NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

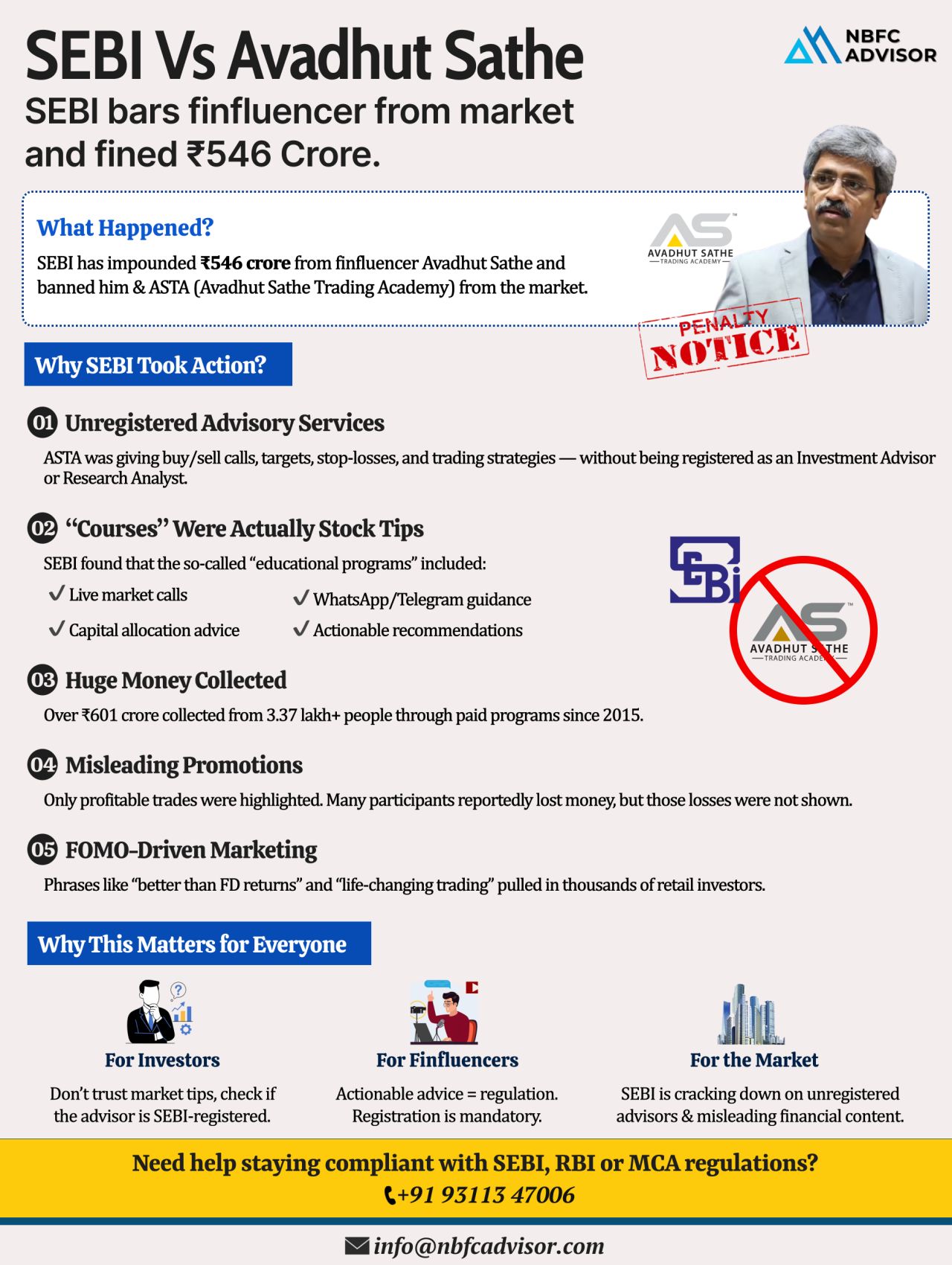

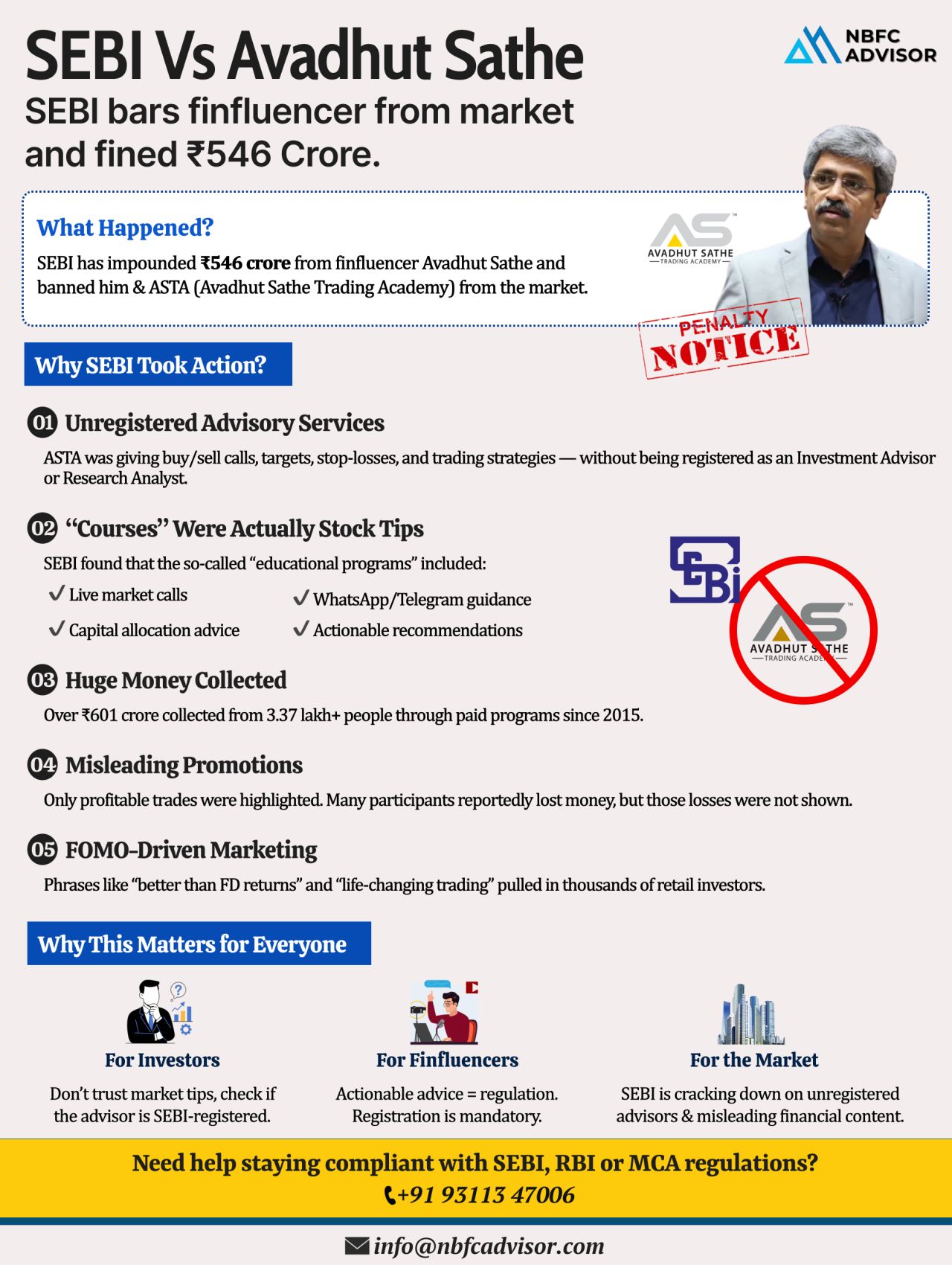

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from ...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe a...

