Planning to Exit Your NBFC? Here’s What You Need to Know Before Making a Decision

Running a Non-Banking Financial Company (NBFC) is a long-term regulatory commitment. However, many NBFC promoters today are considering an exit due to changing...

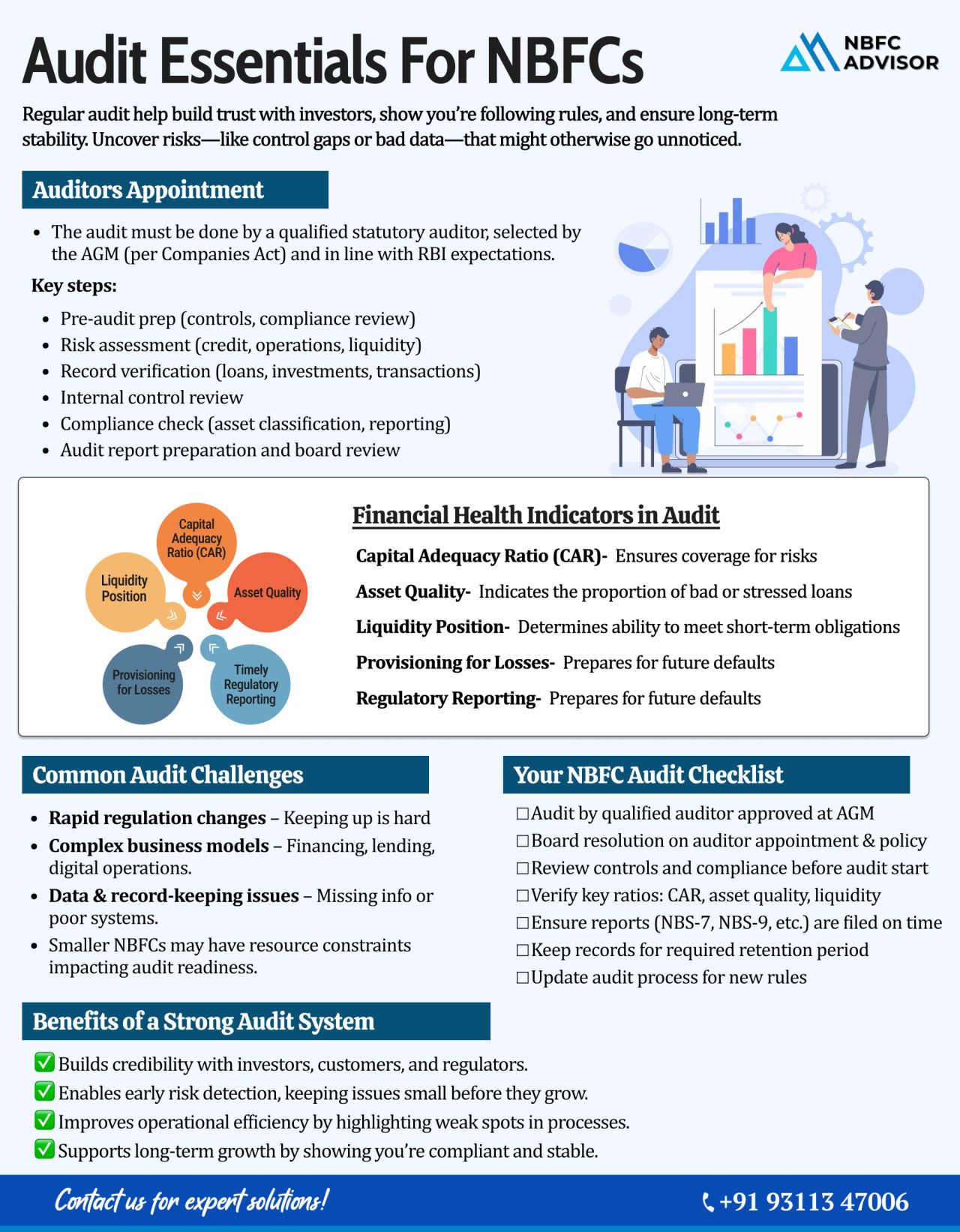

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

Thinking of Starting a Digital Lending Business? Here’s What You Should Know

India’s credit ecosystem is undergoing a digital revolution. By 2030, the country’s digital lending market is projected to reach $515 billion — al...

