NBFC Automation & Software Advisory: Transform Your NBFC with Smart Digital Solutions

In today’s fast-evolving financial ecosystem, Non-Banking Financial Companies (NBFCs) must embrace digital transformation to stay competitive, complian...

NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

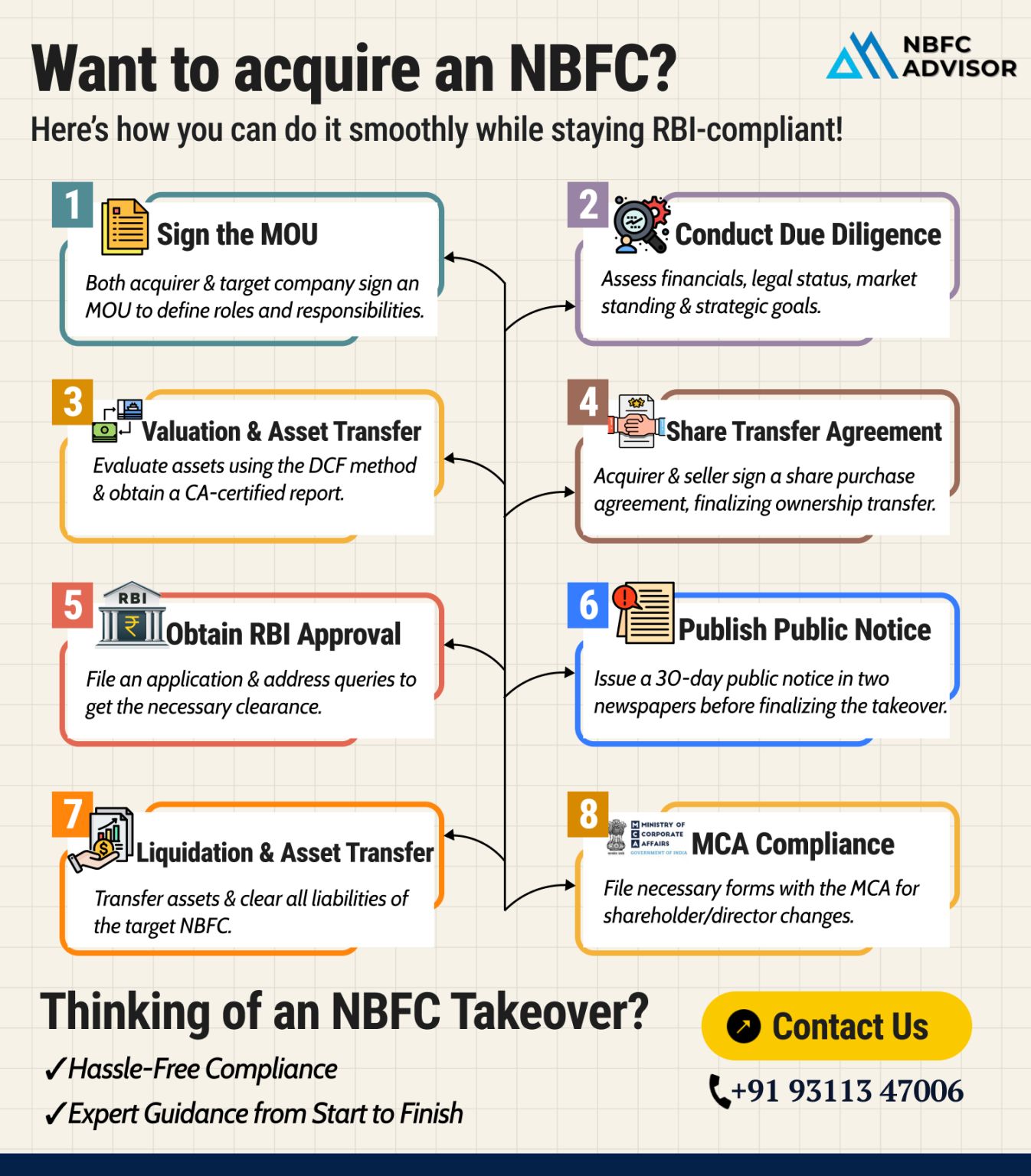

NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Running a Non-Banking Financial Company (NBFC) in India is not just about lending, growth, and profitability. In today’s tightly regulated environment, compliance failures...

