NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

Comprehensive Financial & Tax Services for Non-Residents (NRIs & Foreign Nationals)

Meta Title: Expert Services for Non-Residents (NRIs & Foreign Nationals) | Tax, FEMA, and RBI Consultancy

Meta Description: Simplify your India-relate...

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

📢 Attention NBFCs: Time to Align with RBI’s NOF Compliance Deadlines!

The Reserve Bank of India (RBI) is tightening regulations — and NBFCs need to act fast.

According to the RBI Master Direction – NBFC (Scale-Based Regulatio...

📈 India’s PMS Industry Is Booming – Here’s Why You Should Pay Attention

India’s Portfolio Management Services (PMS) industry is witnessing unprecedented growth — and it’s only just getting started. With total a...

Dreaming of Launching Your NBFC?

Avoid These Top 5 Pitfalls to Secure Your RBI License!

Setting up a Non-Banking Financial Company (NBFC) in India can be a game-changer—but getting the RBI license is where many dreams hit a wall. Each yea...

NBFC Accounting Services by NBFC Advisor

Looking for accurate, reliable, and hassle-free financial management for your NBFC?

At NBFC Advisor, we specialize in providing comprehensive accounting solutions exclusively for Non-Banking Financial Comp...

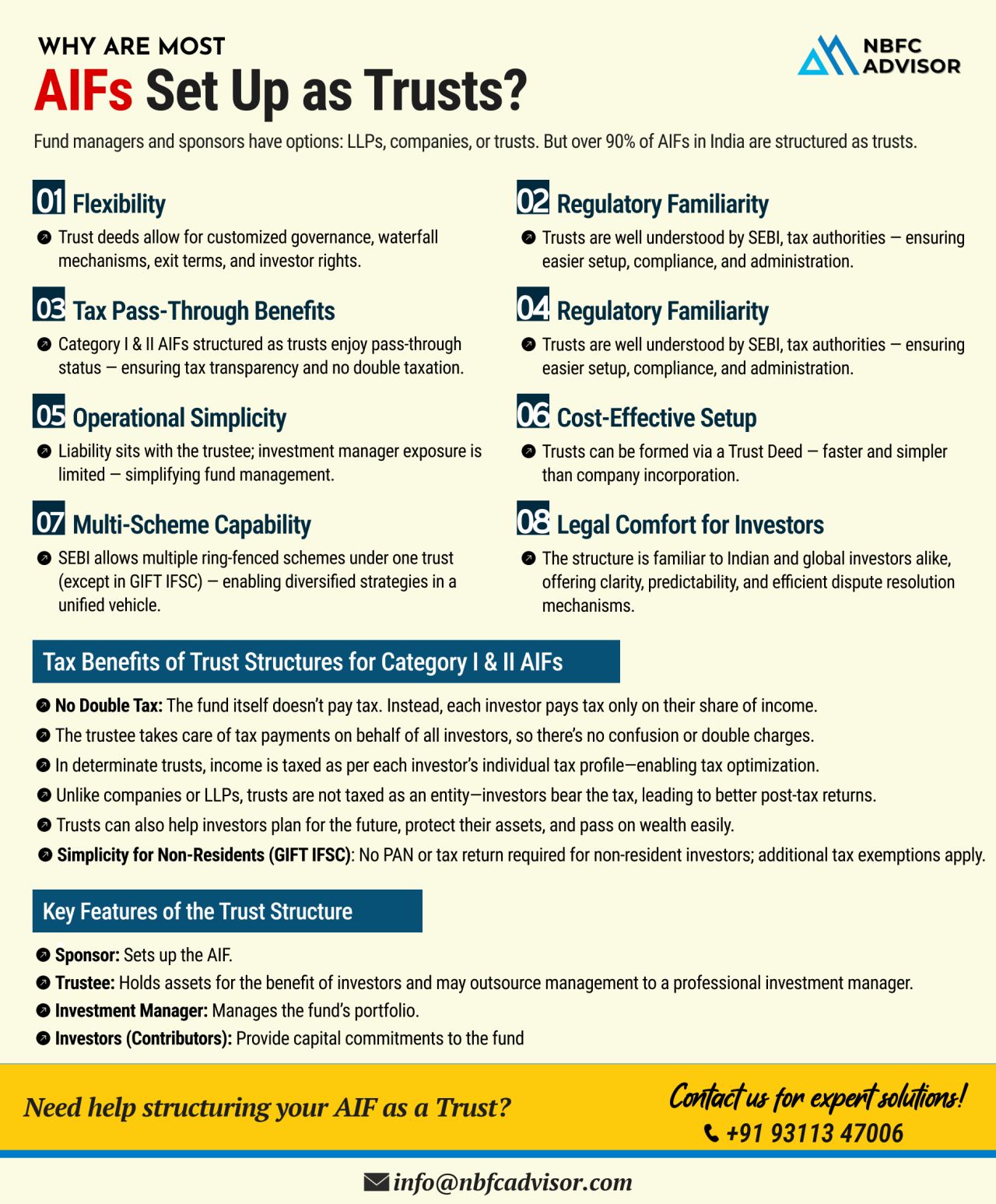

When setting up an Alternative Investment Fund (AIF), one of the most critical decisions is choosing the right legal structure. Should you go for an LLP, a Company, or a Trust?

Let’s break down why most AIFs prefer the Trust route.

Why Fu...

