NBFC Automation & Software Advisory: Transform Your NBFC with Smart Digital Solutions

In today’s fast-evolving financial ecosystem, Non-Banking Financial Companies (NBFCs) must embrace digital transformation to stay competitive, complian...

NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

Planning to Exit Your NBFC? Here’s What You Need to Know Before Making a Decision

Running a Non-Banking Financial Company (NBFC) is a long-term regulatory commitment. However, many NBFC promoters today are considering an exit due to changing...

Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

Are These Mistakes Putting Your NBFC at Risk?

India’s NBFC (Non-Banking Financial Company) sector continues to grow at a fast pace. But with greater opportunity comes increased regulatory oversight and risk. Many NBFCs run into serious issue...

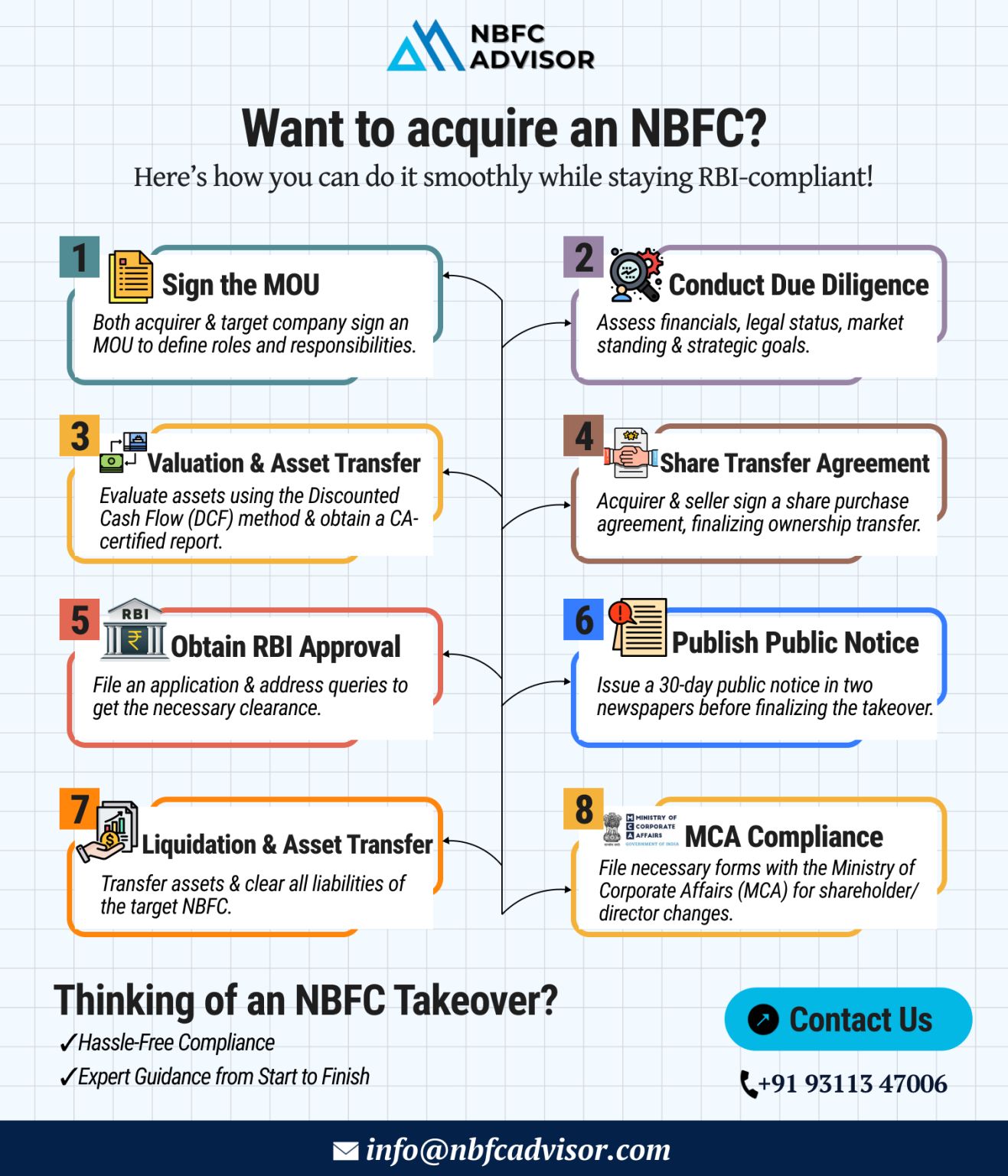

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

The NBFC (Non-Banking Financial Company) sector in India is witnessing rapid growth, offering immense opportunities for businesses looking to establish themselves in the financial landscape.

However, launching an NBFC requires strategic planning, ...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

The SARFAESI Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act) is a powerful legal tool that enables NBFCs to recover bad loans without lengthy court proceedings.

Who Can Use It?

NBFCs with an ...

India’s NBFC sector is expanding rapidly — but regulatory hurdles, compliance requirements, and operational complexities can slow down even the most promising ventures.

That’s where we come in.

We offer end-to-end support for ...

The demand for digital credit in India is at an all-time high.

From MSMEs to individuals, the appetite for alternative financing is growing rapidly — and Non-Banking Financial Companies (NBFCs) are at the forefront of this revolution.

Wit...

This exponential growth is being fueled by:

→ Rapid internet penetration

→ A thriving fintech ecosystem

→ Increasing demand for credit

The opportunity is massive — but navigating the regulatory landscape demands strategic p...

When an ambitious NRI entrepreneur set out to acquire an NBFC in India, he faced a maze of consultants, delays, and false promises. Despite assigning the mandate to a consultant, he soon realized their approach wasn’t aligned with his vision.

...

In the fast-paced world of fintech, many entrepreneurs are eyeing the potential of acquiring an NBFC (Non-Banking Financial Company) or applying for new NBFC registrations.

But here’s the reality: Most attempts fall short. Whether you're...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

In the dynamic realm of Non-Banking Financial Companies (NBFCs), takeover processes play a crucial role in shaping market landscapes and strategic trajectories. Let’s delve into the intricacies of NBFC takeovers, exploring the reasons behind th...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)