🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions, affordable credit, and financial inclusion, especially in Tier II and Tier III cities. NBFCs are now critical players in shaping India’s financial ecosystem and enabling access to credit where traditional banks often fall short.

Why This is the Right Time:

✔️ Investors can explore high-potential NBFC acquisition opportunities to enter a regulated and growing market.

✔️ Aspiring Founders can set up new NBFCs to tap into emerging lending segments like consumer loans, SME finance, vehicle loans, and fintech-driven credit.

But here’s the challenge —

Navigating RBI regulations, sourcing credible buyers or sellers, completing due diligence, and securing timely approvals can be a complicated and time-sensitive process.

That’s Where We Come In!

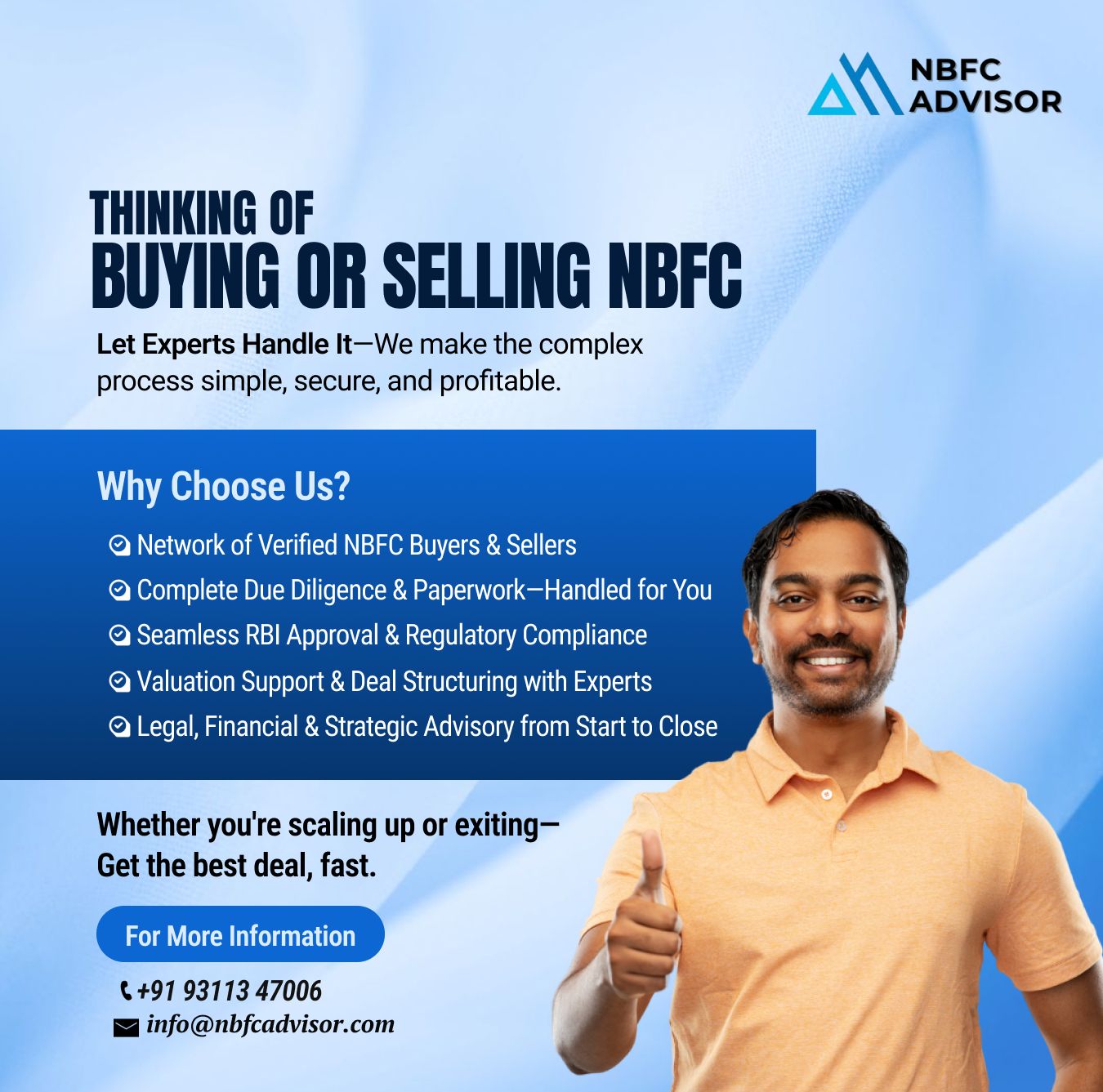

We offer end-to-end NBFC advisory services to simplify your journey:

✅ Connect you with genuine, verified buyers or sellers

✅ Handle RBI licensing, filings, and approval processes seamlessly

✅ Provide valuation support, due diligence, legal structuring, and documentation

✅ Ensure faster, hassle-free, and fully compliant transactions

Whether You’re:

✔️ Looking to Buy an NBFC

✔️ Planning to Sell Your NBFC

✔️ Aiming to Scale or Restructure Your NBFC

👉 We Make the Process Smooth and Effortless for You!

📞 Contact Us Today for a Free Consultation:

+91-9311347006