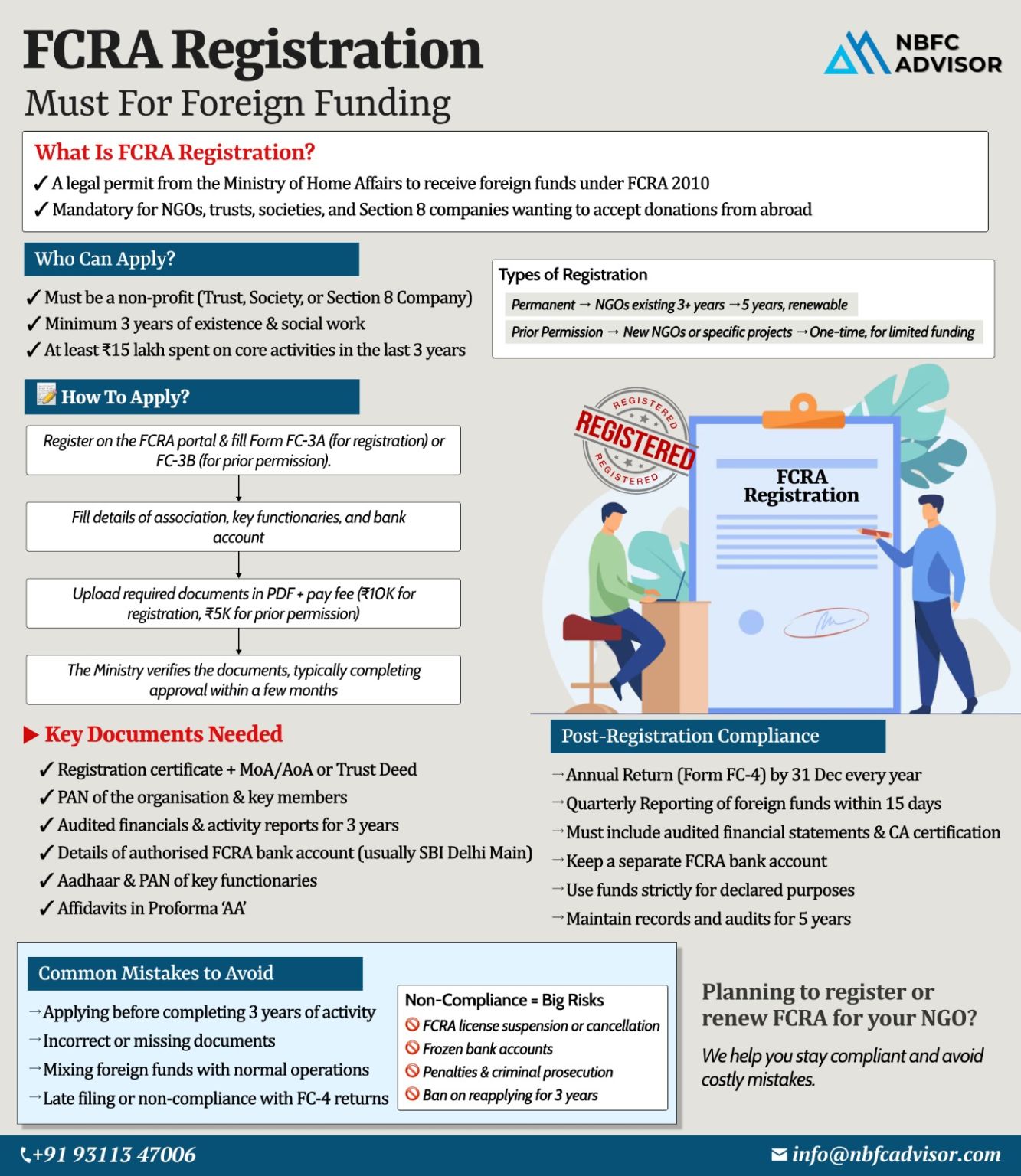

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

Foreign funding can be a lifeline for NGOs working in education, healthcare, human rights, environment, and social welfare. Yet every year, hundreds of NGOs in India lose their ability to ...