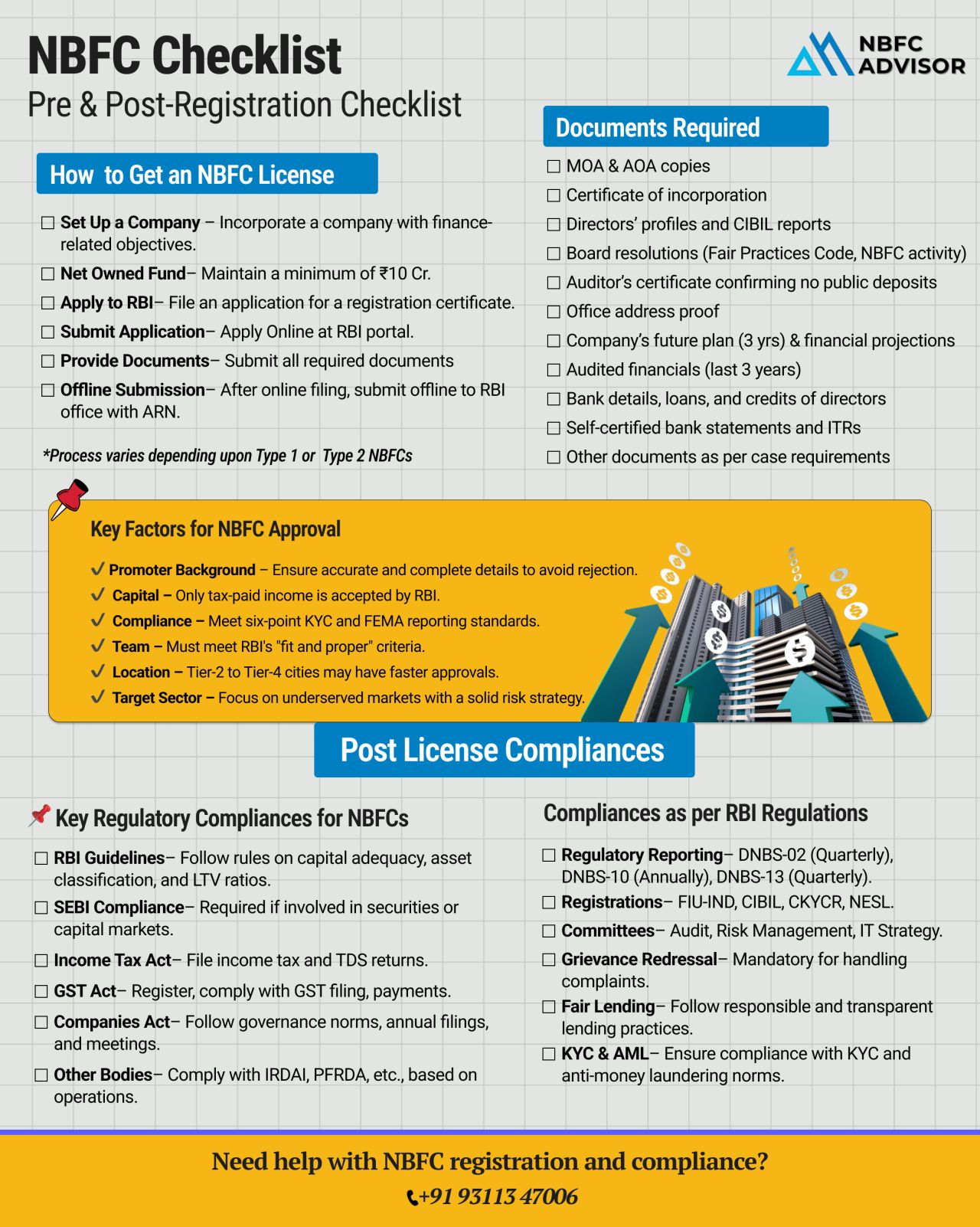

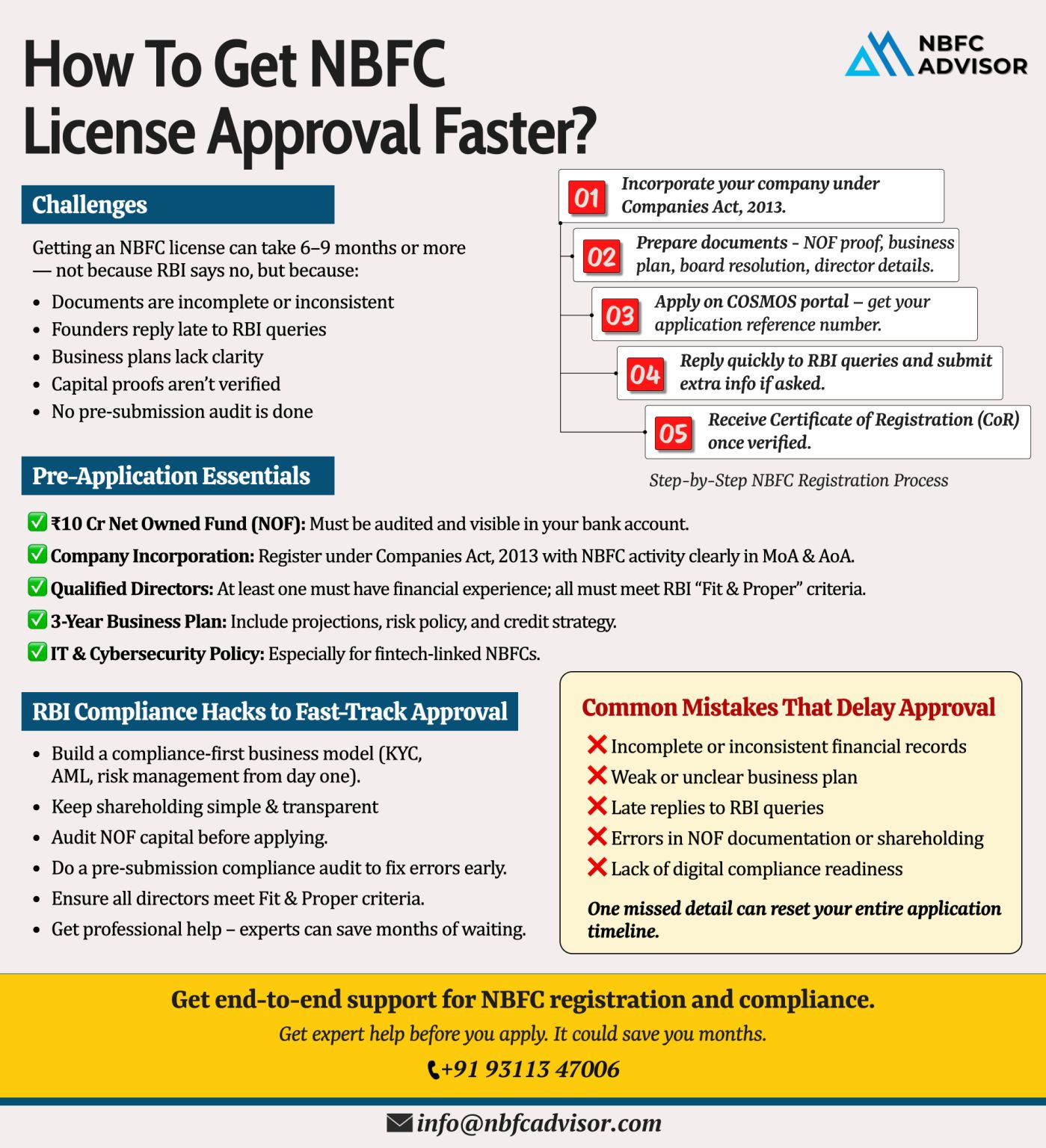

NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey wi...