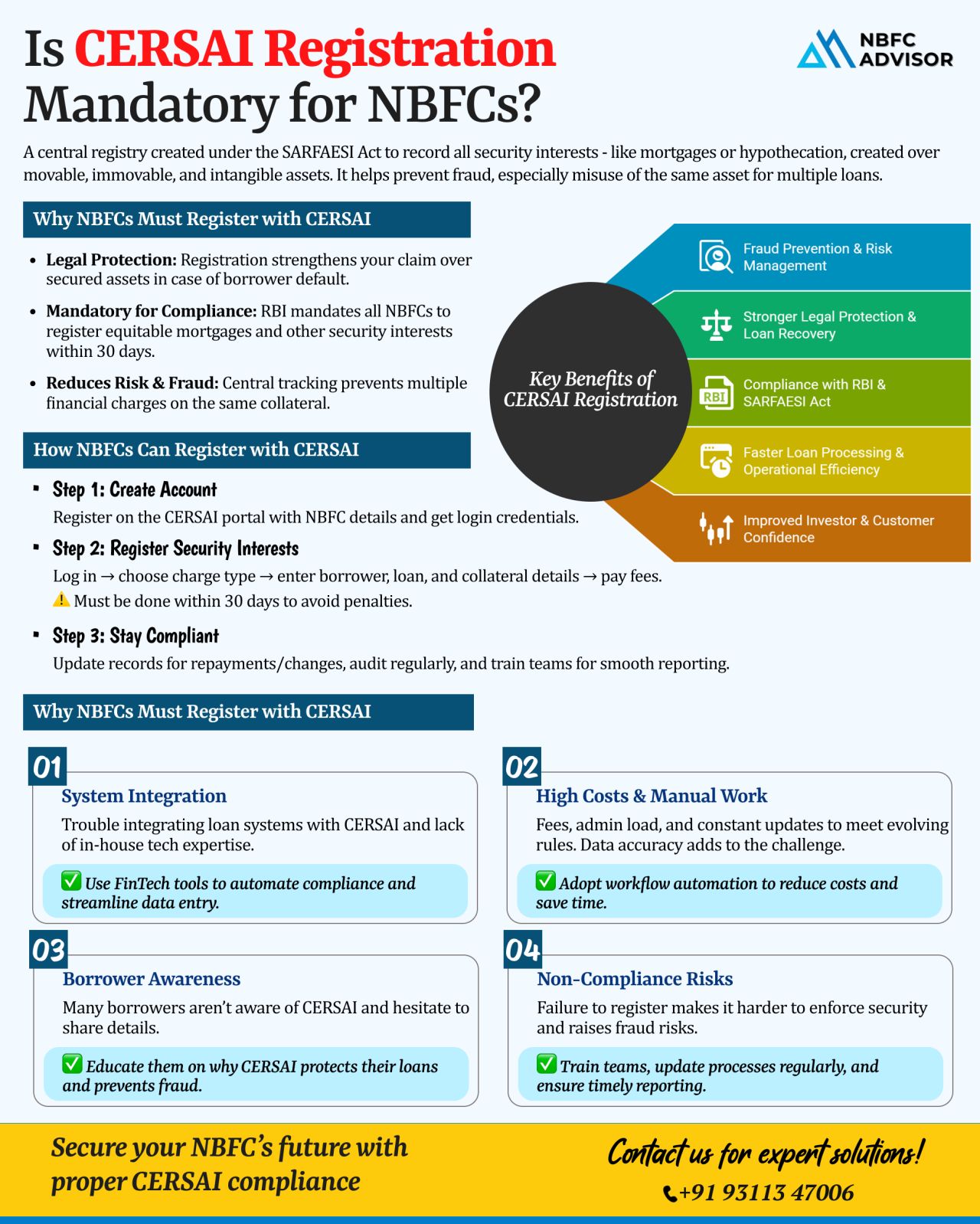

Is CERSAI Registration Mandatory for NBFCs?

One of the most overlooked compliance areas for NBFCs is CERSAI registration. While RBI norms, customer due diligence, and credit processes get proper attention, many lenders fail to recognize that CERSA...