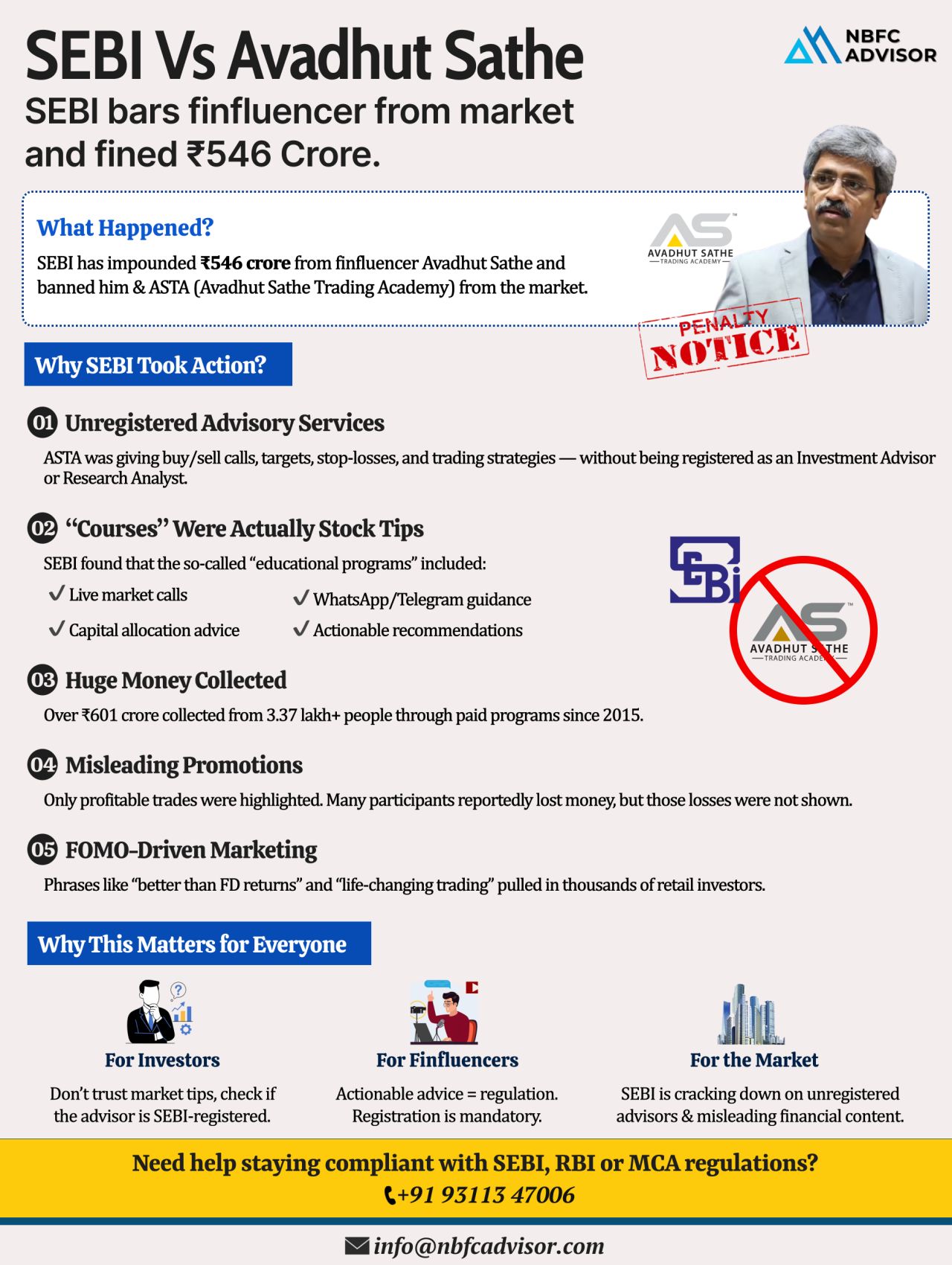

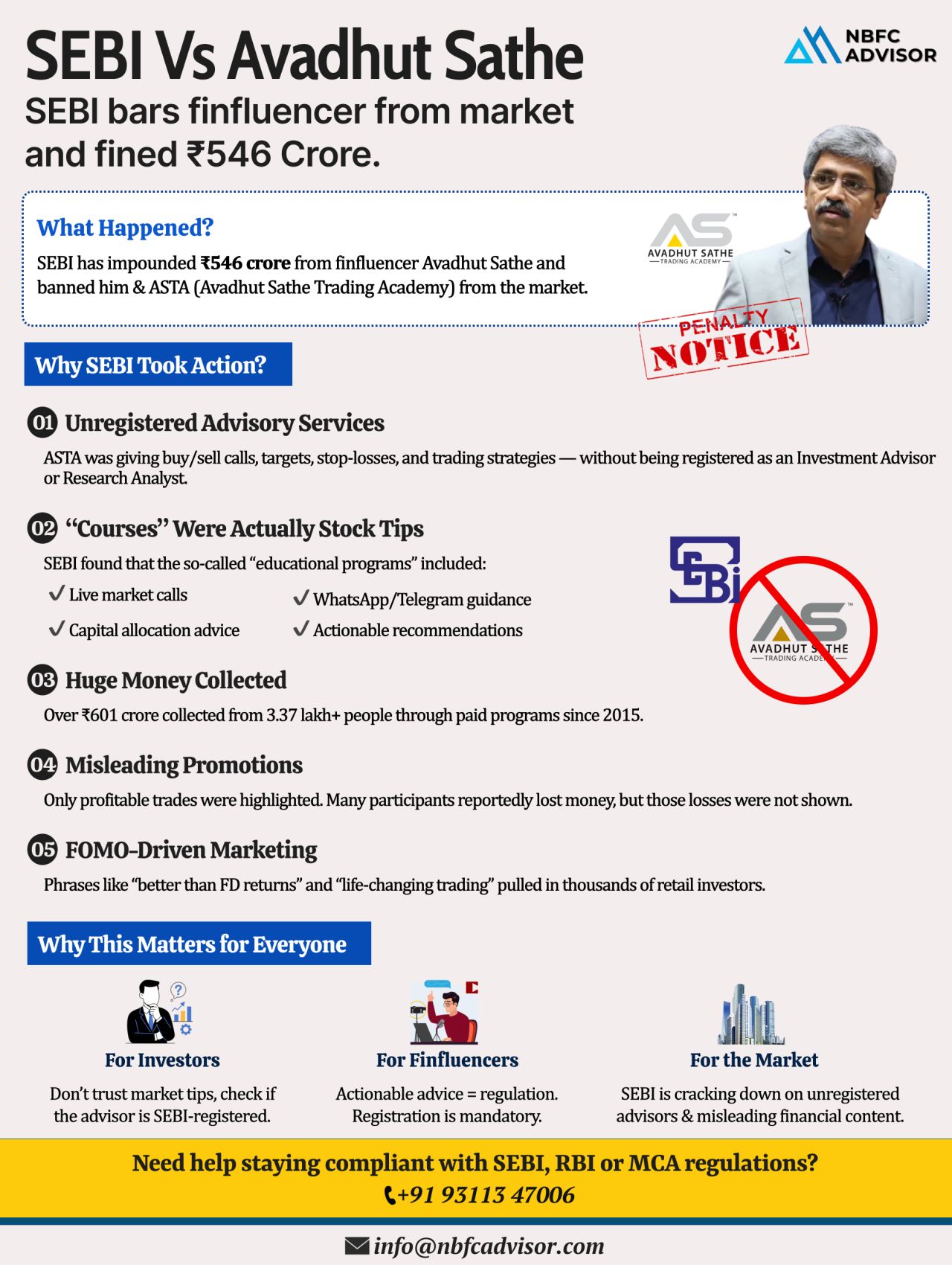

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from ...

One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

Not All NBFCs Are the Same: Understanding RBI’s Scale-Based Regulation (SBR)

Many people still think of Non-Banking Financial Companies (NBFCs) as one single category. In reality, not all NBFCs are created equal.

To strengthen financial s...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe a...

