Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

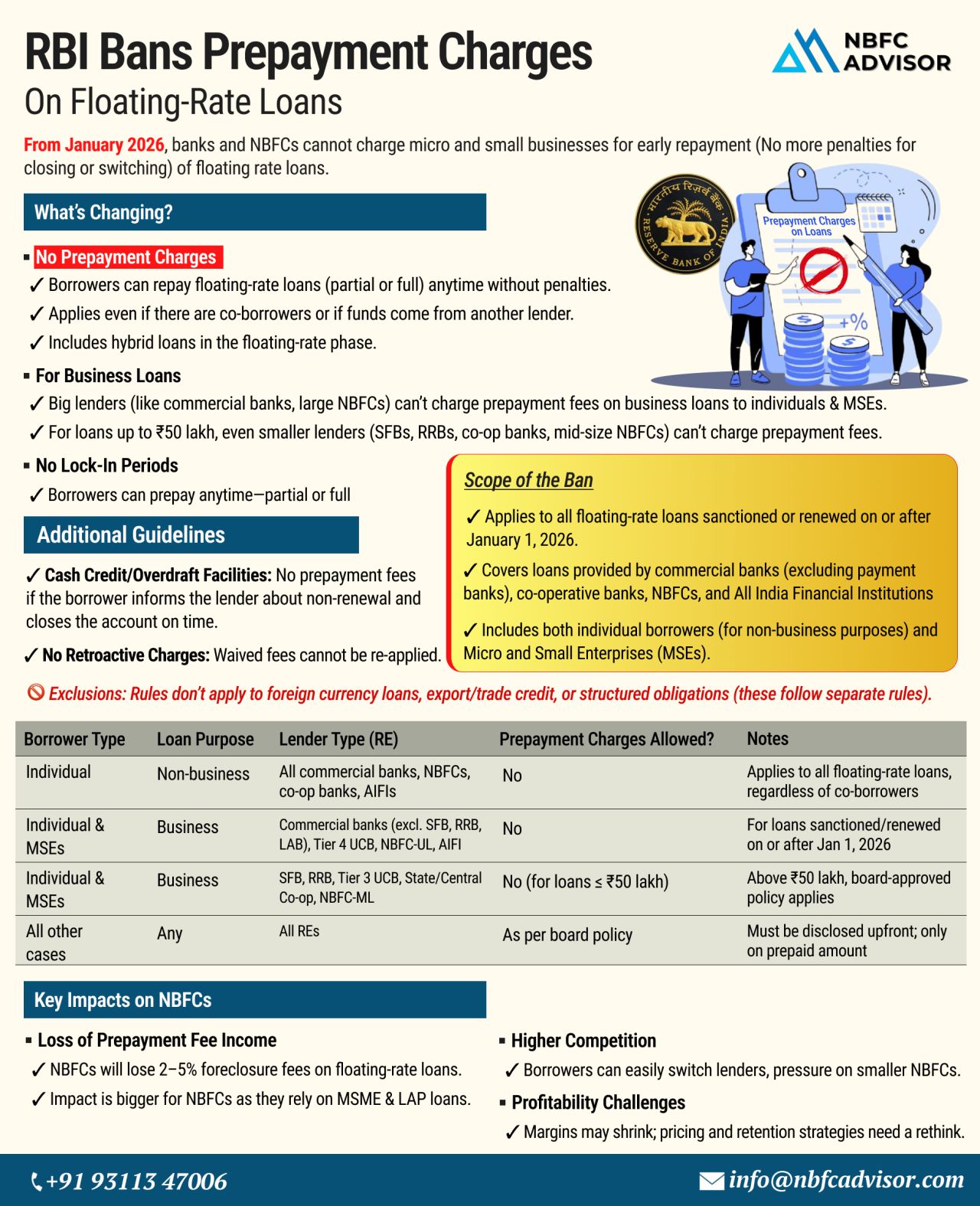

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...