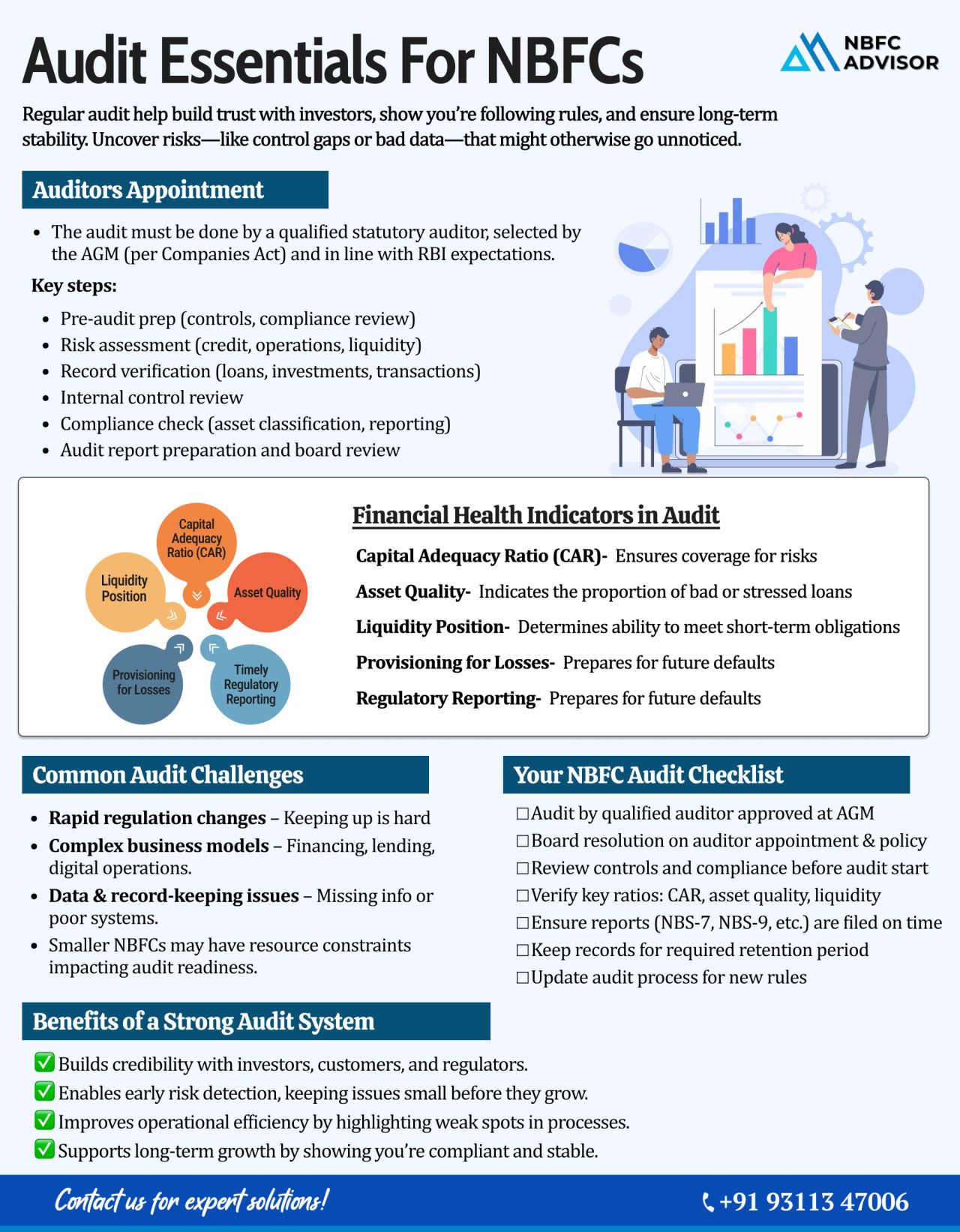

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

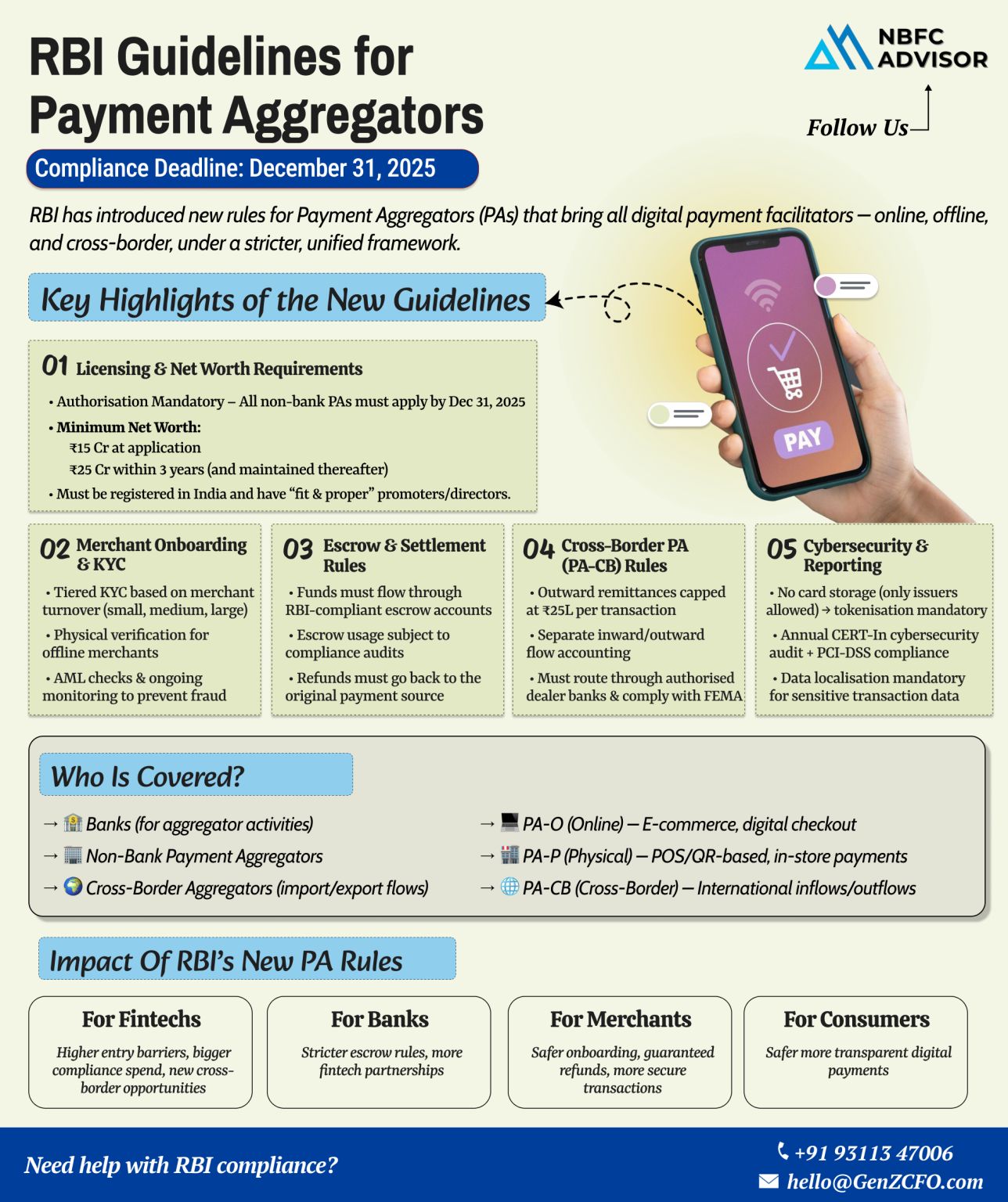

RBI’s Guidelines for Payment Aggregators: What Every Fintech Should Know!