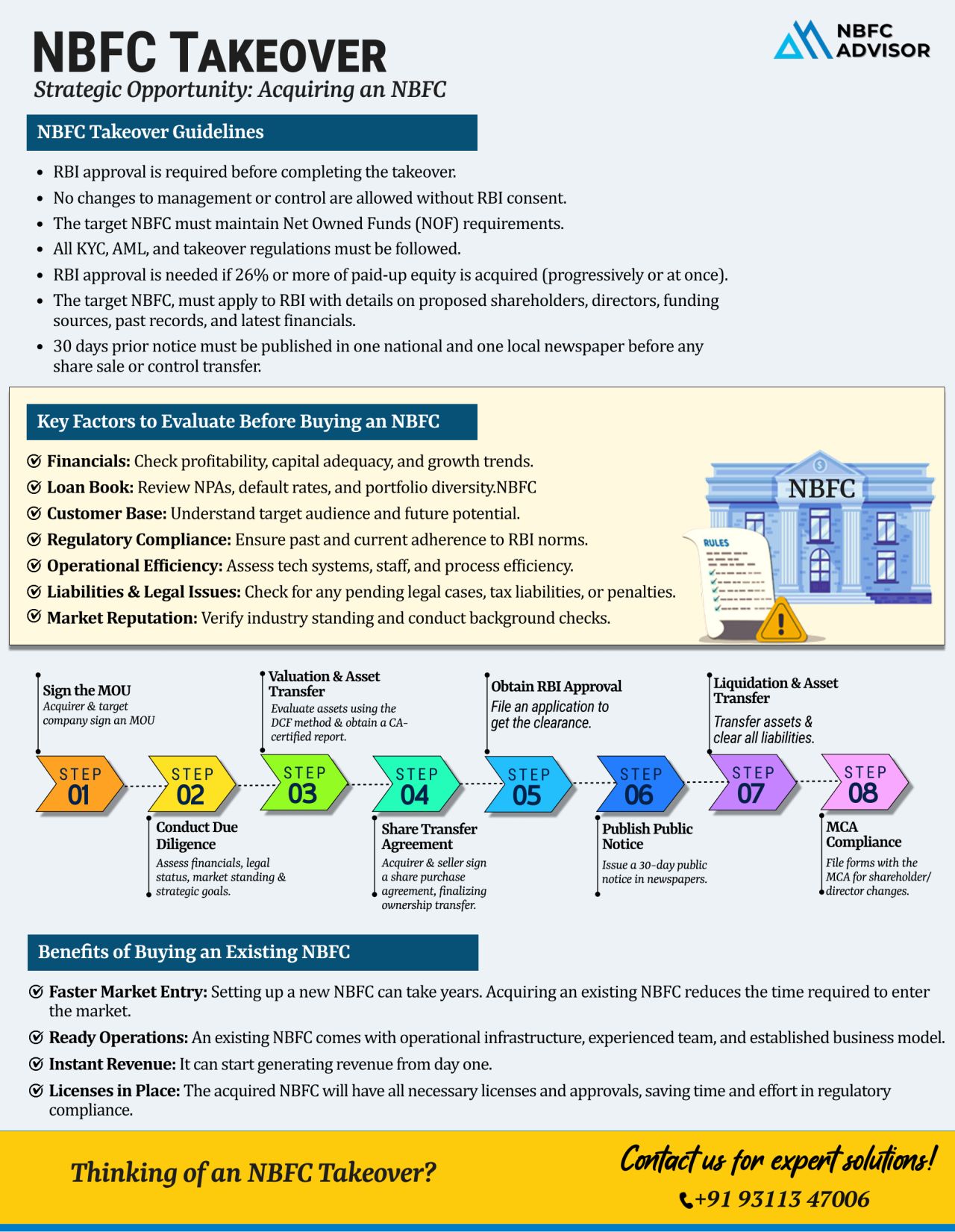

Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and ...

