𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐑𝐞𝐪𝐮𝐢𝐫𝐞 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Understanding GST obligations for Alternative Investment Funds

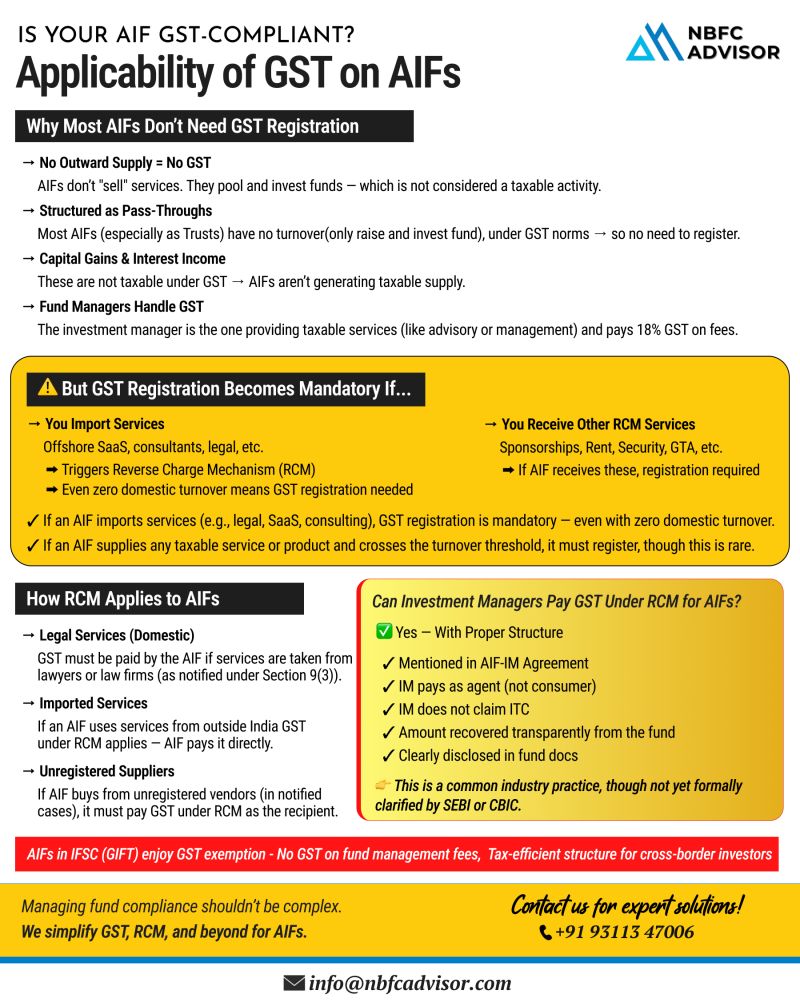

As the Alternative Investment Fund (AIF) landscape continues to grow in India, so does the complexity around tax compliance—particularly GST. One common question fund managers and trustees face is: “Does our AIF need to register under GST?”

The answer isn’t always straightforward. Let’s break it down.

✅ In Most Cases, AIFs Do Not Need GST Registration

Generally speaking, AIFs themselves do not supply goods or services, and therefore are not required to register under GST. Here's why:

-

GST on fund management or advisory services is collected and paid by the fund manager, not the AIF.

-

The returns earned by the AIF—such as capital gains, interest, or dividends—are not considered taxable supplies under GST.

If your AIF is purely investment-focused and does not engage in any outward taxable supply, you’re likely outside the GST net.

⚠️ But Watch Out for RCM Scenarios

Despite having no taxable revenue, your AIF may still be required to register under GST if it falls under the Reverse Charge Mechanism (RCM).

🌍 1. Import of Services

If your AIF avails services from outside India—such as:

-

Legal or tax advice

-

SaaS platforms or investment tech tools

-

Consulting services

…then you must pay GST under RCM, and registration becomes mandatory.

🇮🇳 2. Domestic Services Covered Under RCM

Even if you operate entirely within India, GST applies under RCM if you use:

-

Sponsorship or branding services

-

Security, housekeeping, or legal services from Indian providers

In both cases, the liability to pay GST shifts to the AIF, triggering compulsory registration—regardless of whether you have any turnover.

🚨 Why Some AIFs Are Receiving GST Notices

Recently, several AIFs have received GST notices—not for active non-compliance, but due to uncertainty or lack of awareness around RCM provisions.

Many funds using cross-border services or working with domestic vendors didn’t realize they had a GST liability under RCM, which led to missed registrations or payments.

If your AIF uses any such services, a proactive compliance review is essential.

🏦 What About GIFT City (IFSC) AIFs?

AIFs operating in GIFT IFSC enjoy major tax advantages, including:

-

GST exemption on management fees

-

No GST on many cross-border transactions

This makes GIFT City a preferred jurisdiction for structuring Category III AIFs seeking tax efficiency.

📊 Quick Snapshot: Do You Need GST Registration?

| Scenario | GST Registration Needed? |

|---|---|

| AIF earns only capital gains/interest | ❌ No |

| Management fees charged by manager | ❌ No (Manager handles GST) |

| AIF imports services (legal, SaaS, etc.) | ✅ Yes (RCM applies) |

| Domestic RCM services used (sponsorship, legal) | ✅ Yes |

| GIFT City AIF | ❌ Largely exempt |

📞 Need Clarity on GST for Your AIF?

We assist fund managers, NBFCs, and trustees with:

-

GST applicability assessment

-

AIF registration under GST (if required)

-

Responding to tax notices

-

Ensuring documentation and compliance

Book your FREE consultation today

📞 +91 93113 47006

#NBFCAdvisor #AIF #GST #ReverseCharge #AlternativeInvestment #NBFC #GIFTIFSC #RCM #FinanceCompliance #SEBI #FundManagers