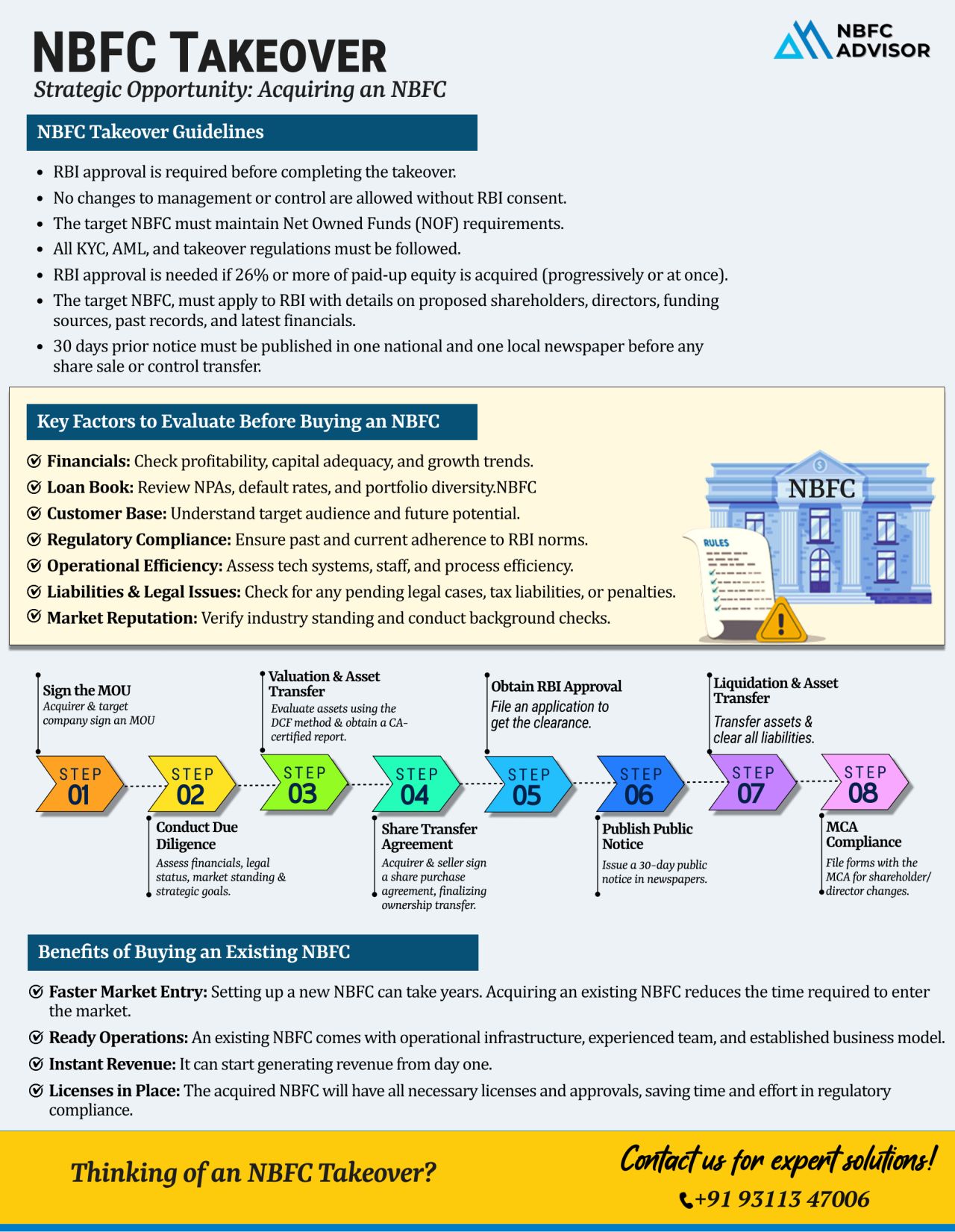

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know Before You Buy

Acquiring an NBFC (Non-Banking Financial Company) can open doors to lending, fintech expansion, digital credit, and financial services — but only if the acqu...

Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and ...

