One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

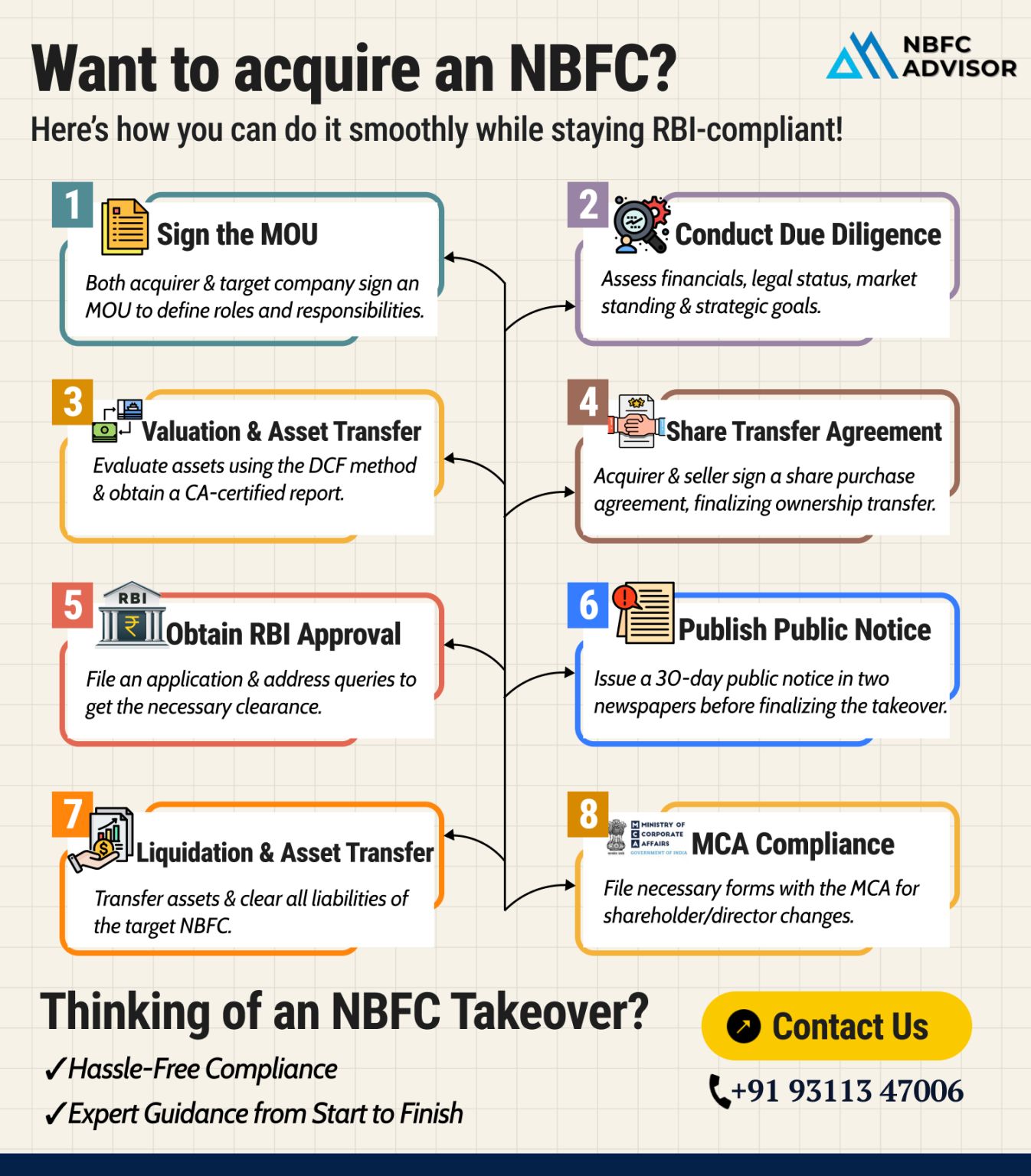

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

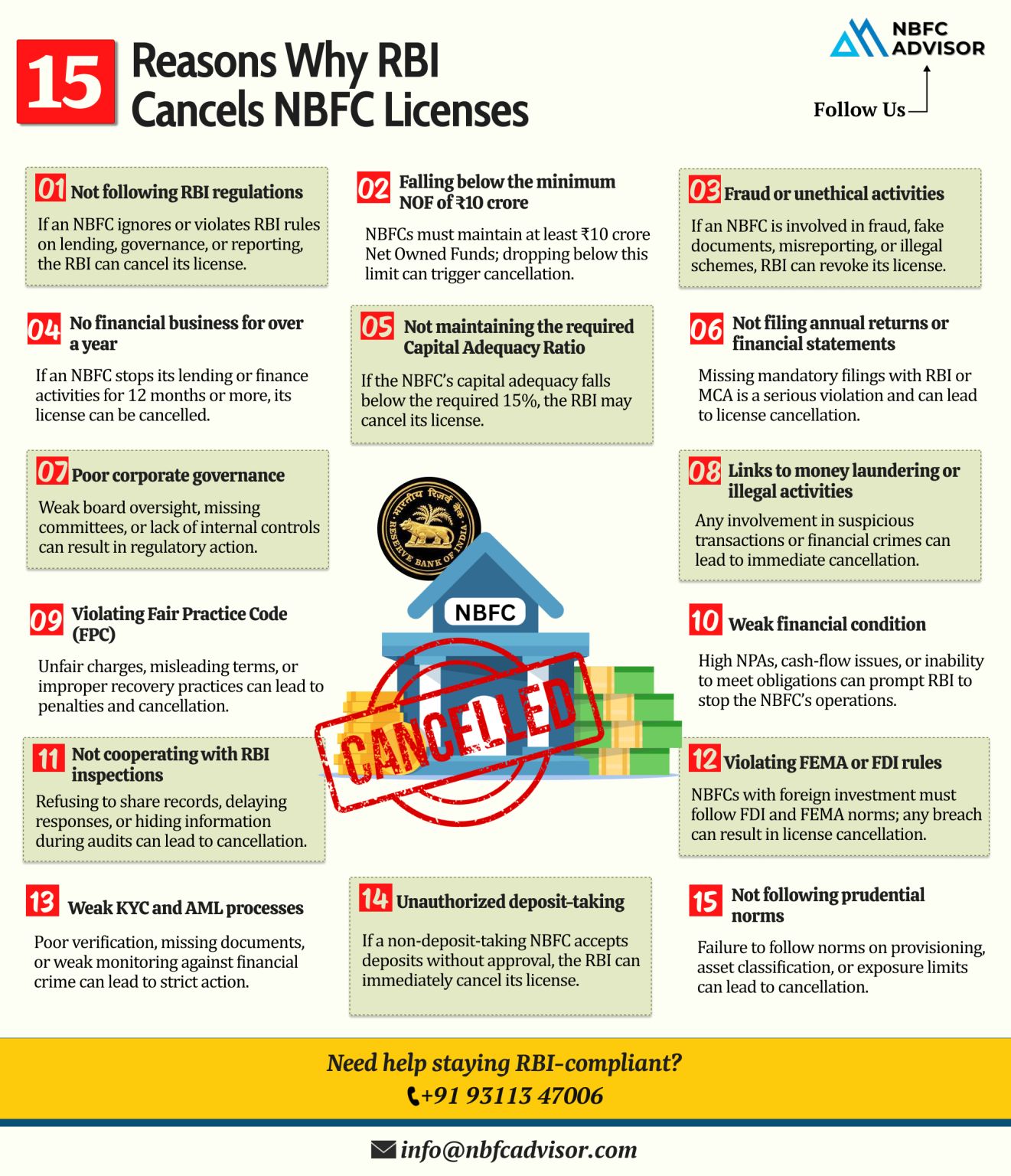

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Many NBFCs don’t fail because of bad business decisions — they fail because of missed compliance.

In today’s regulatory environment, RBI’s supervision...