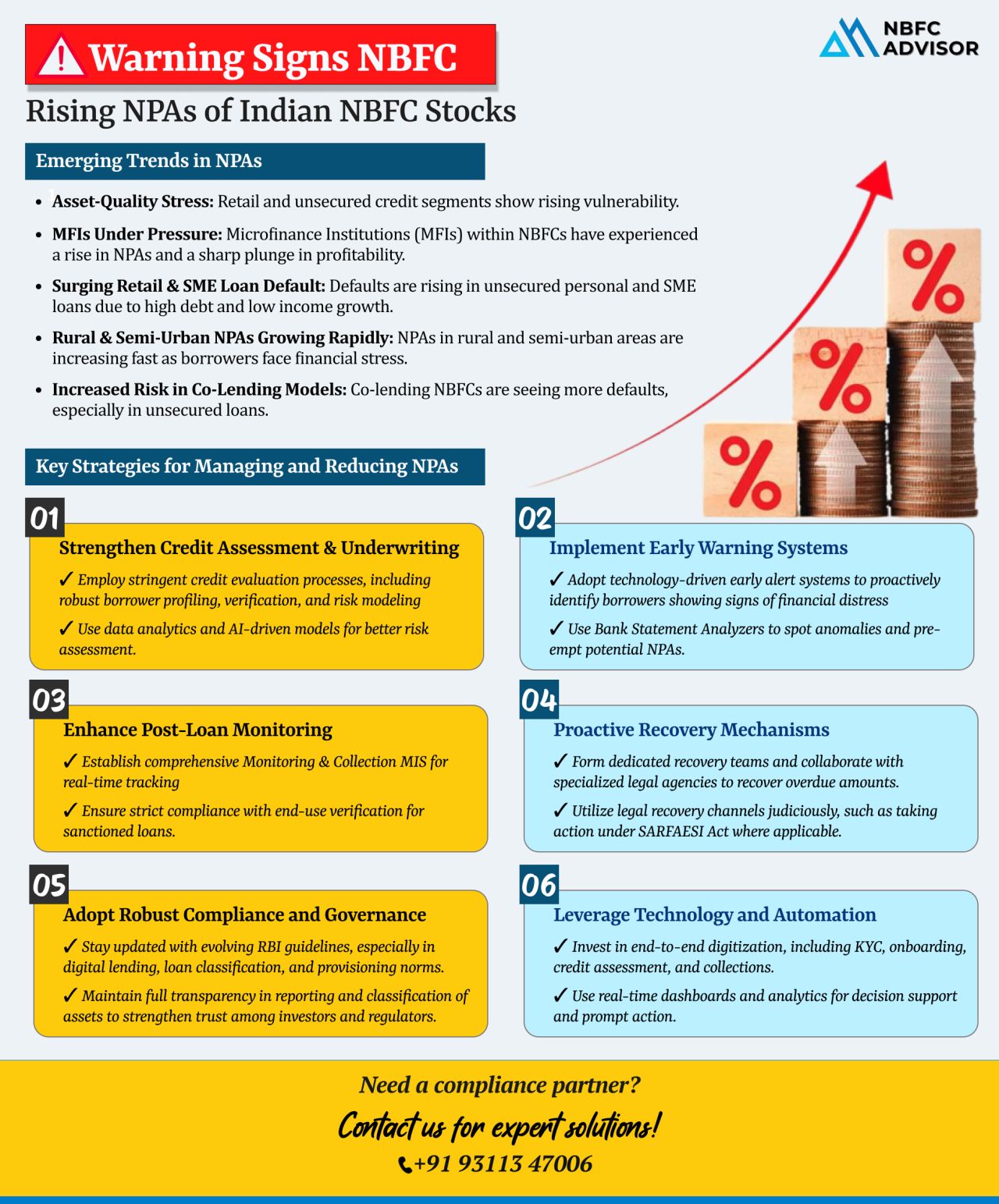

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

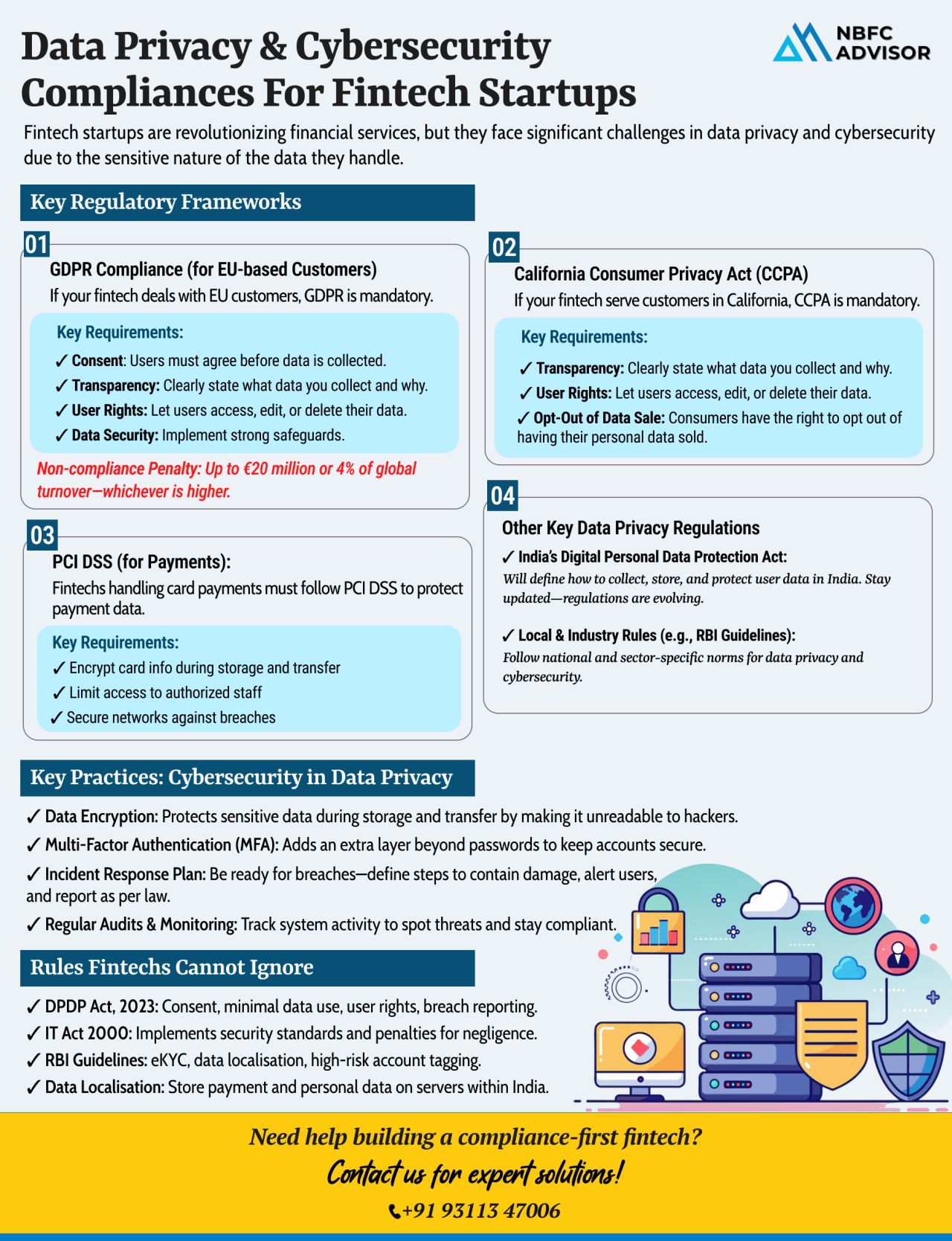

Building a Fintech Startup? One Data Breach Could Cripple Everything

In the high-stakes world of fintech, innovation isn’t enough—security and compliance are your foundation. With sensitive financial data at the heart of your operation...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

