NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

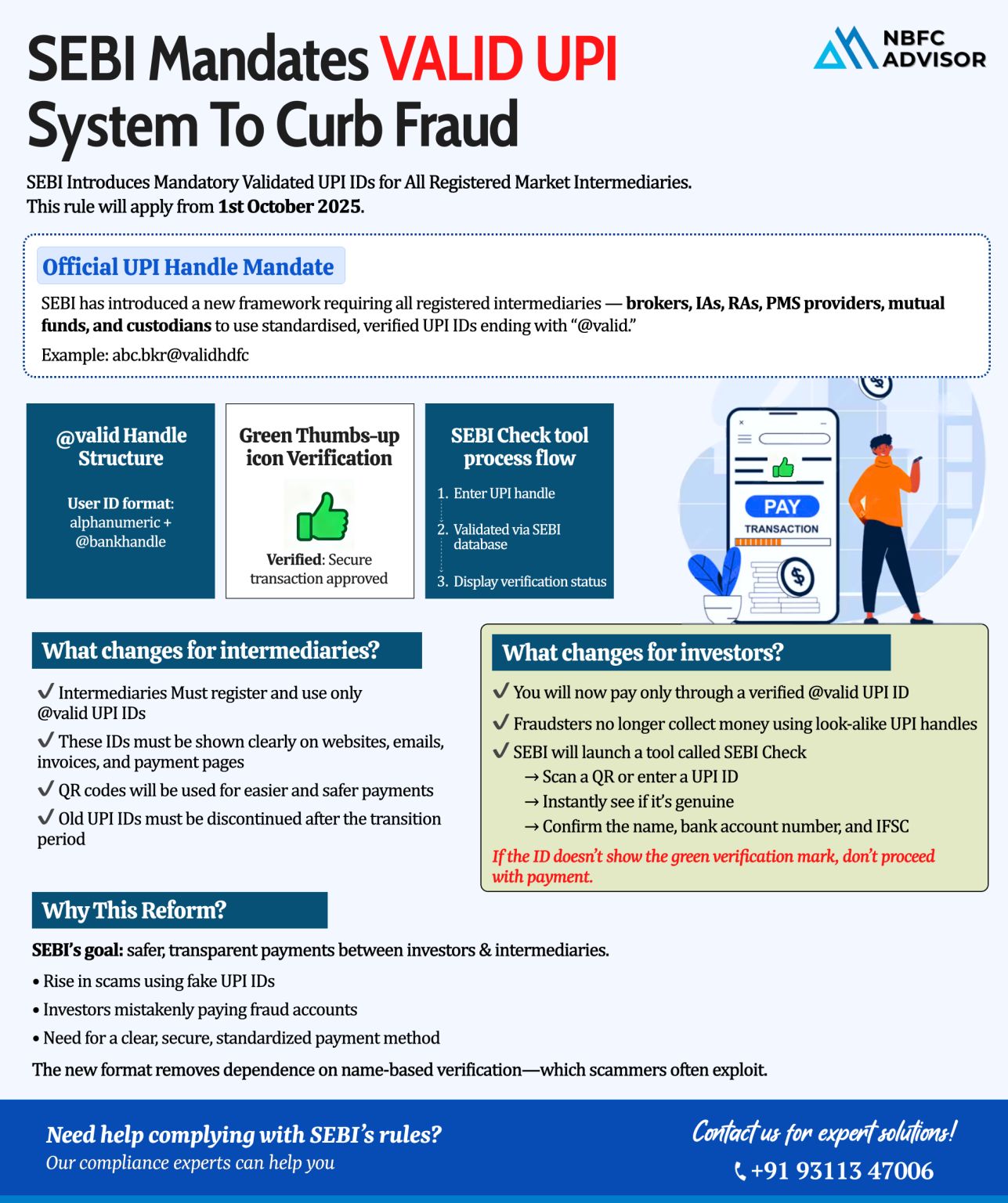

SEBI Introduces VALID UPI System: A Big Step Toward Safer Digital Payments!

The Securities and Exchange Board of India (SEBI) has rolled out a major reform to tighten digital payment security across the financial ecosystem. With rising cases of fa...

