Want to Reduce Loan Defaults? Strengthen Your Credit Appraisal Process 💡

Smart Credit Assessment = Safer Lending

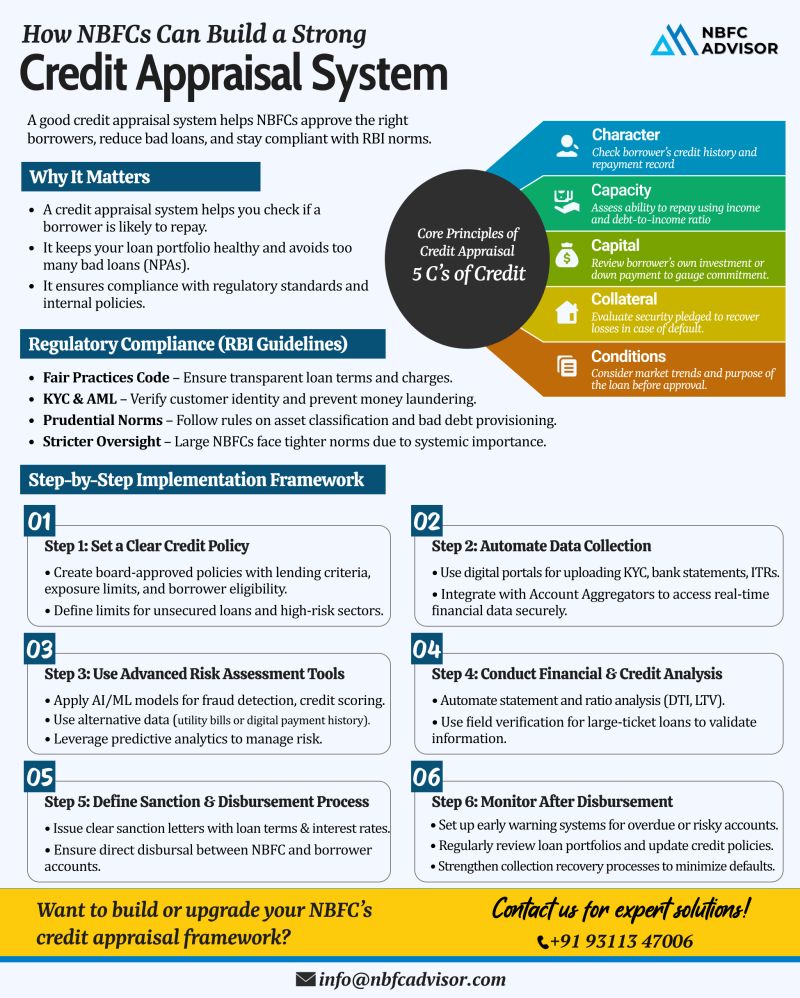

In today’s competitive lending environment, Non-Banking Financial Companies (NBFCs) face increasing pressure to maintain portfolio quality while growing their loan book. But most loan defaults don’t happen overnight — they begin with weak credit checks, incomplete borrower analysis, or poor post-loan monitoring.

A robust credit appraisal system is the foundation of safe, sustainable, and compliant lending.

📋 A Quick Credit Appraisal Checklist for NBFCs

To minimize risk and ensure better lending decisions, every NBFC should review its credit assessment framework against these key checkpoints:

-

✅ Are borrower documents complete and verified?

Ensure thorough verification of KYC, income proofs, collateral, and bank statements. Missing or unverified documents can lead to inaccurate credit assessments. -

✅ Is there a clear risk-scoring model in place?

Develop a quantitative and qualitative scoring model that evaluates a borrower’s repayment capacity, credit history, and business viability. -

✅ Are decision rules defined and reviewed regularly?

Set clear decision-making guidelines and update them based on market trends, default patterns, and regulatory updates. -

✅ Is technology used to speed up the process and reduce errors?

Adopt digital credit appraisal tools and AI-driven analytics to enhance accuracy, reduce human error, and shorten approval timelines. -

✅ Do you monitor loans after disbursement and flag early risks?

Post-loan monitoring is critical. Use early warning systems (EWS) to detect delays or financial distress before they turn into defaults. -

✅ Are your credit policies aligned with RBI regulations?

Regularly review credit practices to ensure full compliance with RBI’s Fair Practices Code, KYC, and risk management guidelines.

⚙️ Why a Strong Credit Appraisal Framework Matters

A structured and data-driven credit appraisal process helps NBFCs:

-

Reduce default and delinquency rates

-

Strengthen risk management and compliance

-

Improve decision-making consistency

-

Build trust with regulators, investors, and borrowers

In short, it’s not just about approving loans — it’s about approving the right loans.

🧩 How NBFC Advisor Can Help

At NBFC Advisor, we help financial institutions design, assess, and strengthen their credit appraisal frameworks in line with RBI’s regulatory standards.

Our experts specialize in:

✅ Credit policy and risk framework development

✅ Process automation and technology integration

✅ Staff training and audit readiness

✅ Compliance reviews and credit audits

With the right system in place, your NBFC can achieve faster disbursements, fewer defaults, and stronger long-term growth.

📞 Get Expert Guidance Today

Want to build a safer and smarter lending process?

Contact NBFC Advisor for a free consultation!

📞 +91 93113 47006

#NBFCAdvisor #NBFC #CreditAppraisal #RBICompliance #DigitalLending #RiskManagement #Finance