FinTech–NBFC Collaboration Service: Powering Scalable, RBI-Compliant Digital Lending Partnerships

The future of financial services lies in collaboration. FinTech companies bring technology, customer experience, and innovation, while NBFCs br...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity Shaping the Future of Finance

India is witnessing one of the fastest fintech revolutions in the world. With rapid digitisation, supportive government initiatives, and a tech-savvy population...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

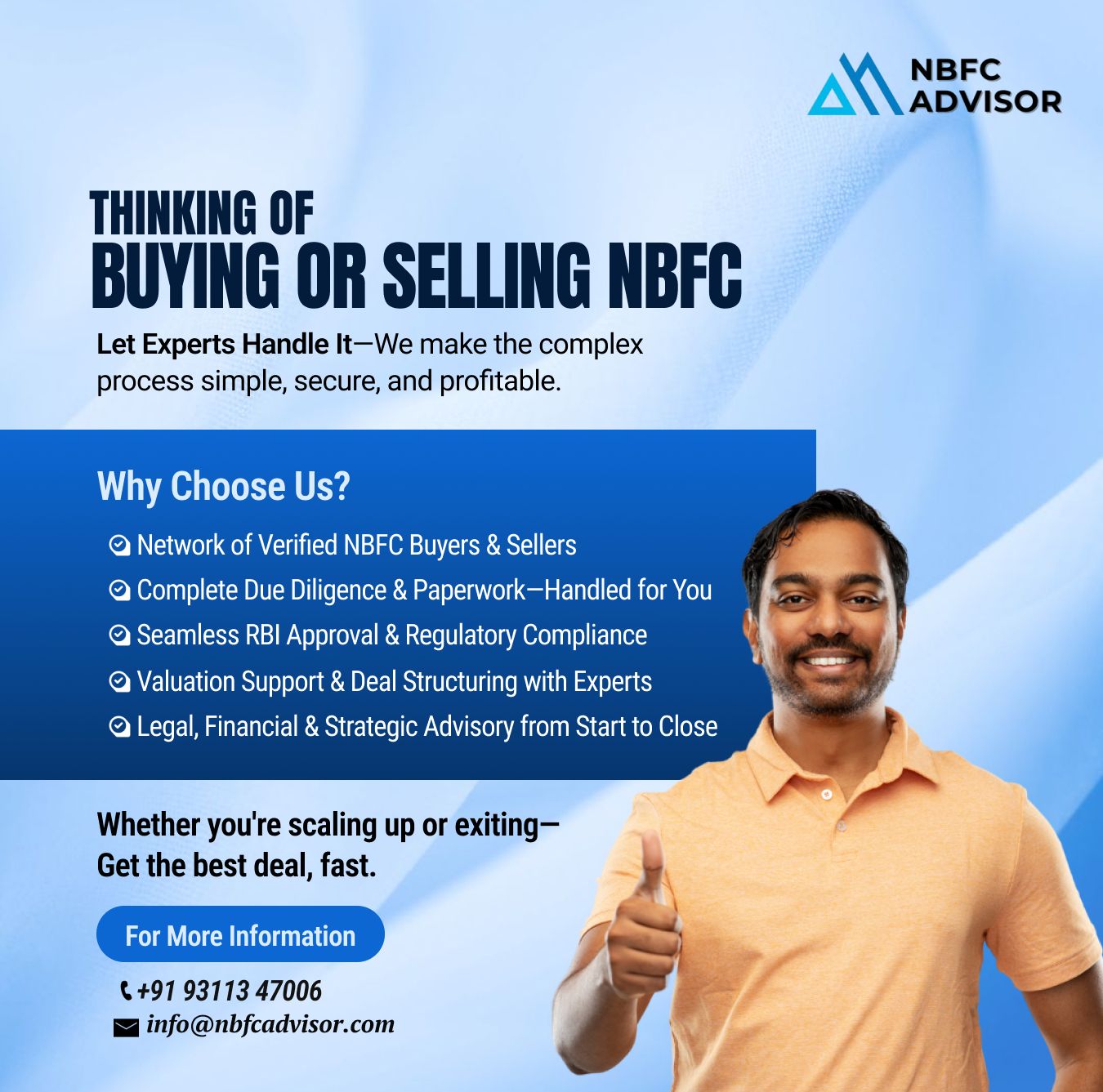

Looking to Acquire an NBFC for Sale? Here’s What You Must Know Before You Buy

Acquiring an NBFC (Non-Banking Financial Company) can open doors to lending, fintech expansion, digital credit, and financial services — but only if the acqu...

