NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

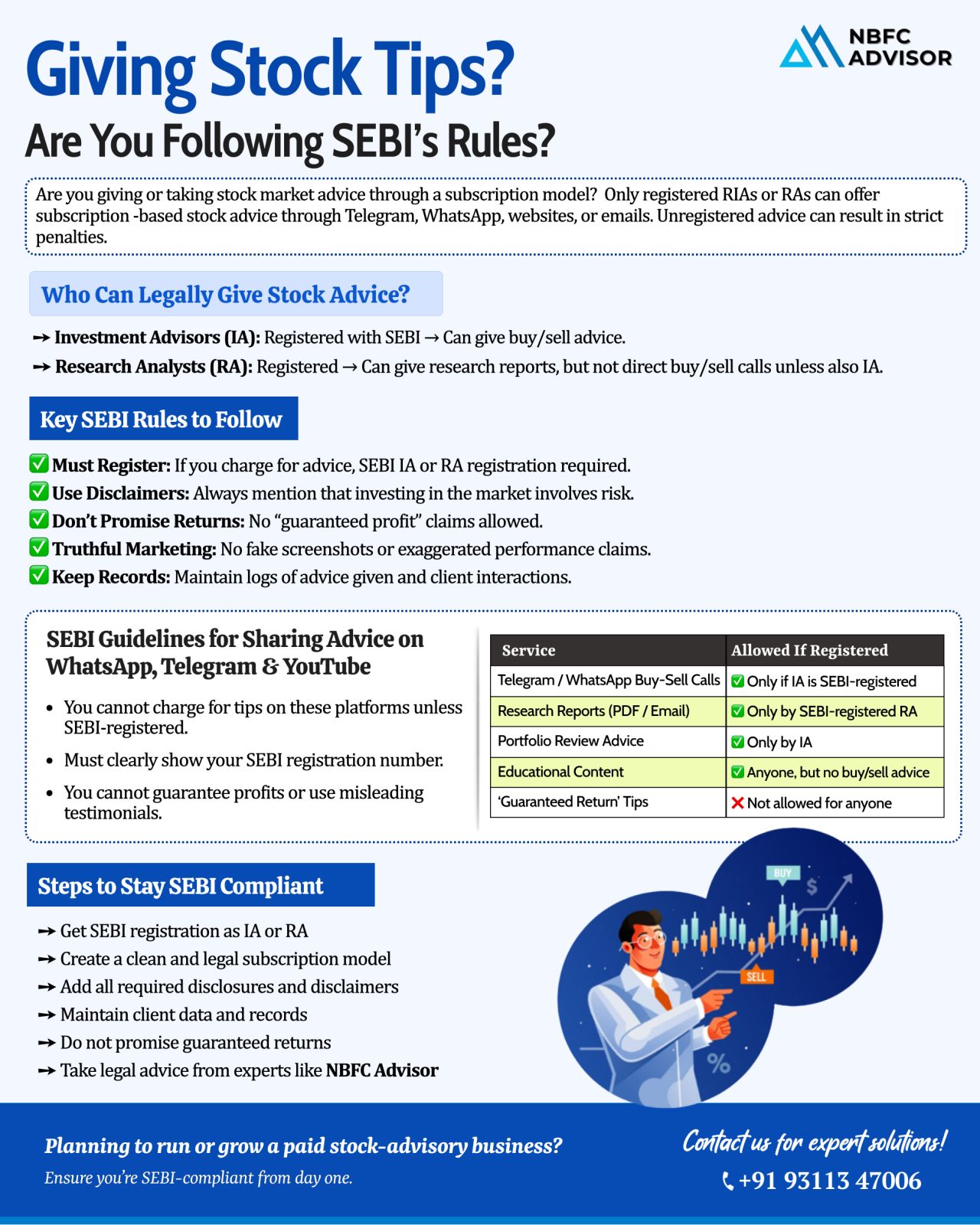

Selling Stock Tips on Telegram, WhatsApp, or Instagram? SEBI Has Strict Rules You Must Follow

In recent years, social media has become a major hub for stock market discussions. From Telegram channels to WhatsApp groups and Instagram pages, thousan...