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

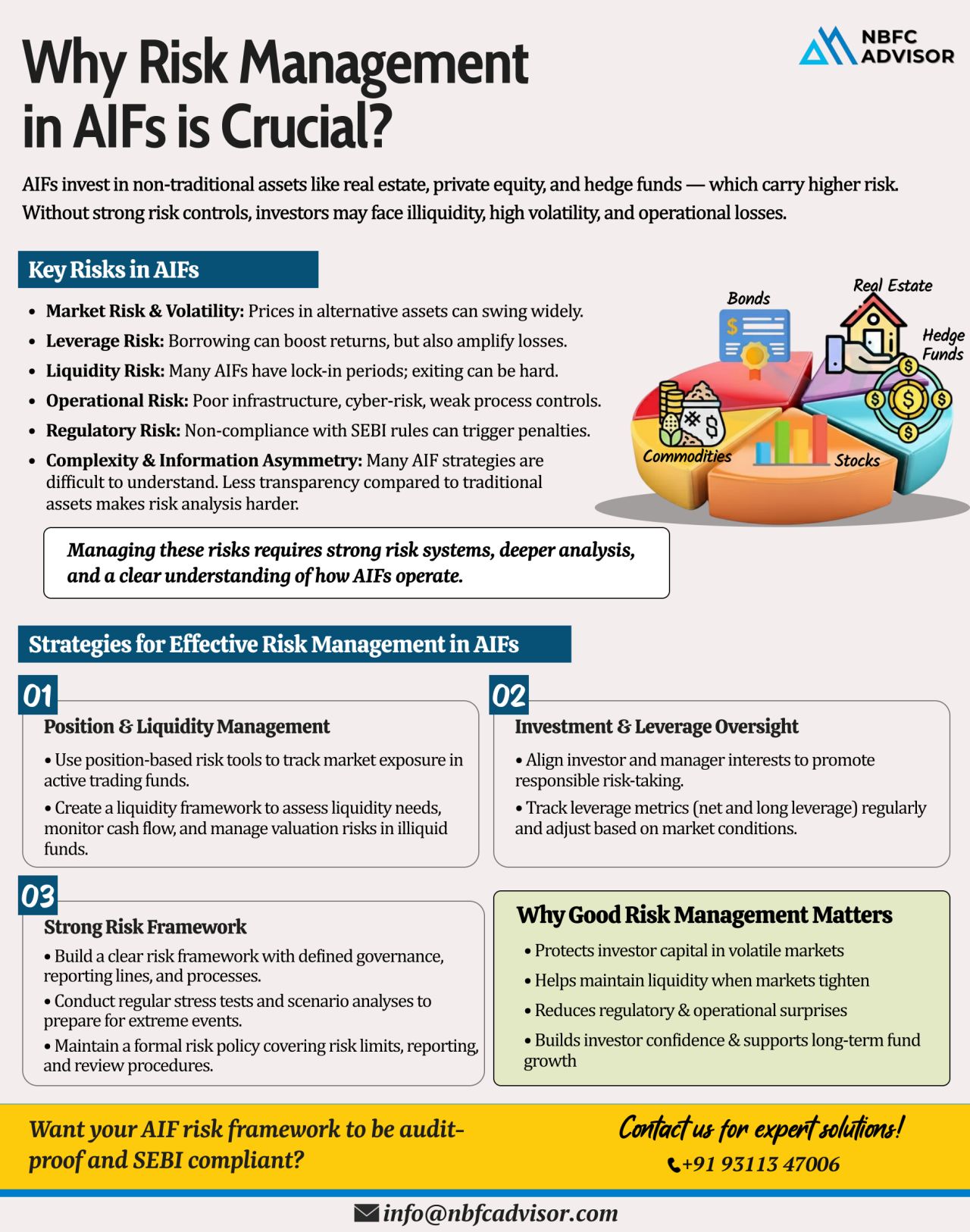

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Many NBFCs don’t fail because of bad business decisions — they fail because of missed compliance.

In today’s regulatory environment, RBI’s supervision...