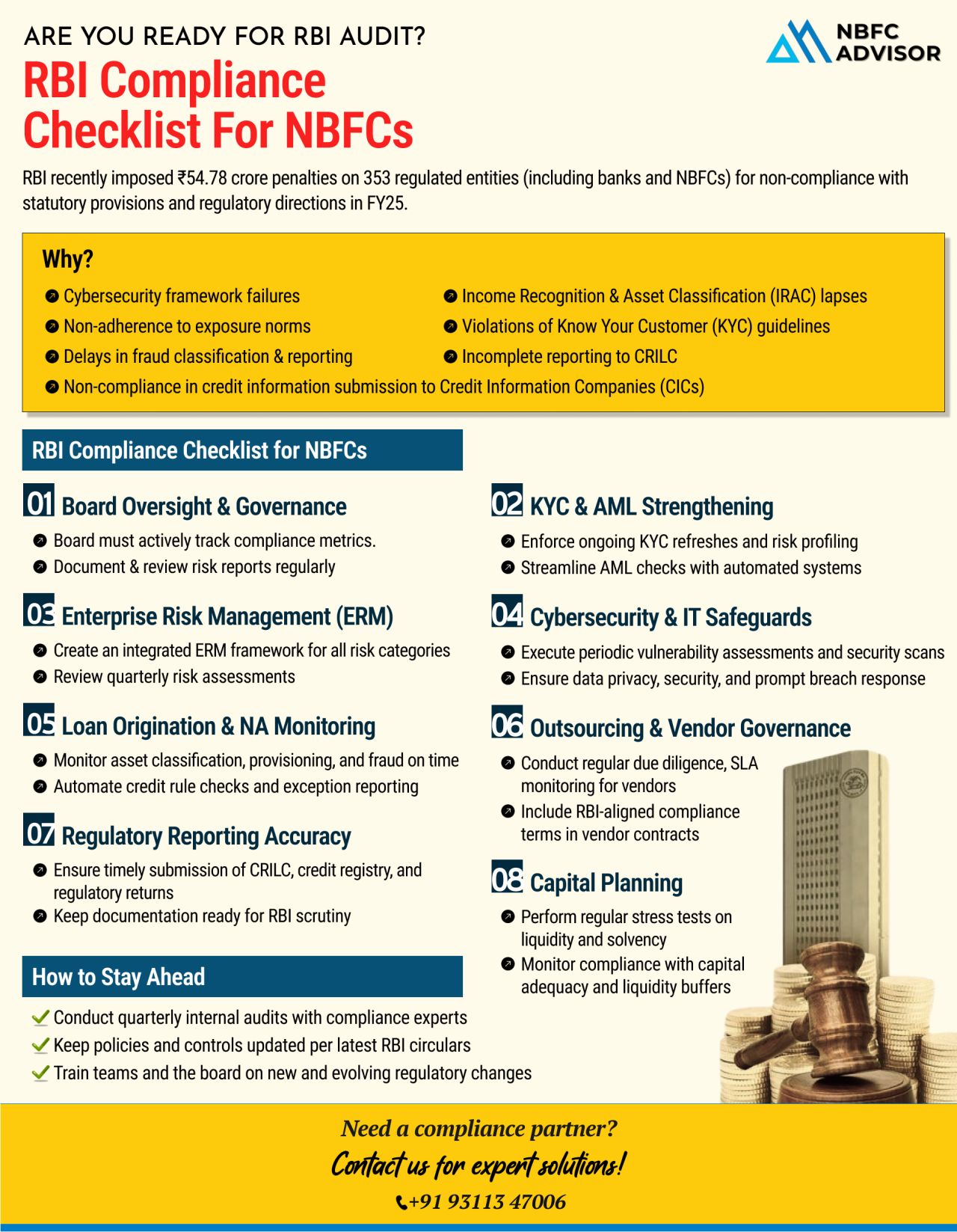

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

India’s fintech and lending ecosystem is evolving at a rapid pace. As a result, more entrepreneurs, family offices, and investors are exploring the Non-Banking Financial Company (NBFC) route to tap into new opportunities in the financial sector...