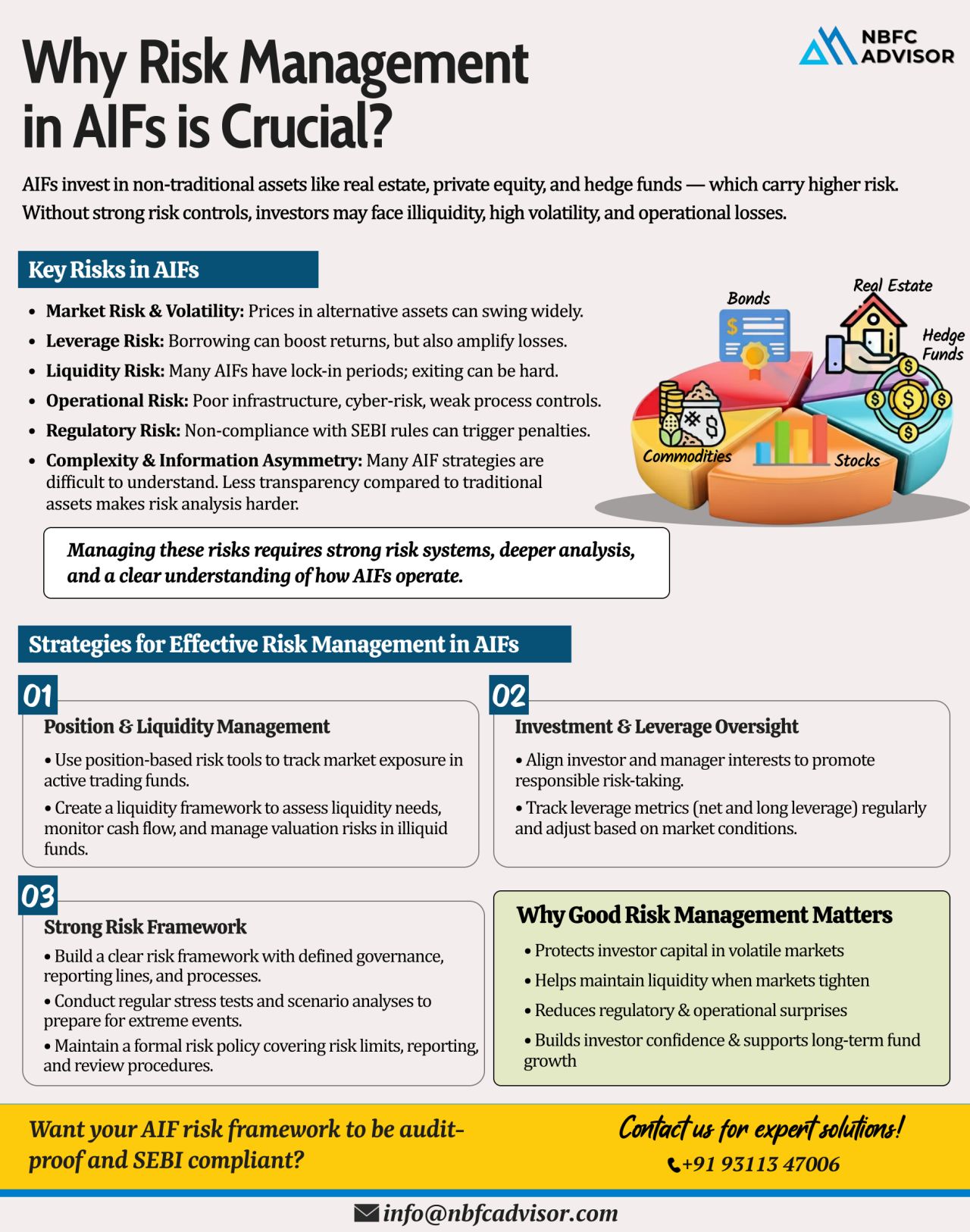

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

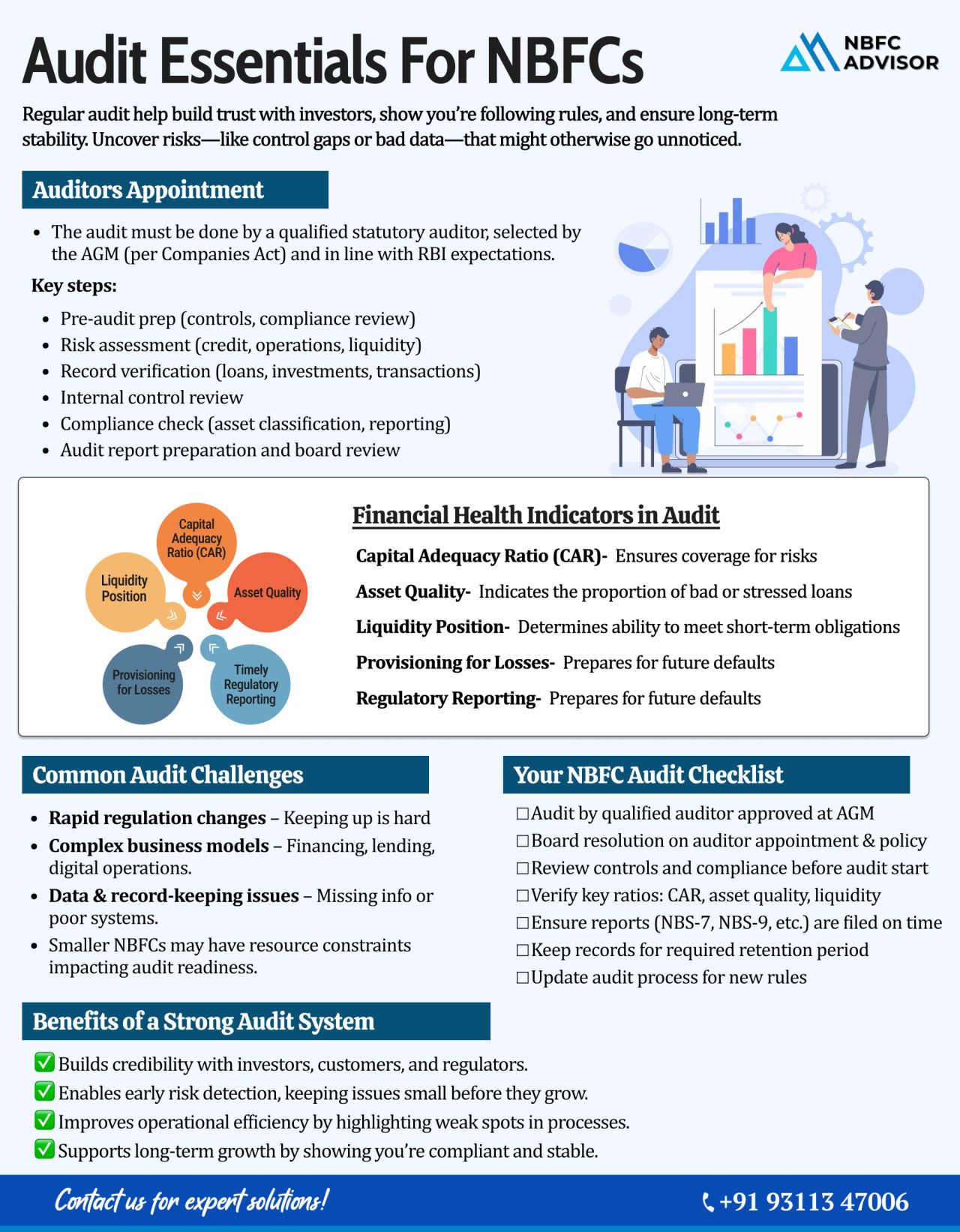

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

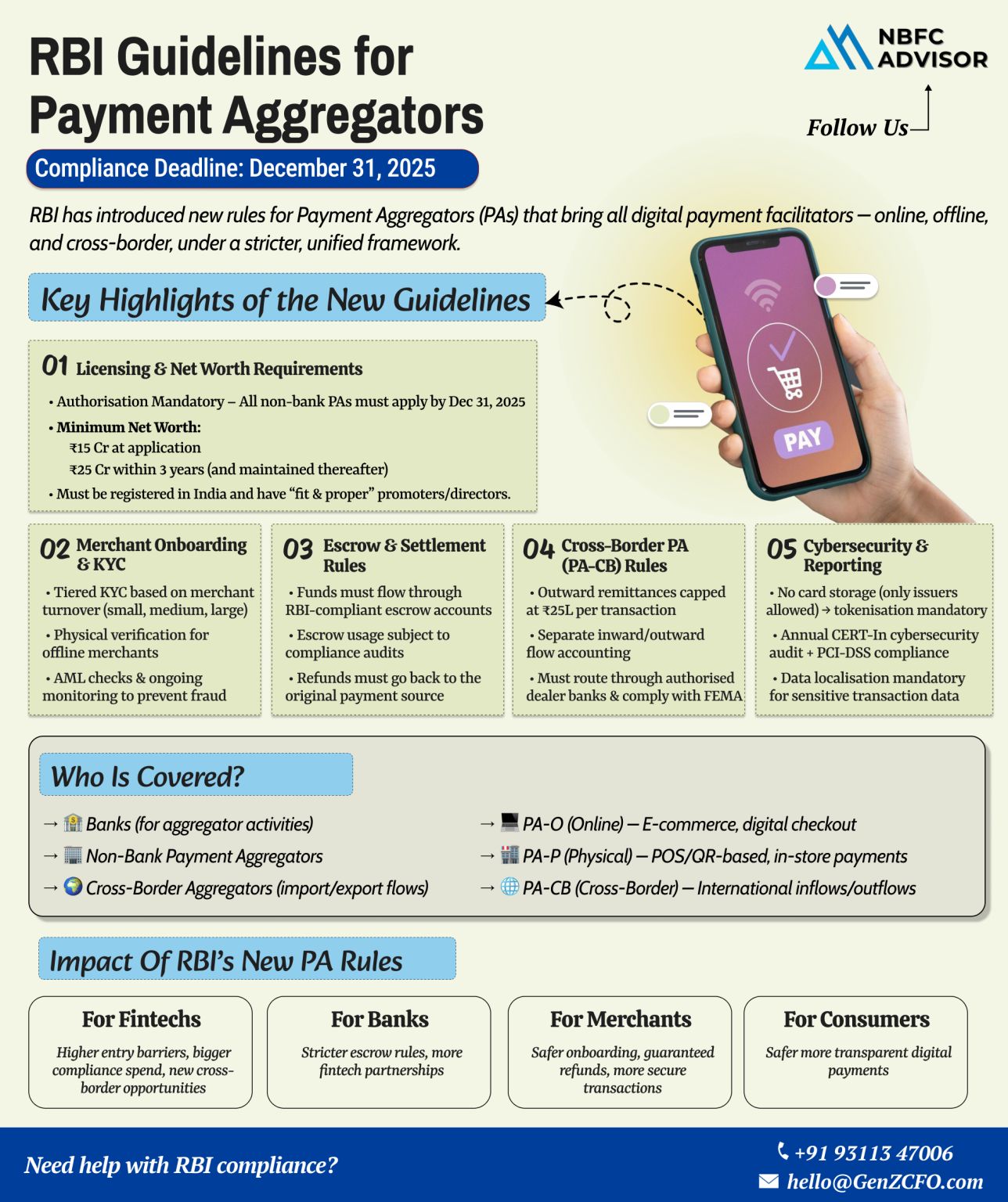

RBI’s Guidelines for Payment Aggregators: What Every Fintech Should Know!

India’s digital payments ecosystem has seen exponential growth in recent years — from UPI to wallets and payment gateways. To keep pace with this innovatio...

