FinTech–NBFC Collaboration Service: Powering Scalable, RBI-Compliant Digital Lending Partnerships

The future of financial services lies in collaboration. FinTech companies bring technology, customer experience, and innovation, while NBFCs br...

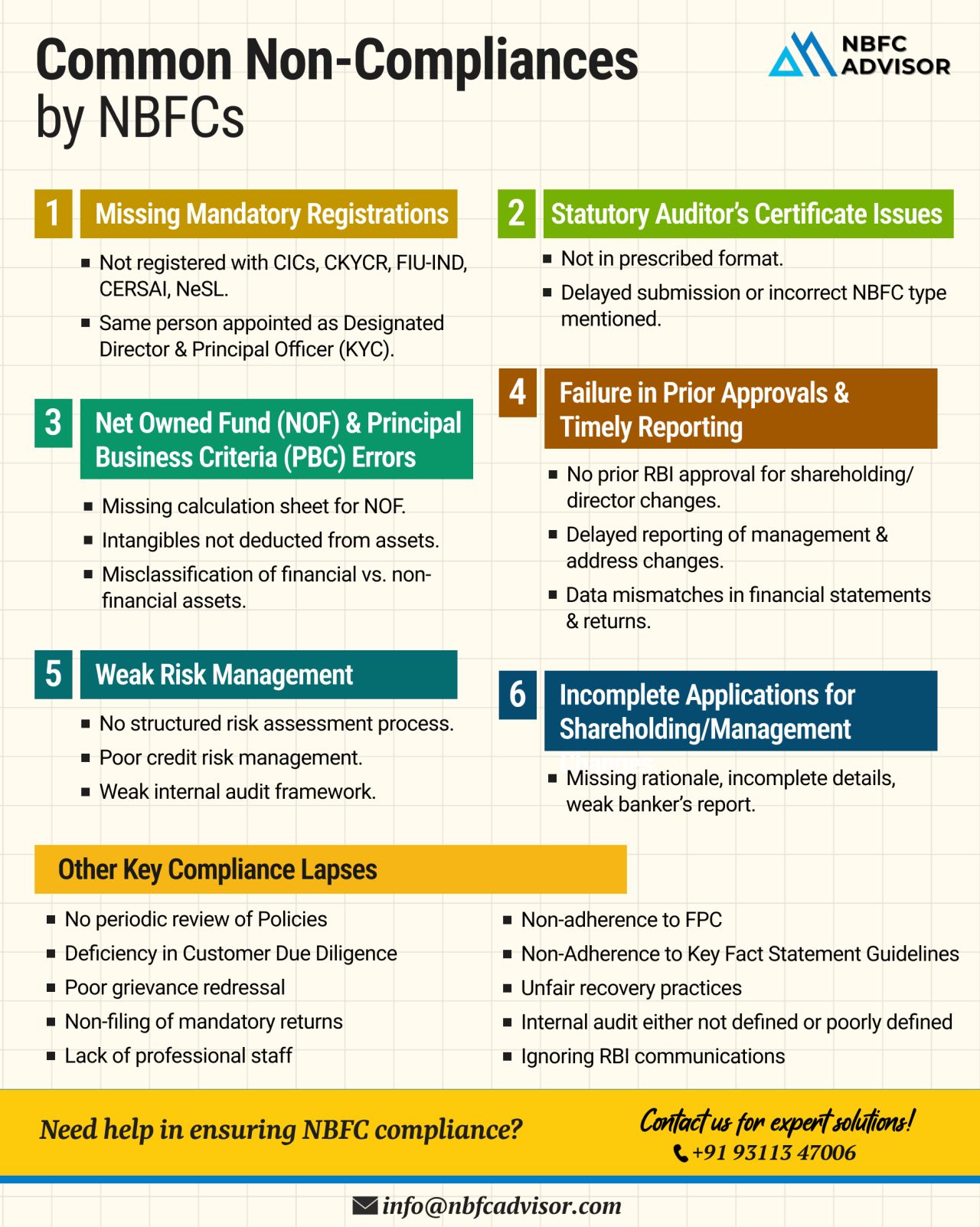

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

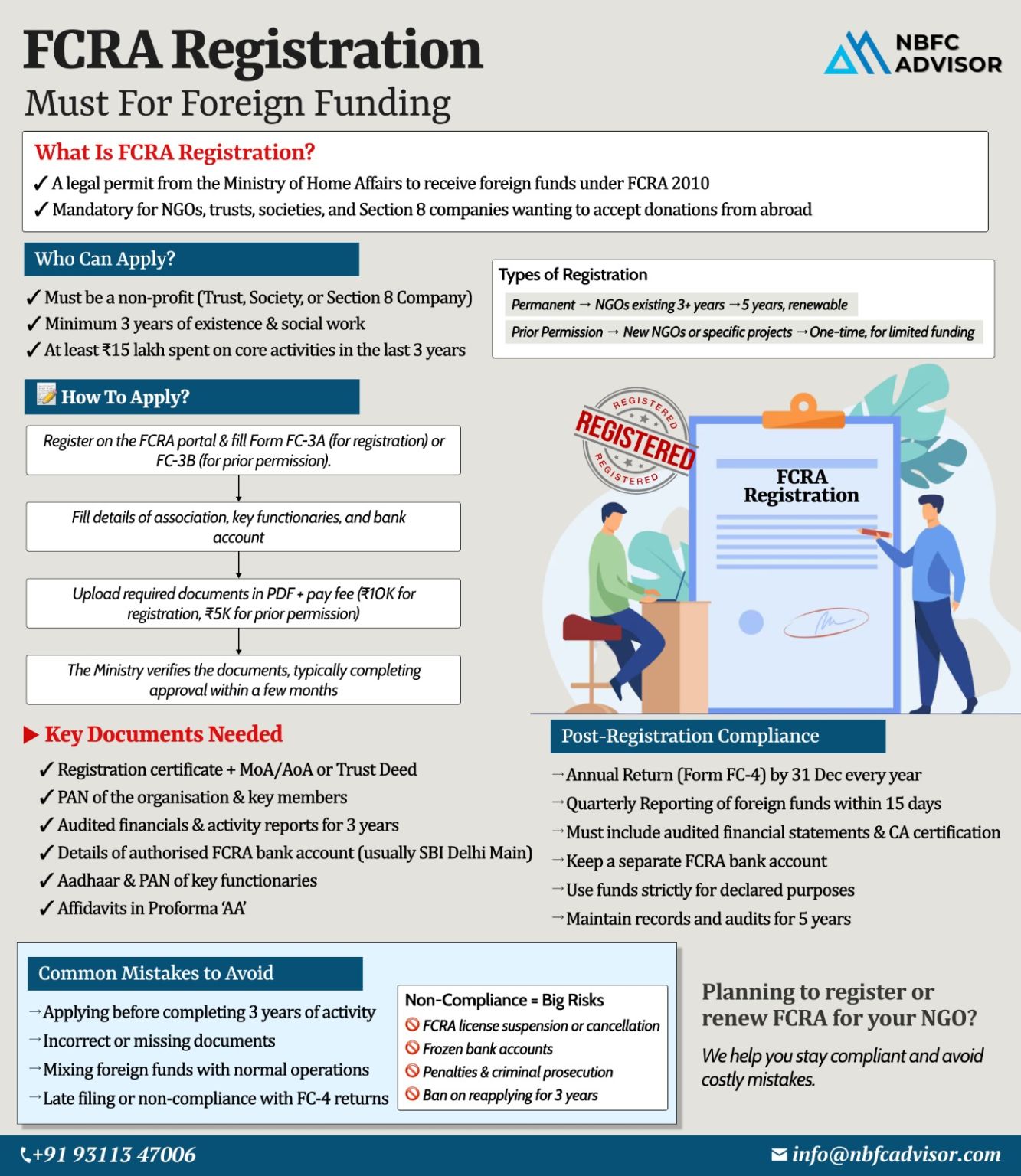

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

Foreign funding can be a lifeline for NGOs working in education, healthcare, human rights, environment, and social welfare. Yet every year, hundreds of NGOs in India lose their ability to ...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know Before You Buy

Acquiring an NBFC (Non-Banking Financial Company) can open doors to lending, fintech expansion, digital credit, and financial services — but only if the acqu...