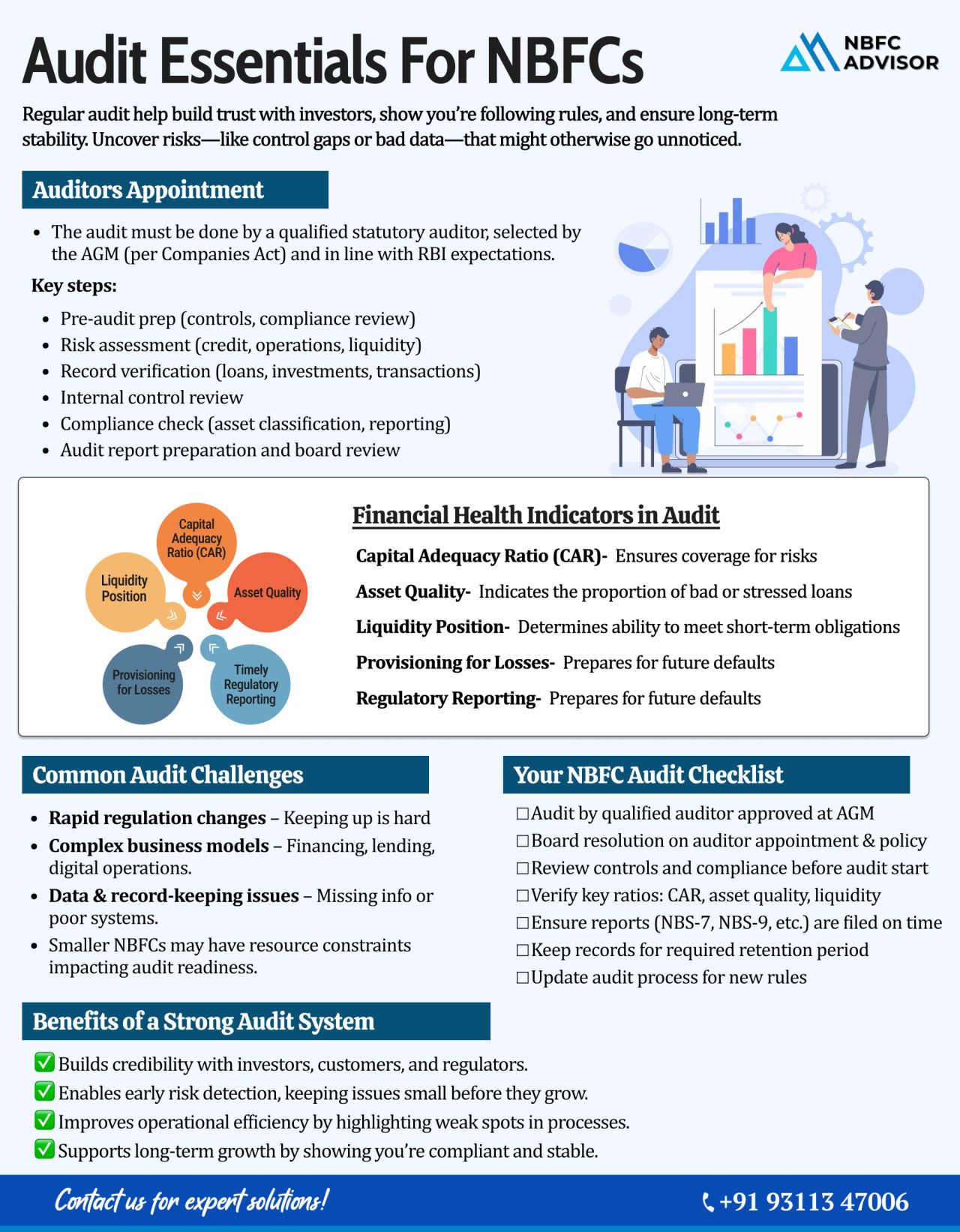

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

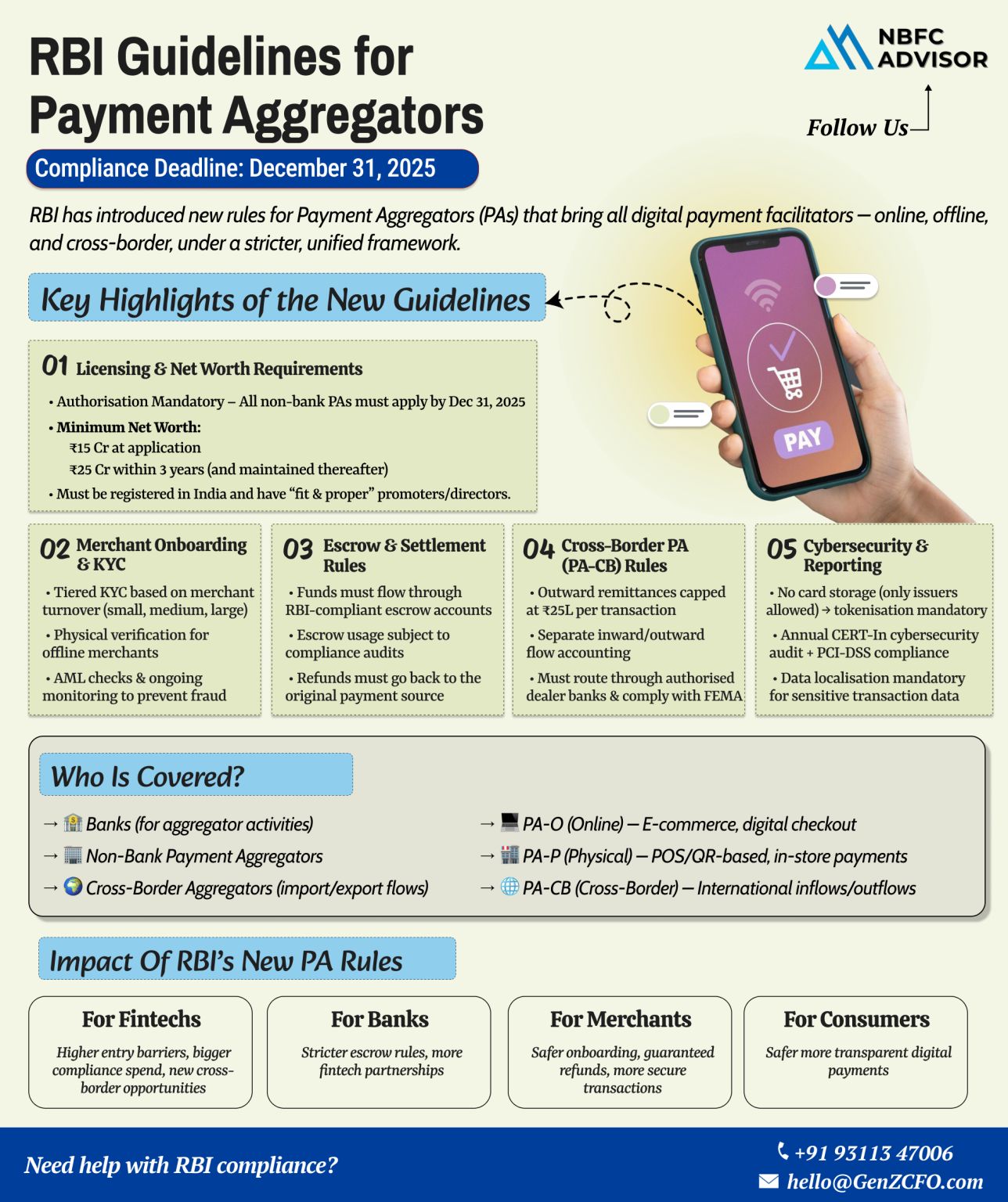

RBI’s Guidelines for Payment Aggregators: What Every Fintech Should Know!

India’s digital payments ecosystem has seen exponential growth in recent years — from UPI to wallets and payment gateways. To keep pace with this innovatio...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

On August 16, 2024, the Reserve Bank of India (RBI) issued a notification announcing significant revisions to the Master Direction – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017 (‘Dir...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

India is on the verge of a financial revolution, thanks to its growing economy and diverse demographics. However, there still exists a significant credit gap, especially among businesses and individuals. This gap is obstructing the country's econ...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In the relentless pursuit of financial inclusion, a notable paradigm shift has unfolded in recent years, marked by the symbiotic relationship between Non-Banking Financial Companies (NBFCs) and Fintech firms. This strategic alliance has emerged as a ...

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)