NBFC Compliance Services: Stay RBI-Compliant, Avoid Penalties & Build Long-Term Trust

In today’s regulated financial environment, compliance is the backbone of every successful NBFC. With increasing supervision by the Reserve Bank of Ind...

Planning to Exit Your NBFC? Here’s What You Need to Know Before Making a Decision

Running a Non-Banking Financial Company (NBFC) is a long-term regulatory commitment. However, many NBFC promoters today are considering an exit due to changing...

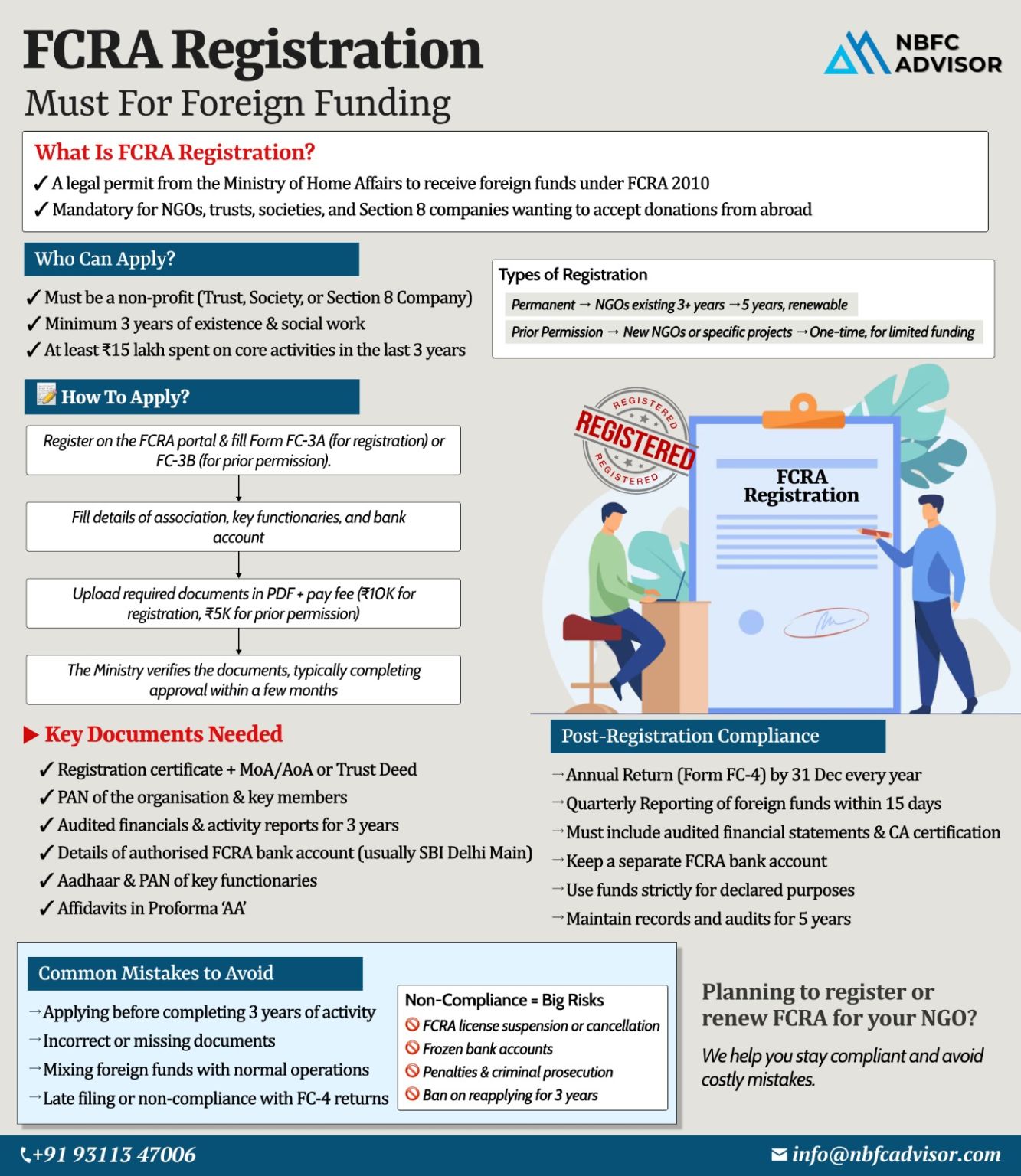

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

Foreign funding can be a lifeline for NGOs working in education, healthcare, human rights, environment, and social welfare. Yet every year, hundreds of NGOs in India lose their ability to ...

Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

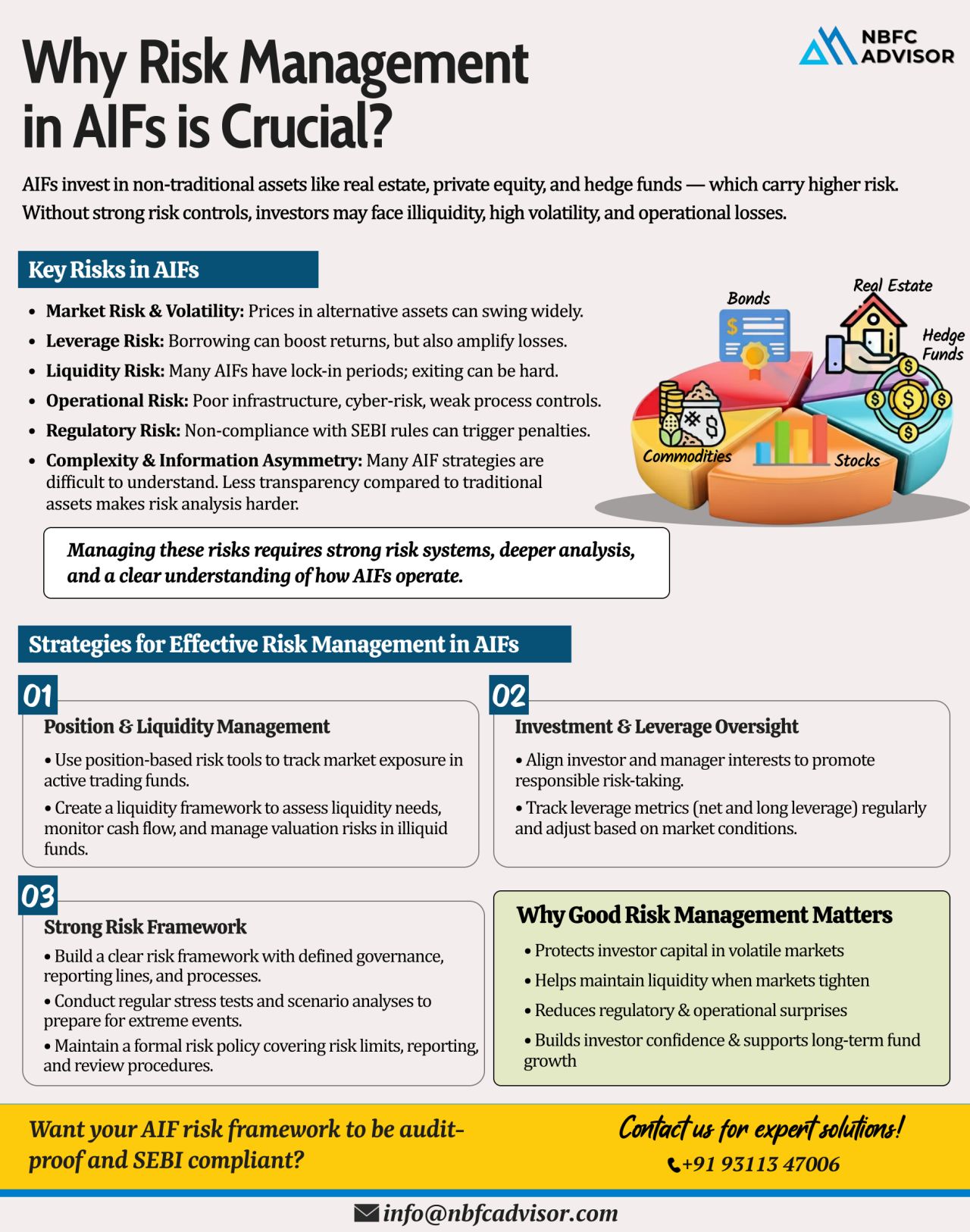

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

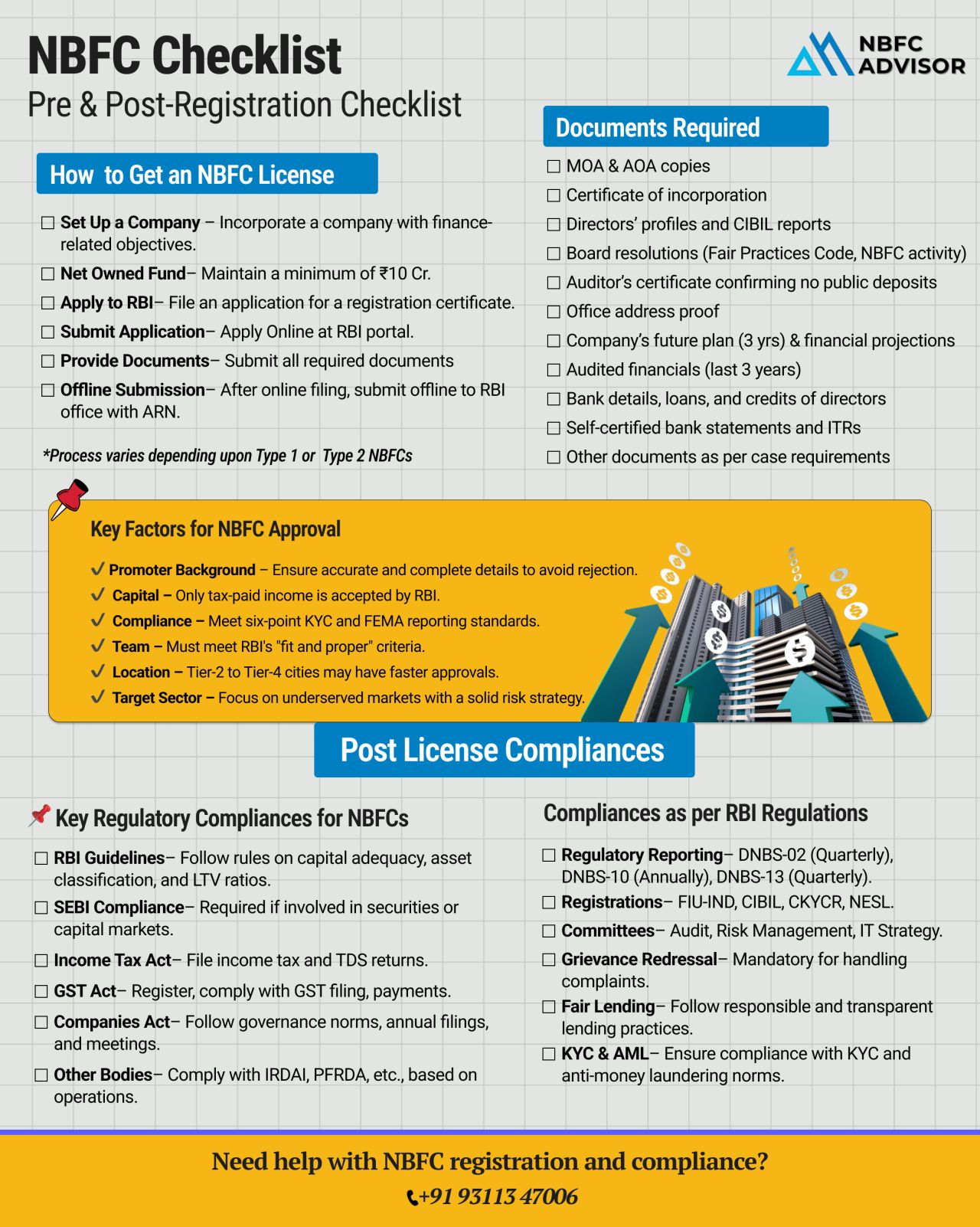

NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey wi...

Want to Register Your NBFC Faster?

Starting a Non-Banking Financial Company (NBFC) is one of the most promising ventures in India’s growing financial ecosystem. However, most founders face one common hurdle — RBI registration delays du...