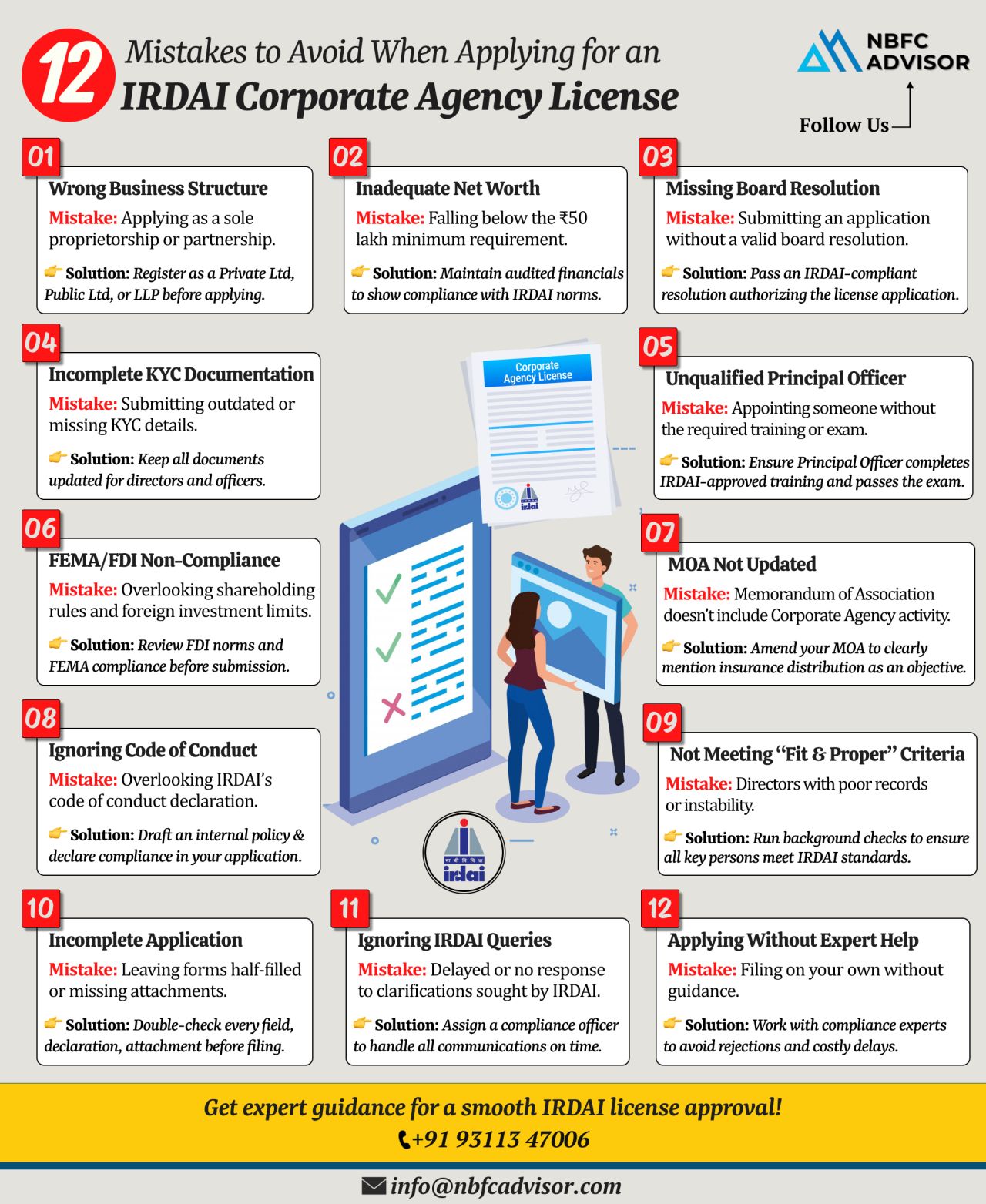

Getting an IRDAI Corporate Agency License? Don’t Make These Costly Mistakes

If your company, LLP, or bank is planning to sell or distribute insurance policies—whether it’s life, health, or motor insurance—you’ll...

