India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

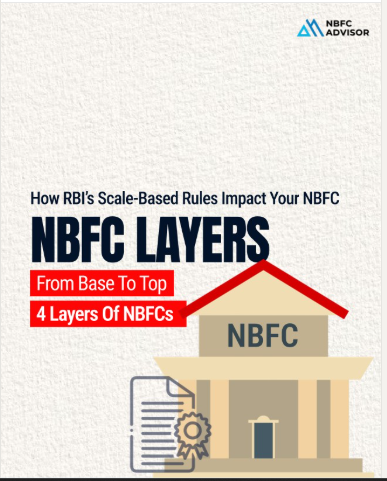

Not All NBFCs Are the Same: Understanding RBI’s Scale-Based Regulation (SBR)

Many people still think of Non-Banking Financial Companies (NBFCs) as one single category. In reality, not all NBFCs are created equal.

To strengthen financial s...

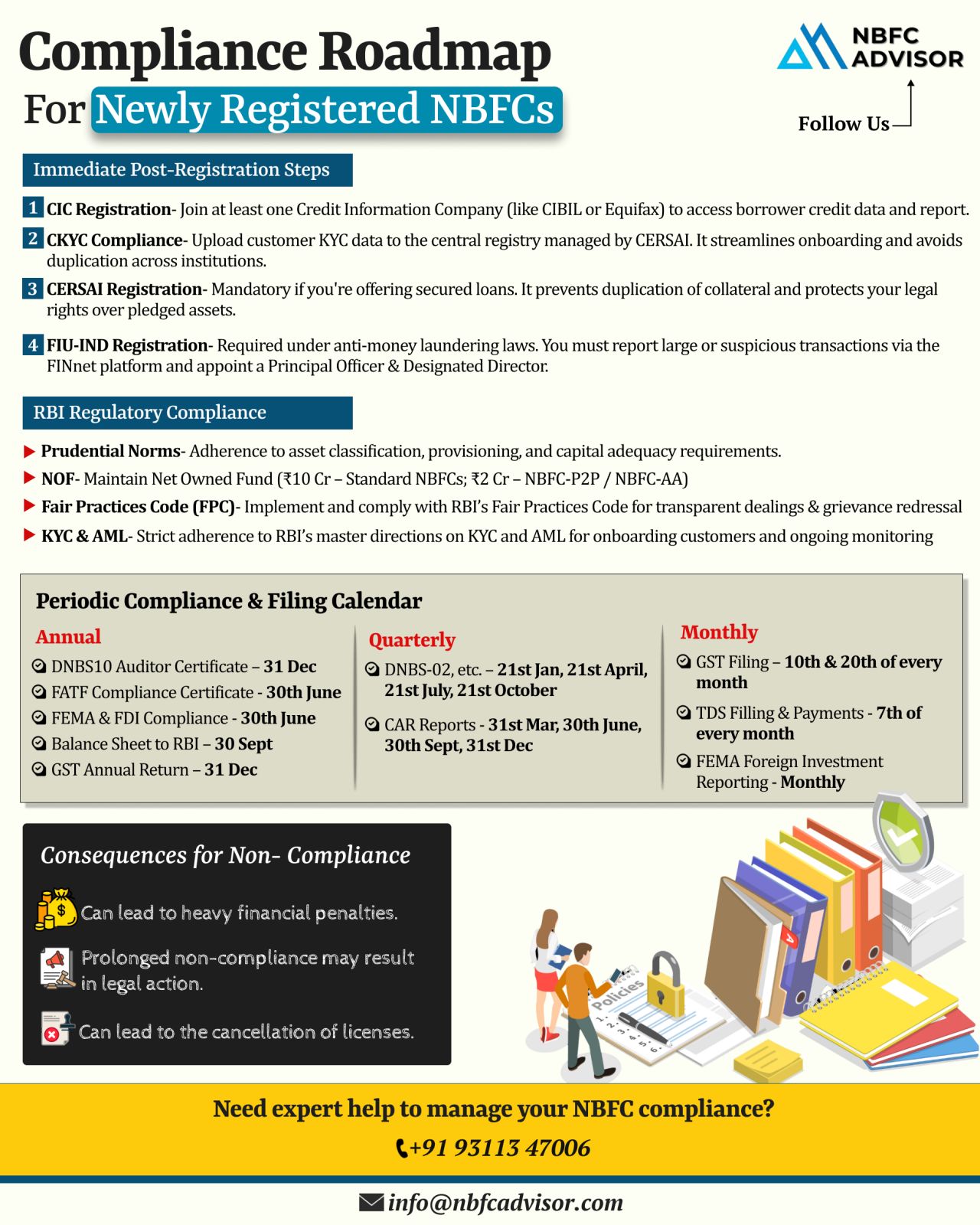

Newly Licensed as an NBFC? Here’s What Comes Next

Obtaining an RBI license is a major milestone for any NBFC. However, the license alone doesn’t guarantee smooth operations—the real challenge begins with meeting regulatory compli...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