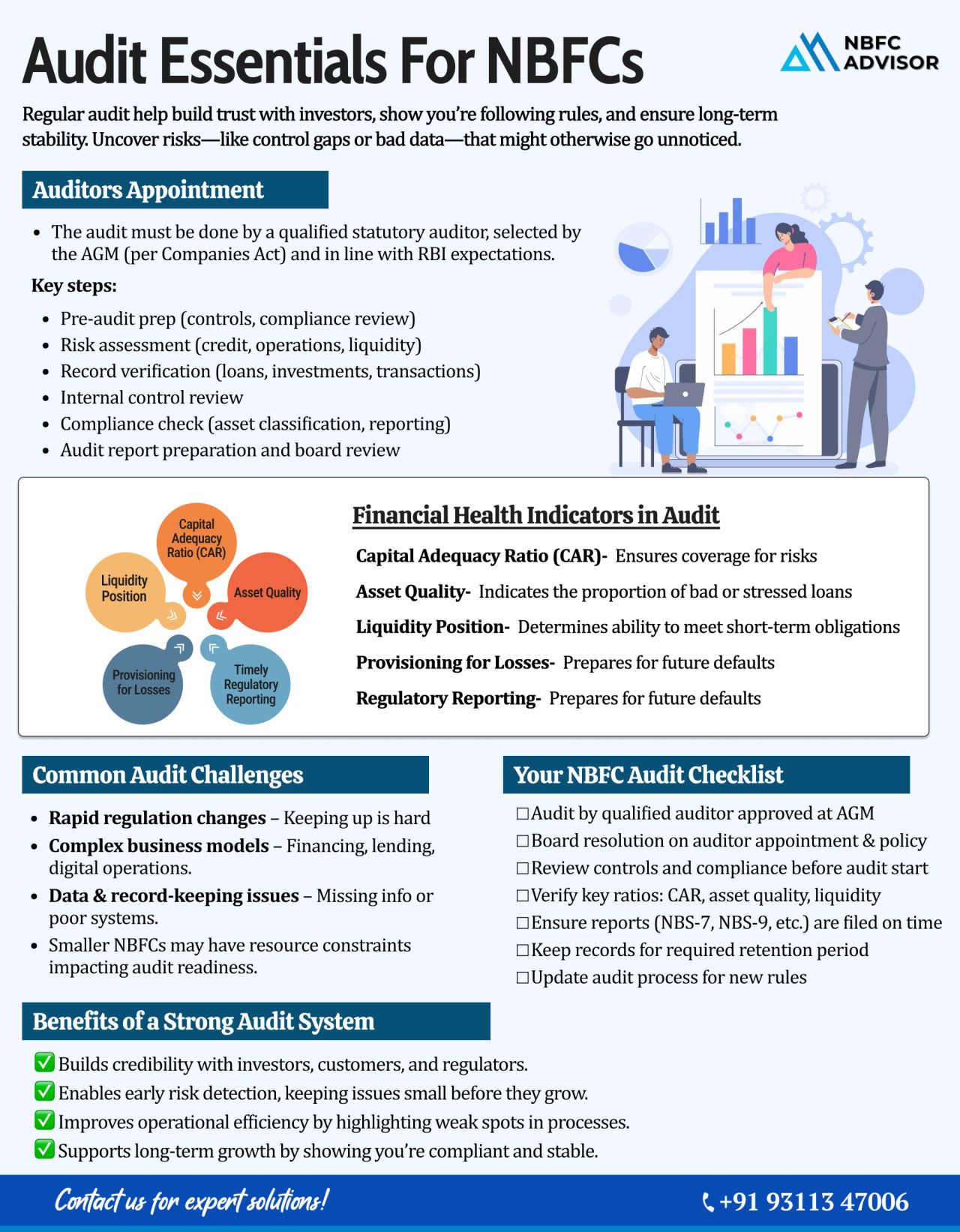

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

Want to Register Your NBFC Faster?

Starting a Non-Banking Financial Company (NBFC) is one of the most promising ventures in India’s growing financial ecosystem. However, most founders face one common hurdle — RBI registration delays du...

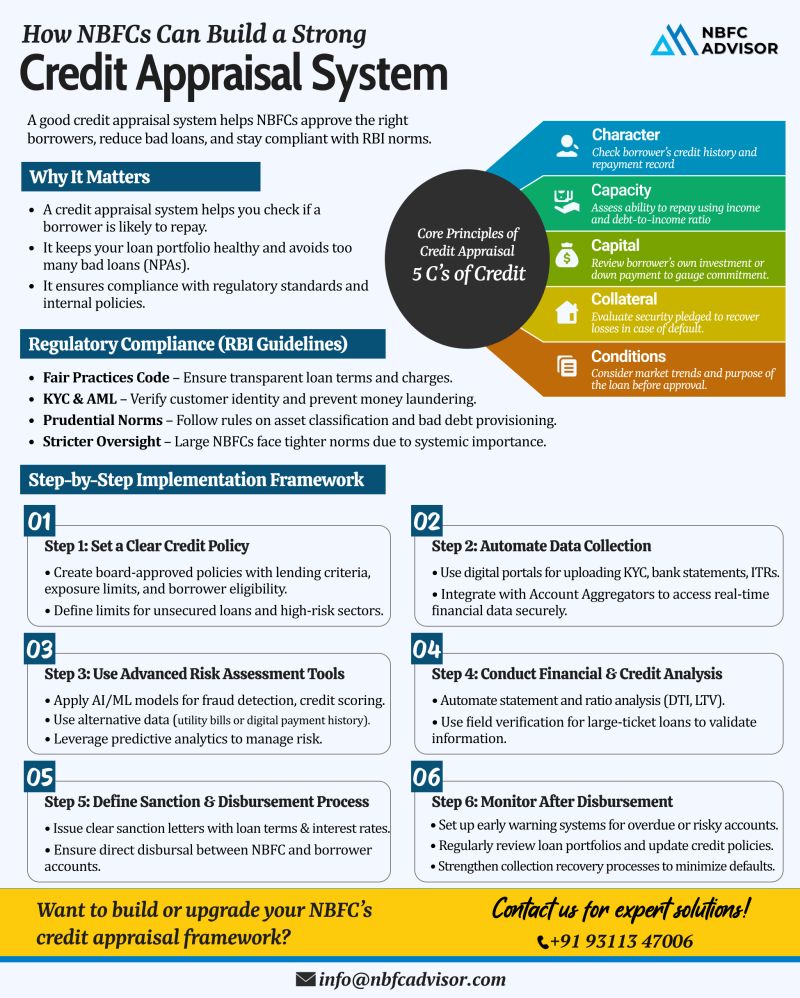

Want to Reduce Loan Defaults? Strengthen Your Credit Appraisal Process 💡

Smart Credit Assessment = Safer Lending

In today’s competitive lending environment, Non-Banking Financial Companies (NBFCs) face increasing pressure to maintain por...

Thinking of Starting a Digital Lending Business? Here’s What You Should Know

India’s credit ecosystem is undergoing a digital revolution. By 2030, the country’s digital lending market is projected to reach $515 billion — al...