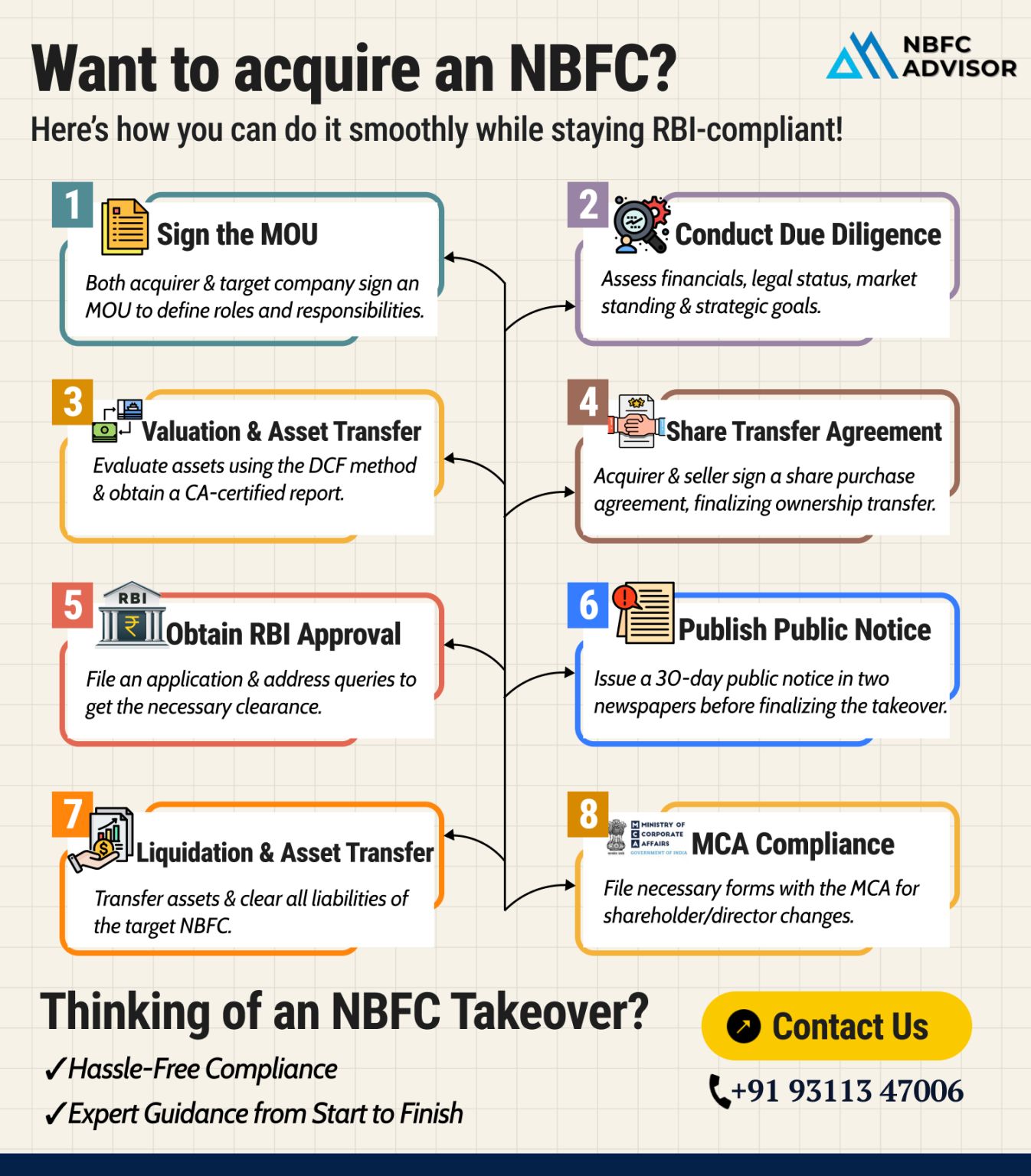

Acquiring a Non-Banking Financial Company (NBFC) can unlock exciting growth opportunities—but staying compliant with RBI regulations is non-negotiable.

Here’s how to acquire an NBFC the right way:

1️⃣ Sign the MoU

Define roles, res...