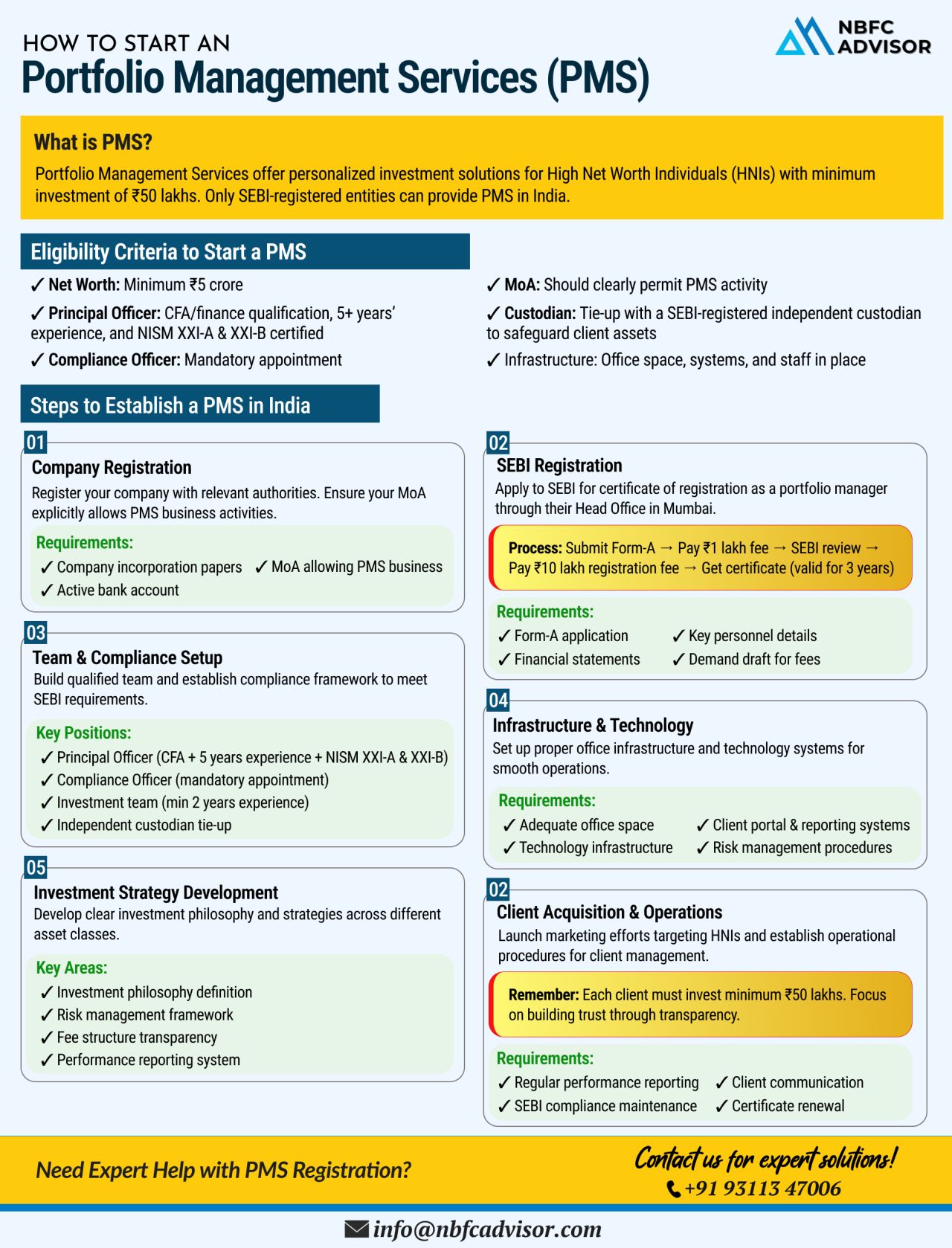

Are you planning to start your own Portfolio Management Service (PMS)? There’s never been a better time—especially if you leverage the exceptional advantages offered by GIFT City, India’s only International Financial Services Centre...

The NBFC (Non-Banking Financial Company) sector in India is witnessing rapid growth, offering immense opportunities for businesses looking to establish themselves in the financial landscape.

However, launching an NBFC requires strategic planning, ...

The gold loan industry in India is experiencing rapid growth. It is expected to cross ₹10 lakh crore in FY25 and reach ₹15 lakh crore by 2027.

NBFCs Are Leading the Surge

Non-Banking Financial Companies (NBFCs) are playing a major role in this ...

The NBFC sector is a pillar of India’s financial ecosystem, but it faces regulatory, liquidity, and operational hurdles that impact growth and stability.

🔍 Top Challenges NBFCs Face:

⚠️ Regulatory Hurdles – Stricter RBI norms lead ...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

At NBFC Advisor, we provide powerful tools to streamline your operations and enhance efficiency at every step. Whether you're in NBFC, Microfinance, Gold Loans, or Vehicle Loans, our tailored solutions have you covered!

Why Choose NBFC Advisor...

In today’s rapidly evolving financial landscape, co-lending has emerged as a significant force reshaping how loans are disbursed in India. The model, which enables banks and Non-Banking Financial Companies (NBFCs) to jointly disburse loans, has...

The LendingTech sector in India is witnessing rapid growth, driven by the rising demand for digital lending solutions that target unbanked and underserved populations. This article delves into how LendingTech startups are differentiating themselves, ...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

Emerging technologies and strategic partnerships are crucial for Non-Banking Financial Companies (NBFCs) to thrive in an increasingly regulated and competitive financial landscape. By integrating advanced technologies and collaborating with FinTech c...