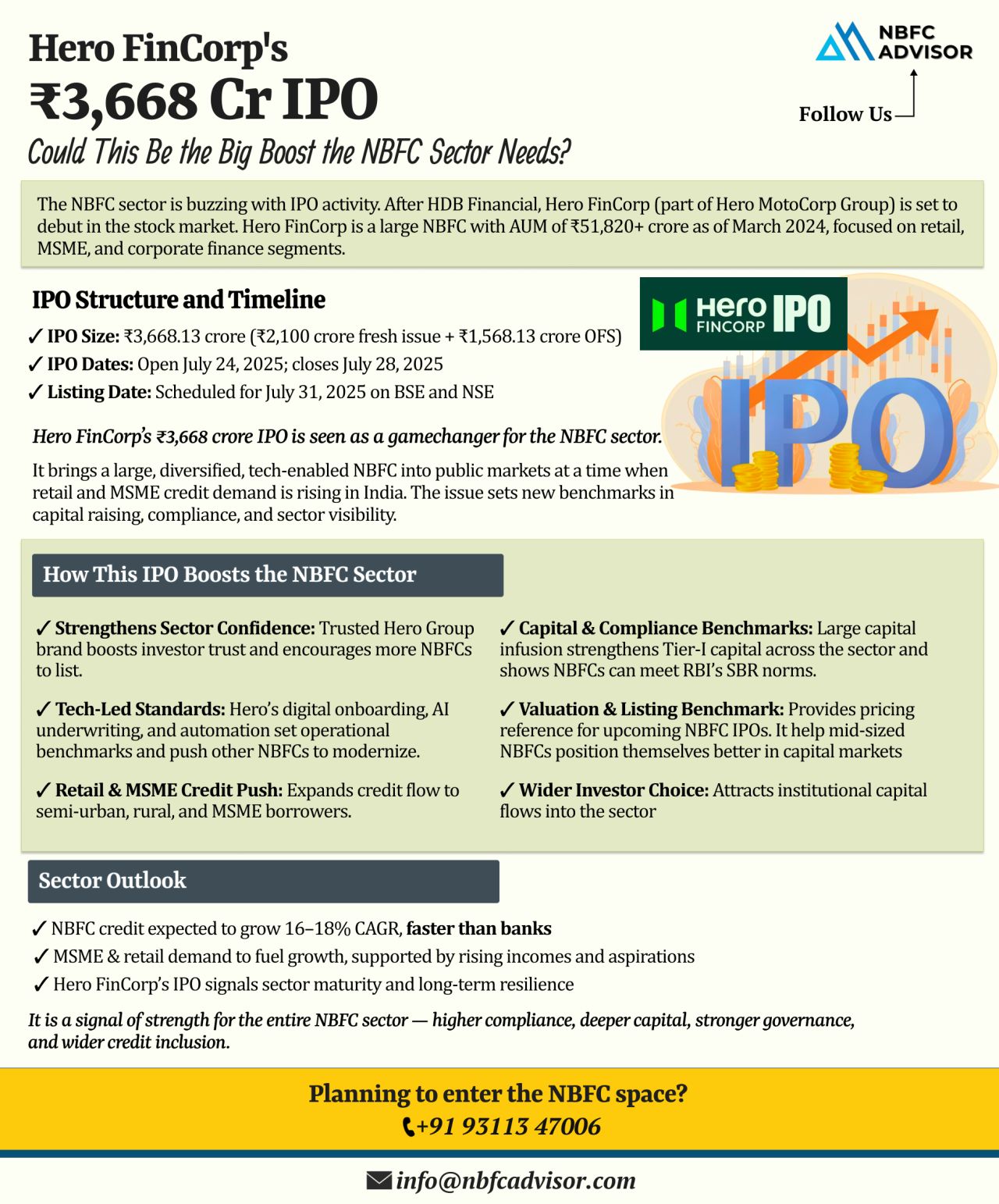

Hero FinCorp’s ₹3,668 Cr IPO: What It Means for the NBFC Sector

The Non-Banking Financial Company (NBFC) sector in India is witnessing a surge in Initial Public Offerings (IPOs), signaling a phase of growth and investor confidence. Following...

