One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

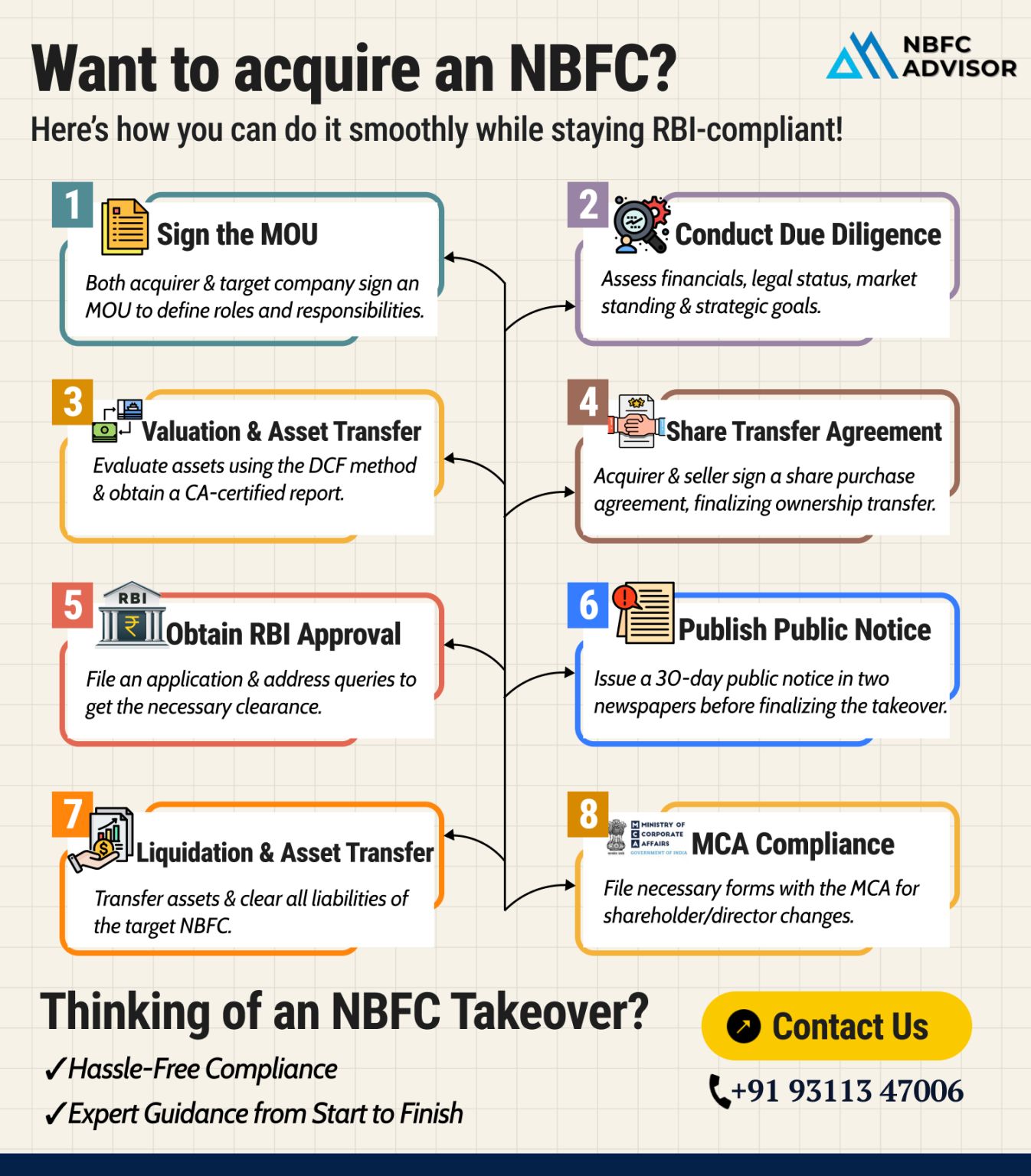

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know Before You Buy

Acquiring an NBFC (Non-Banking Financial Company) can open doors to lending, fintech expansion, digital credit, and financial services — but only if the acqu...