Why Many NBFC Applications Get Rejected by the RBI — And How to Avoid It

Applying for an NBFC (Non-Banking Financial Company) license from the Reserve Bank of India (RBI) is an exciting step for any finance or fintech entrepreneur. However, ...

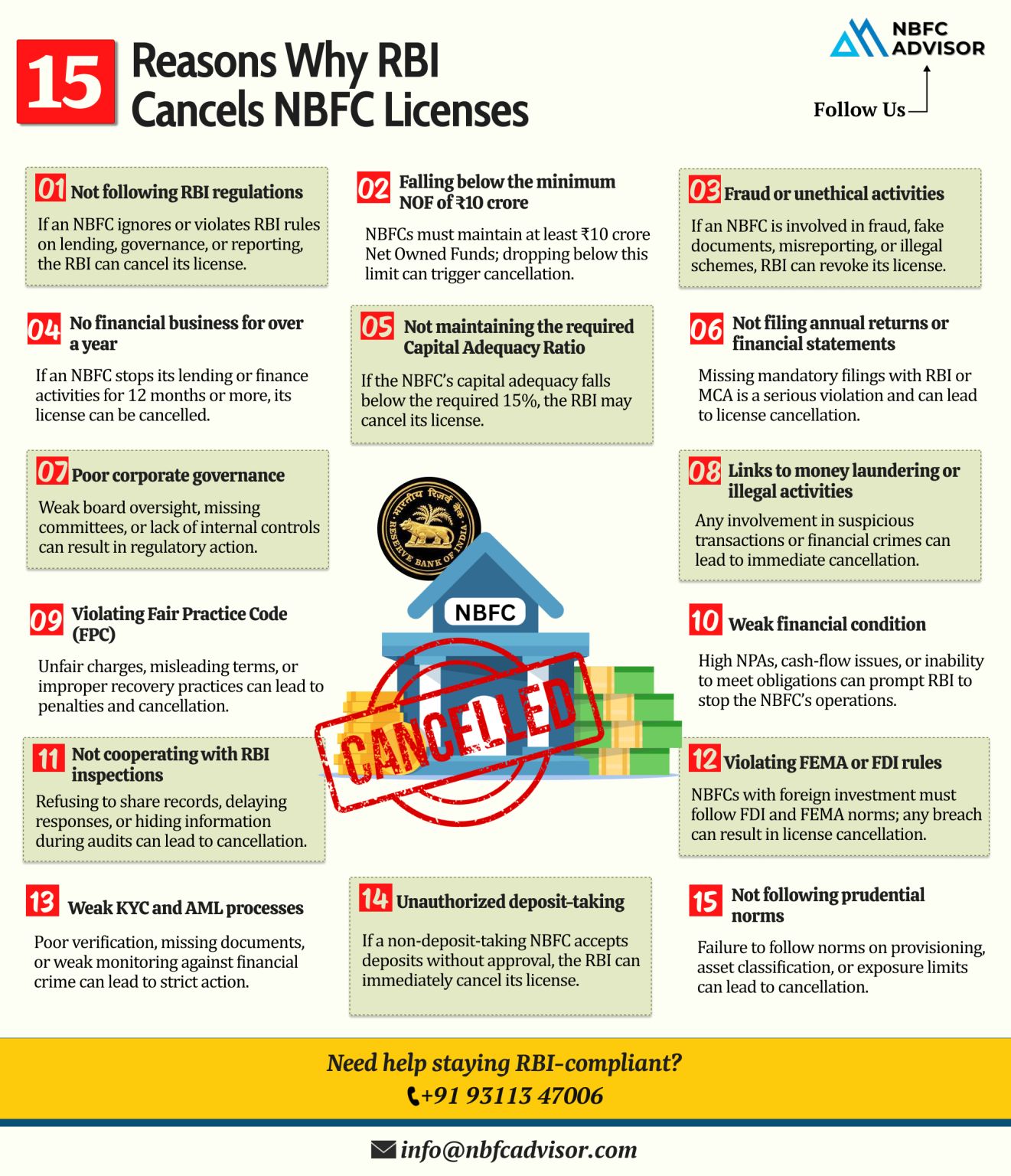

RBI Is Cracking Down on NBFCs — Is Your Company Compliance-Ready?