India’s digital payments ecosystem has seen exponential growth in recent years — from UPI to wallets and payment gateways. To keep pace with this innovatio...

Top Mistakes NBFC Founders Make While Applying for an RBI License (and How to Avoid Them)

Top Mistakes NBFC Founders Make While Applying for an RBI License

Getting an NBFC (Non-Banking Financial Company) License from the Reserve Bank of India (...

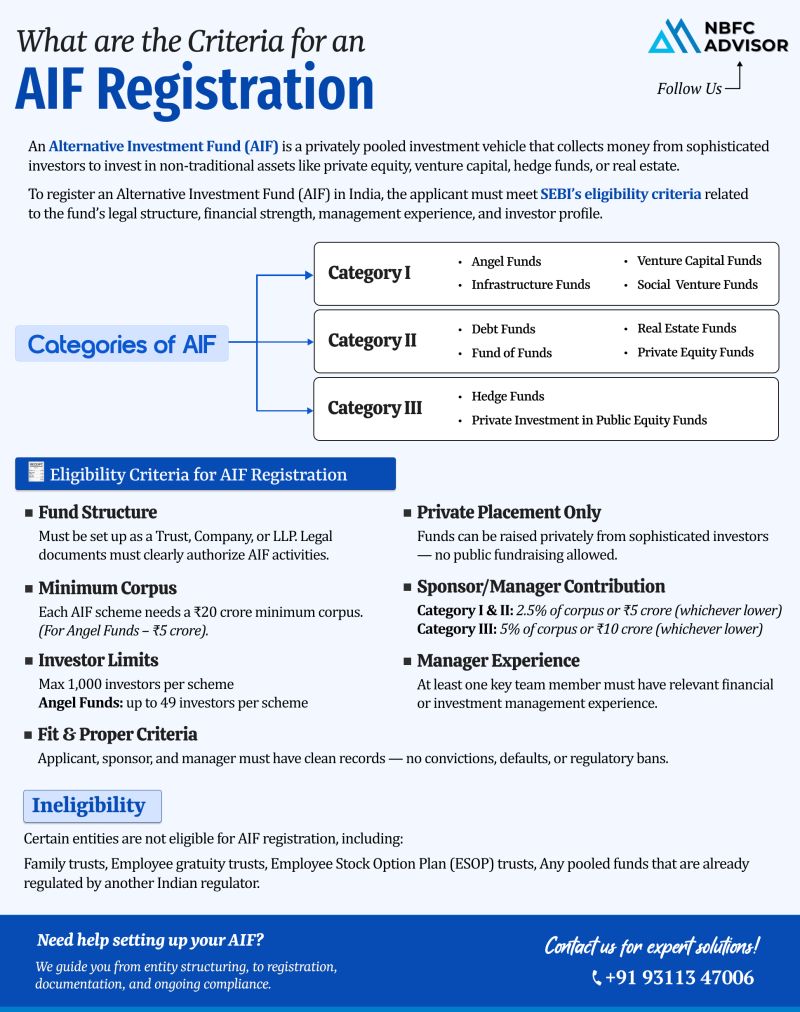

Thinking of Starting an Alternative Investment Fund (AIF)? Here’s What You Should Know

India’s financial landscape is rapidly evolving, and Alternative Investment Funds (AIFs) have emerged as one of the most attractive investment vehic...

Why Are NBFCs Turning to Loan Against Property (LAP)?

India’s Non-Banking Financial Companies (NBFCs) are entering a new growth phase — and Loan Against Property (LAP) is leading the way.

The Shift Toward Secure, Reliable, and Scala...

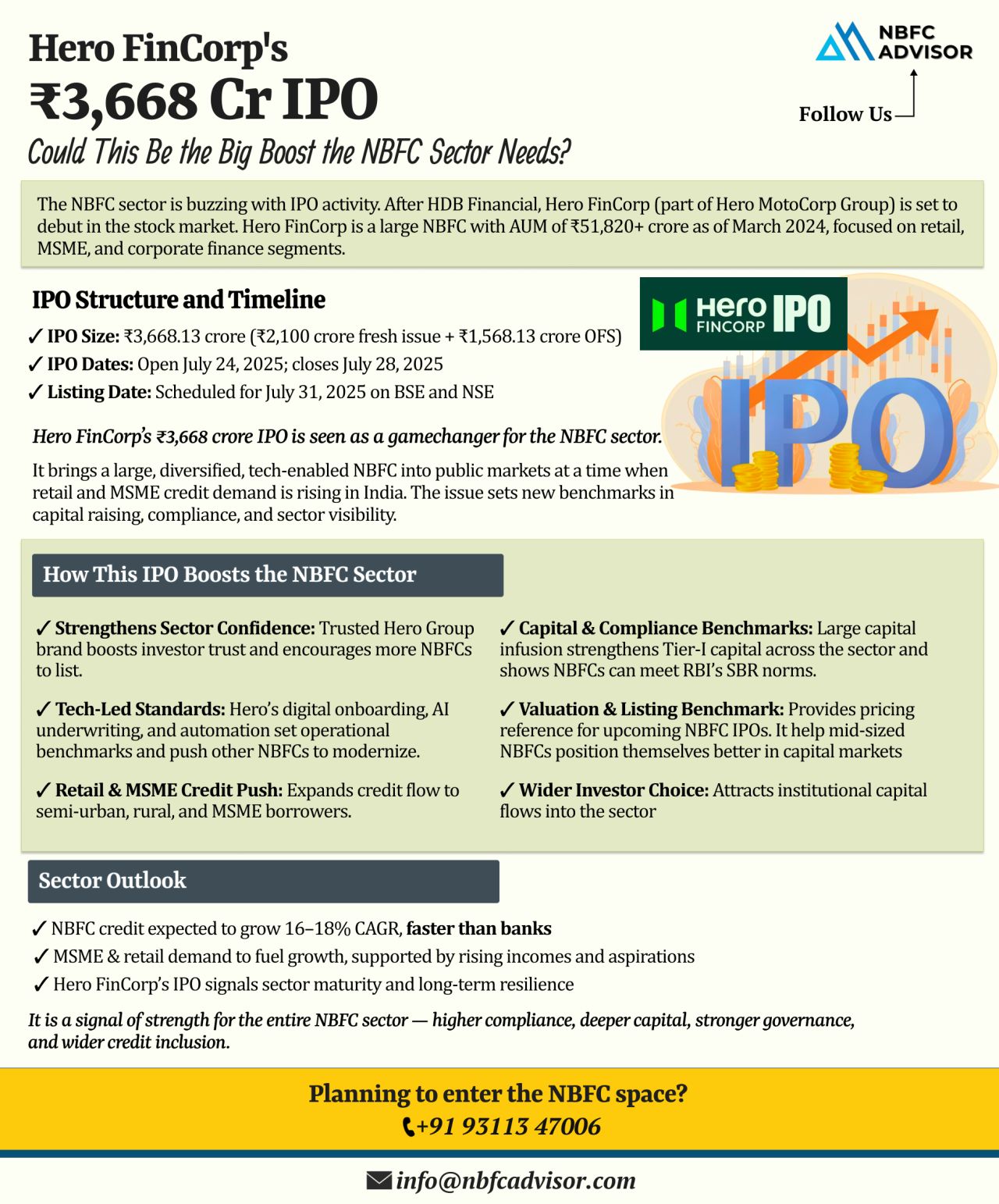

Hero FinCorp’s ₹3,668 Cr IPO: What It Means for the NBFC Sector

The Non-Banking Financial Company (NBFC) sector in India is witnessing a surge in Initial Public Offerings (IPOs), signaling a phase of growth and investor confidence. Following...