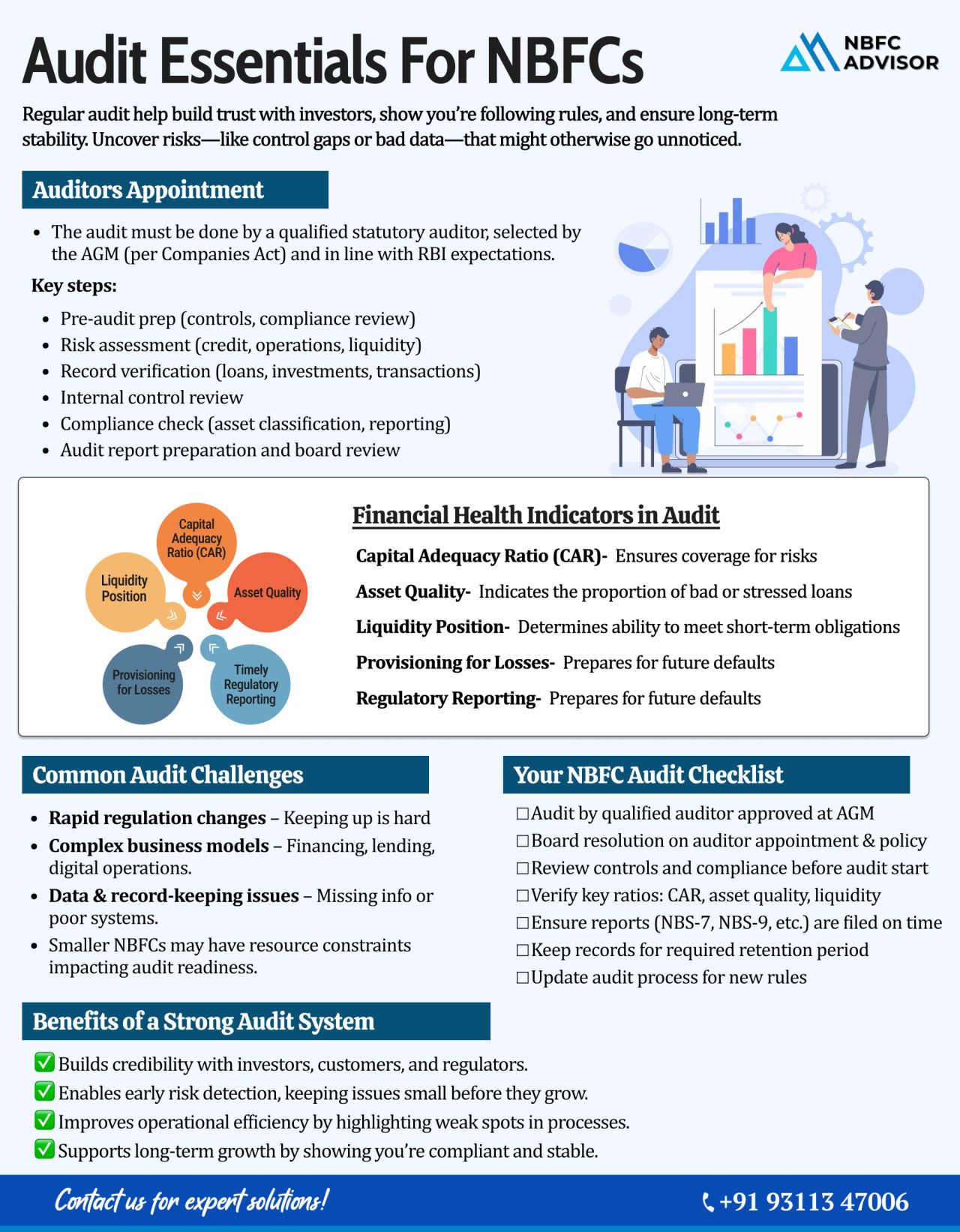

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

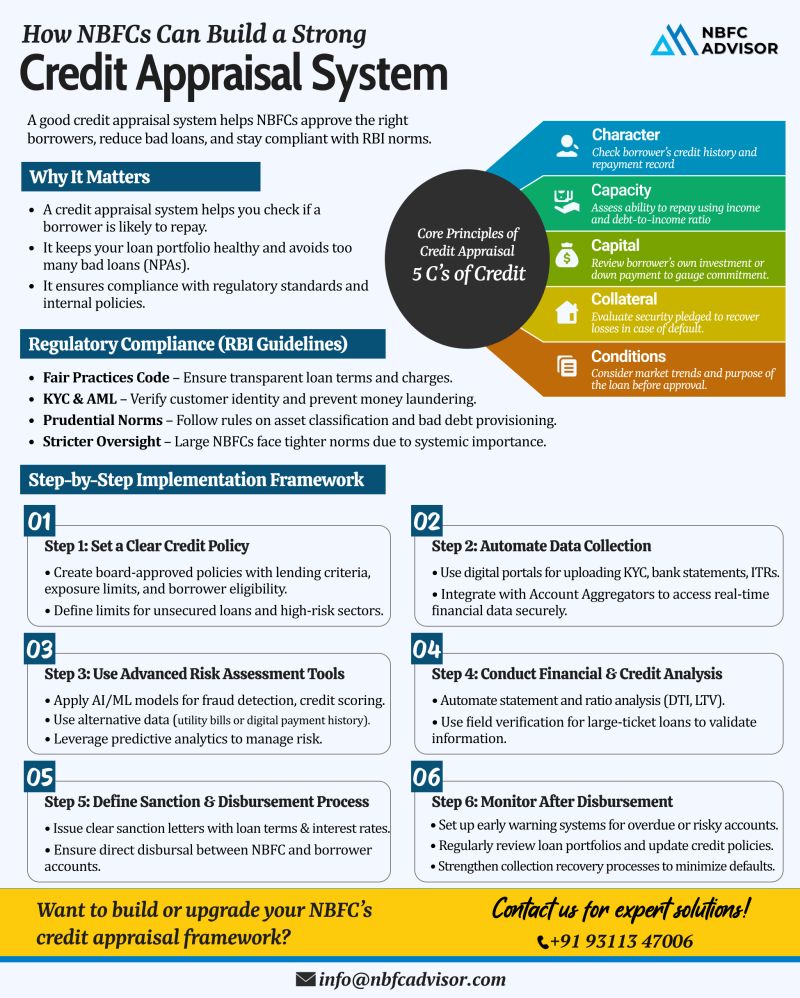

Want to Reduce Loan Defaults? Strengthen Your Credit Appraisal Process 💡

Smart Credit Assessment = Safer Lending

In today’s competitive lending environment, Non-Banking Financial Companies (NBFCs) face increasing pressure to maintain por...

Thinking of Starting a Digital Lending Business? Here’s What You Should Know

India’s credit ecosystem is undergoing a digital revolution. By 2030, the country’s digital lending market is projected to reach $515 billion — al...

Why Are NBFCs Turning to Loan Against Property (LAP)?

India’s Non-Banking Financial Companies (NBFCs) are entering a new growth phase — and Loan Against Property (LAP) is leading the way.

The Shift Toward Secure, Reliable, and Scala...