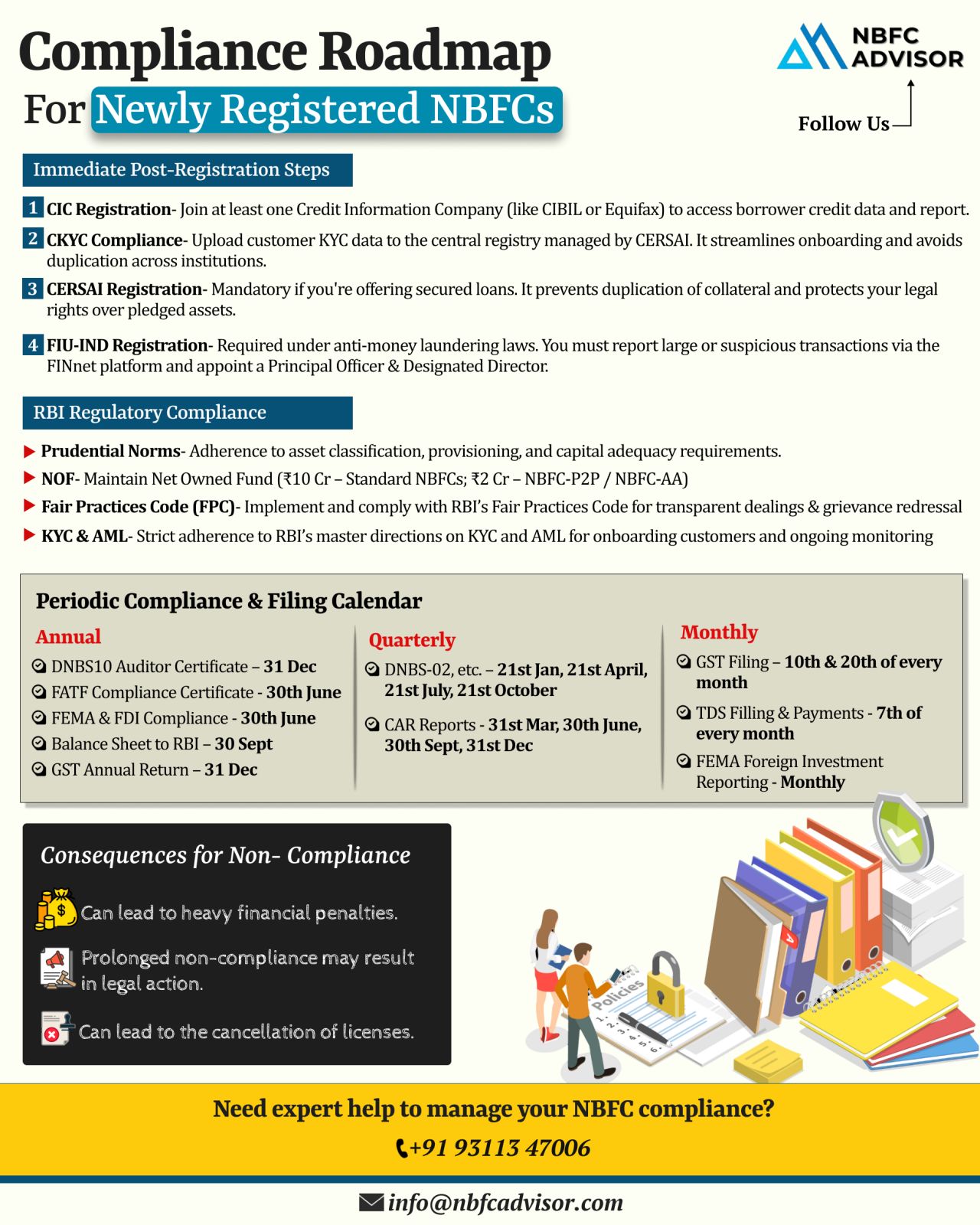

Newly Licensed as an NBFC? Here’s What Comes Next

Obtaining an RBI license is a major milestone for any NBFC. However, the license alone doesn’t guarantee smooth operations—the real challenge begins with meeting regulatory compli...

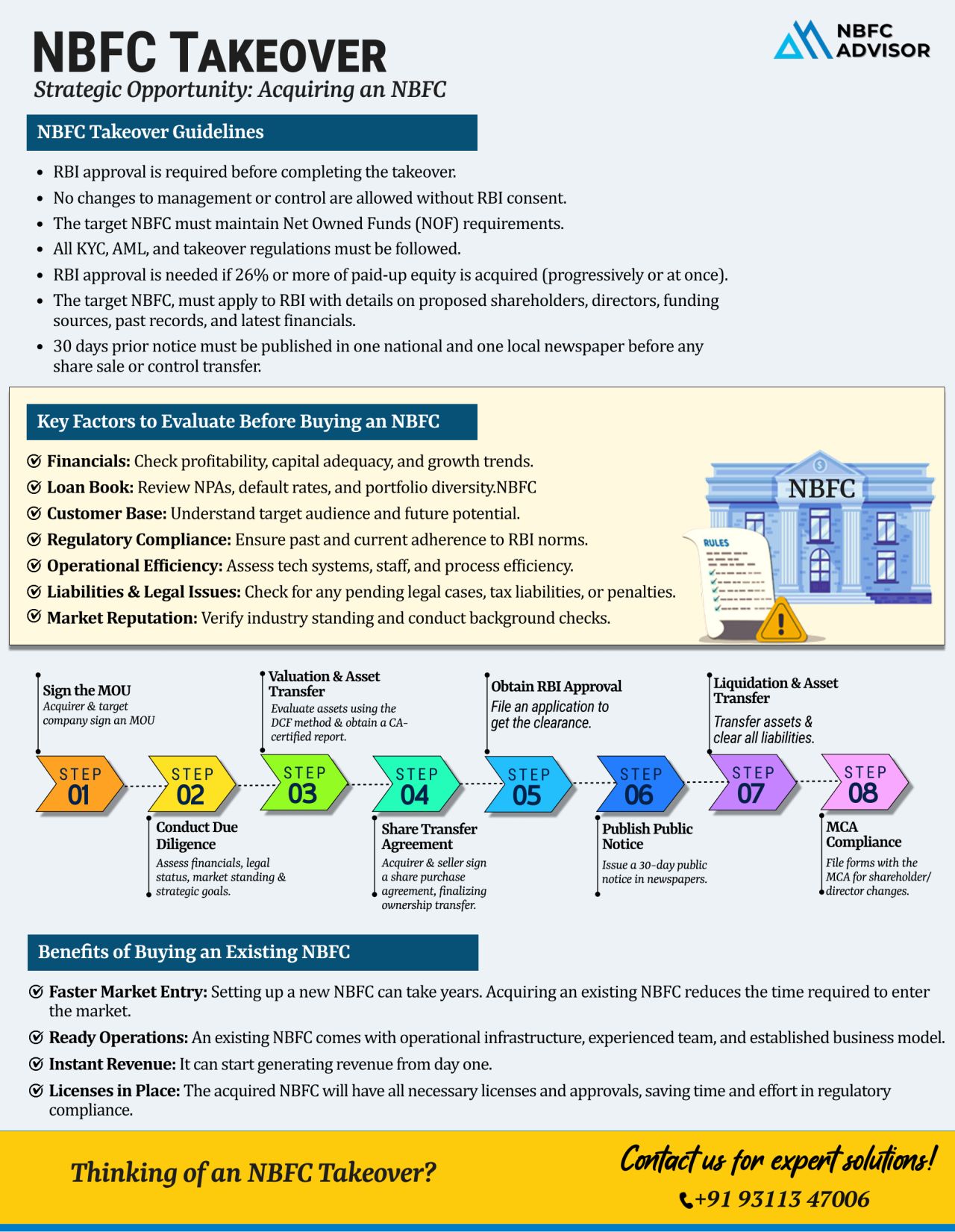

NBFC Takeovers: The Quickest Gateway to India’s Digital Lending Boom

India’s digital lending market is on a steep growth curve, projected to reach $515 billion by 2030. Innovative financial solutions such as peer-to-peer (P2P) lending,...

Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and ...

