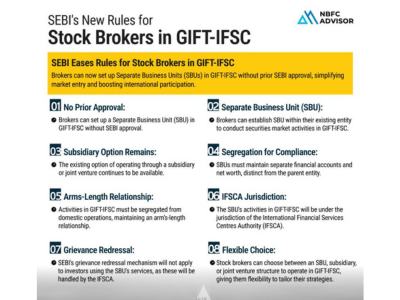

The Securities and Exchange Board of India (SEBI) has unveiled a progressive framework to ease the entry of Indian stock brokers into the GIFT-International Financial Services Centre (GIFT-IFSC). This move is set to simplify cross-border operations and open new international avenues for brokers.

Key Highlights of SEBI’s New Guidelines:

-

No Prior SEBI Approval Required: Brokers can now set up a Separate Business Unit (SBU) in GIFT-IFSC without needing SEBI’s prior approval.

-

Leverage Existing Subsidiaries: Existing subsidiaries can be designated as SBUs, providing greater operational flexibility.

-

Segregated Operations: SBUs must maintain separate accounts and operations from domestic business activities.

-

IFSCA as the Regulatory Authority: All SBU operations will be regulated by the International Financial Services Centres Authority (IFSCA).

-

Investor Grievance Redressal: IFSCA, not SEBI, will handle investor complaints related to SBU services.

-

Multiple Setup Options: Brokers have the freedom to establish an SBU, a wholly-owned subsidiary, or a joint venture in GIFT-IFSC.

Why GIFT-IFSC is a Game-Changer for Stock Brokers:

-

Attractive Tax Regime:

-

Only 9% Minimum Alternate Tax (MAT) and 10% dividend tax for non-resident SBUs.

-

100% income tax exemption for 10 consecutive years within a 15-year period.

-

100% capital gains tax exemption for foreign brokers on specified securities.

-

-

Transaction Cost Benefits:

-

No Securities Transaction Tax (STT), Commodity Transaction Tax (CTT), or stamp duty on market trades.

-

-

Seamless Currency Operations:

-

Free convertibility of foreign currency, making international trading hassle-free.

-

Unlock Global Growth While Maintaining Domestic Roots

For stock brokers looking to expand globally while continuing domestic operations, GIFT-IFSC presents a strategic and cost-effective gateway to scale international presence.

📞 Ready to Set Up Your SBU in GIFT-IFSC?

Contact us for a free consultation today!

📞 +91 93113 47006