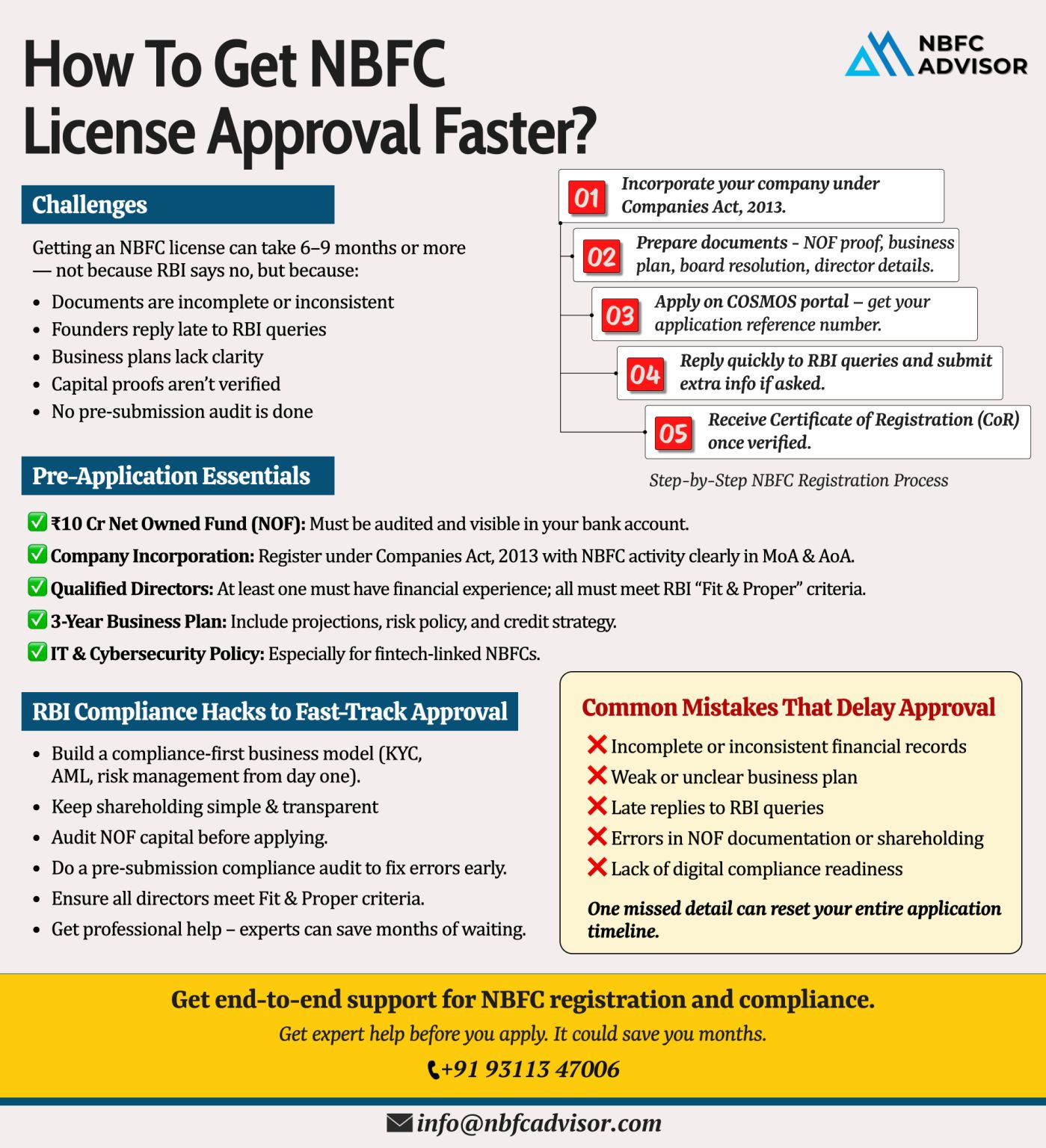

Top Mistakes NBFC Founders Make While Applying for an RBI License (and How to Avoid Them)

Top Mistakes NBFC Founders Make While Applying for an RBI License

Getting an NBFC (Non-Banking Financial Company) License from the Reserve Bank of India (...

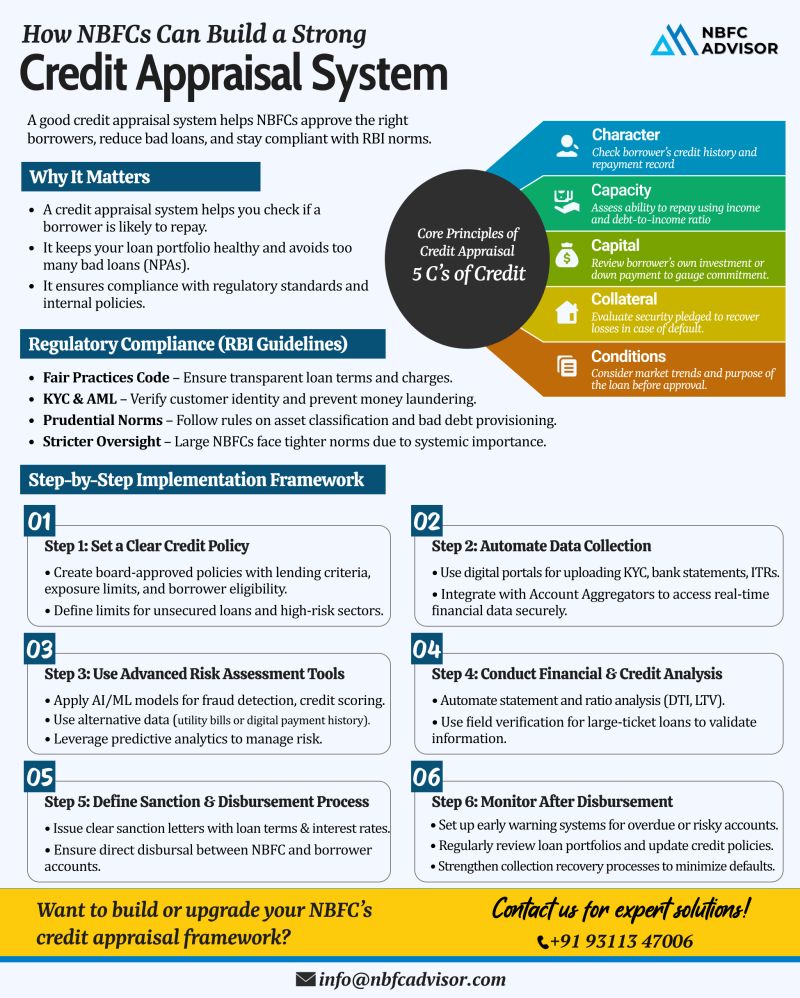

Want to Reduce Loan Defaults? Strengthen Your Credit Appraisal Process 💡

Smart Credit Assessment = Safer Lending

In today’s competitive lending environment, Non-Banking Financial Companies (NBFCs) face increasing pressure to maintain por...