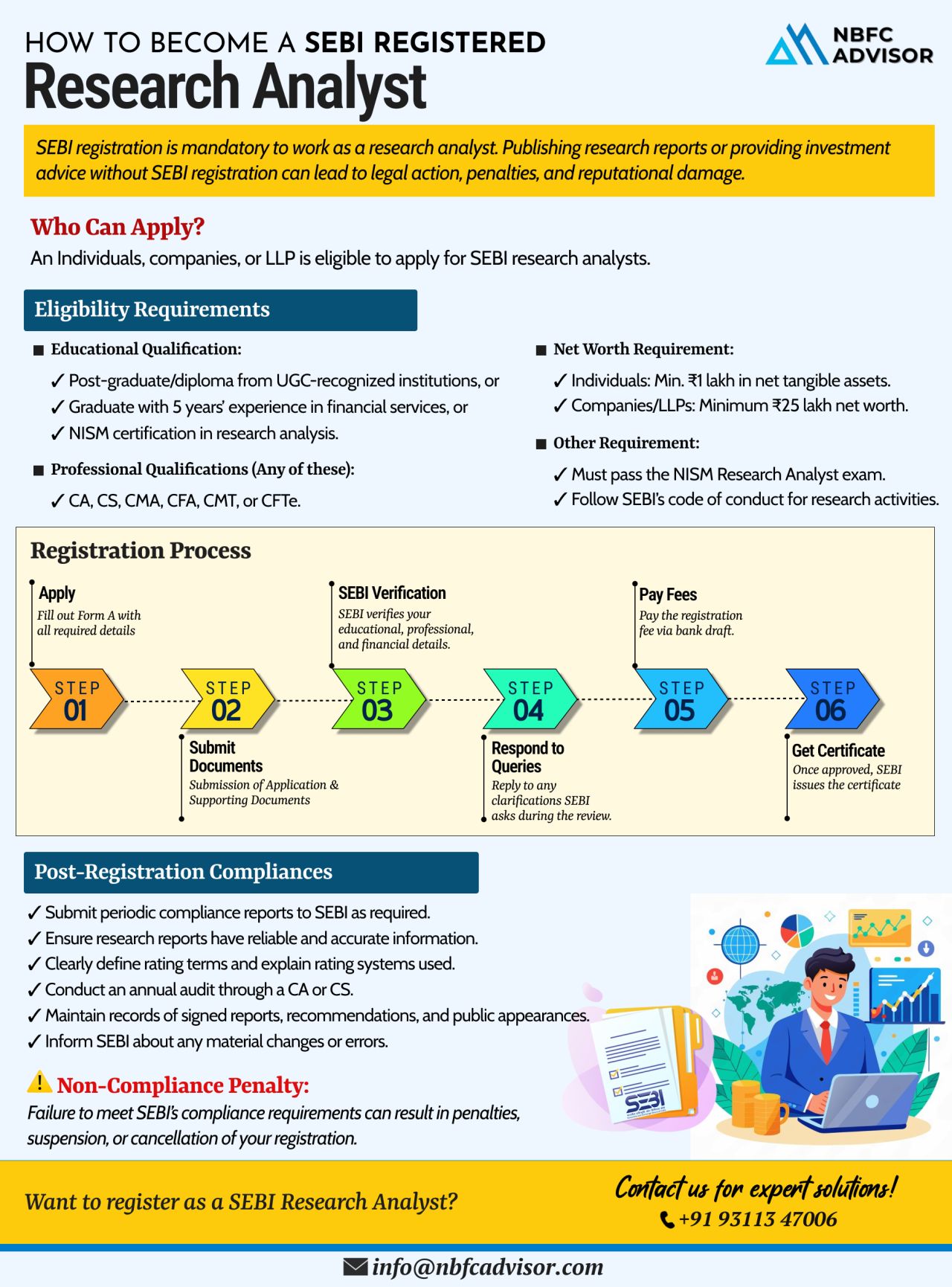

Publishing Research Reports Without SEBI Registration?

That’s a Shortcut to Penalties, Suspension & Reputational Damage

In India’s regulated financial ecosystem, publishing equity research or market analysis without SEBI registr...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