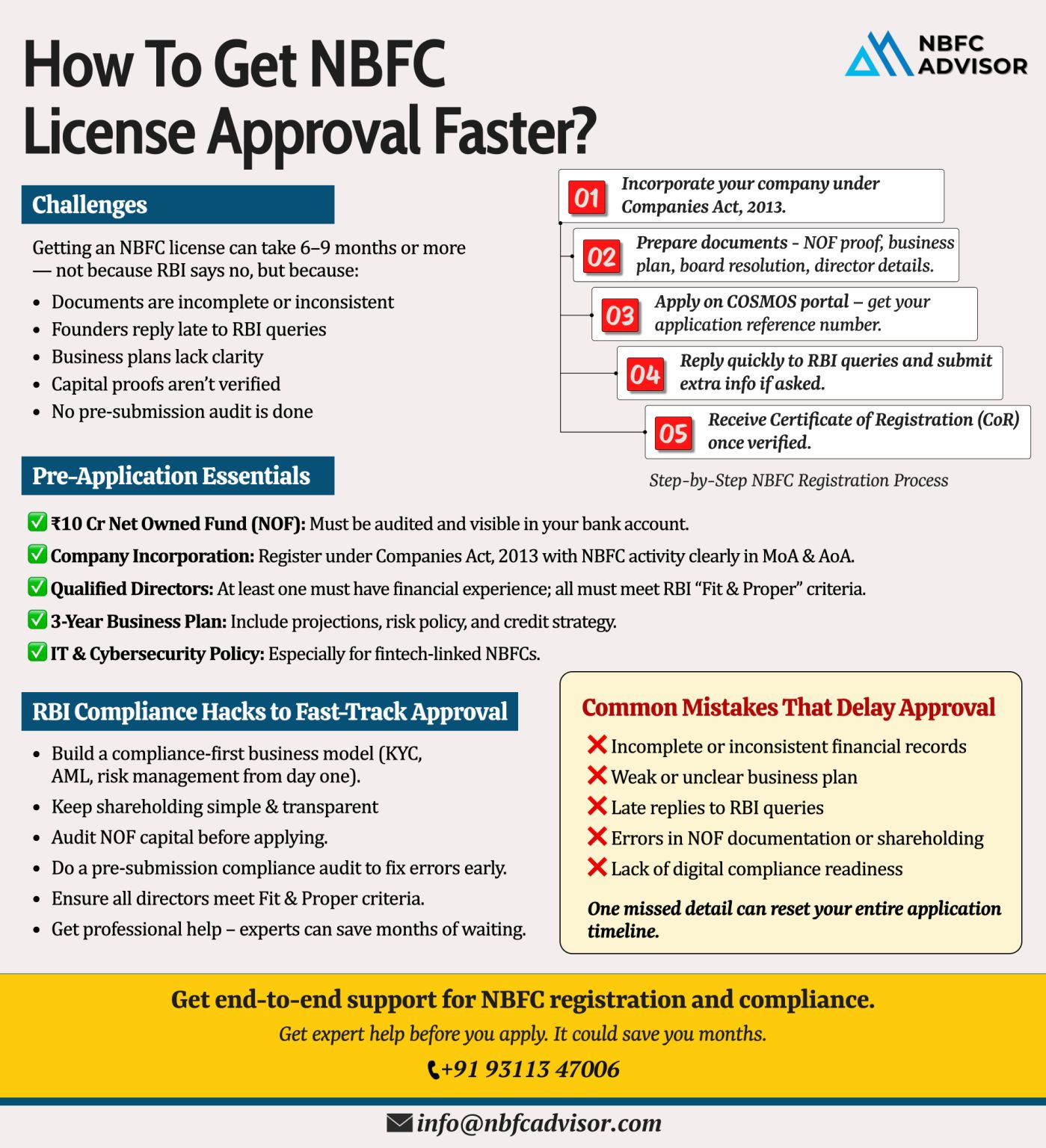

Top Mistakes NBFC Founders Make While Applying for an RBI License (and How to Avoid Them)

Top Mistakes NBFC Founders Make While Applying for an RBI License

Getting an NBFC (Non-Banking Financial Company) License from the Reserve Bank of India (...

Thinking of Entering India’s Fast-Growing NBFC Space? Choose an NBFC Takeover for Faster Market Entry

India’s Non-Banking Financial Company (NBFC) sector has emerged as one of the most dynamic segments of the financial market — o...

