Purchase and Sale of NBFC in India: Complete Legal, RBI & Compliance Guide

The purchase and sale of a Non-Banking Financial Company (NBFC) in India has become a popular route for investors, financial institutions, and FinTech players to enter ...

Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

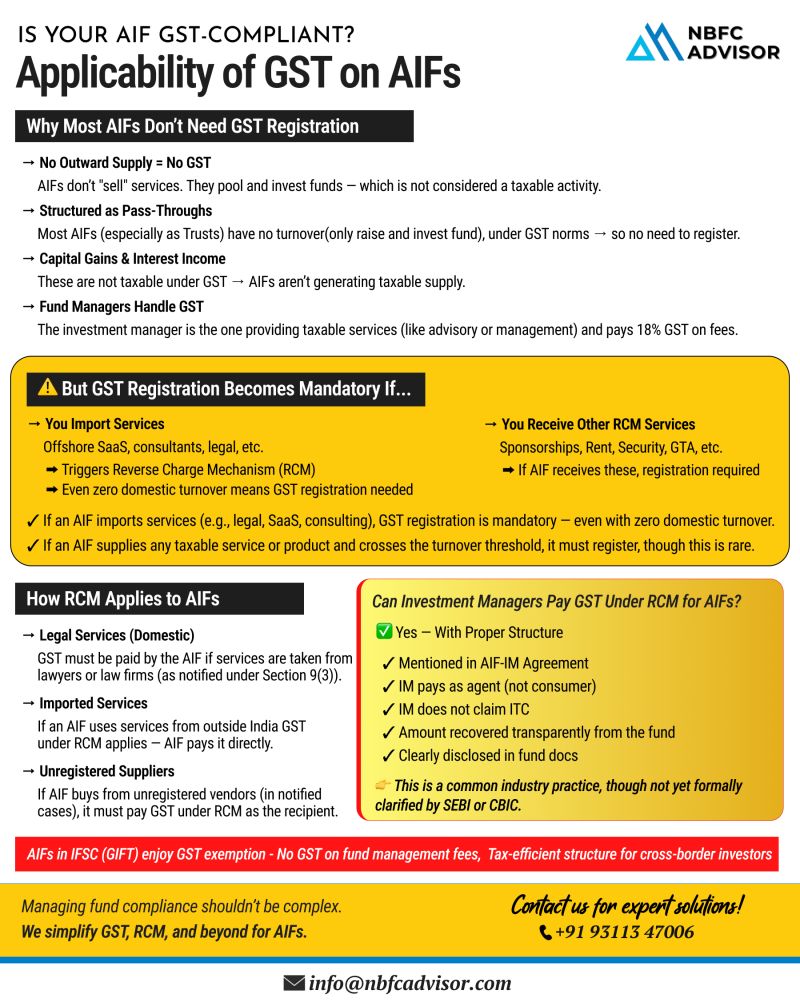

𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐑𝐞𝐪𝐮𝐢𝐫𝐞 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Understanding GST obligations for Alternative Investment Funds

As the Alternative Investment Fund (AIF) landscape continues to grow in India, so does the complexity a...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

Introduction: In the ever-evolving landscape of finance, Non-Banking Financial Companies (NBFCs) are emerging not just as financial entities but as true catalysts for transformative change. This blog delves into the profound impact of NBFCs, explorin...

.jpeg)

.jpeg)

.jpeg)