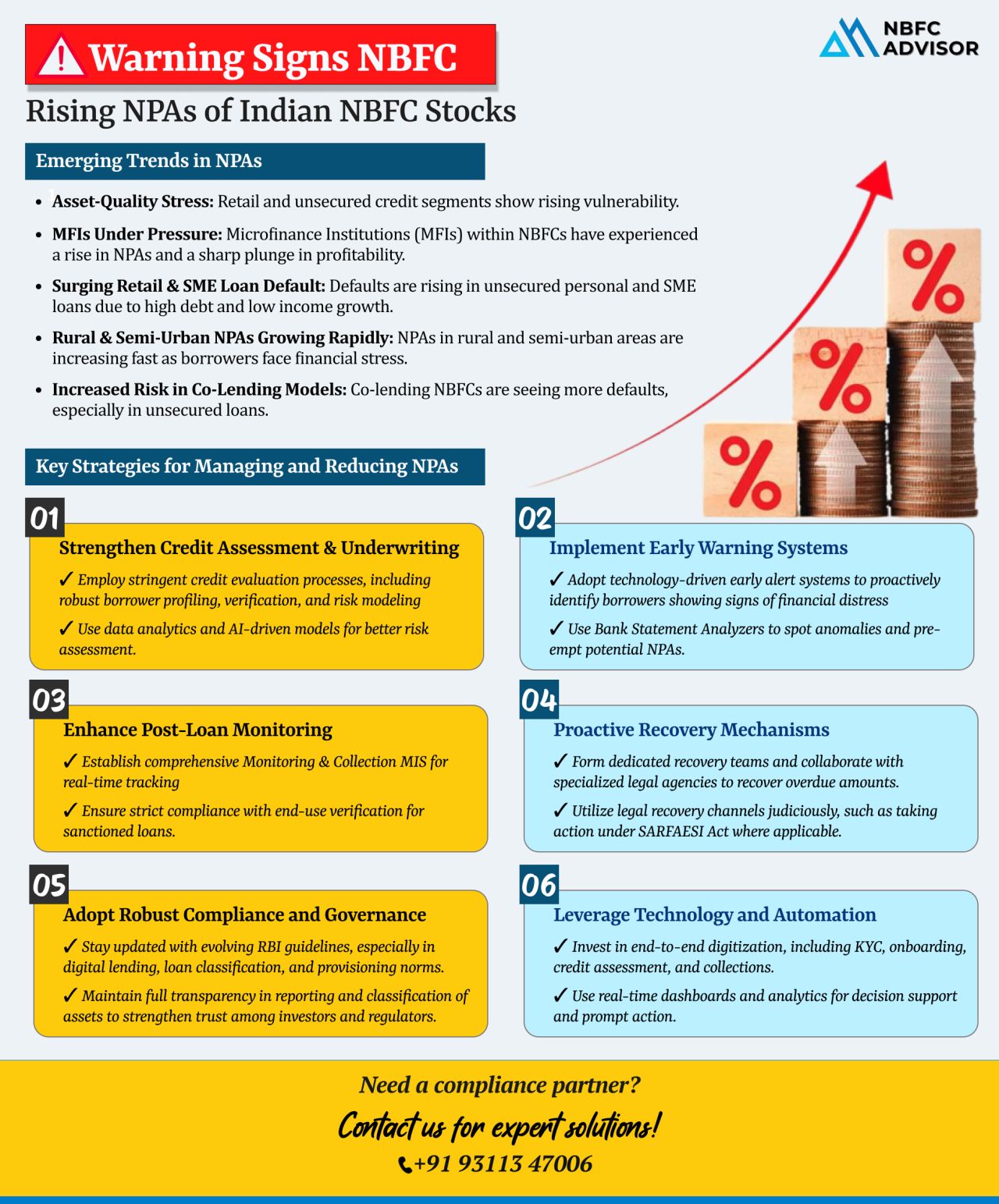

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

📉 Is Your NBFC at Risk of RBI Action?

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to lice...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