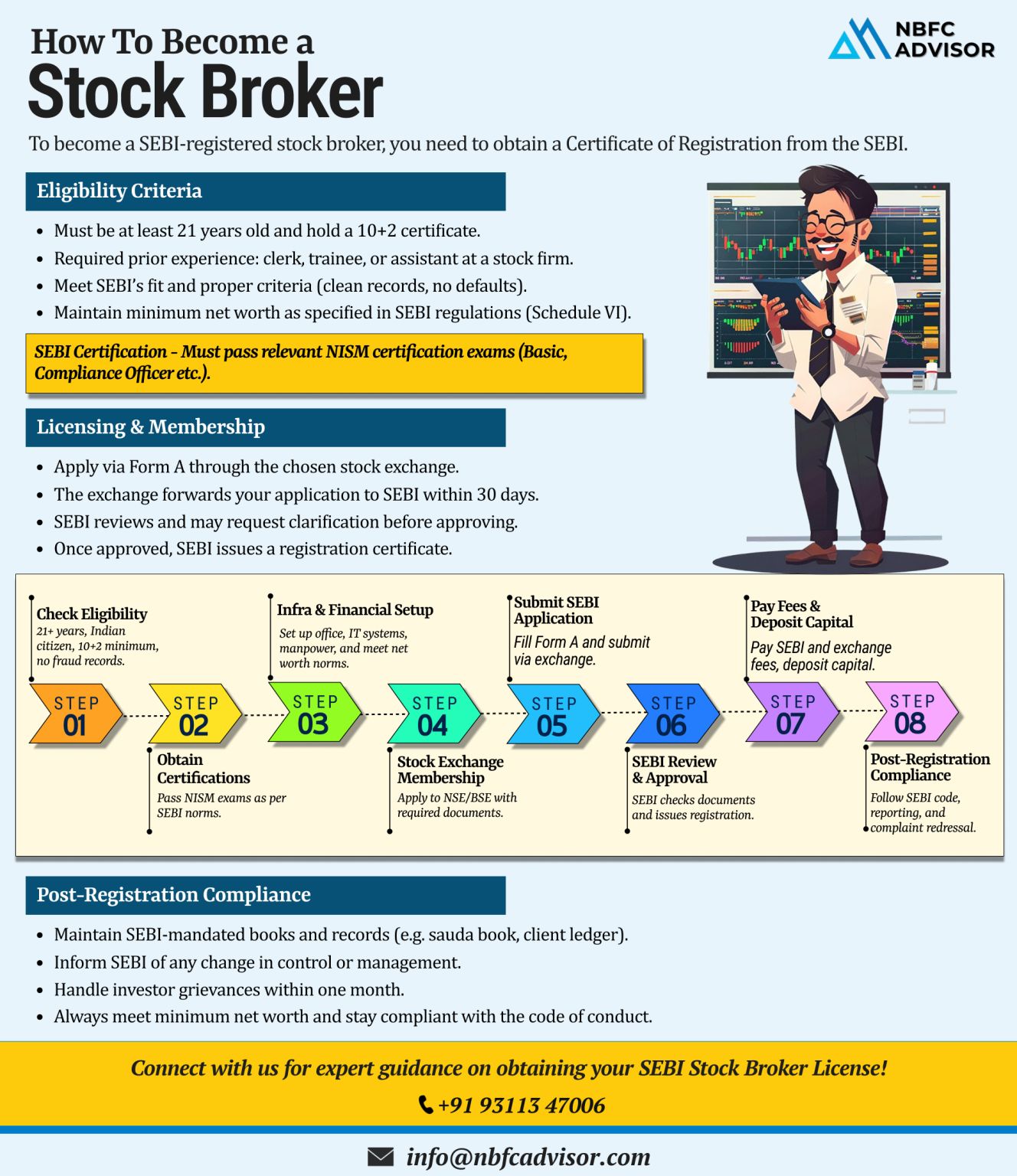

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

Is Your NBFC Ready for the Latest RBI Updates?

The Reserve Bank of India (RBI) is rolling out significant measures to tighten the compliance landscape for Non-Banking Financial Companies (NBFCs). These updates span digital lending, reporting requi...

Are These Mistakes Putting Your NBFC at Risk?

India’s NBFC (Non-Banking Financial Company) sector continues to grow at a fast pace. But with greater opportunity comes increased regulatory oversight and risk. Many NBFCs run into serious issue...

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📉 Is Your NBFC at Risk of RBI Action?

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to lice...