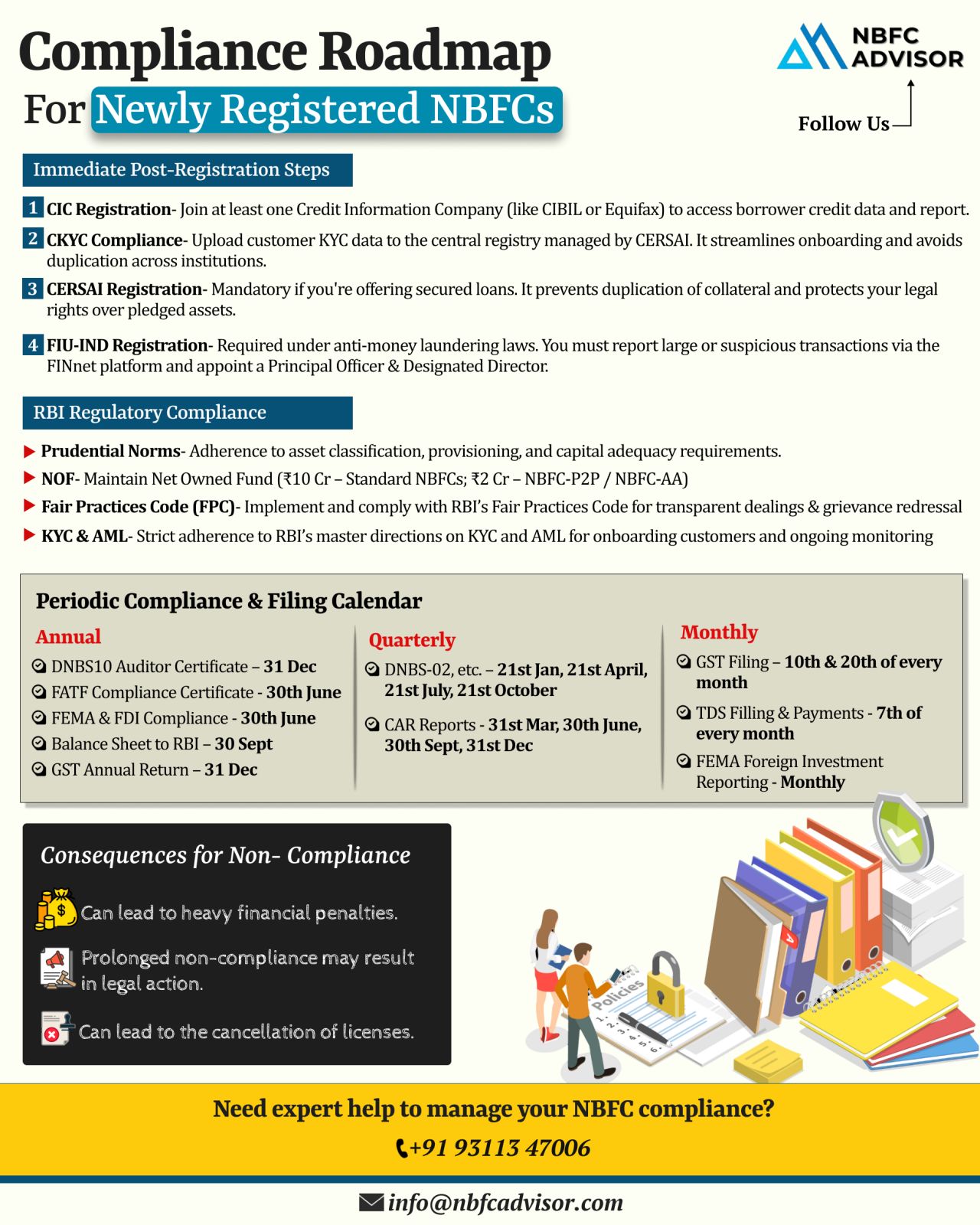

Newly Licensed as an NBFC? Here’s What Comes Next

Obtaining an RBI license is a major milestone for any NBFC. However, the license alone doesn’t guarantee smooth operations—the real challenge begins with meeting regulatory compli...