The Reserve Bank of India (RBI) has intensified its scrutiny of Non-Banking Financial Companies (NBFCs)—and the message is loud and clear: compliance is no longer negoti...

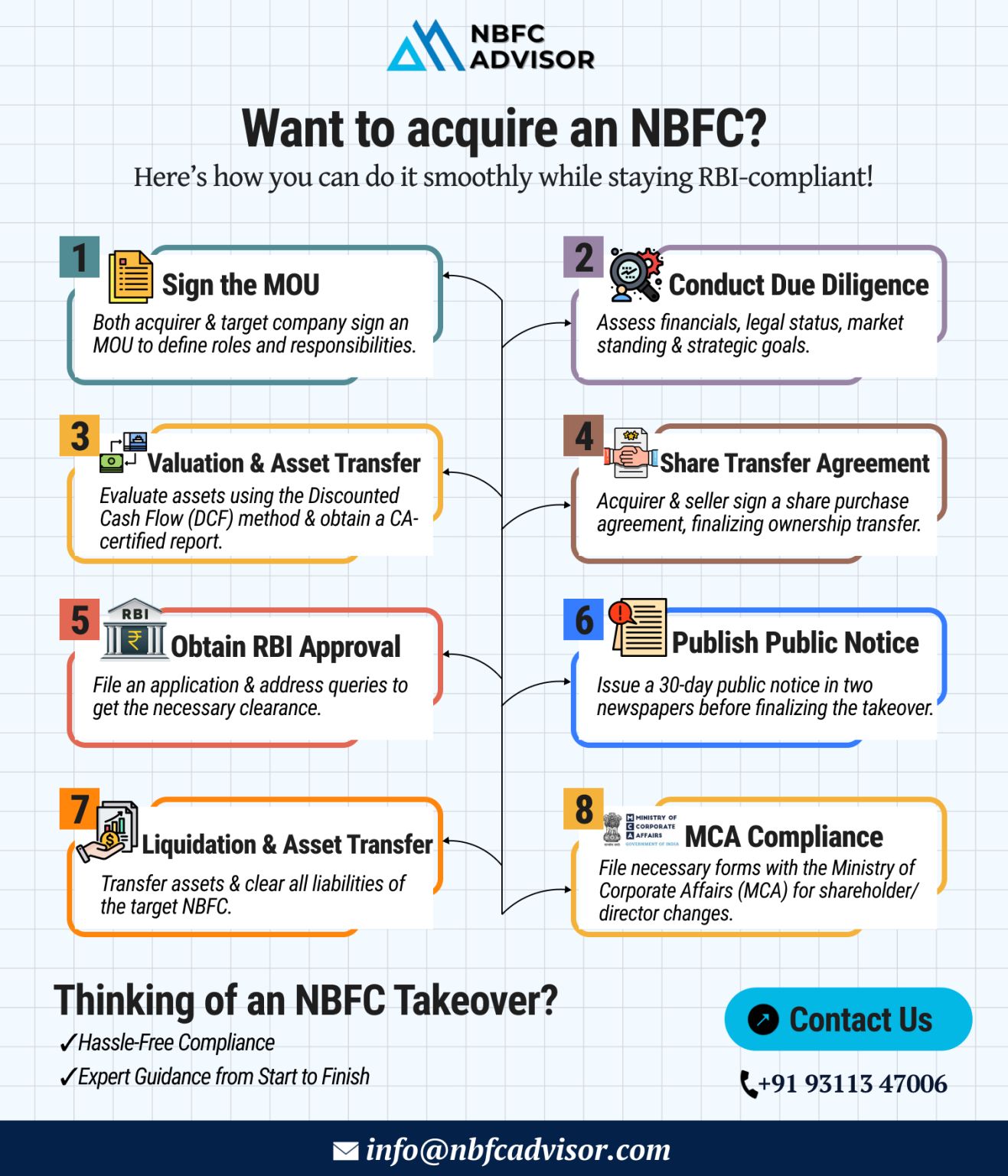

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

₹12 lakh income? No tax.

₹12,10,000 income? ₹61,500 tax?

What happens if your income exceeds ₹12 lakh by just ₹1?

Did you know that earning just ₹1 extra above ₹12 lakh could shoot up your tax liability disproportionately?

That’s wh...