Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

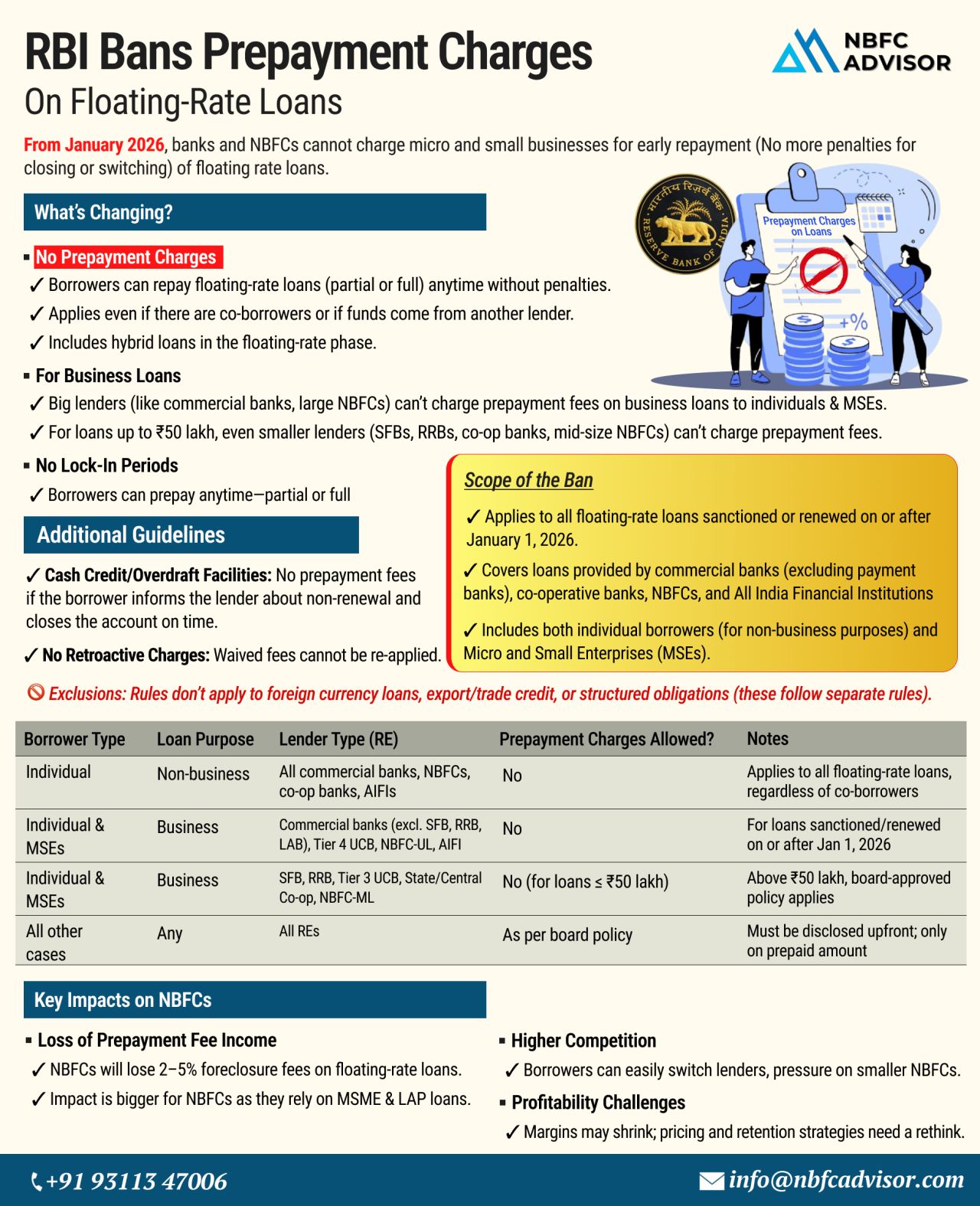

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

Here’s Your Complete Roadmap

India’s stock market is expanding rapidly, offering exciting opportunities for professionals looking to enter the financial sector. If you're aiming to become a SEBI-registered stock broker, you’l...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In the dynamic realm of Non-Banking Financial Companies (NBFCs), takeover processes play a crucial role in shaping market landscapes and strategic trajectories. Let’s delve into the intricacies of NBFC takeovers, exploring the reasons behind th...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

.jpeg)

.jpeg)