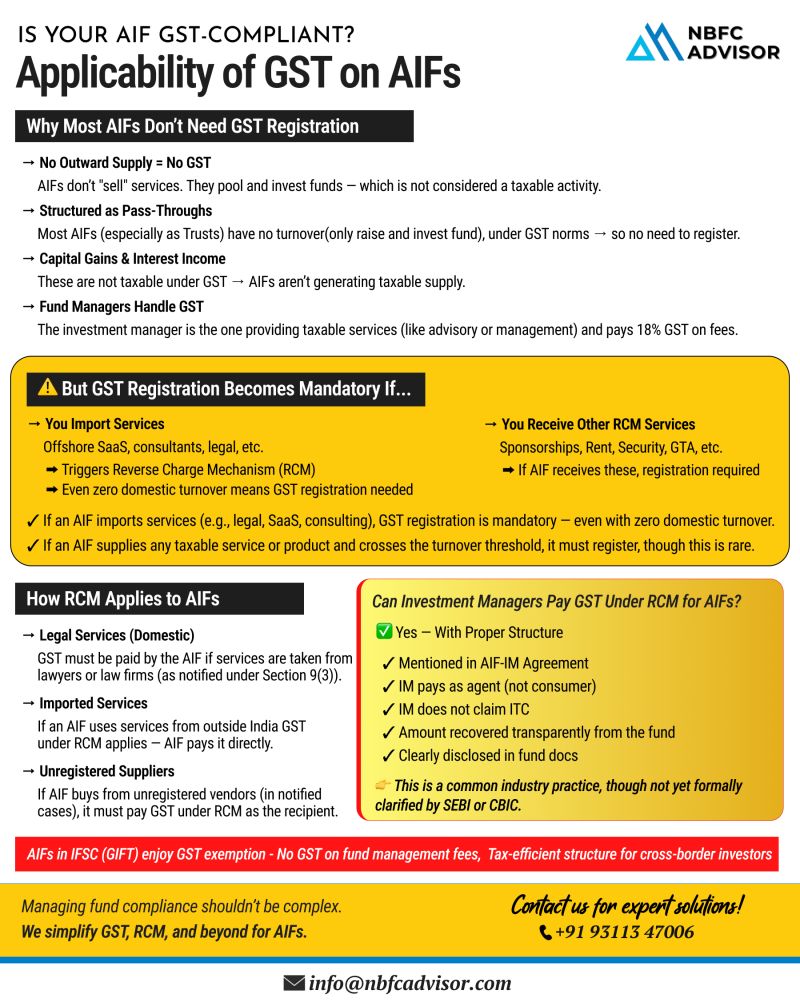

𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐑𝐞𝐪𝐮𝐢𝐫𝐞 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Understanding GST obligations for Alternative Investment Funds

As the Alternative Investment Fund (AIF) landscape continues to grow in India, so does the complexity a...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

𝐈𝐬 𝐘𝐨𝐮𝐫 𝐍𝐁𝐅𝐂 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

Compliance Isn’t Optional — It’s Essential.

It’s not just about following rules. Compliance is the foundation of trust, sustainable growth, and long-term success for every NBFC.

...

In a landmark move towards enhancing transparency, efficiency, and digital convenience, the Securities and Exchange Board of India (SEBI) has made DigiLocker integration mandatory for all intermediaries.

This mandate is a significant step forward ...

Staying compliant with SEBI (Securities and Exchange Board of India) regulations isn’t just a legal formality — it’s a reflection of your company’s corporate governance and credibility in the market.

For listed companies, a...

Non-Banking Financial Companies (NBFCs) are grappling with mounting defaults, prolonged legal processes, and tightening cash flows. In today’s landscape, debt recovery isn’t just about compliance—it’s about business continuity...

Most loan defaults don’t happen because of bad customers — they happen because of bad credit decisions.

Yet, many NBFCs still rely on outdated, unstructured loan assessment methods.

If you’re serious about scaling safely and s...

The demand for digital credit in India is at an all-time high.

From MSMEs to individuals, the appetite for alternative financing is growing rapidly — and Non-Banking Financial Companies (NBFCs) are at the forefront of this revolution.

Wit...

The India Fintech Foundation (IFF) has officially been launched — and it could be the most significant development for the fintech sector since UPI.

Why this matters:

IFF is set to become a self-regulatory organization (SRO) for fin...

Aditya Birla Capital has officially merged with its subsidiary, Aditya Birla Finance.

This isn’t just a merger—it’s a strategic move to simplify structure, enhance financial strength, and boost operational efficiency.

Why This...

If you're running an NBFC, you already know—compliance is non-negotiable. One missed filing or overlooked regulation could lead to penalties, restrictions, or even license cancellation.

With RBI tightening regulations, staying compliant ...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

.png)

.jpeg)