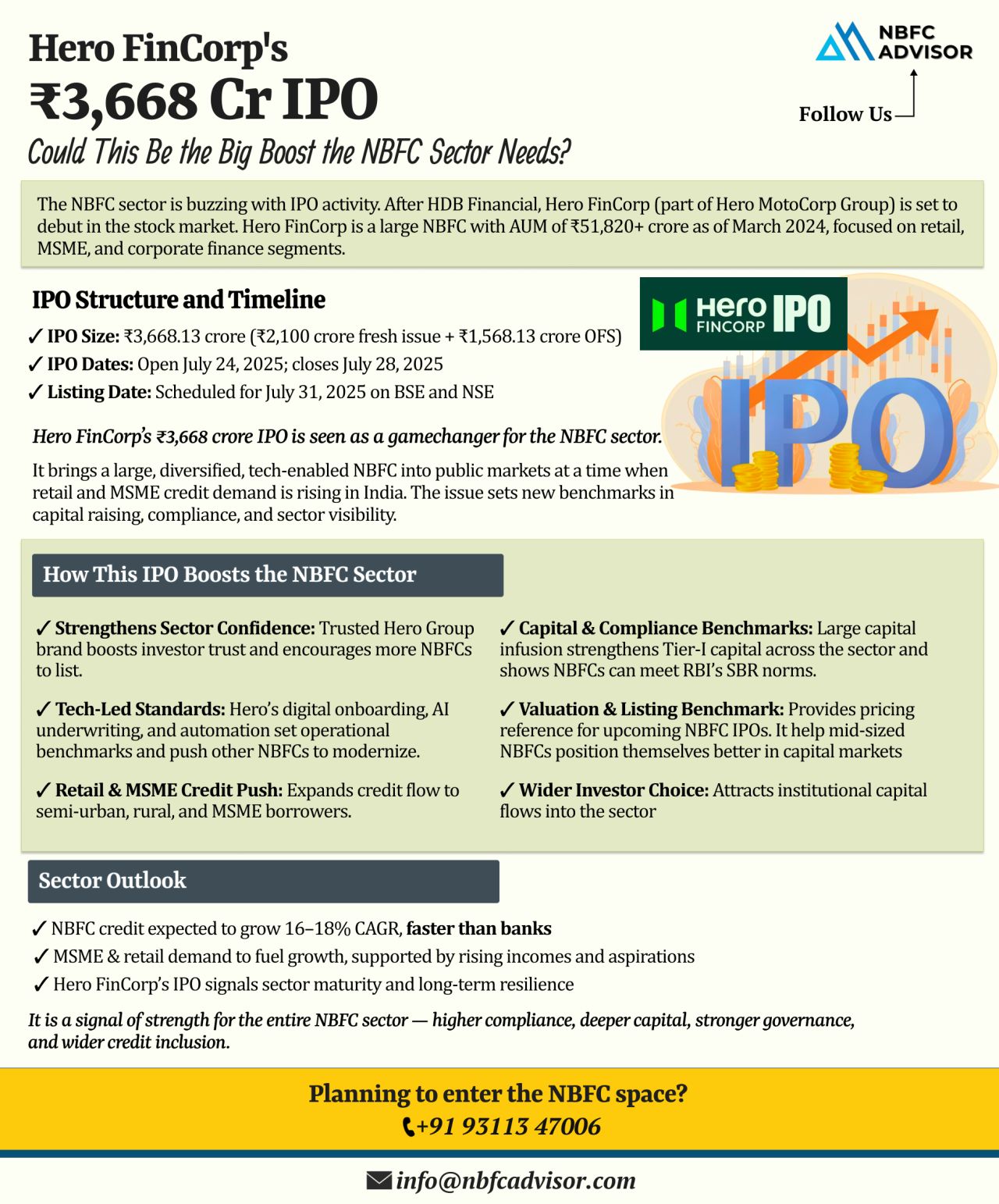

Hero FinCorp’s ₹3,668 Cr IPO: What It Means for the NBFC Sector

The Non-Banking Financial Company (NBFC) sector in India is witnessing a surge in Initial Public Offerings (IPOs), signaling a phase of growth and investor confidence. Following...