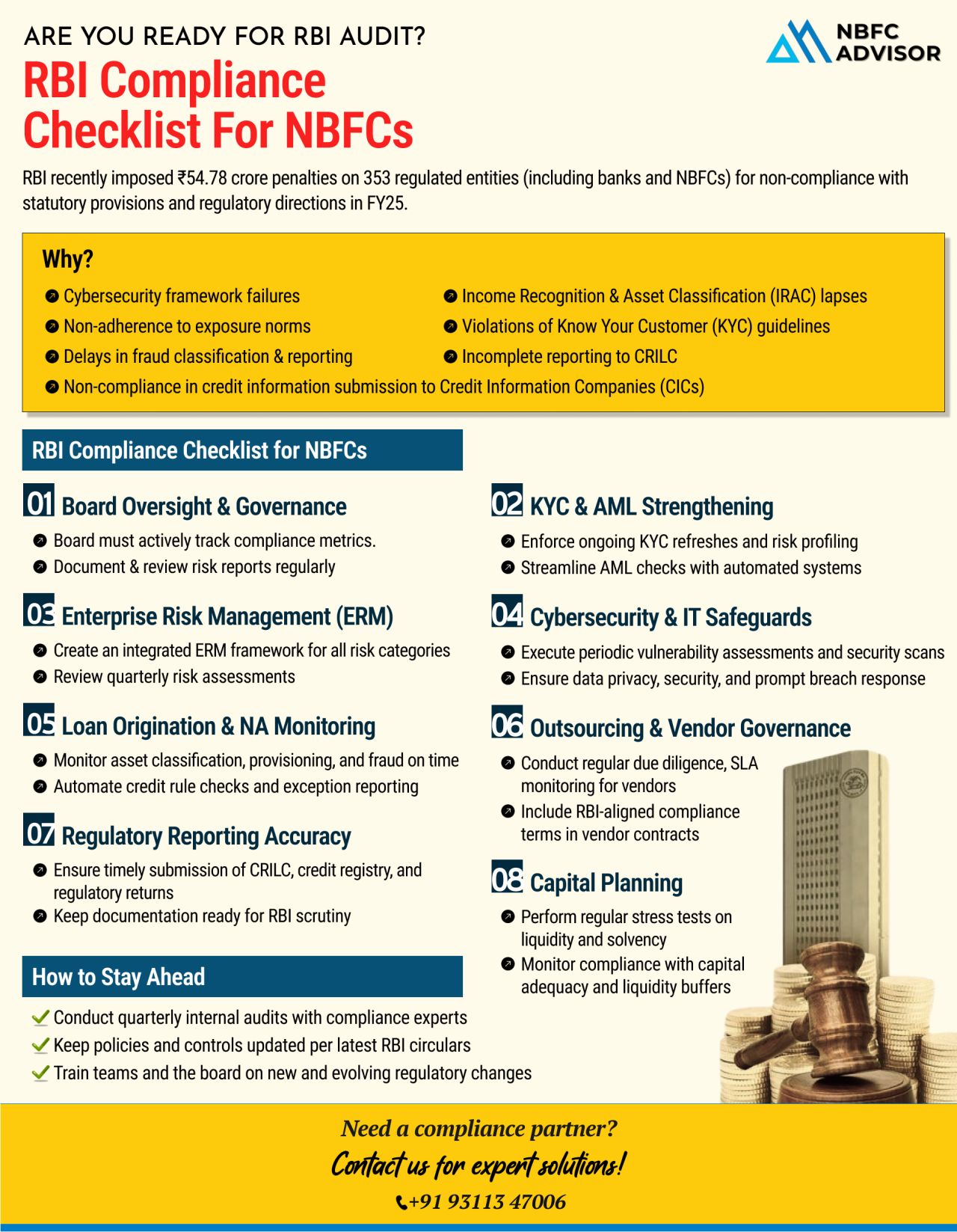

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

In today’s financial landscape, trust is everything—and Non-Banking Financial Companies (NBFCs) that prioritize ethical lending practices stand out from the rest. Beyond regulatory compliance, ethical conduct helps NBFCs build long-term c...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

.jpeg)