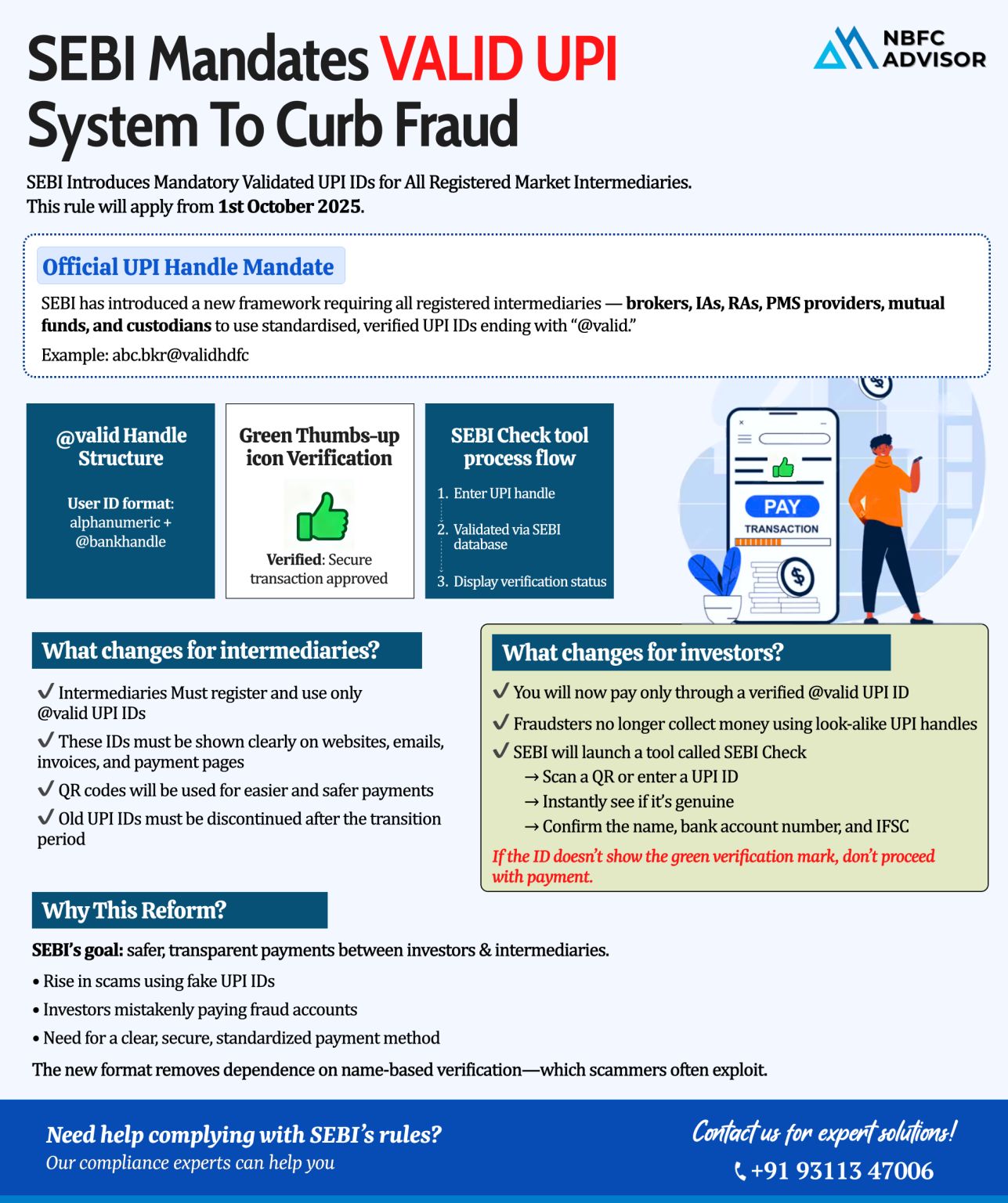

SEBI Introduces VALID UPI System: A Big Step Toward Safer Digital Payments!