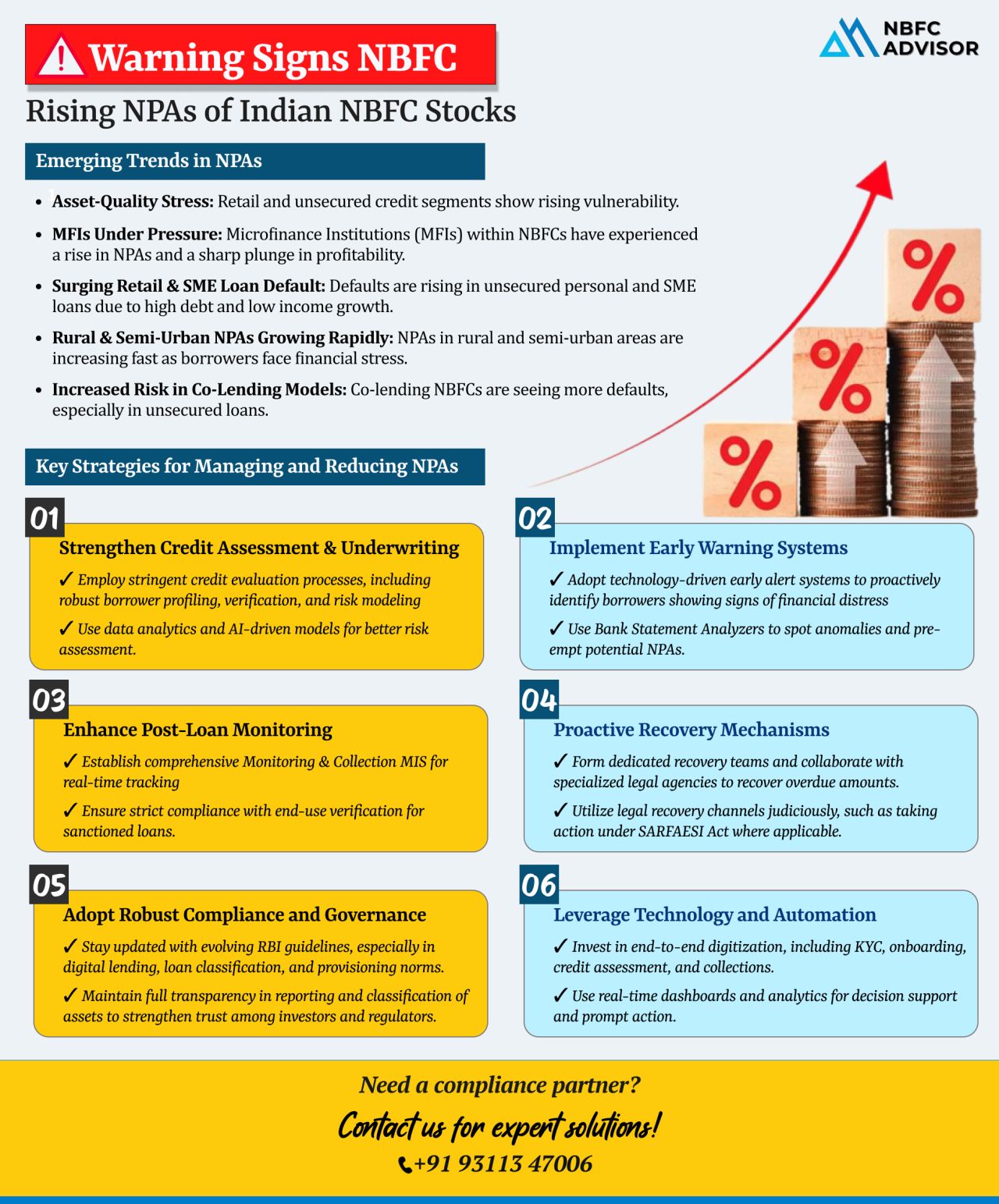

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

Dreaming of Launching Your NBFC?

Avoid These Top 5 Pitfalls to Secure Your RBI License!

Setting up a Non-Banking Financial Company (NBFC) in India can be a game-changer—but getting the RBI license is where many dreams hit a wall. Each yea...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