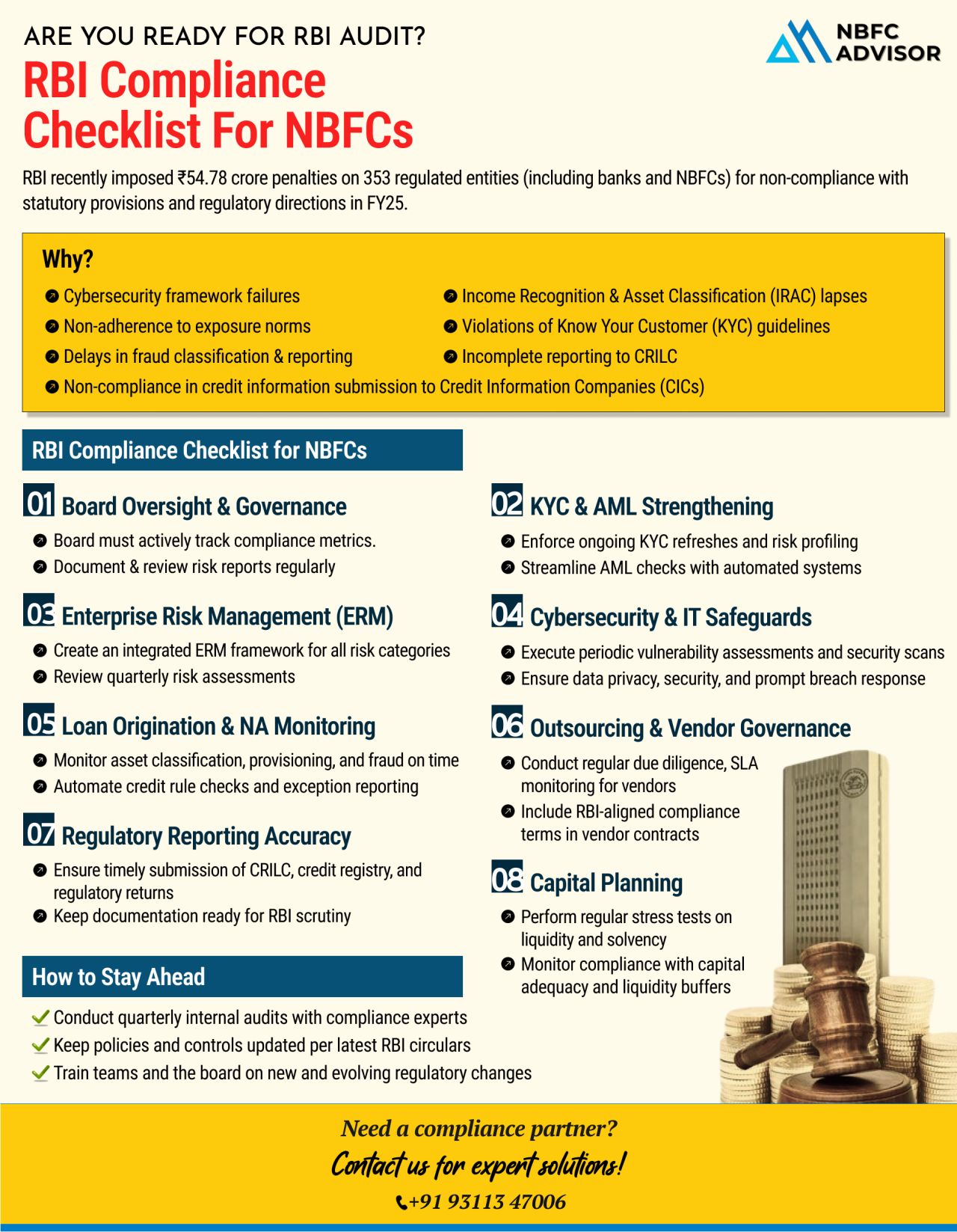

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

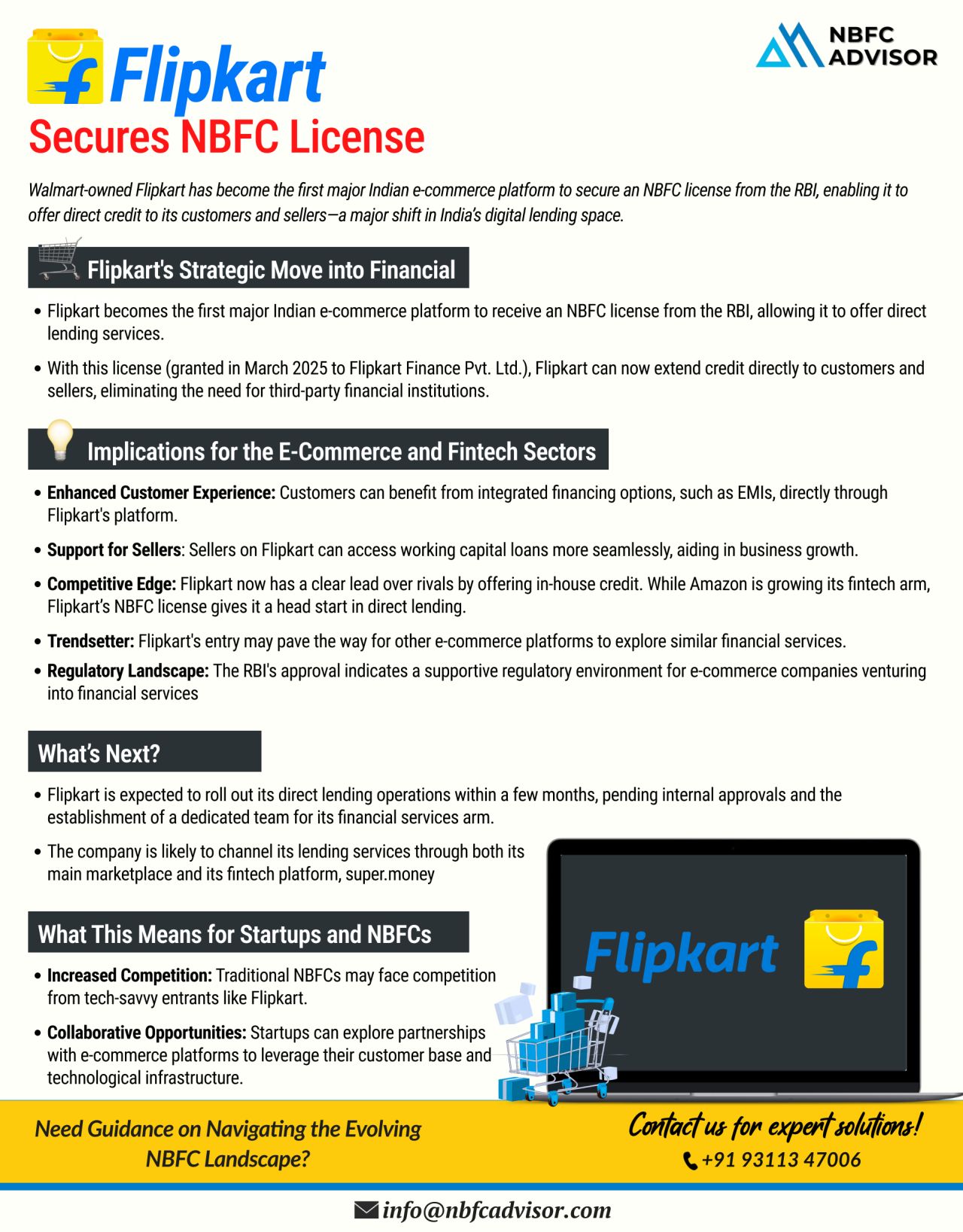

Flipkart Becomes the First Major Indian E-Commerce Platform to Secure an NBFC License

In a groundbreaking move, Flipkart has become the first large Indian e-commerce platform to receive a Non-Banking Financial Company (NBFC) license. This developm...

The Reserve Bank of India (RBI) has issued a directive that could significantly reshape how Non-Banking Financial Companies (NBFCs) and fintechs collaborate in the digital lending space.

Key Update

NBFCs can no longer rely on Default Loss Guara...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

In today’s financial landscape, trust is everything—and Non-Banking Financial Companies (NBFCs) that prioritize ethical lending practices stand out from the rest. Beyond regulatory compliance, ethical conduct helps NBFCs build long-term c...