Cheques Will Clear in Just Hours – Rolling Out October 2025

Big changes are coming for India’s banking sector! The Reserve Bank of India (RBI) is all set to transform cheque clearance, cutting down waiting times from days to only a few...

NBFC Takeovers: The Quickest Gateway to India’s Digital Lending Boom

India’s digital lending market is on a steep growth curve, projected to reach $515 billion by 2030. Innovative financial solutions such as peer-to-peer (P2P) lending,...

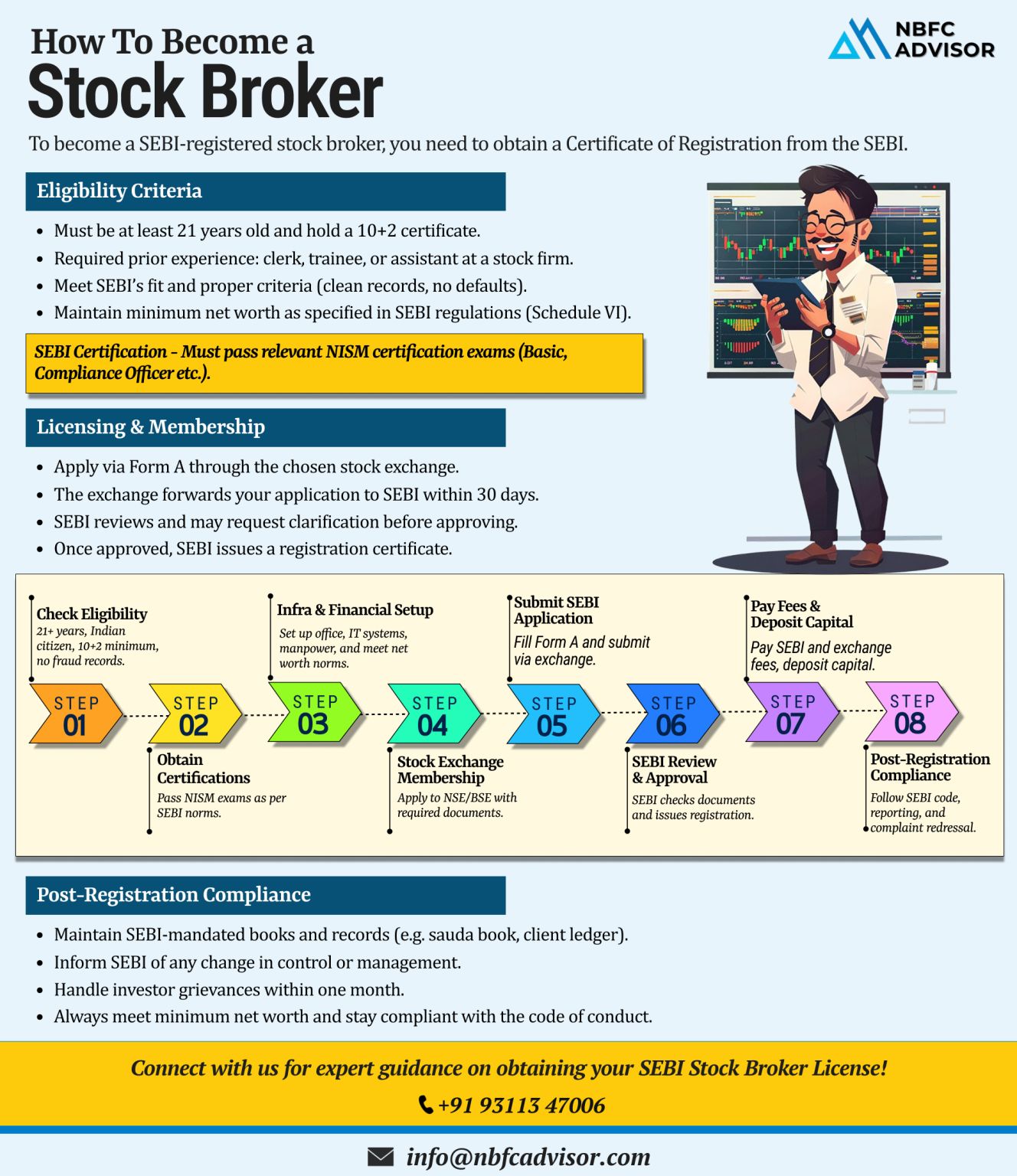

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

Is Your NBFC Ready for the Latest RBI Updates?

The Reserve Bank of India (RBI) is rolling out significant measures to tighten the compliance landscape for Non-Banking Financial Companies (NBFCs). These updates span digital lending, reporting requi...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

