One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

Not All NBFCs Are the Same: Understanding RBI’s Scale-Based Regulation (SBR)

Many people still think of Non-Banking Financial Companies (NBFCs) as one single category. In reality, not all NBFCs are created equal.

To strengthen financial s...

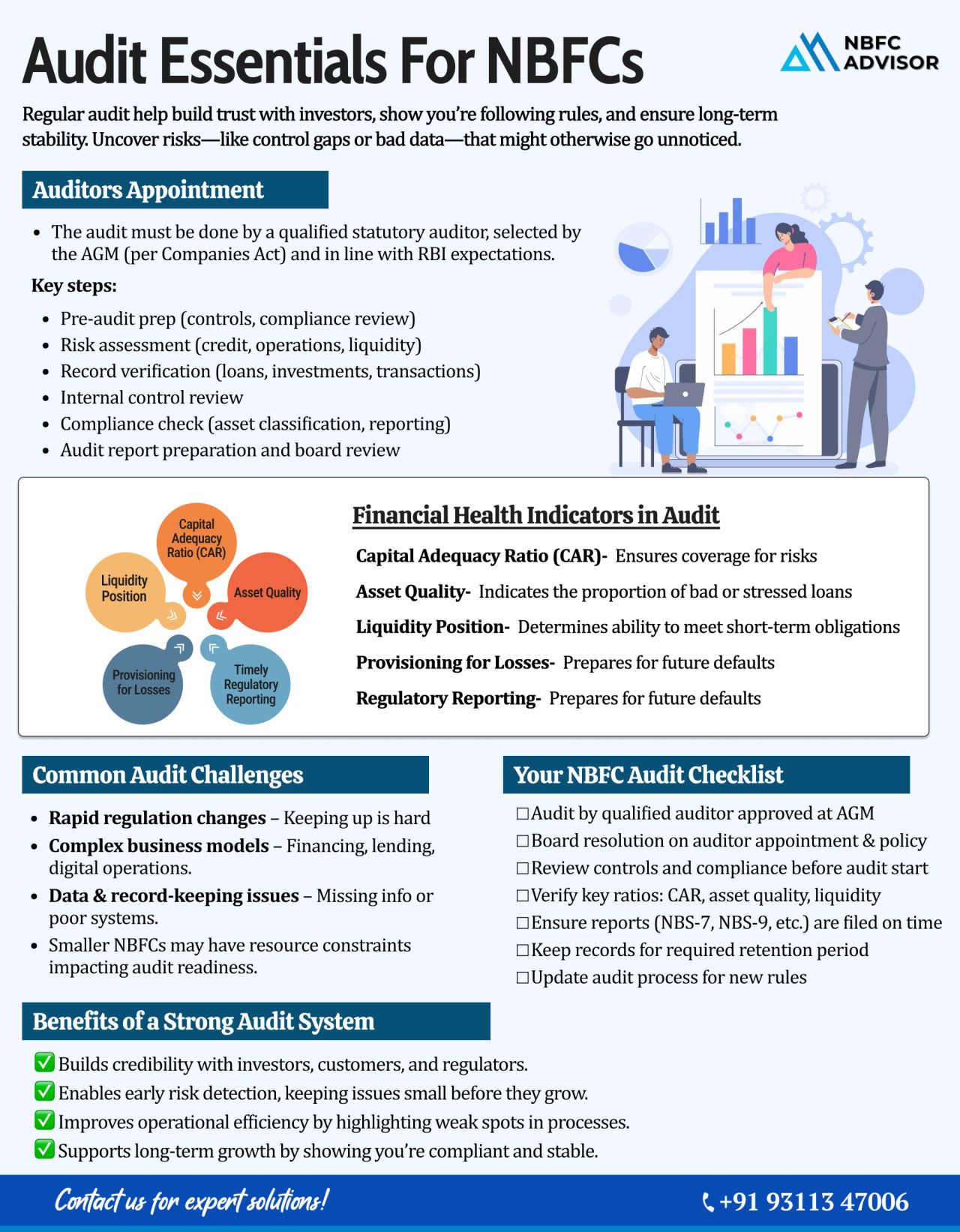

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

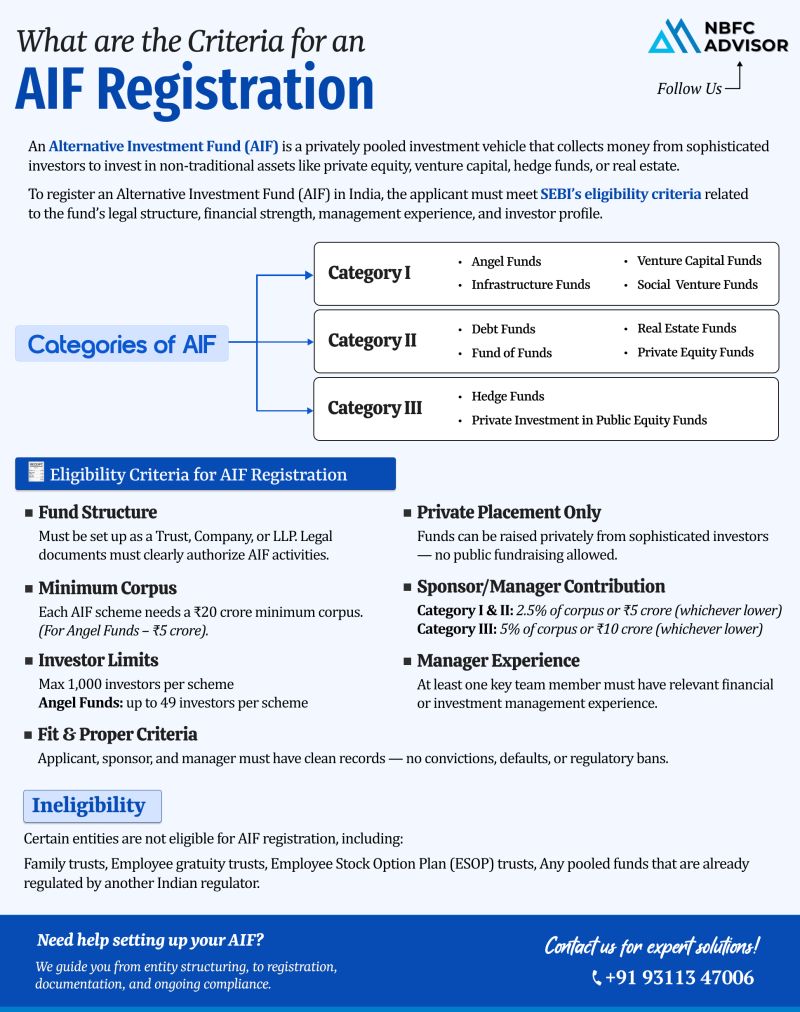

Thinking of Starting an Alternative Investment Fund (AIF)? Here’s What You Should Know

India’s financial landscape is rapidly evolving, and Alternative Investment Funds (AIFs) have emerged as one of the most attractive investment vehic...

Why Many NBFC Applications Get Rejected by the RBI — And How to Avoid It

Applying for an NBFC (Non-Banking Financial Company) license from the Reserve Bank of India (RBI) is an exciting step for any finance or fintech entrepreneur. However, ...