India’s Non-Banking Financial Companies (NBFCs) are growing at a pace that’s outstripping the country’s GDP, signaling a major shift in the financial services landscape. This acceleration is powered by rapid credit expansion, digita...

The Reserve Bank of India (RBI) has issued the Reserve Bank of India (Digital Lending) Directions, 2025, which came into effect on May 8, 2025. These updated guidelines aim to regulate digital lending while fostering innovation, transparency, and fin...

The gold loan industry in India is experiencing rapid growth. It is expected to cross ₹10 lakh crore in FY25 and reach ₹15 lakh crore by 2027.

NBFCs Are Leading the Surge

Non-Banking Financial Companies (NBFCs) are playing a major role in this ...

The Reserve Bank of India (RBI) has introduced updated guidelines aimed at strengthening gold loan practices and enhancing the co-lending framework for better transparency, responsible lending, and financial inclusion.

Key Highlights:

✅ L...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

Most loan defaults don’t happen because of bad customers — they happen because of bad credit decisions.

Yet, many NBFCs still rely on outdated, unstructured loan assessment methods.

If you’re serious about scaling safely and s...

The demand for digital credit in India is at an all-time high.

From MSMEs to individuals, the appetite for alternative financing is growing rapidly — and Non-Banking Financial Companies (NBFCs) are at the forefront of this revolution.

Wit...

In today’s competitive market, delayed payments can create major cash flow challenges—especially for Micro, Small, and Medium Enterprises (MSMEs). That’s where factoring steps in as a powerful financial solution.

What is Factor...

Valued at $350 billion, India’s lending market is projected to surpass $720 billion by 2030 — unlocking immense opportunities for lenders across the ecosystem.

What is Co-Lending?

Introduced by the RBI, co-lending allows banks and...

With over 190 million adults in India lacking a formal credit history, traditional credit scoring models fall short.

Alternative Credit Scoring taps into digital footprints—such as rent payments, utility bills, mobile transactions, and even ...

In the era of Open Finance, NBFC Account Aggregators (AA) are revolutionizing how financial data is shared, accessed, and utilized. If you're a fintech, NBFC, or financial service provider, an NBFC-AA license could be your key to unlocking a futu...

India’s Peer-to-Peer (P2P) lending market is growing at an impressive 21% CAGR, transforming how individuals and businesses access credit. By eliminating intermediaries, P2P platforms offer faster and more flexible funding solutions.

Why is ...

The buzz around Non-Banking Financial Companies (NBFCs) is louder than ever, fueled by Digital Transformation and Regulatory Adaptation.

As India moves towards a $7 trillion economy by 2030, NBFCs are playing a pivotal role—powering MSMEs, a...

RBI Halts New Credit Lines & Renewals for Large NBFCs

The Reserve Bank of India (RBI) has directed large Non-Banking Financial Companies (NBFCs) to stop issuing new lines of credit and renewing existing ones for businesses.

Why?

NBFCs ha...

India’s credit landscape is rapidly evolving, and Pass-Through Certificates (PTCs) are driving this transformation.

What Are PTCs?

PTCs are financial instruments backed by loan pools, allowing NBFCs to transfer loan ownership to ban...

