NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

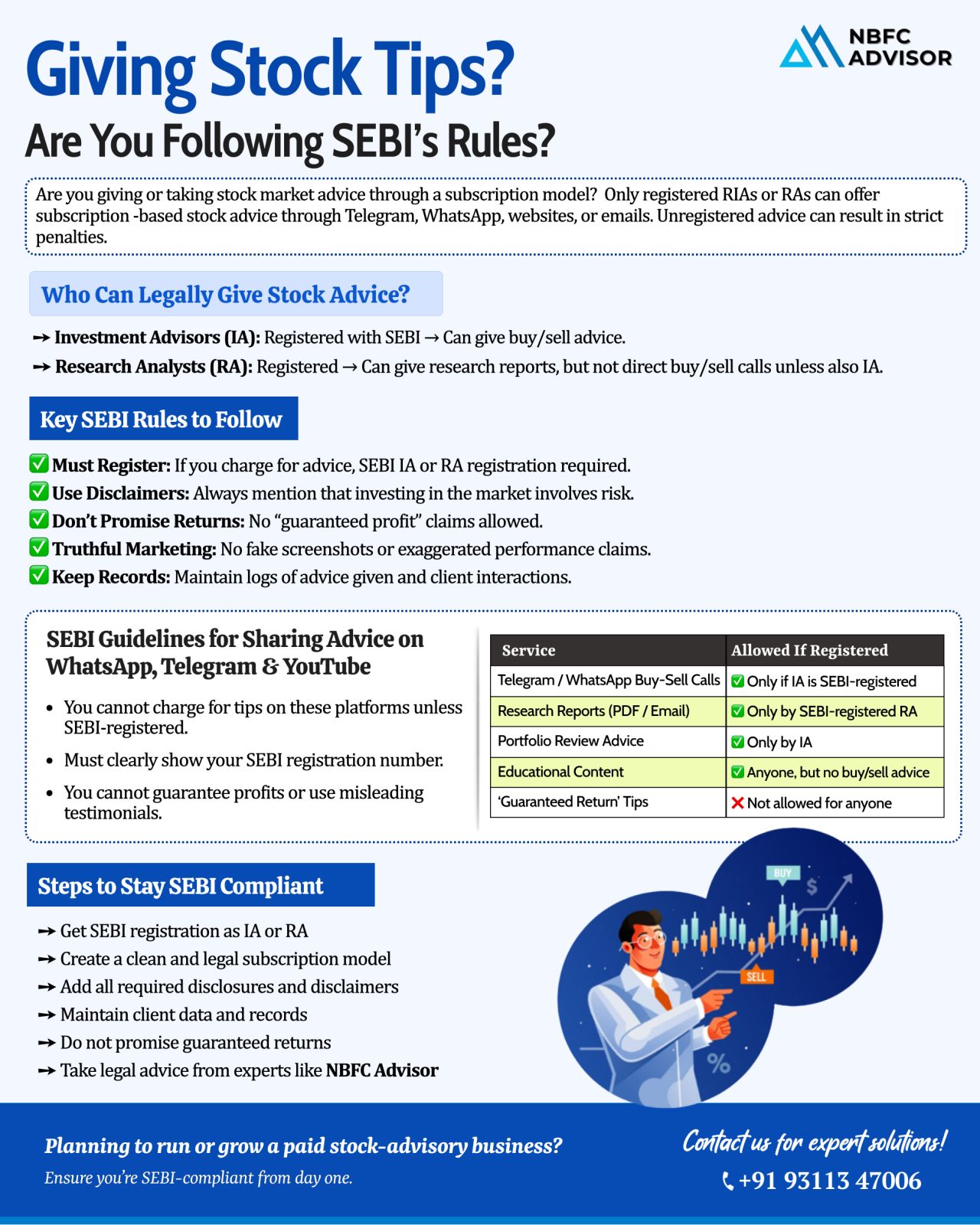

Selling Stock Tips on Telegram, WhatsApp, or Instagram? SEBI Has Strict Rules You Must Follow

In recent years, social media has become a major hub for stock market discussions. From Telegram channels to WhatsApp groups and Instagram pages, thousan...

RBI Is Cracking Down on NBFCs — Is Your Company Compliance-Ready?

The Reserve Bank of India (RBI) has intensified its scrutiny of Non-Banking Financial Companies (NBFCs)—and the message is loud and clear: compliance is no longer negoti...

Dreaming of Launching Your NBFC?

Avoid These Top 5 Pitfalls to Secure Your RBI License!

Setting up a Non-Banking Financial Company (NBFC) in India can be a game-changer—but getting the RBI license is where many dreams hit a wall. Each yea...

In the fast-paced world of fintech, many entrepreneurs are eyeing the potential of acquiring an NBFC (Non-Banking Financial Company) or applying for new NBFC registrations.

But here’s the reality: Most attempts fall short. Whether you're...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

.jpeg)

.jpeg)