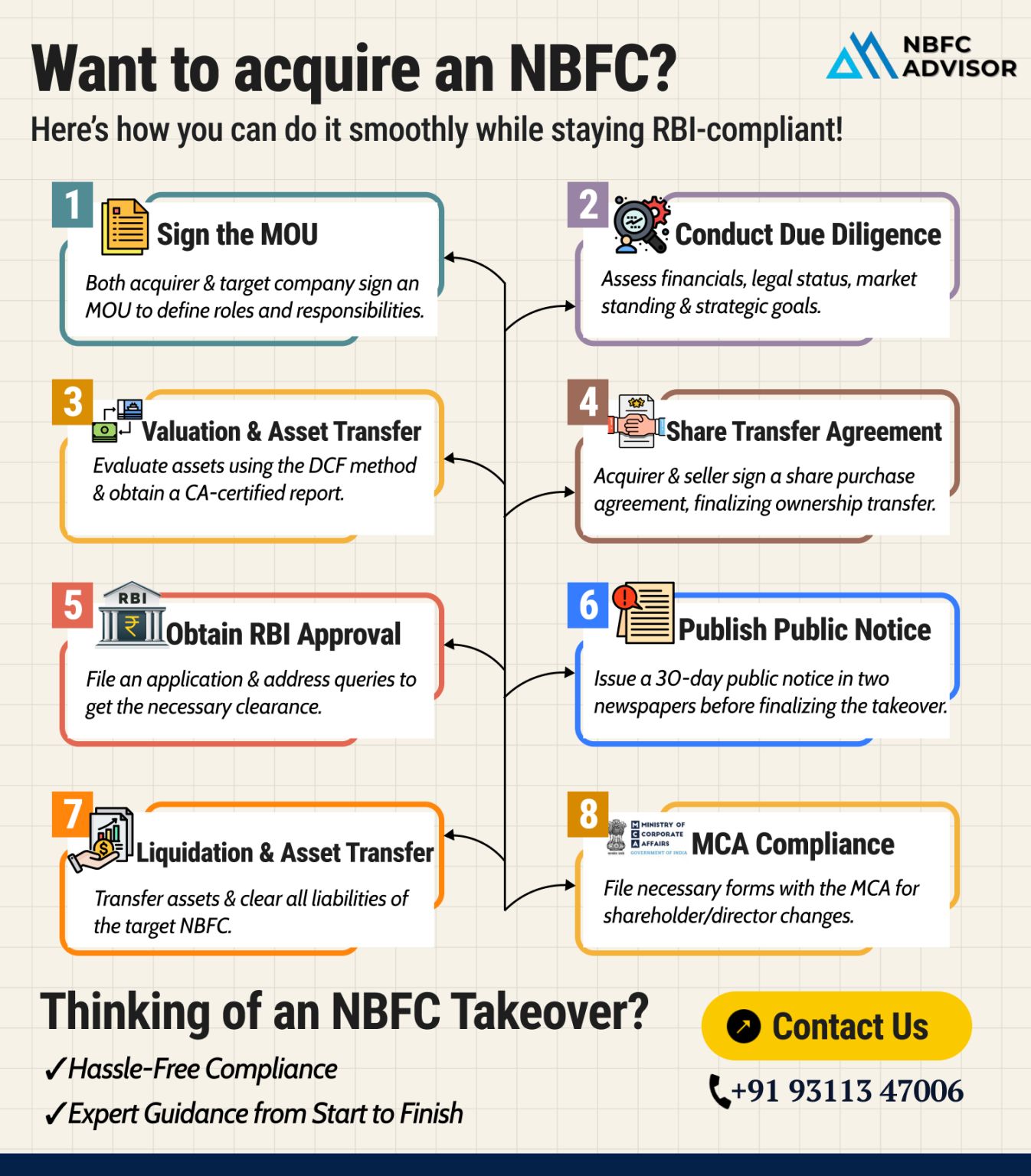

NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

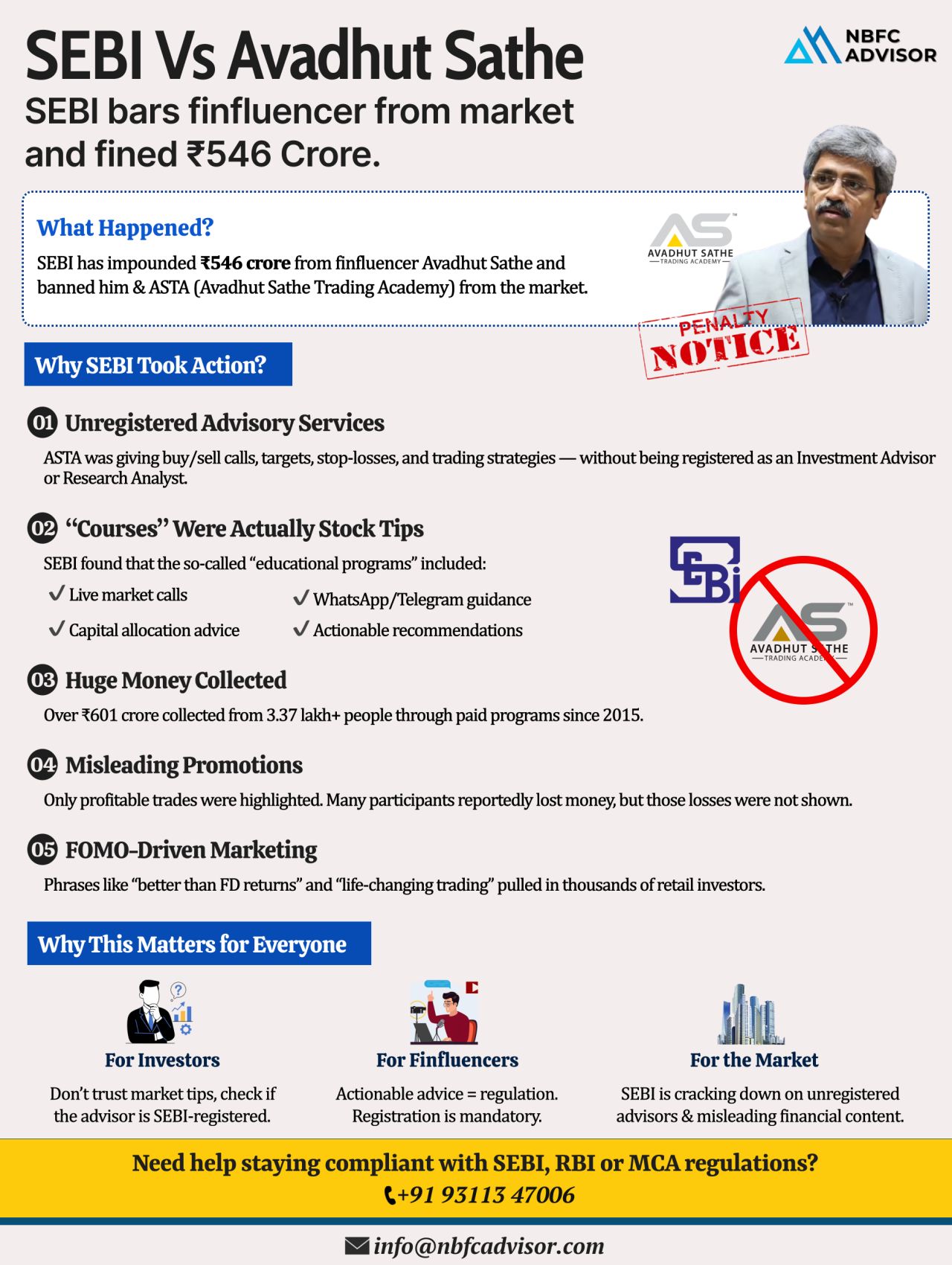

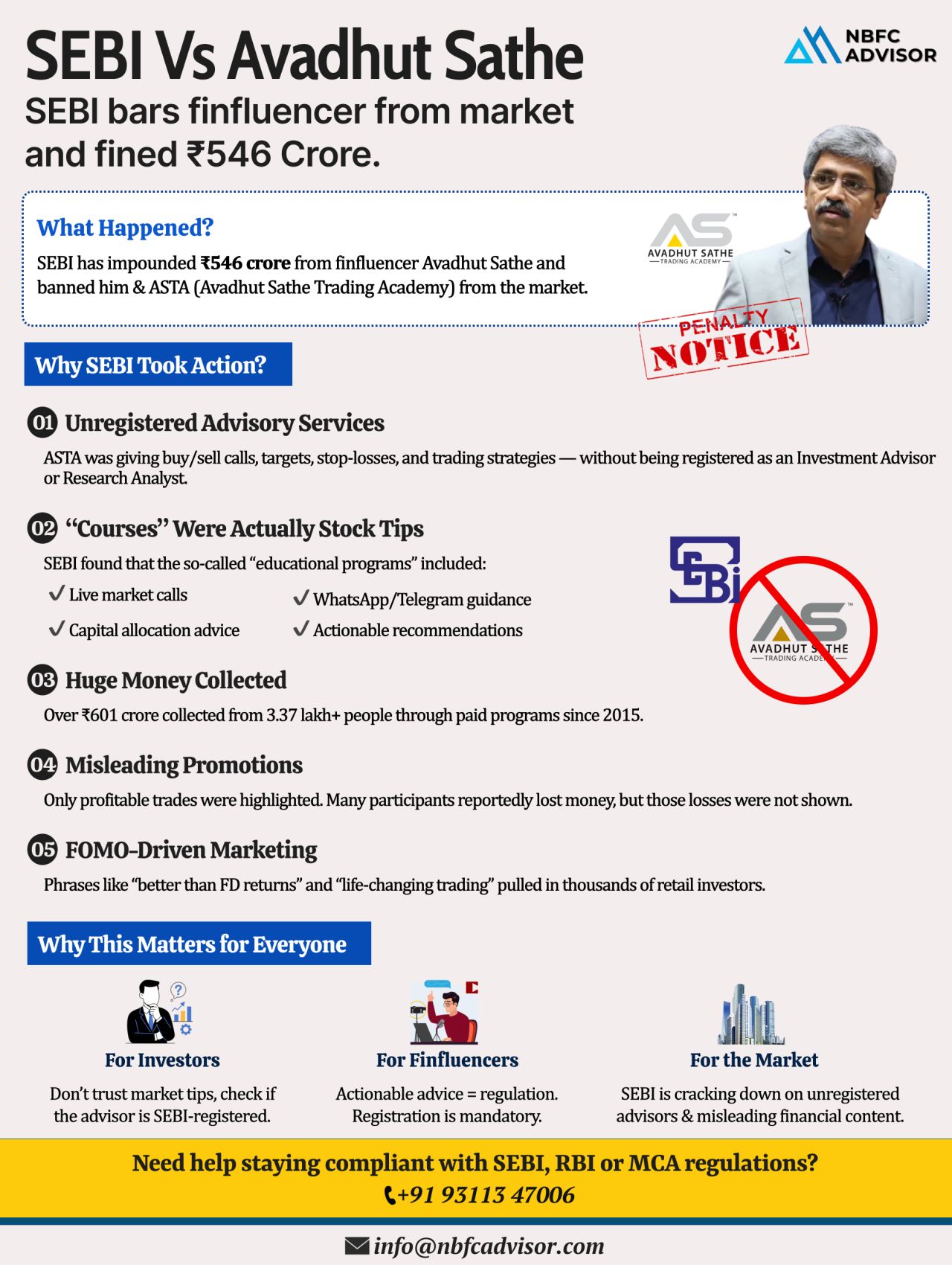

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from ...

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe a...

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Many NBFCs don’t fail because of bad business decisions — they fail because of missed compliance.

In today’s regulatory environment, RBI’s supervision...

Thinking of Entering India’s Fast-Growing NBFC Space? Choose an NBFC Takeover for Faster Market Entry

India’s Non-Banking Financial Company (NBFC) sector has emerged as one of the most dynamic segments of the financial market — o...

Thinking of Starting an NBFC? Here’s Why a Takeover Might Be Smarter Than a Fresh Registration

If you’re planning to enter the lending and finance industry, setting up a Non-Banking Financial Company (NBFC) can be a powerful way to gro...

NBFC Takeovers: The Quickest Gateway to India’s Digital Lending Boom

India’s digital lending market is on a steep growth curve, projected to reach $515 billion by 2030. Innovative financial solutions such as peer-to-peer (P2P) lending,...