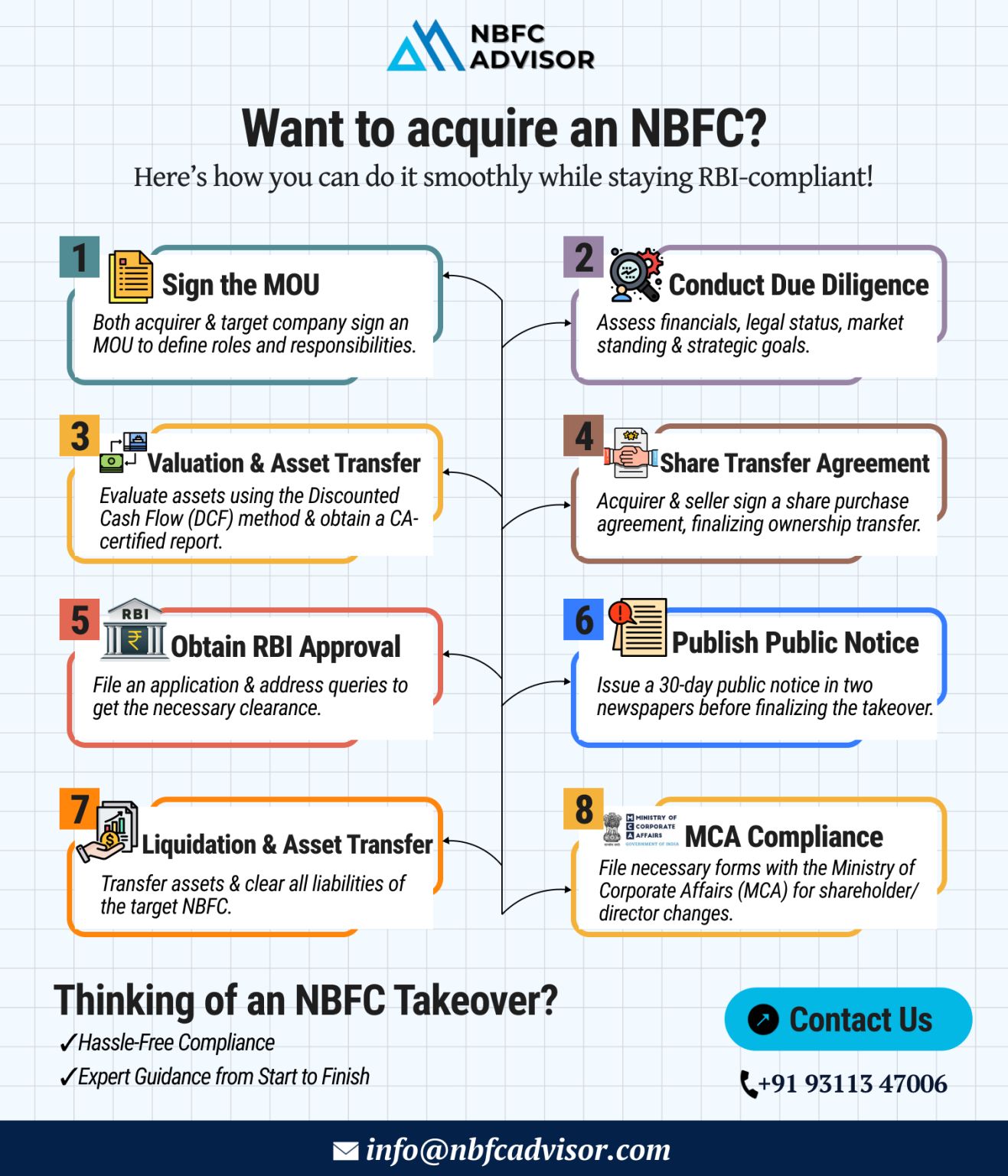

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

If you’re passionate about guiding people toward better financial decisions, becoming a SEBI Registered Investment Advisor (RIA) is a smart and impactful career move.

India needs more qualified, ethical, and SEBI-recognized advisors—an...

Here’s Your Complete Roadmap

India’s stock market is expanding rapidly, offering exciting opportunities for professionals looking to enter the financial sector. If you're aiming to become a SEBI-registered stock broker, you’l...

In today’s financial landscape, trust is everything—and Non-Banking Financial Companies (NBFCs) that prioritize ethical lending practices stand out from the rest. Beyond regulatory compliance, ethical conduct helps NBFCs build long-term c...

Acquiring a Non-Banking Financial Company (NBFC) can unlock exciting growth opportunities—but staying compliant with RBI regulations is non-negotiable.

Here’s how to acquire an NBFC the right way:

1️⃣ Sign the MoU

Define roles, res...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

When an ambitious NRI entrepreneur set out to acquire an NBFC in India, he faced a maze of consultants, delays, and false promises. Despite assigning the mandate to a consultant, he soon realized their approach wasn’t aligned with his vision.

...

Non-Banking Financial Companies (NBFCs) play a vital role in India’s financial ecosystem, but with RBI tightening regulations, compliance is now more crucial than ever.

⚠️ Non-Compliance Can Lead To:

🔴 Heavy fines & financial penalti...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

Please remember the following information regarding Non-Banking Financial Companies (NBFCs):

NBFCs play a vital role in providing funding to the Indian economy, and the Reserve Bank of India (RBI) is responsible for regulating and supervising thes...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In the dynamic realm of Non-Banking Financial Companies (NBFCs), takeover processes play a crucial role in shaping market landscapes and strategic trajectories. Let’s delve into the intricacies of NBFC takeovers, exploring the reasons behind th...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)