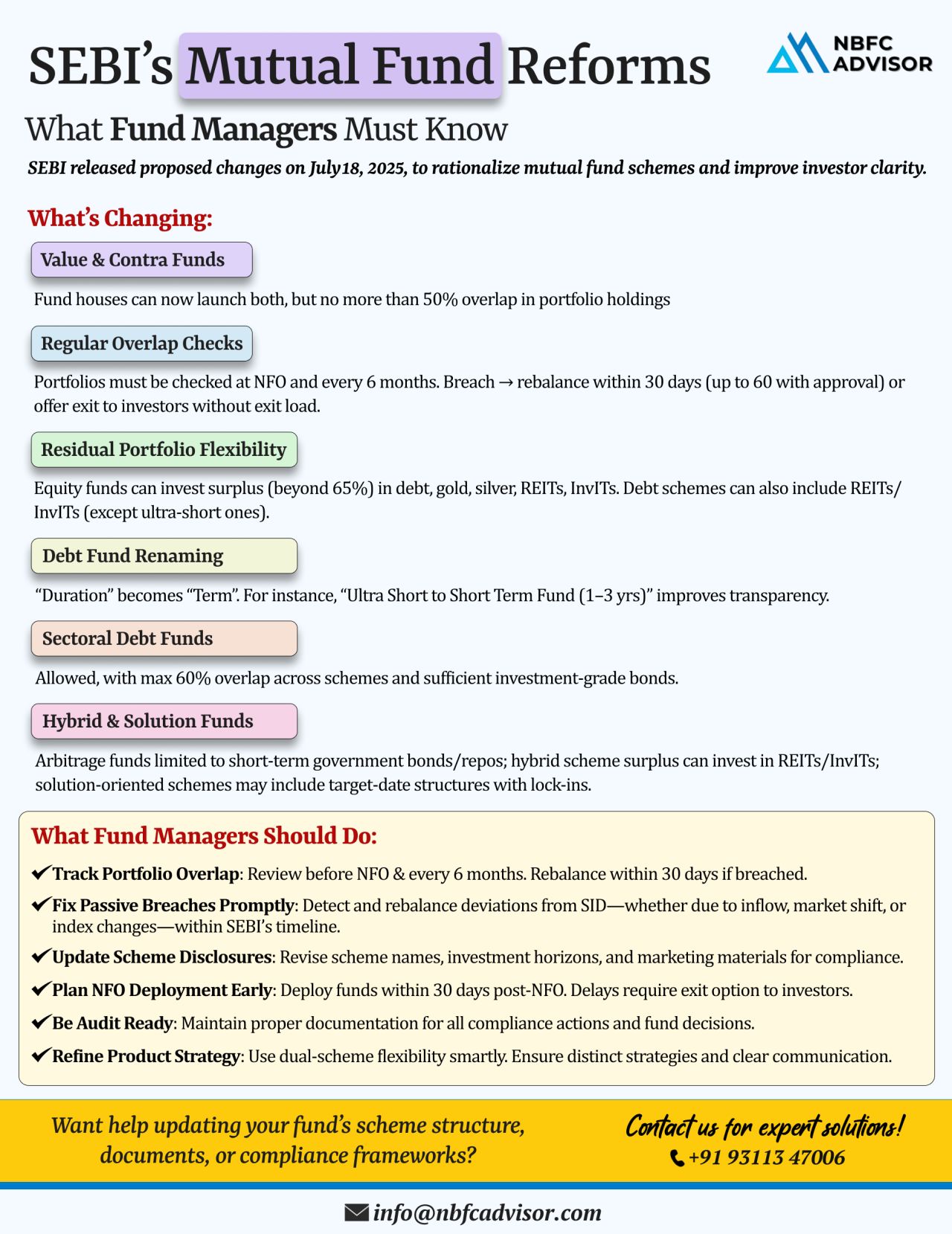

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

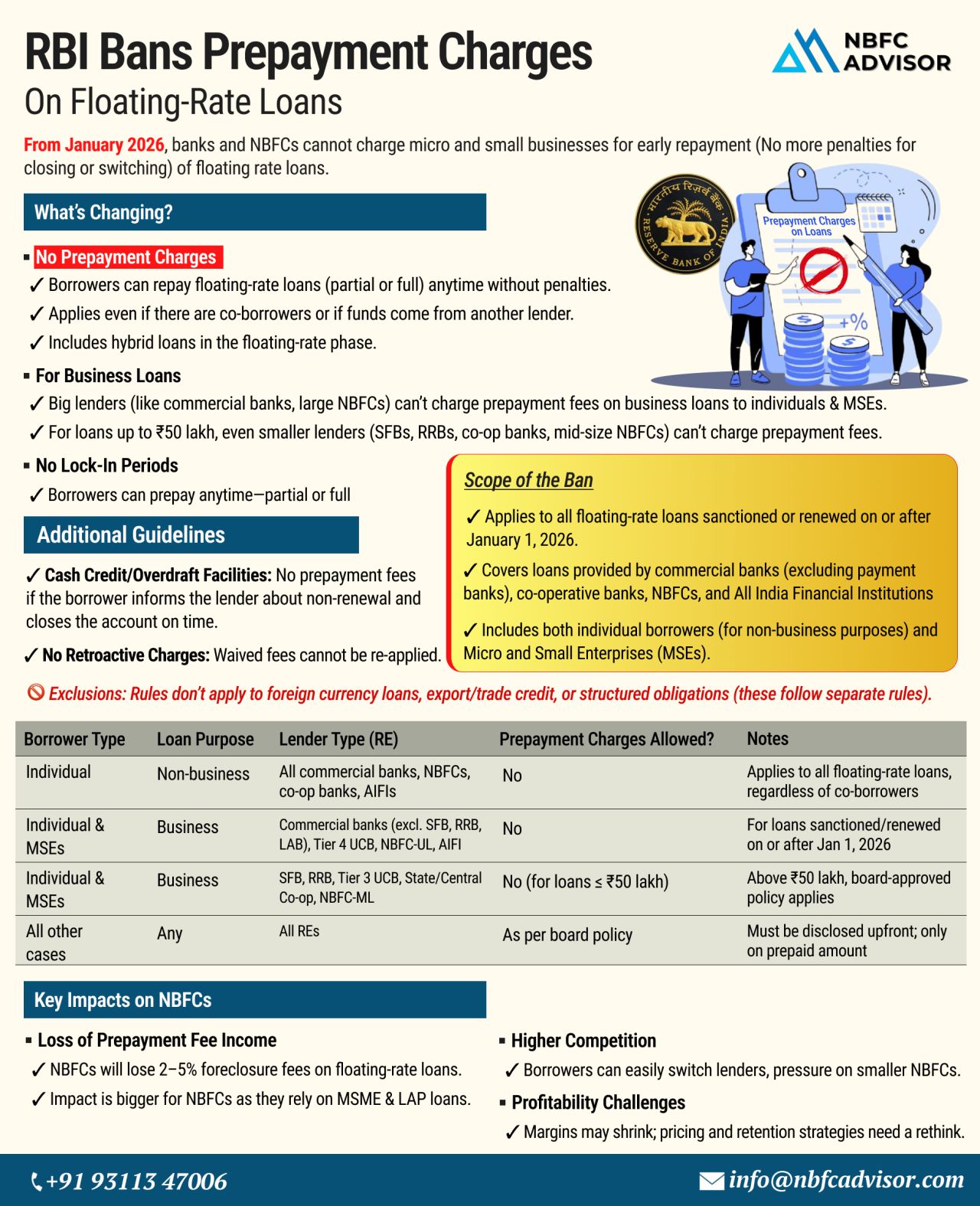

RBI Bans Prepayment Charges on Floating-Rate Loans!

What It Means for NBFCs from January 2026

The Reserve Bank of India (RBI) has announced a significant reform that will reshape the lending landscape — especially for Non-Banking Financia...