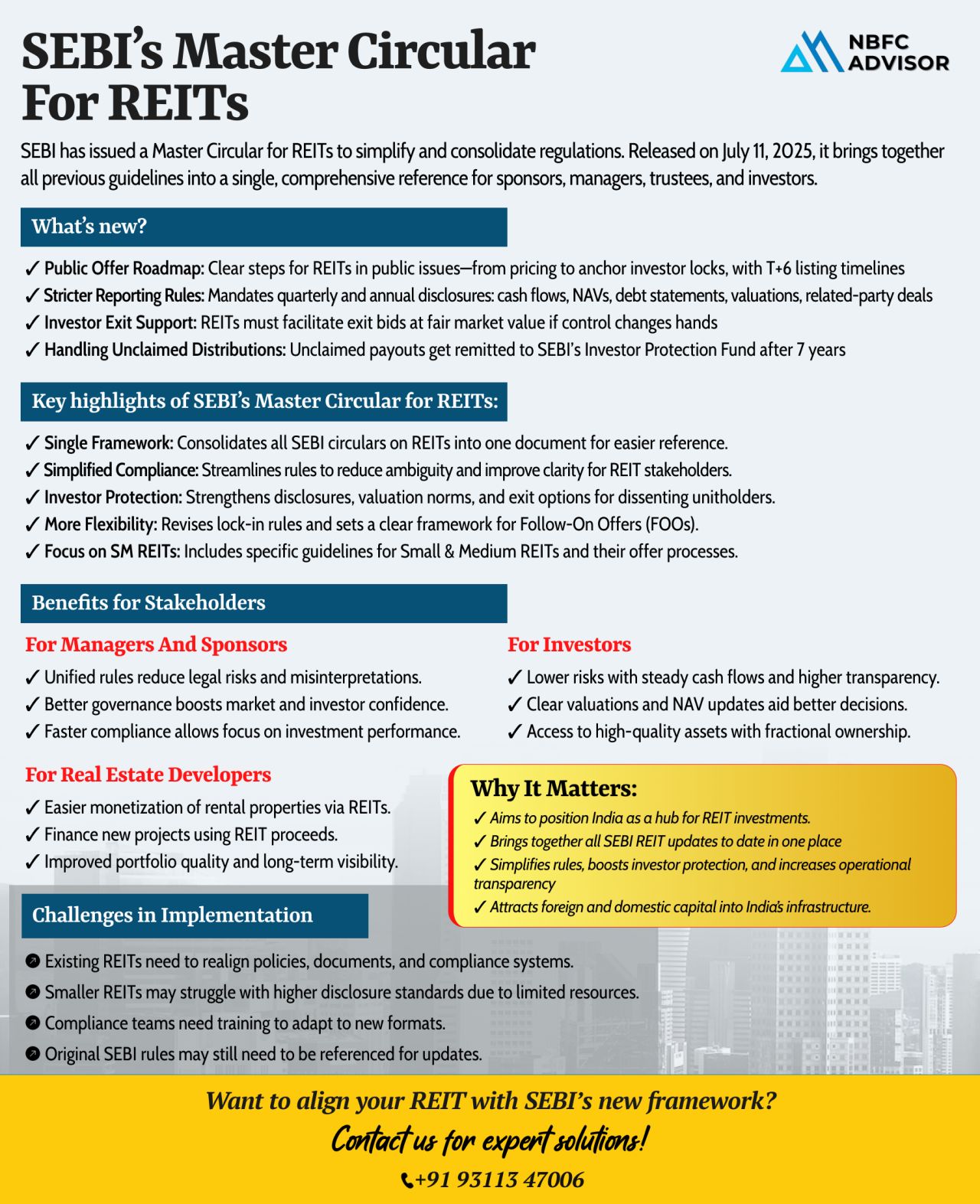

SEBI’s New Master Circular: A Landmark Move for India’s REIT Market

In a strategic step toward regulatory simplification and investor protection, the Securities and Exchange Board of India (SEBI) has released a comprehensive Master Cir...

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘶𝘭𝘦𝘴 𝘈𝘳𝘦 𝘊𝘩𝘢𝘯𝘨𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under an entirely new regulatory framework—and the implications are significant for startups, inves...

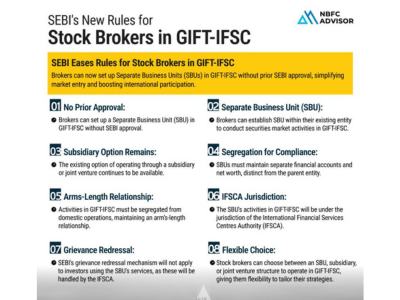

The Securities and Exchange Board of India (SEBI) has unveiled a progressive framework to ease the entry of Indian stock brokers into the GIFT-International Financial Services Centre (GIFT-IFSC). This move is set to simplify cross-border operations a...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Emerging technologies and strategic partnerships are crucial for Non-Banking Financial Companies (NBFCs) to thrive in an increasingly regulated and competitive financial landscape. By integrating advanced technologies and collaborating with FinTech c...

In the dynamic landscape of Non-Banking Financial Companies (NBFCs), the right guidance can make all the difference. This blog unveils the comprehensive support and expertise offered by NBFC Advisor, empowering financial entities to not only thrive b...