Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mistake in due diligence, valuation, or RBI approval can derail the entire transaction.

Let’s break down how an NBFC takeover actually works and what you must get right.

Why NBFC Takeovers Are Complex

An NBFC is regulated by the Reserve Bank of India (RBI). Any change in ownership or control requires strict compliance with RBI guidelines. Unlike normal business acquisitions, you’re not just buying assets—you’re stepping into a regulated financial ecosystem.

Key risks include:

- Hidden compliance gaps

- Incorrect valuation

- Delays or rejection from RBI

- Legacy liabilities

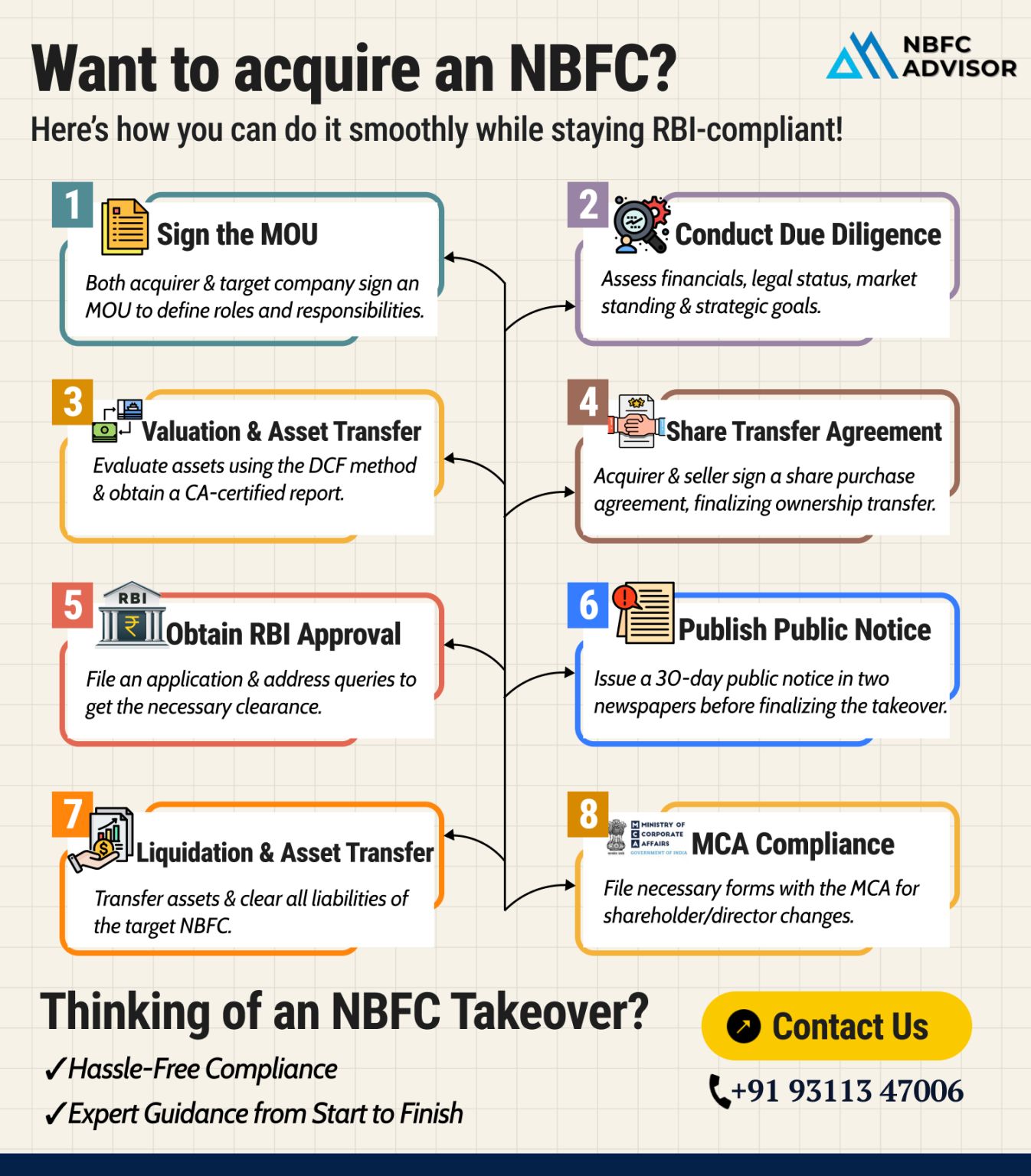

Step-by-Step Process of an NBFC Takeover

1. Deal Sourcing

Identifying a clean, compliant, and RBI-registered NBFC is the first challenge. Many NBFCs available for sale have unresolved regulatory or financial issues.

2. Due Diligence

This is the most critical phase. It includes:

- Regulatory compliance review

- Loan book and asset quality analysis

- Statutory filings and RBI returns

- Financial, legal, and tax checks

Even one missed red flag can become a major liability post-takeover.

3. Valuation

NBFC valuation depends on:

- Net Owned Funds (NOF)

- Asset quality

- Profitability

- Compliance history

Overvaluation or poor structuring can create future regulatory and financial problems.

4. RBI Approval

RBI approval is mandatory for change in management or control. The application must include:

- Shareholding structure

- Source of funds

- Promoter background

- Business plan and governance framework

Any inconsistency can lead to delays or rejection.

5. Transfer & Post-Takeover Compliance

Once approved, shares are transferred, management is restructured, and ongoing RBI compliance must be maintained from Day 1.

Why Many Investors Choose NBFC Takeovers

If done correctly, an NBFC takeover offers:

- Faster market entry

- Ready regulatory structure

- Existing licenses and approvals

- Operational stability from Day 1

It’s often more efficient than applying for a fresh NBFC license.

How We Help

We provide end-to-end NBFC takeover support, including:

- Verified NBFC deal sourcing

- Comprehensive due diligence

- Valuation assistance

- RBI approval documentation and follow-ups

- Post-takeover compliance guidance

Our goal is to ensure your acquisition is secure, compliant, and future-ready.

Need Expert Support?

If you’re planning an NBFC takeover or need help with due diligence or RBI approval, connect with us today.

📩 DM us for verified NBFCs and complete compliance support.

Hashtags

#NBFCAdvisor #NBFCTakeover #RBICompliance #Regulatory #Fintech