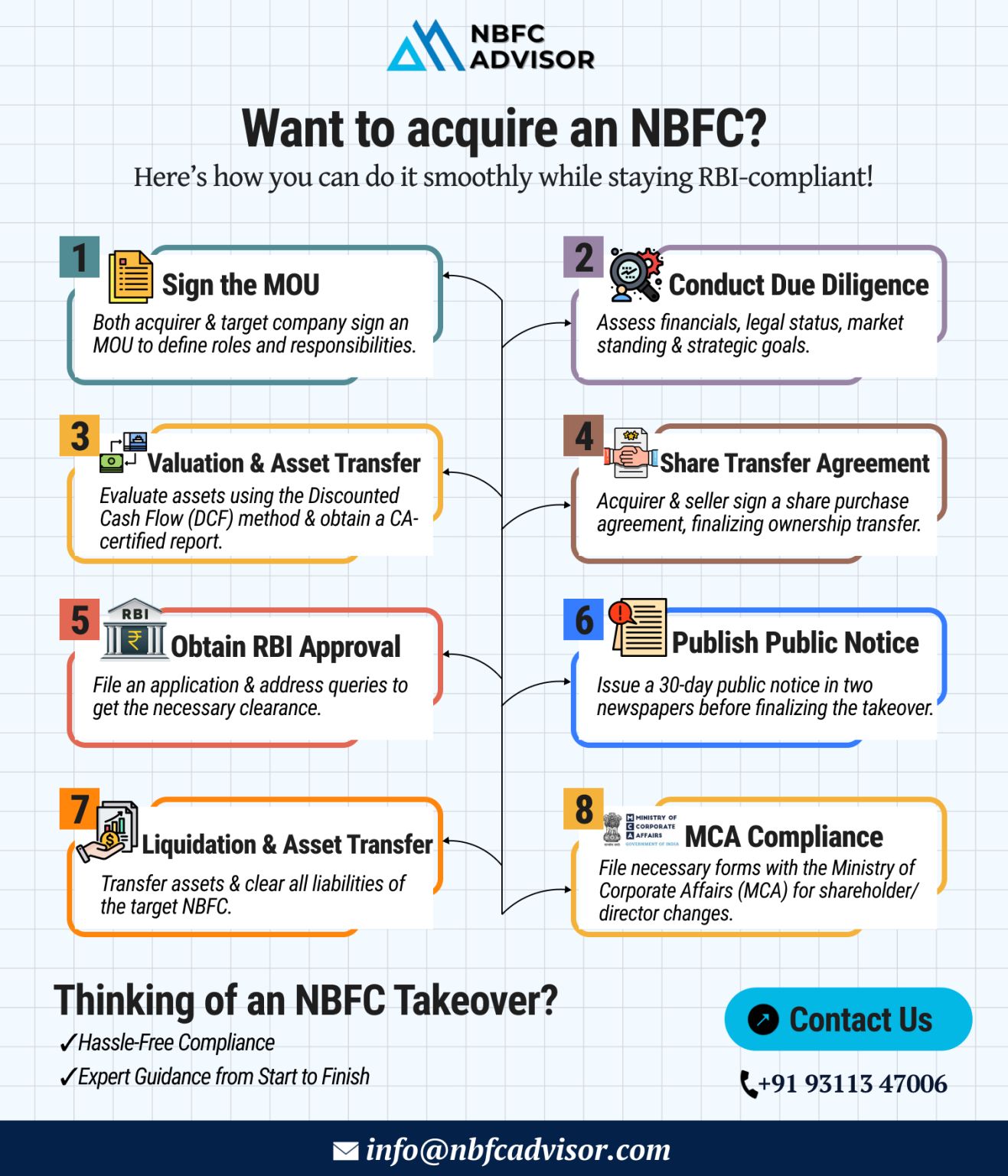

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

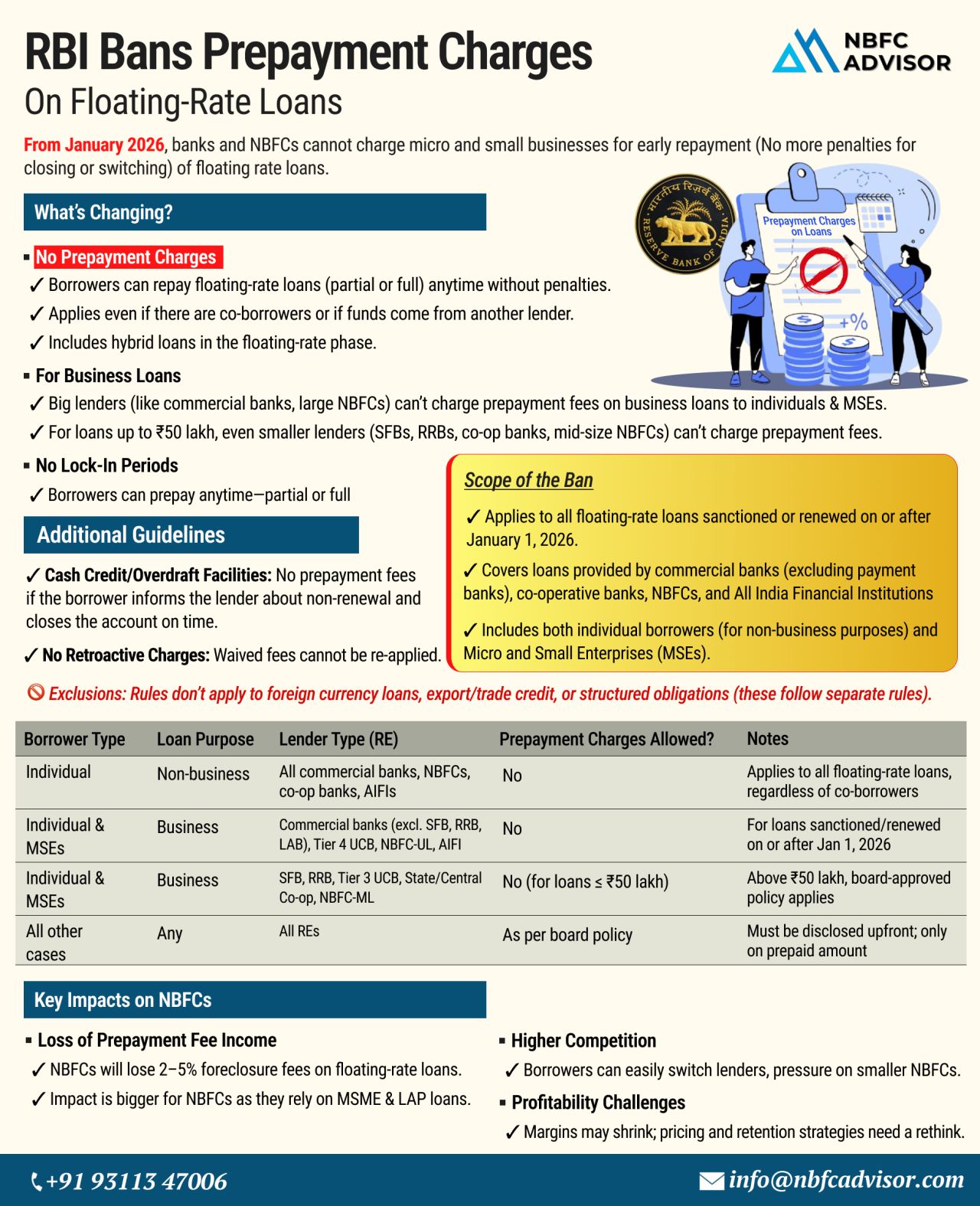

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

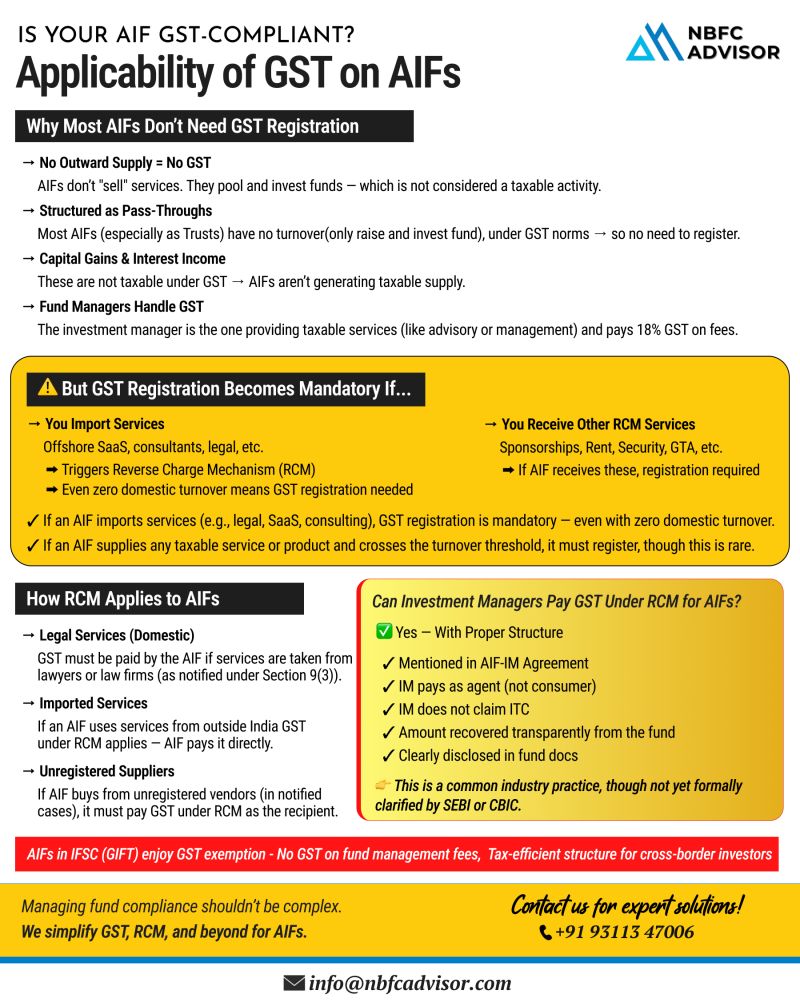

𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐑𝐞𝐪𝐮𝐢𝐫𝐞 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Understanding GST obligations for Alternative Investment Funds

As the Alternative Investment Fund (AIF) landscape continues to grow in India, so does the complexity a...

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐮𝐥𝐞𝐬 — 𝘈𝘳𝘦 𝘠𝘰𝘶𝘳 𝘖𝘱𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘴 𝘊𝘰𝘮𝘱𝘭𝘪𝘢𝘯𝘵?

India’s digital lending ecosystem is expanding at an unprecedented pace. But with rapid growth comes increasing...