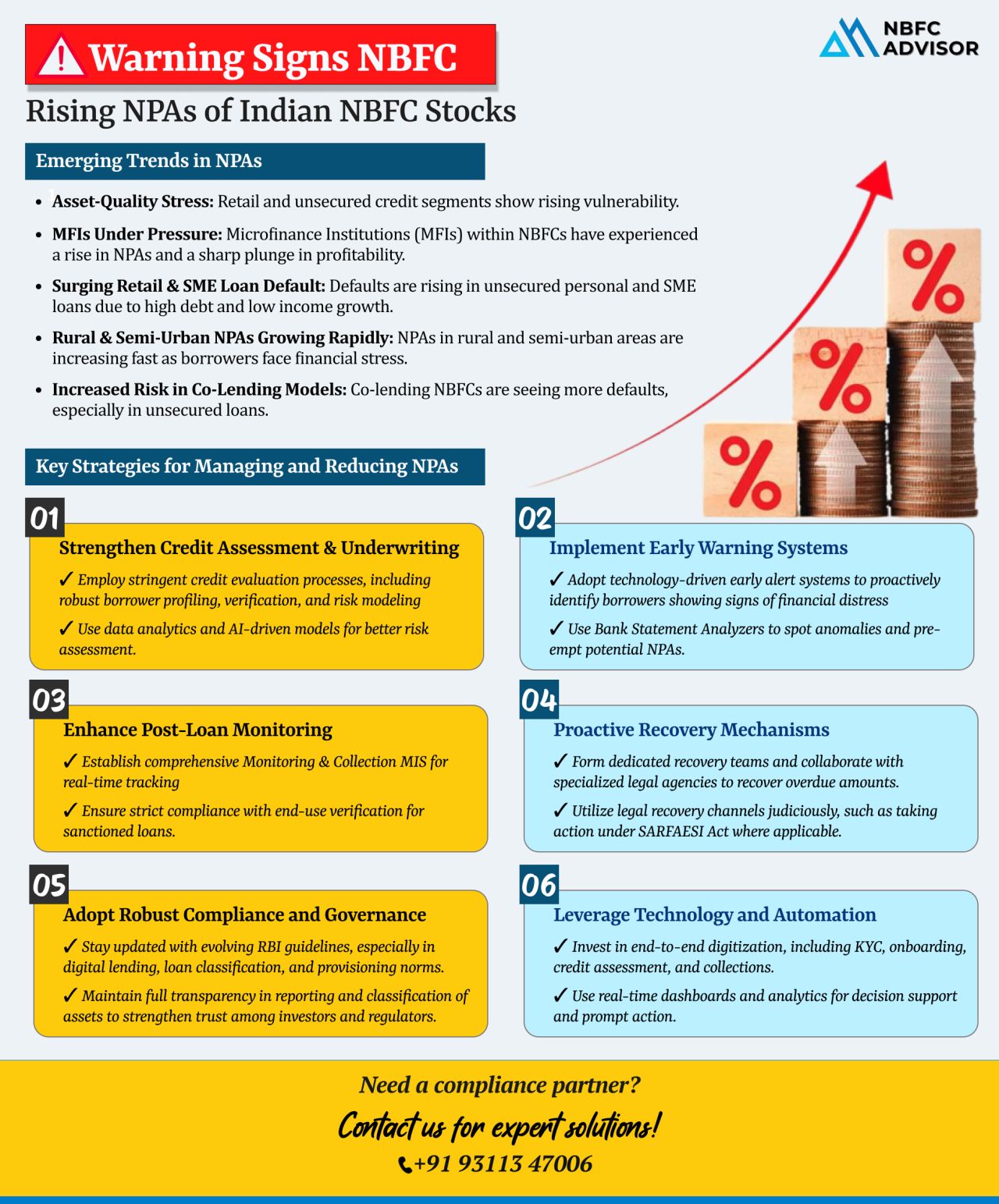

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

Are These Mistakes Putting Your NBFC at Risk?

India’s NBFC (Non-Banking Financial Company) sector continues to grow at a fast pace. But with greater opportunity comes increased regulatory oversight and risk. Many NBFCs run into serious issue...

Top 10 Mistakes to Steer Clear of During AIF Registration

Registering an Alternative Investment Fund (AIF) with SEBI is a critical step toward launching a compliant and successful investment vehicle in India. However, many fund managers and promot...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

📢 Attention NBFCs: Time to Align with RBI’s NOF Compliance Deadlines!

The Reserve Bank of India (RBI) is tightening regulations — and NBFCs need to act fast.

According to the RBI Master Direction – NBFC (Scale-Based Regulatio...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