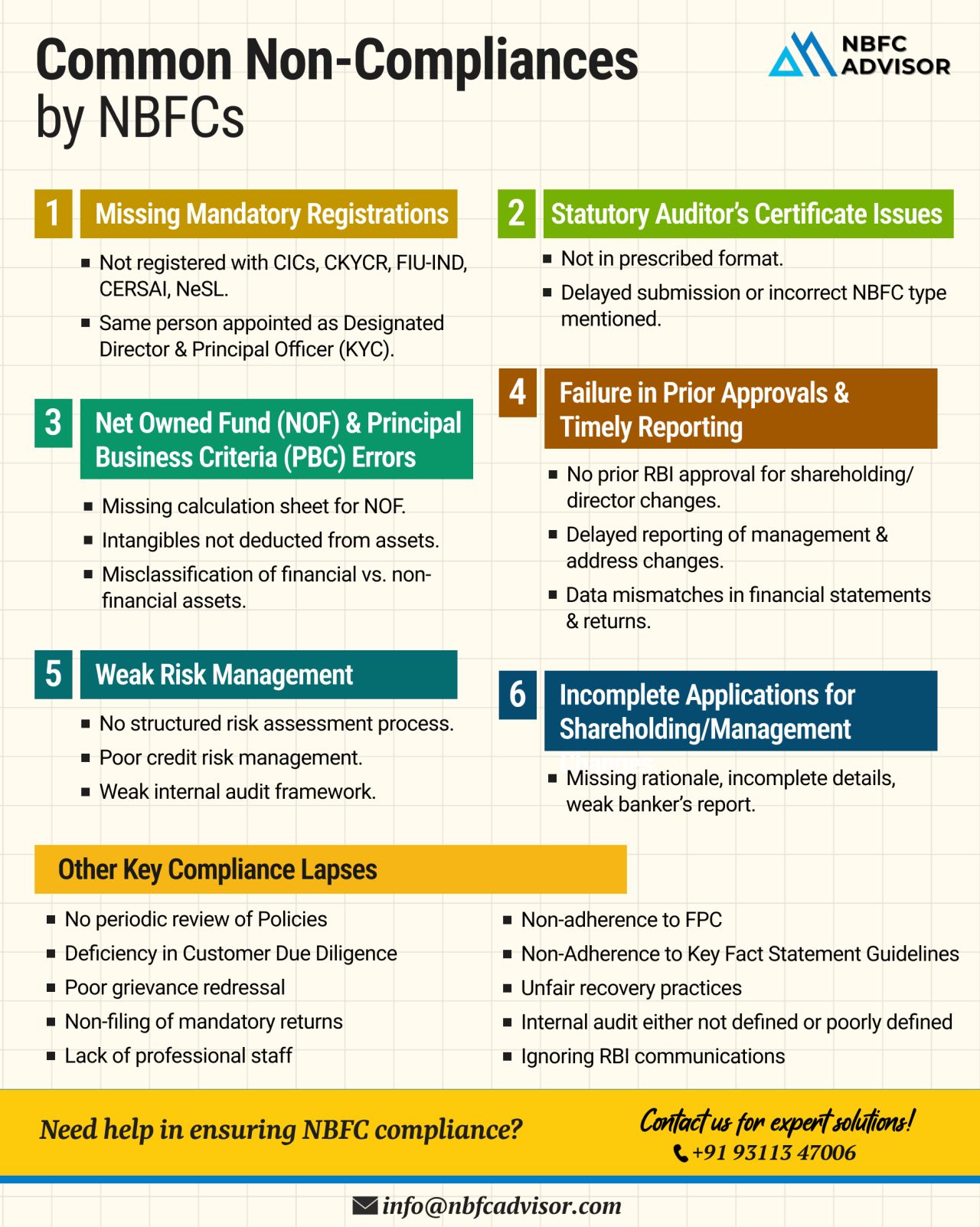

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

Microfinance has long been a cornerstone of financial inclusion in India, supporting small businesses and underserved communities. However, the latest Micrometer Q3 FY 2024-25 report unveils alarming trends, raising concerns about the sector's st...

The NBFC sector is a pillar of India’s financial ecosystem, but it faces regulatory, liquidity, and operational hurdles that impact growth and stability.

🔍 Top Challenges NBFCs Face:

⚠️ Regulatory Hurdles – Stricter RBI norms lead ...

India’s digital lending industry is on a rapid growth trajectory, projected to hit $1.3 trillion by 2030! With AI-powered risk assessment, fintech innovation, and RBI-backed policies, the sector is ripe with opportunities.

💰 Want to tap int...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

Digital lending is set to hit ₹5 TRILLION by FY28! 📈

With a 40% CAGR growth, the industry is expected to double its market share in India’s retail loan space in just four years.

And the best part? It’s just getting started!

What...

The Reserve Bank of India (RBI), led by Governor Sanjay Malhotra, recently held a crucial meeting with leading Non-Banking Financial Companies (NBFCs)—his first such interaction since taking office. The meeting brought together MDs and CEOs fro...

Most people fear credit cards—but when used wisely, they can skyrocket your credit score faster than anything else! 🚀

Here’s how:

✅ Use Only 30% of Your Limit

Keeping your usage low shows lenders you’re responsible.

✅ Pay...

NBFCs face huge financial risks, rising fraud, and strict RBI regulations. Traditional KYC checks are too slow, manual, and risky!

That’s where Verification APIs come in—helping NBFCs stay compliant, prevent fraud, and onboard cu...

India’s digital lending space has witnessed tremendous growth, making credit more accessible to individuals and MSMEs. However, with this growth has come a dark side—a rise in unregulated lenders engaging in:

❌ Predatory inte...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

In today’s rapidly evolving financial landscape, co-lending has emerged as a significant force reshaping how loans are disbursed in India. The model, which enables banks and Non-Banking Financial Companies (NBFCs) to jointly disburse loans, has...

The LendingTech sector in India is witnessing rapid growth, driven by the rising demand for digital lending solutions that target unbanked and underserved populations. This article delves into how LendingTech startups are differentiating themselves, ...

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Introduction

Jio Financial Services (JFS), a financial arm of the energy-to-telecom conglomerate Reliance Industries Limited (RIL), has recently transitioned from a Non-Banking Financial Company (NBFC) to a Core Investment Company (CIC). This sign...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

Co-lending, a collaborative lending model where multiple lenders join forces to provide financing to a borrower, has become increasingly popular in the financial sector. This approach allows lenders to capitalize on their individual strengths while s...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

According to a recent industry report by the Microfinance Industry Network (MFIN), NBFC-MFIs have emerged as the largest providers of micro-credit in the country by the end of the 2023-24 fiscal year. The report highlights significant trends in the m...

Emerging technologies and strategic partnerships are crucial for Non-Banking Financial Companies (NBFCs) to thrive in an increasingly regulated and competitive financial landscape. By integrating advanced technologies and collaborating with FinTech c...

In the rapidly evolving financial services sector, Non-Banking Financial Companies (NBFCs) are experiencing a transformative shift, thanks to the advent of digital and AI-enabled tools. Systems such as Loan Origination Systems (LOS) and Loan Manageme...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

The fintech industry is experiencing an unprecedented evolution, driven by groundbreaking innovations that are transforming how we manage, invest, and think about money. From artificial intelligence to blockchain, the financial landscape is being red...

In recent months, the Reserve Bank of India (RBI) has implemented several stringent measures affecting non-banking financial companies (NBFCs). These measures include restrictions on important business areas such as gold loans and securities financin...

A Non-Banking Financial Company (NBFC) provides various financial services such as loan facilitation, stock acquisition, hire-purchase, and insurance, contributing significantly to the nation’s financial growth. To establish an NBFC in India, u...

The finance world is experiencing a profound transformation, driven by the pervasive influence of the digital realm. One of the most intriguing shifts is the collaboration between Non-Banking Financial Companies (NBFCs) and Fintech startups. This par...

In today's rapidly changing financial landscape, traditional credit scoring methods often fail to meet the needs of millions of people worldwide who are underserved by formal banking systems. Emerging economies, such as the Philippines, struggle ...

India is on the verge of a financial revolution, thanks to its growing economy and diverse demographics. However, there still exists a significant credit gap, especially among businesses and individuals. This gap is obstructing the country's econ...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In the relentless pursuit of financial inclusion, a notable paradigm shift has unfolded in recent years, marked by the symbiotic relationship between Non-Banking Financial Companies (NBFCs) and Fintech firms. This strategic alliance has emerged as a ...

In India, Micro, Small, and Medium Enterprises (MSMEs) and retail borrowers constitute a significant portion of the economy, yet access to formal financing remains a challenge. However, the emergence of co-lending partnerships between Banks and Non-B...

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

Rules.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)