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘶𝘭𝘦𝘴 𝘈𝘳𝘦 𝘊𝘩𝘢𝘯𝘨𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under an entirely new regulatory framework—and the implications are significant for startups, inves...

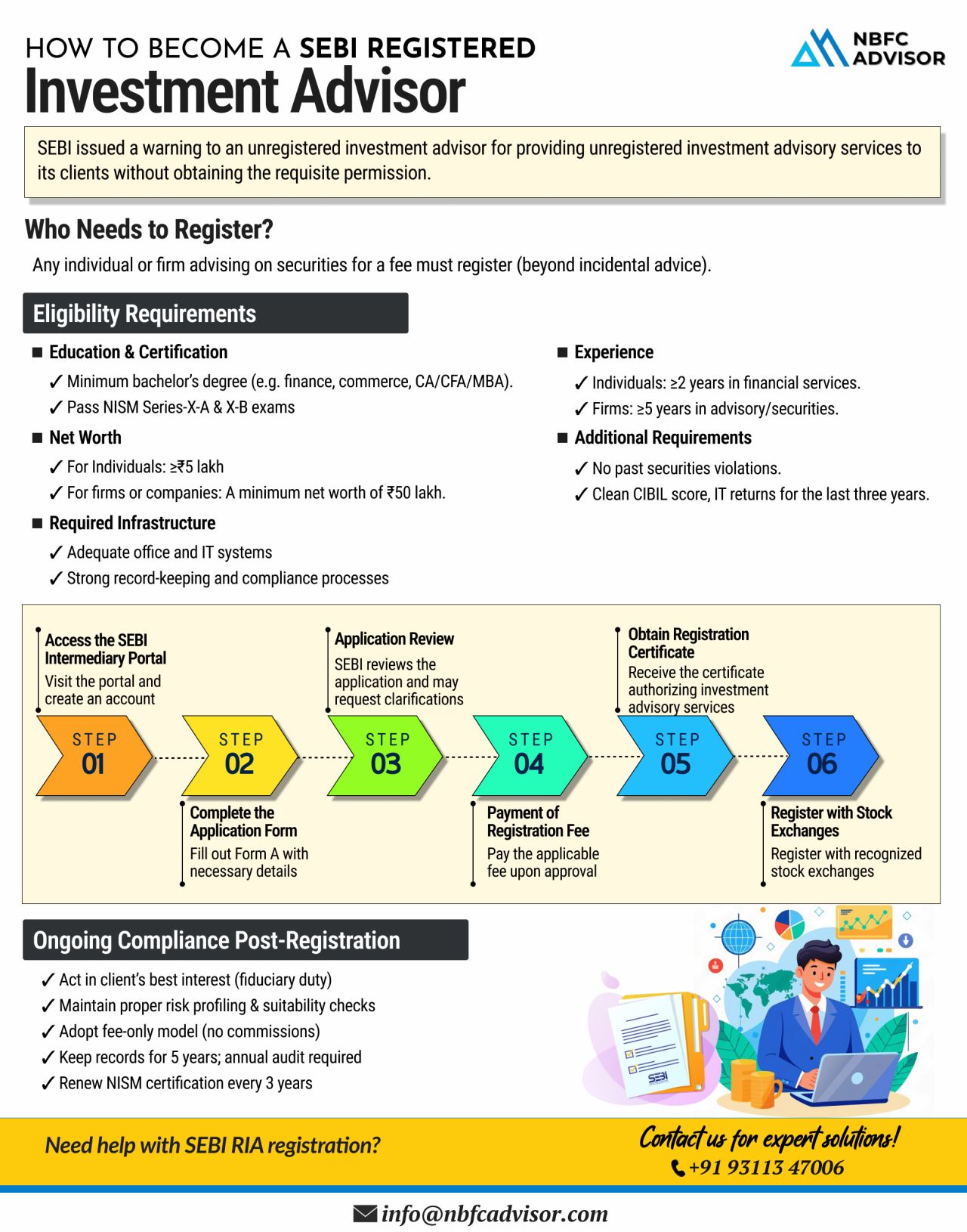

⚠️ SEBI Issues Stern Warning to Unregistered Investment Advisors – Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strong warning to unregistered investment advisors. If you're offering financia...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

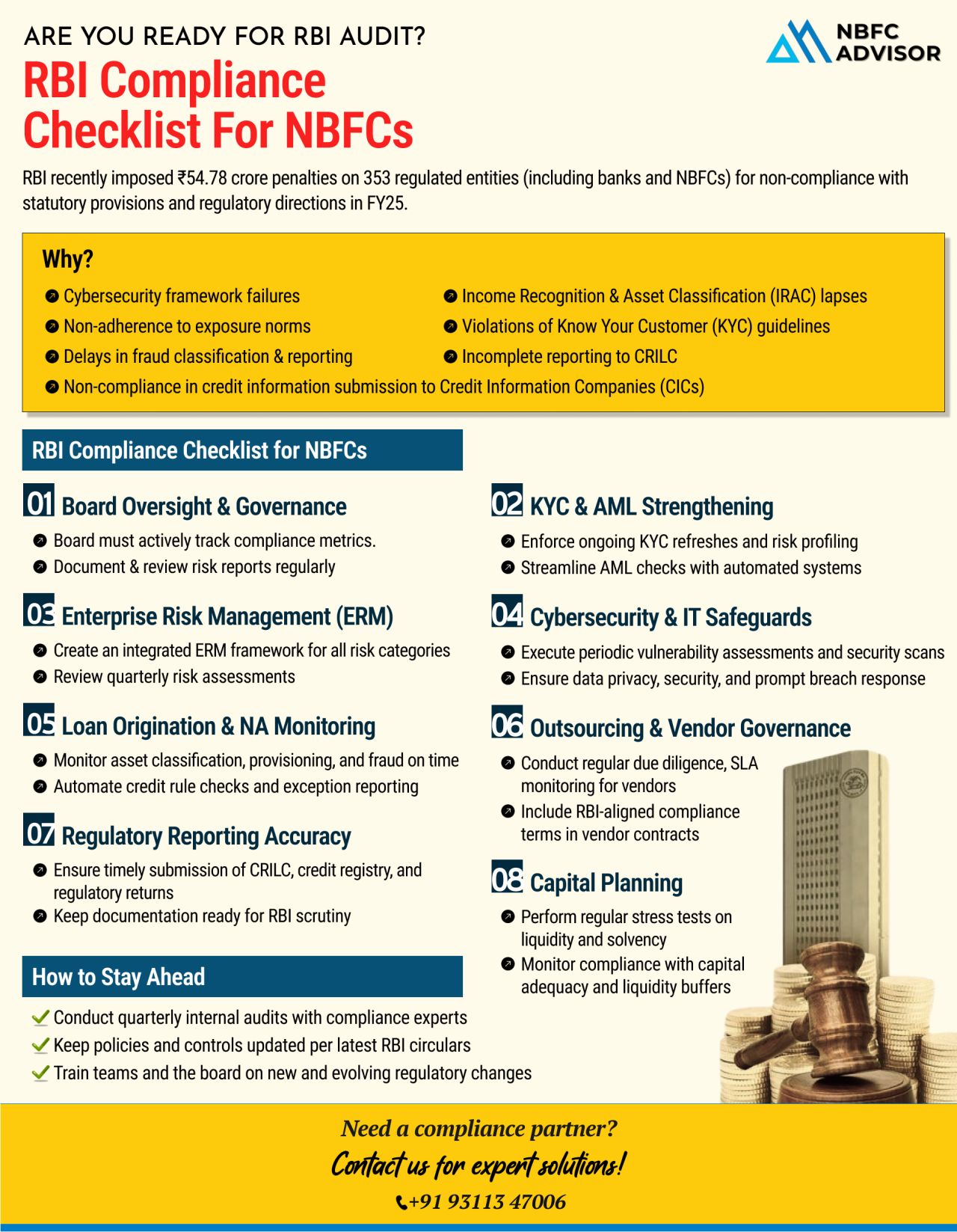

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

If you’re passionate about guiding people toward better financial decisions, becoming a SEBI Registered Investment Advisor (RIA) is a smart and impactful career move.