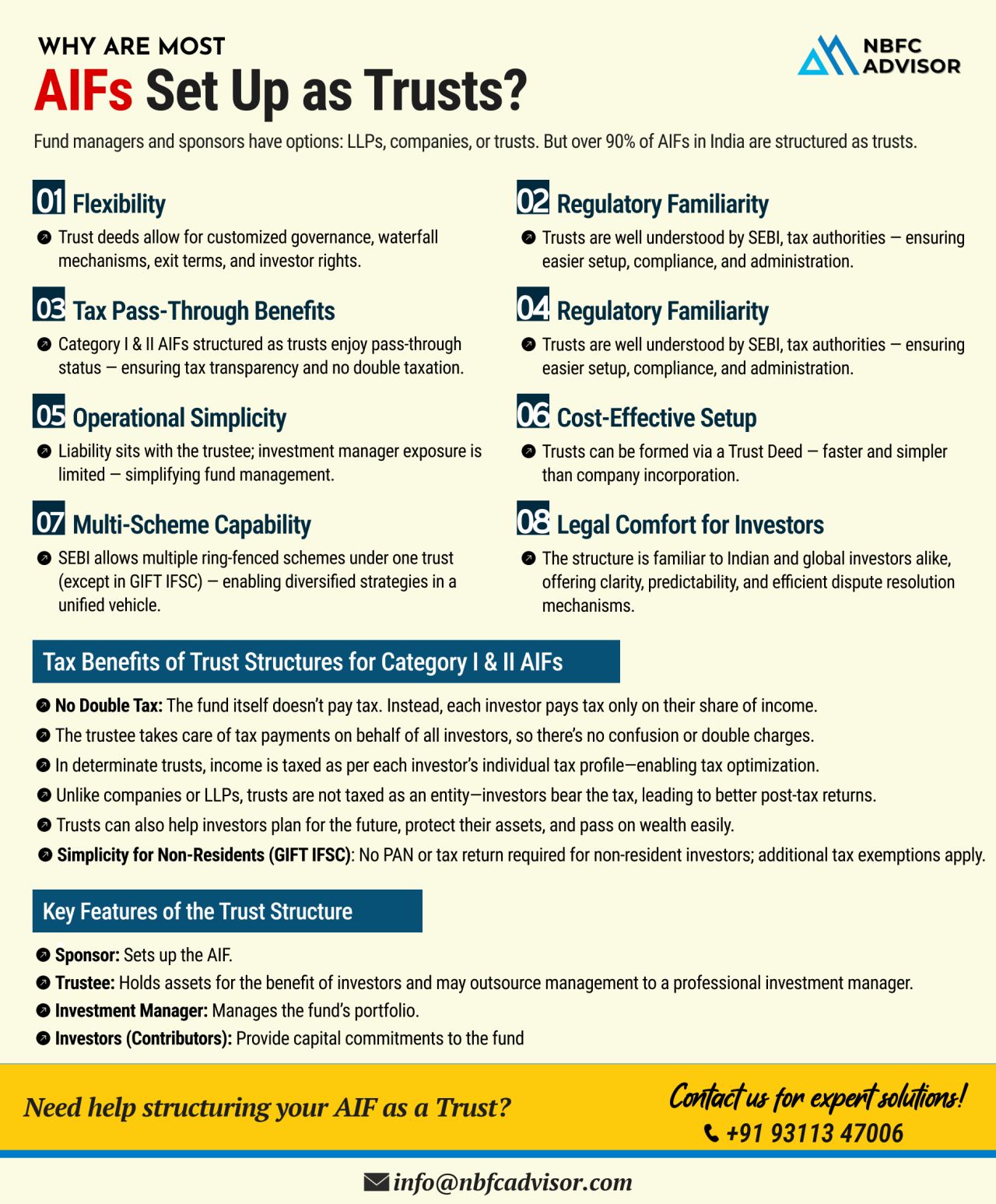

When setting up an Alternative Investment Fund (AIF), one of the most critical decisions is choosing the right legal structure. Should you go for an LLP, a Company, or a Trust?

Let’s break down why most AIFs prefer the Trust route.

Why Fu...

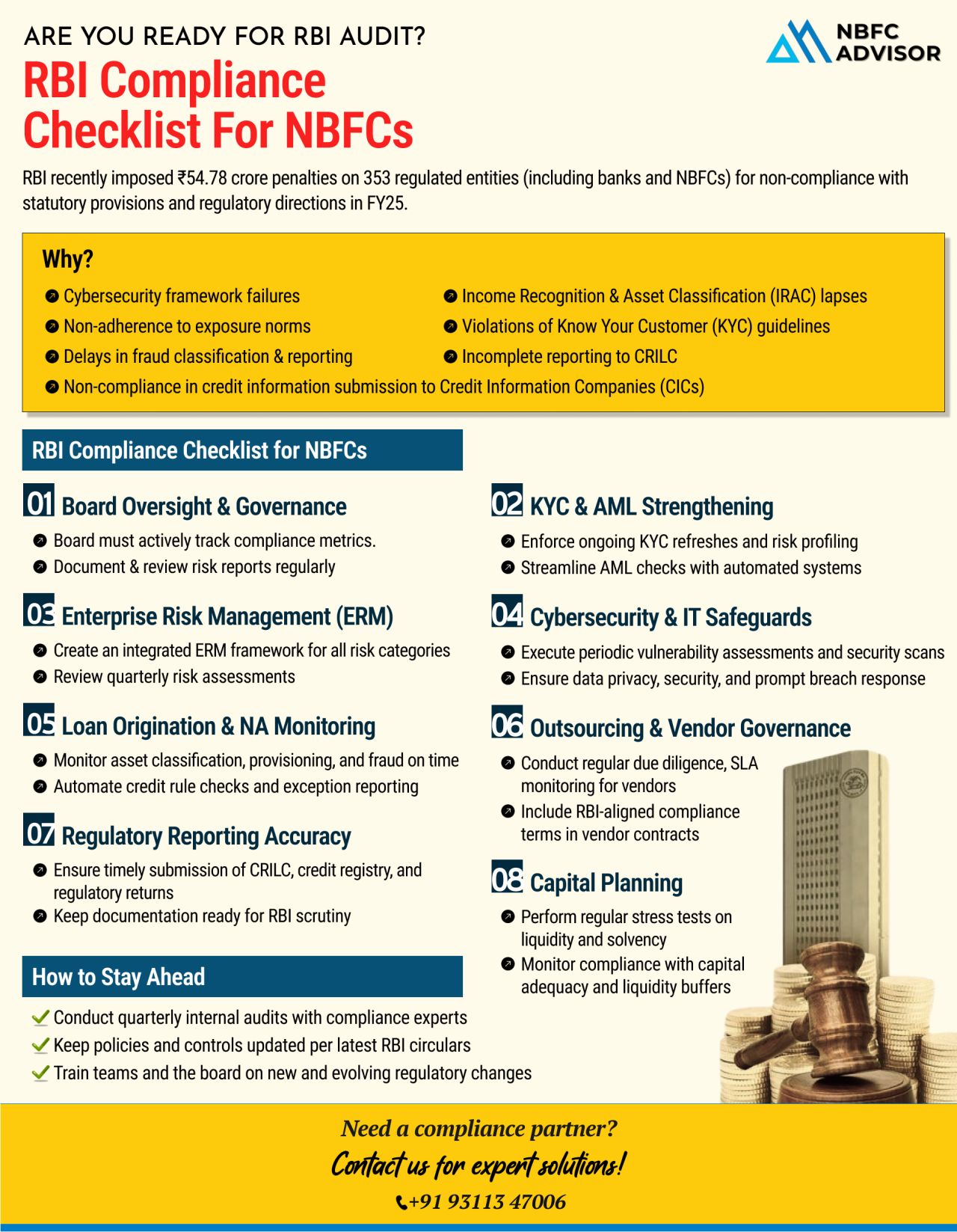

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

Flipkart Becomes the First Major Indian E-Commerce Platform to Secure an NBFC License

In a groundbreaking move, Flipkart has become the first large Indian e-commerce platform to receive a Non-Banking Financial Company (NBFC) license. This developm...

The Reserve Bank of India (RBI) has issued a directive that could significantly reshape how Non-Banking Financial Companies (NBFCs) and fintechs collaborate in the digital lending space.

Key Update

NBFCs can no longer rely on Default Loss Guara...

Staying compliant with SEBI (Securities and Exchange Board of India) regulations isn’t just a legal formality — it’s a reflection of your company’s corporate governance and credibility in the market.

For listed companies, a...

The NBFC Account Aggregator (AA) framework is revolutionizing financial data sharing in India. An NBFC-AA is a regulated intermediary that allows individuals to securely consolidate and share their financial data—such as bank, insurance, mutual...

Driven by the rapid rise of digital payments and widespread technology adoption, India's Fintech sector is on an explosive growth trajectory.

For entrepreneurs looking to establish a Fintech company, navigating the regulatory, legal, and opera...