In the rapidly evolving financial services sector, Non-Banking Financial Companies (NBFCs) are experiencing a transformative shift, thanks to the advent of digital and AI-enabled tools. Systems such as Loan Origination Systems (LOS) and Loan Manageme...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

The fintech industry is experiencing an unprecedented evolution, driven by groundbreaking innovations that are transforming how we manage, invest, and think about money. From artificial intelligence to blockchain, the financial landscape is being red...

The finance world is experiencing a profound transformation, driven by the pervasive influence of the digital realm. One of the most intriguing shifts is the collaboration between Non-Banking Financial Companies (NBFCs) and Fintech startups. This par...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In India, Micro, Small, and Medium Enterprises (MSMEs) and retail borrowers constitute a significant portion of the economy, yet access to formal financing remains a challenge. However, the emergence of co-lending partnerships between Banks and Non-B...

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

In an era marked by rapid technological advancements, the landscape of digital inclusion is continually evolving. This blog explores the symbiotic relationship between technological progress and the pursuit of digital inclusion, shedding light on how...

Introduction: In the ever-evolving landscape of finance, Non-Banking Financial Companies (NBFCs) are emerging not just as financial entities but as true catalysts for transformative change. This blog delves into the profound impact of NBFCs, explorin...

In the dynamic landscape of Non-Banking Financial Companies (NBFCs), the right guidance can make all the difference. This blog unveils the comprehensive support and expertise offered by NBFC Advisor, empowering financial entities to not only thrive b...

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)