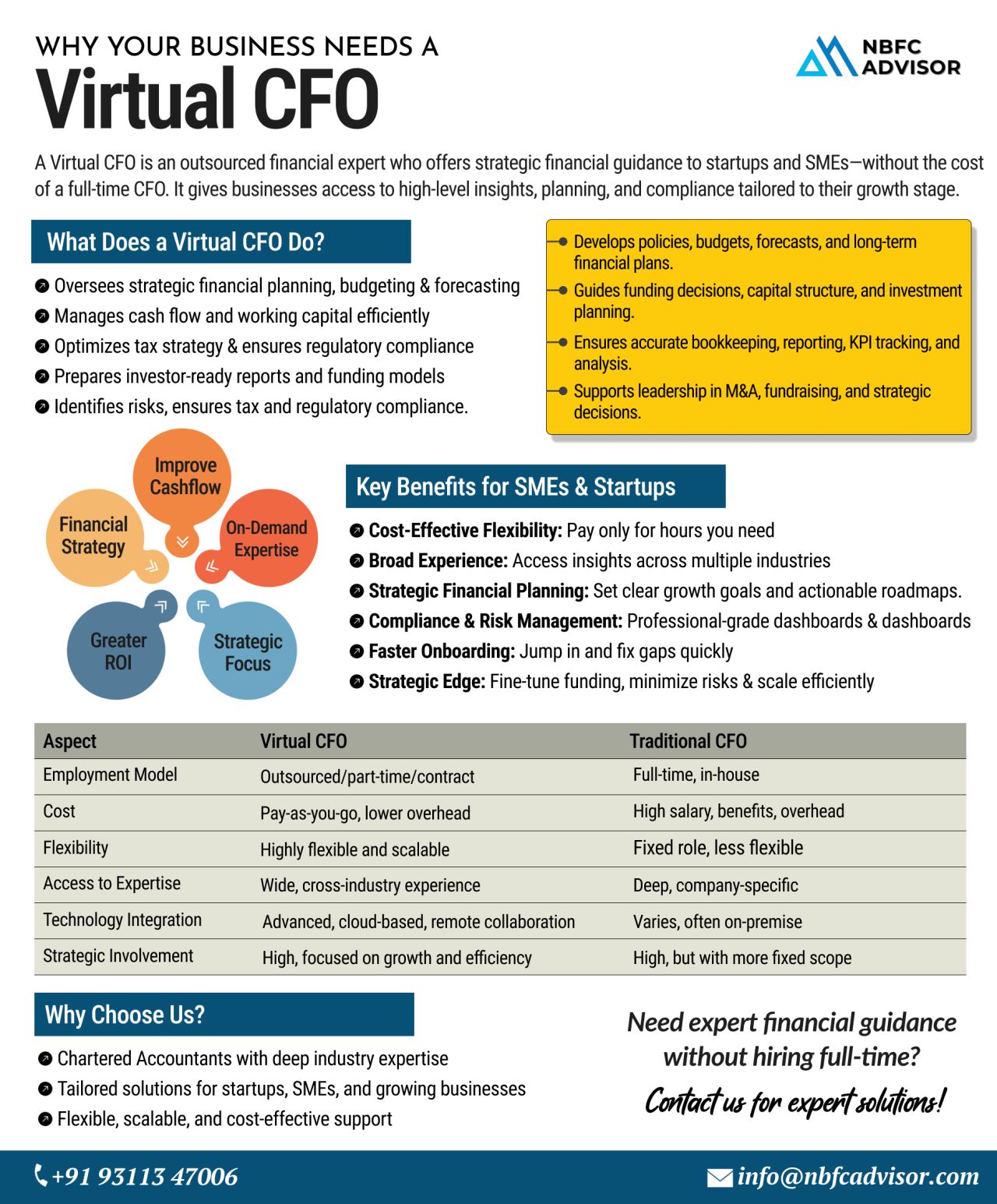

Struggling to Make Sense of Your Finances?

As businesses grow, it’s common to hit a point where spreadsheets, basic reports, and guesswork just aren’t enough. You need clarity, strategy, and confidence behind every financial decision &...