The Reserve Bank of India (RBI) has released draft guidelines on gold loans, aimed at improving transparency and regulatory consistency in the sector. While these new norms bring much-needed clarity, they also introduce stricter compliance requiremen...

With increasing regulatory scrutiny, fintech startups and NBFCs must ensure alignment with global and local data protection laws to remain competitive and trusted:

Key Regulations to Watch:

→ GDPR – Emphasizes a consent-first approac...

The India Fintech Foundation (IFF) has officially been launched — and it could be the most significant development for the fintech sector since UPI.

Why this matters:

IFF is set to become a self-regulatory organization (SRO) for fin...

The Reserve Bank of India (RBI), led by Governor Sanjay Malhotra, recently held a crucial meeting with leading Non-Banking Financial Companies (NBFCs)—his first such interaction since taking office. The meeting brought together MDs and CEOs fro...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

In today’s rapidly evolving financial landscape, co-lending has emerged as a significant force reshaping how loans are disbursed in India. The model, which enables banks and Non-Banking Financial Companies (NBFCs) to jointly disburse loans, has...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

Co-lending, a collaborative lending model where multiple lenders join forces to provide financing to a borrower, has become increasingly popular in the financial sector. This approach allows lenders to capitalize on their individual strengths while s...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

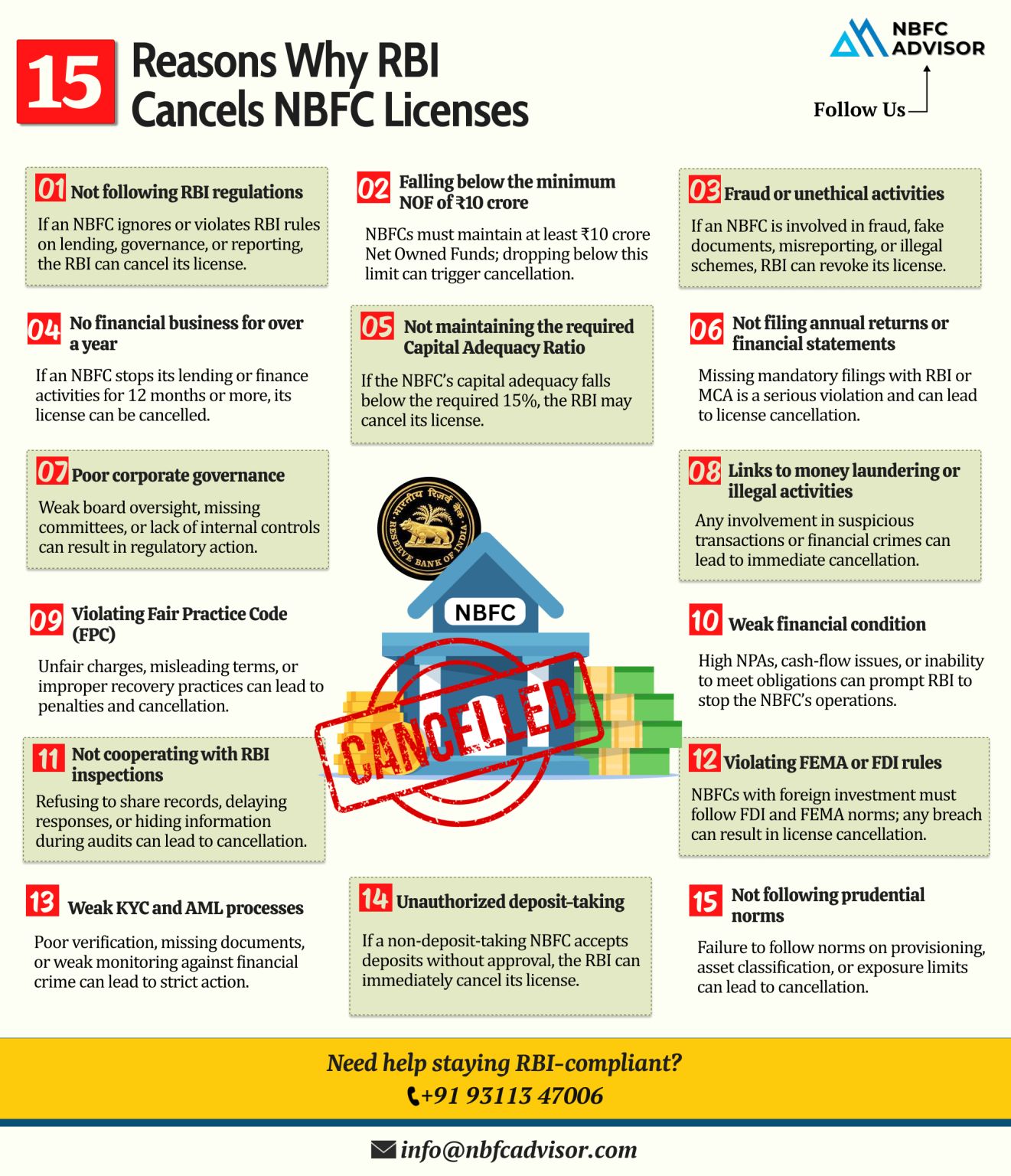

In a significant move reinforcing its commitment to maintaining financial stability and consumer protection, the Reserve Bank of India (RBI) recently canceled the licenses of two non-banking financial companies (NBFCs) - Polytex India Ltd, based in M...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

In recent months, the Reserve Bank of India (RBI) has implemented several stringent measures affecting non-banking financial companies (NBFCs). These measures include restrictions on important business areas such as gold loans and securities financin...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

In the intricate world of finance, Non-Banking Financial Companies (NBFCs) operate within a nuanced regulatory landscape. This blog offers an insightful exploration into the complexities, nuances and critical role of compliance in shaping the traject...

Rules.png)

India’s Future of Financial Data Sharing.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)