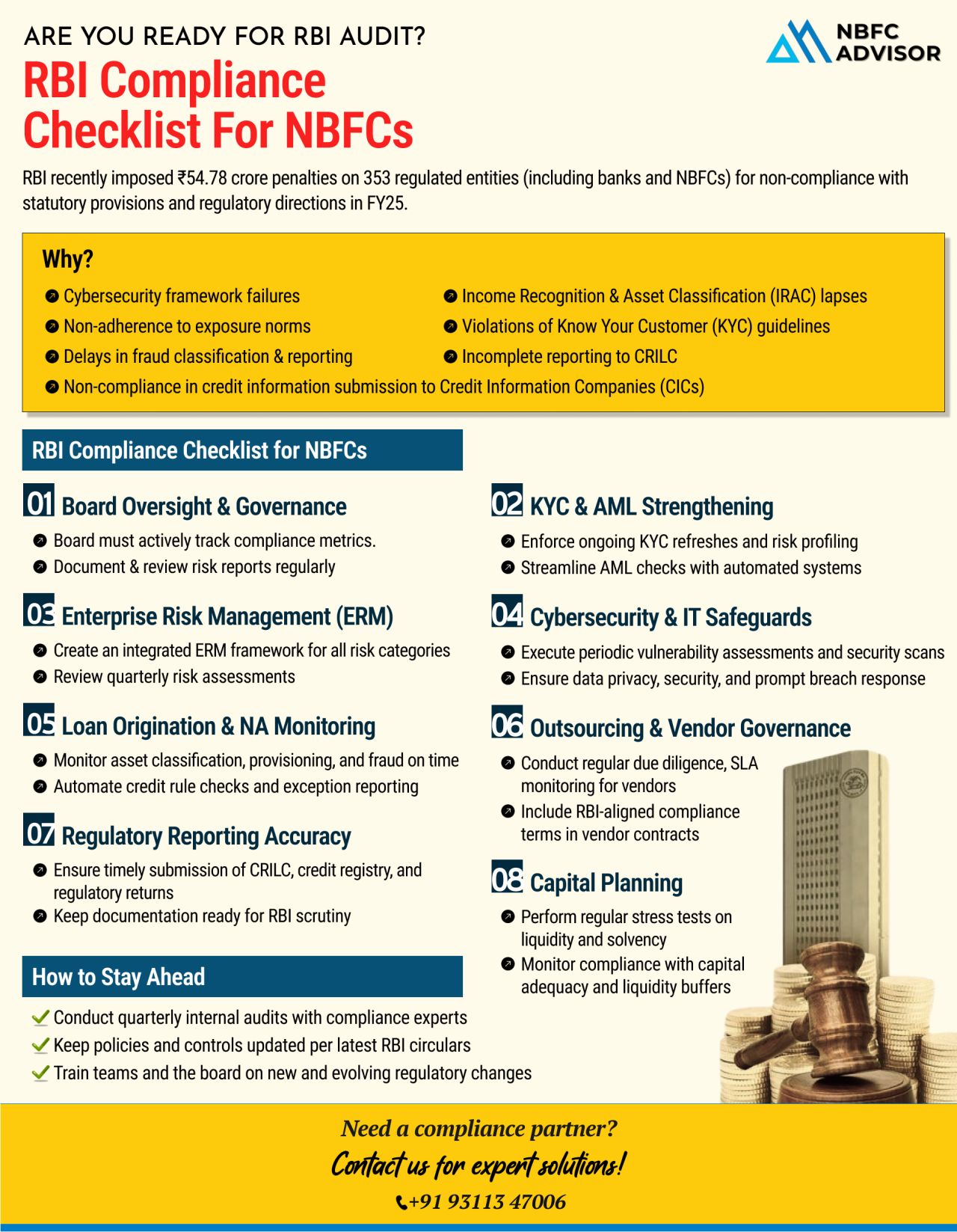

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

If you’re passionate about guiding people toward better financial decisions, becoming a SEBI Registered Investment Advisor (RIA) is a smart and impactful career move.

India needs more qualified, ethical, and SEBI-recognized advisors—an...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

Here’s Your Complete Roadmap

India’s stock market is expanding rapidly, offering exciting opportunities for professionals looking to enter the financial sector. If you're aiming to become a SEBI-registered stock broker, you’l...

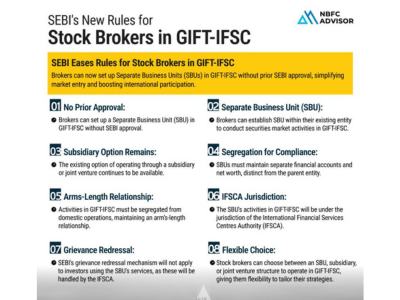

The Securities and Exchange Board of India (SEBI) has unveiled a progressive framework to ease the entry of Indian stock brokers into the GIFT-International Financial Services Centre (GIFT-IFSC). This move is set to simplify cross-border operations a...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...

Introduction: In the ever-evolving landscape of finance, Non-Banking Financial Companies (NBFCs) are emerging not just as financial entities but as true catalysts for transformative change. This blog delves into the profound impact of NBFCs, explorin...

.jpeg)

.jpeg)