The Securities and Exchange Board of India (SEBI) has rolled out a major reform to tighten digital payment security across the financial ecosystem. With rising cases of fa...

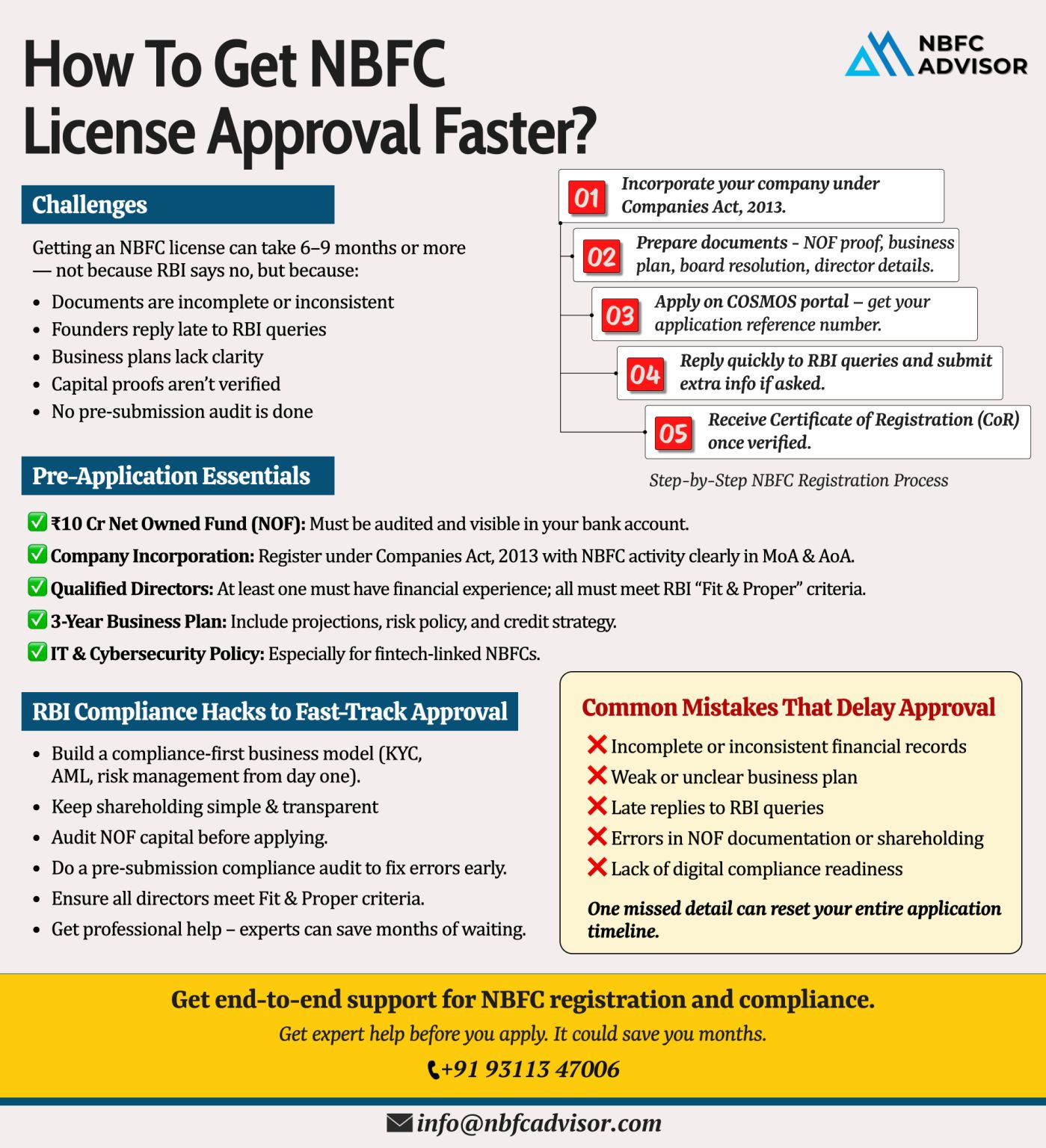

Top Mistakes NBFC Founders Make While Applying for an RBI License (and How to Avoid Them)

Top Mistakes NBFC Founders Make While Applying for an RBI License

Getting an NBFC (Non-Banking Financial Company) License from the Reserve Bank of India (...