India needs more qualified, ethical, and SEBI-recognized advisors—an...

The Reserve Bank of India (RBI) has issued a directive that could significantly reshape how Non-Banking Financial Companies (NBFCs) and fintechs collaborate in the digital lending space.

Key Update

NBFCs can no longer rely on Default Loss Guara...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

Here’s Your Complete Roadmap

India’s stock market is expanding rapidly, offering exciting opportunities for professionals looking to enter the financial sector. If you're aiming to become a SEBI-registered stock broker, you’l...

Have you ever wondered how credit rating giants like CRISIL, ICRA, and CARE operate?

It’s not just about analyzing financial statements—it’s about aligning with SEBI’s stringent regulations and building a strong internal fr...

India’s Non-Banking Financial Companies (NBFCs) are growing at a pace that’s outstripping the country’s GDP, signaling a major shift in the financial services landscape. This acceleration is powered by rapid credit expansion, digita...

India's digital transaction volume has skyrocketed from 2,071 crore in FY 2017–18 to a staggering 18,737 crore in FY 2023–24, reflecting a CAGR of 44%.

This rapid growth presents a massive opportunity for businesses looking to ente...

Acquiring a Non-Banking Financial Company (NBFC) can unlock exciting growth opportunities—but staying compliant with RBI regulations is non-negotiable.

Here’s how to acquire an NBFC the right way:

1️⃣ Sign the MoU

Define roles, res...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

Fintech–NBFC–Bank partnerships are leading a significant transformation — reshaping lending models, expanding access, and simplifying financial services.

Opportunities

Digital loans and banking are now reaching Tier 2 an...

The gold loan industry in India is experiencing rapid growth. It is expected to cross ₹10 lakh crore in FY25 and reach ₹15 lakh crore by 2027.

NBFCs Are Leading the Surge

Non-Banking Financial Companies (NBFCs) are playing a major role in this ...

The NBFC Account Aggregator (AA) framework is revolutionizing financial data sharing in India. An NBFC-AA is a regulated intermediary that allows individuals to securely consolidate and share their financial data—such as bank, insurance, mutual...

India’s NBFC sector is projected to reach ₹60 trillion by FY26—now is the perfect time to enter the market.

Why Start an NBFC?

✔ Fintech NBFCs are growing rapidly

✔ Huge demand in credit-deprived sectors

✔ Faster loan disbursals t...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

Valued at $350 billion, India’s lending market is projected to surpass $720 billion by 2030 — unlocking immense opportunities for lenders across the ecosystem.

What is Co-Lending?

Introduced by the RBI, co-lending allows banks and...

In the era of Open Finance, NBFC Account Aggregators (AA) are revolutionizing how financial data is shared, accessed, and utilized. If you're a fintech, NBFC, or financial service provider, an NBFC-AA license could be your key to unlocking a futu...

The Reserve Bank of India (RBI) has imposed fines on six NBFCs for violating key regulatory norms under the RBI Act, 1934. These penalties, totaling over ₹60 lakh, highlight RBI’s tightening grip on governance and compliance.

Who Got Fined...

India’s Peer-to-Peer (P2P) lending market is growing at an impressive 21% CAGR, transforming how individuals and businesses access credit. By eliminating intermediaries, P2P platforms offer faster and more flexible funding solutions.

Why is ...

The Reserve Bank of India’s (RBI) revised Net Owned Fund (NOF) requirements will impact thousands of NBFCs across India. Whether you operate as an NBFC-ICC, NBFC-MFI, NBFC-Factor, or a Type I NBFC, understanding these regulatory changes is cruc...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

Microfinance has long been a cornerstone of financial inclusion in India, supporting small businesses and underserved communities. However, the latest Micrometer Q3 FY 2024-25 report unveils alarming trends, raising concerns about the sector's st...

India’s digital lending industry is on a rapid growth trajectory, projected to hit $1.3 trillion by 2030! With AI-powered risk assessment, fintech innovation, and RBI-backed policies, the sector is ripe with opportunities.

💰 Want to tap int...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

Digital lending is set to hit ₹5 TRILLION by FY28! 📈

With a 40% CAGR growth, the industry is expected to double its market share in India’s retail loan space in just four years.

And the best part? It’s just getting started!

What...

The International Financial Services Centres Authority (IFSCA) has introduced key updates to its Fund Management Regulations, 2022, effective February 19, 2025. These revisions align with the December 2024 proposals and bring significant changes for ...

Did you know? Gold loans in India are projected to cross ₹10 lakh crore in FY25 and surge to ₹15 lakh crore by 2027!

🏆 NBFCs are leading the charge, growing at 17-19% YoY, thanks to:

✅ Faster approvals

✅ Flexible repayment options

✅ Higher LTV...

The Reserve Bank of India (RBI), led by Governor Sanjay Malhotra, recently held a crucial meeting with leading Non-Banking Financial Companies (NBFCs)—his first such interaction since taking office. The meeting brought together MDs and CEOs fro...

In the fast-paced world of fintech, many entrepreneurs are eyeing the potential of acquiring an NBFC (Non-Banking Financial Company) or applying for new NBFC registrations.

But here’s the reality: Most attempts fall short. Whether you're...

In a landmark move, the Karnataka government has strengthened its stance against the coercive recovery tactics used by Microfinance Institutions (MFIs). The latest draft of the Karnataka Microfinance (Prevention of Coercive Actions) Ordinance, 2025 i...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

₹12 lakh income? No tax.

₹12,10,000 income? ₹61,500 tax?

What happens if your income exceeds ₹12 lakh by just ₹1?

Did you know that earning just ₹1 extra above ₹12 lakh could shoot up your tax liability disproportionately?

That’s wh...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

In today’s rapidly evolving financial landscape, co-lending has emerged as a significant force reshaping how loans are disbursed in India. The model, which enables banks and Non-Banking Financial Companies (NBFCs) to jointly disburse loans, has...

The LendingTech sector in India is witnessing rapid growth, driven by the rising demand for digital lending solutions that target unbanked and underserved populations. This article delves into how LendingTech startups are differentiating themselves, ...

On August 16, 2024, the Reserve Bank of India (RBI) issued a notification announcing significant revisions to the Master Direction – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017 (‘Dir...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

Please remember the following information regarding Non-Banking Financial Companies (NBFCs):

NBFCs play a vital role in providing funding to the Indian economy, and the Reserve Bank of India (RBI) is responsible for regulating and supervising thes...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

According to a recent industry report by the Microfinance Industry Network (MFIN), NBFC-MFIs have emerged as the largest providers of micro-credit in the country by the end of the 2023-24 fiscal year. The report highlights significant trends in the m...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

In recent months, the Reserve Bank of India (RBI) has implemented several stringent measures affecting non-banking financial companies (NBFCs). These measures include restrictions on important business areas such as gold loans and securities financin...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In the intricate world of finance, regulatory compliance stands as the bedrock of stability and credibility. This blog explores the profound impact of NBFC Advisor, showcasing how its expert guidance has been instrumental in steering Non-Banking Fina...

In the dynamic landscape of Non-Banking Financial Companies (NBFCs), the right guidance can make all the difference. This blog unveils the comprehensive support and expertise offered by NBFC Advisor, empowering financial entities to not only thrive b...

Rules.png)

India’s Future of Financial Data Sharing.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)