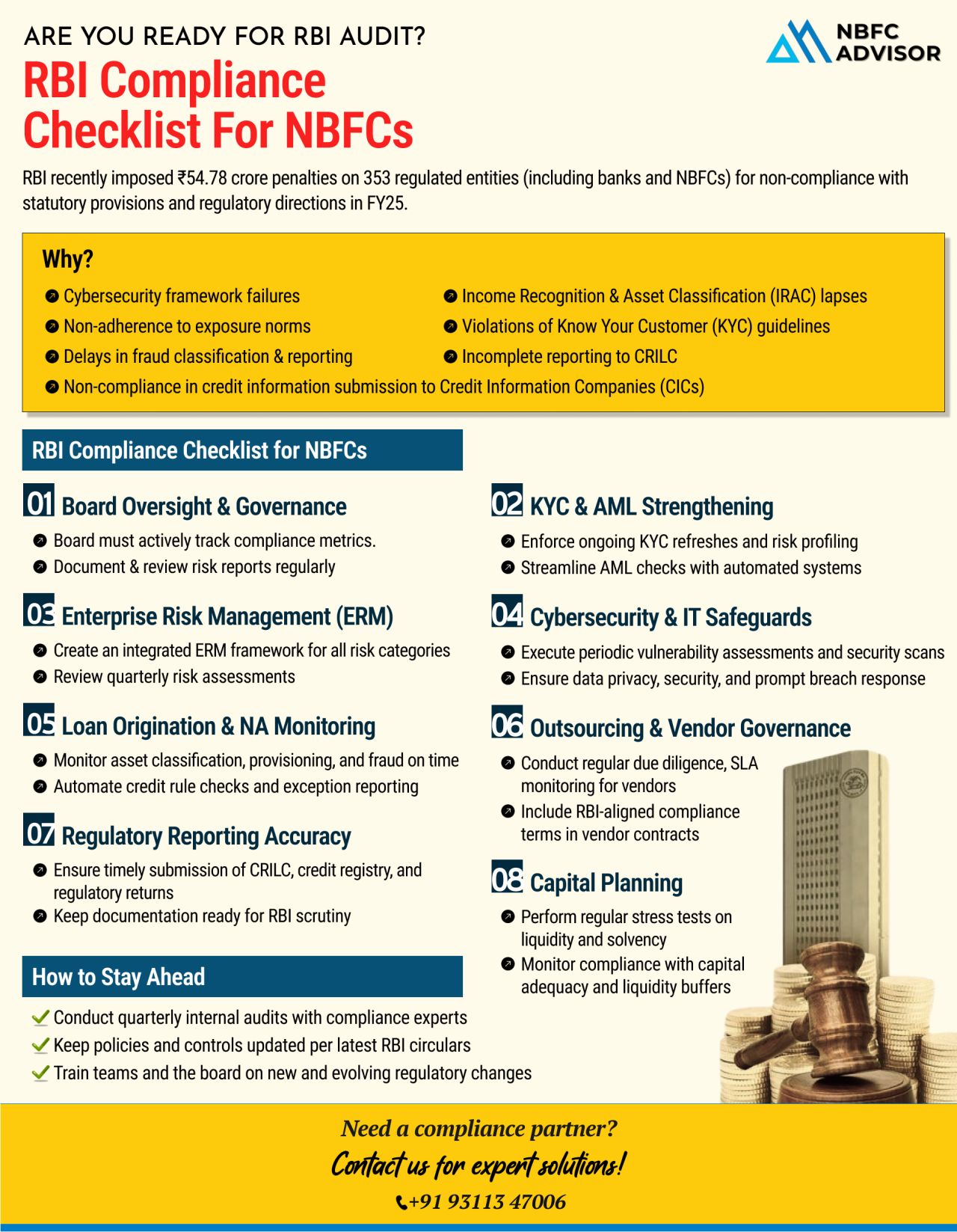

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

Why Do Most NBFCs Struggle to Scale?

It's Not Just About Funding – It's About Financial Visibility

Many Non-Banking Financial Companies (NBFCs) face significant challenges when it comes to scaling their operations. While most peop...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

Most loan defaults don’t happen because of bad customers — they happen because of bad credit decisions.

Yet, many NBFCs still rely on outdated, unstructured loan assessment methods.

If you’re serious about scaling safely and s...

With over 190 million adults in India lacking a formal credit history, traditional credit scoring models fall short.

Alternative Credit Scoring taps into digital footprints—such as rent payments, utility bills, mobile transactions, and even ...

In the era of Open Finance, NBFC Account Aggregators (AA) are revolutionizing how financial data is shared, accessed, and utilized. If you're a fintech, NBFC, or financial service provider, an NBFC-AA license could be your key to unlocking a futu...

Traditional KYC is slow, expensive, and vulnerable to fraud. Video KYC (vKYC) is revolutionizing the process by making it faster, safer, and more efficient.

✅ Faster Approvals – Complete KYC in 10-15 minutes, loan disbursal within 48 hours.

...

India’s digital lending industry is on a rapid growth trajectory, projected to hit $1.3 trillion by 2030! With AI-powered risk assessment, fintech innovation, and RBI-backed policies, the sector is ripe with opportunities.

💰 Want to tap int...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

Digital lending is set to hit ₹5 TRILLION by FY28! 📈

With a 40% CAGR growth, the industry is expected to double its market share in India’s retail loan space in just four years.

And the best part? It’s just getting started!

What...

India’s digital lending space has witnessed tremendous growth, making credit more accessible to individuals and MSMEs. However, with this growth has come a dark side—a rise in unregulated lenders engaging in:

❌ Predatory inte...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

In today’s rapidly evolving financial landscape, co-lending has emerged as a significant force reshaping how loans are disbursed in India. The model, which enables banks and Non-Banking Financial Companies (NBFCs) to jointly disburse loans, has...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

Emerging technologies and strategic partnerships are crucial for Non-Banking Financial Companies (NBFCs) to thrive in an increasingly regulated and competitive financial landscape. By integrating advanced technologies and collaborating with FinTech c...

In the rapidly evolving financial services sector, Non-Banking Financial Companies (NBFCs) are experiencing a transformative shift, thanks to the advent of digital and AI-enabled tools. Systems such as Loan Origination Systems (LOS) and Loan Manageme...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In the relentless pursuit of financial inclusion, a notable paradigm shift has unfolded in recent years, marked by the symbiotic relationship between Non-Banking Financial Companies (NBFCs) and Fintech firms. This strategic alliance has emerged as a ...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)