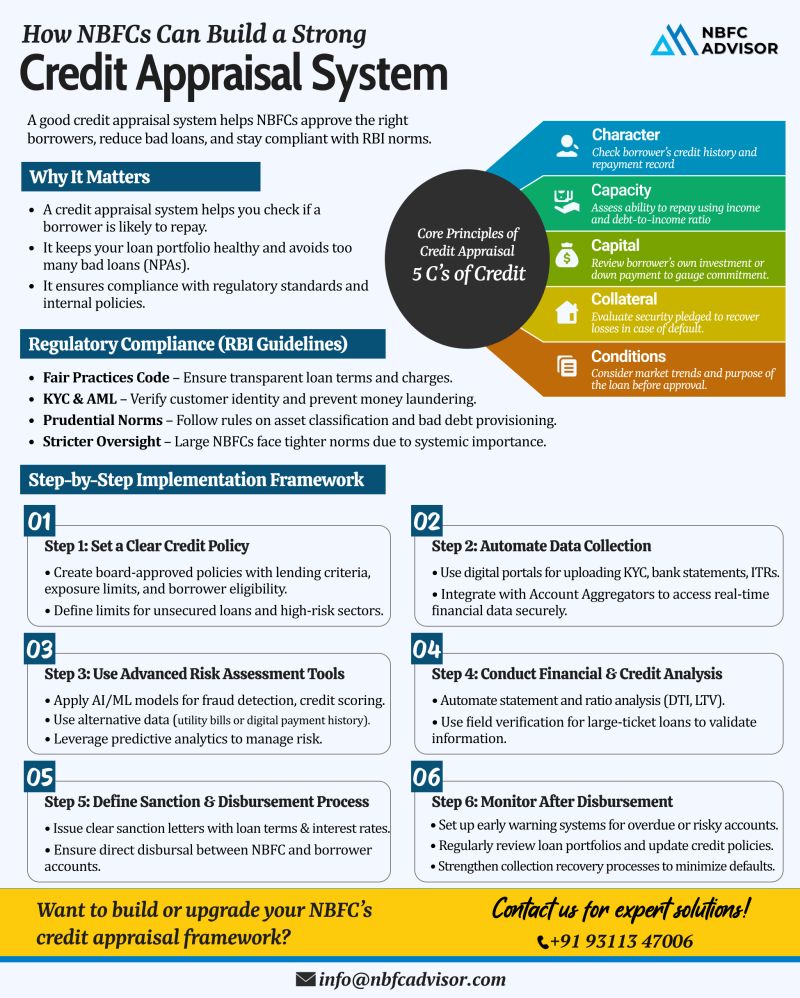

Want to Reduce Loan Defaults? Strengthen Your Credit Appraisal Process 💡

Smart Credit Assessment = Safer Lending

In today’s competitive lending environment, Non-Banking Financial Companies (NBFCs) face increasing pressure to maintain por...

Thinking of Starting an NBFC? Here’s Why a Takeover Might Be Smarter Than a Fresh Registration

If you’re planning to enter the lending and finance industry, setting up a Non-Banking Financial Company (NBFC) can be a powerful way to gro...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

Unlock Your Financial Future with NBFC Advisor

Transform your NBFC deal into a seamless, secure, and successful venture with our expert guidance. At NBFC Advisor, we take the complexity out of the process, handling everything from meticulous due d...

.png)