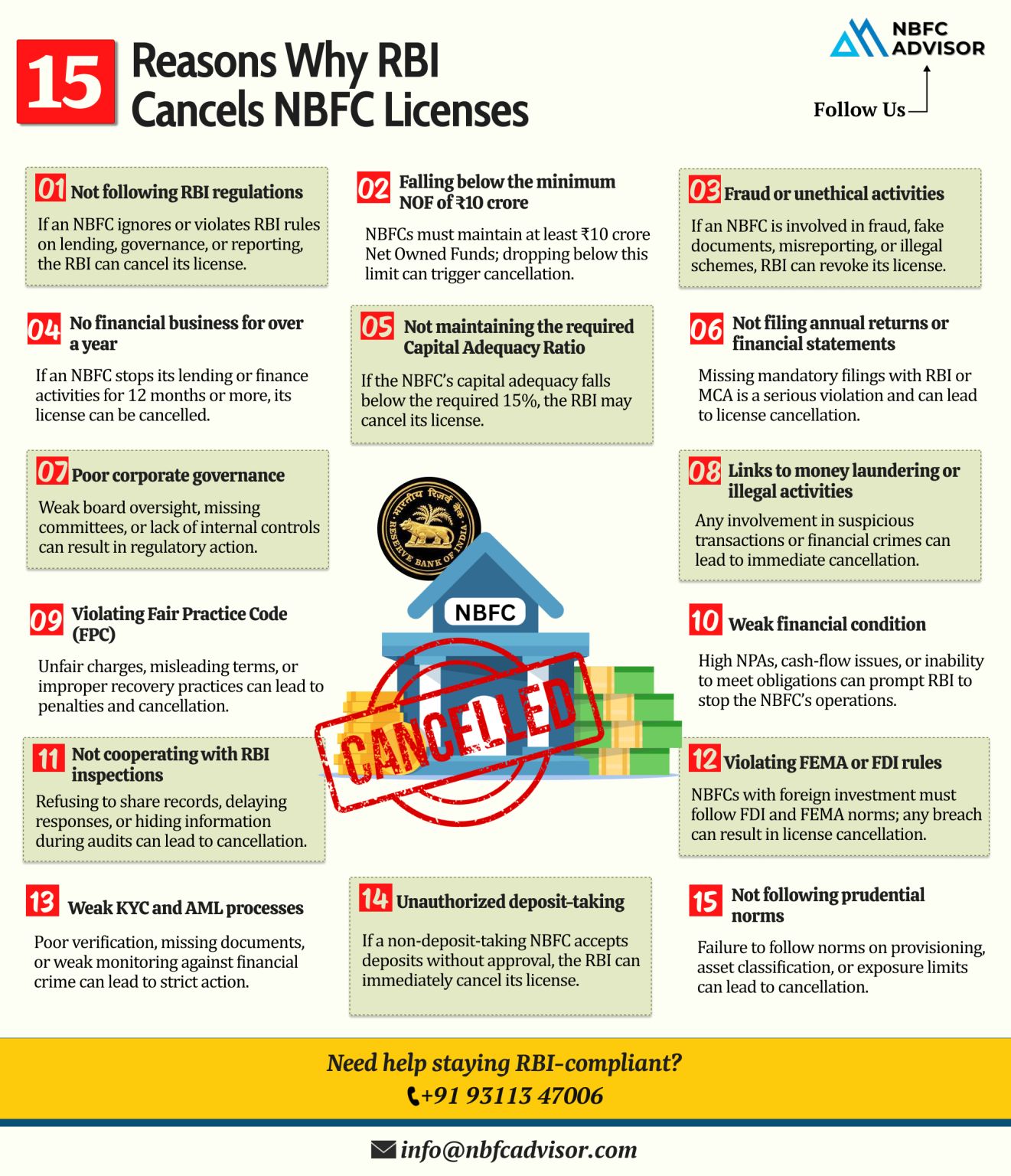

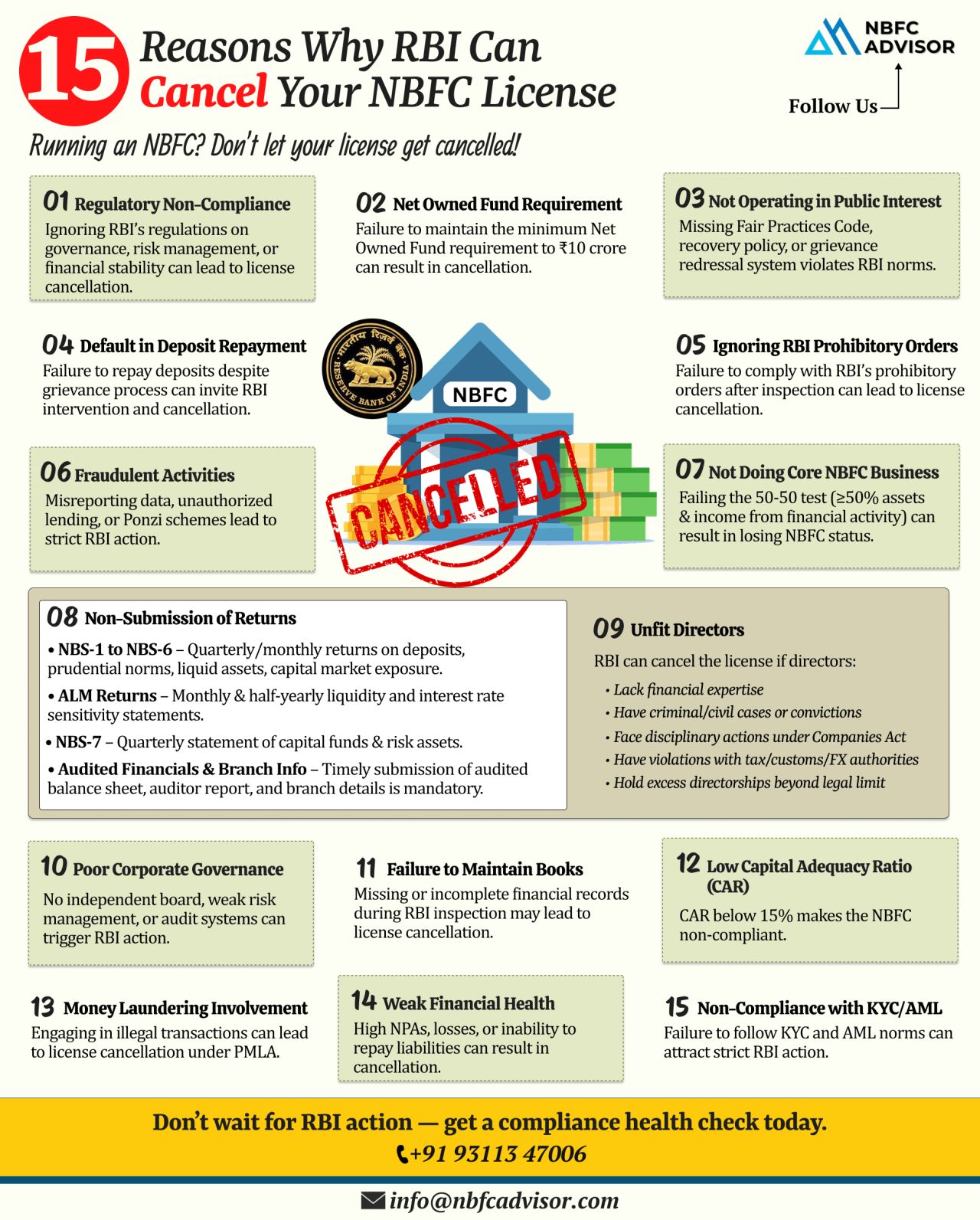

15 Warning Signs That Could Put Your NBFC License at Risk

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Interestingly, most of these cancellations are not due to fraud, but result ...

NBFC Takeovers: The Quickest Gateway to India’s Digital Lending Boom

India’s digital lending market is on a steep growth curve, projected to reach $515 billion by 2030. Innovative financial solutions such as peer-to-peer (P2P) lending,...

Is Your NBFC Ready for the Latest RBI Updates?

The Reserve Bank of India (RBI) is rolling out significant measures to tighten the compliance landscape for Non-Banking Financial Companies (NBFCs). These updates span digital lending, reporting requi...

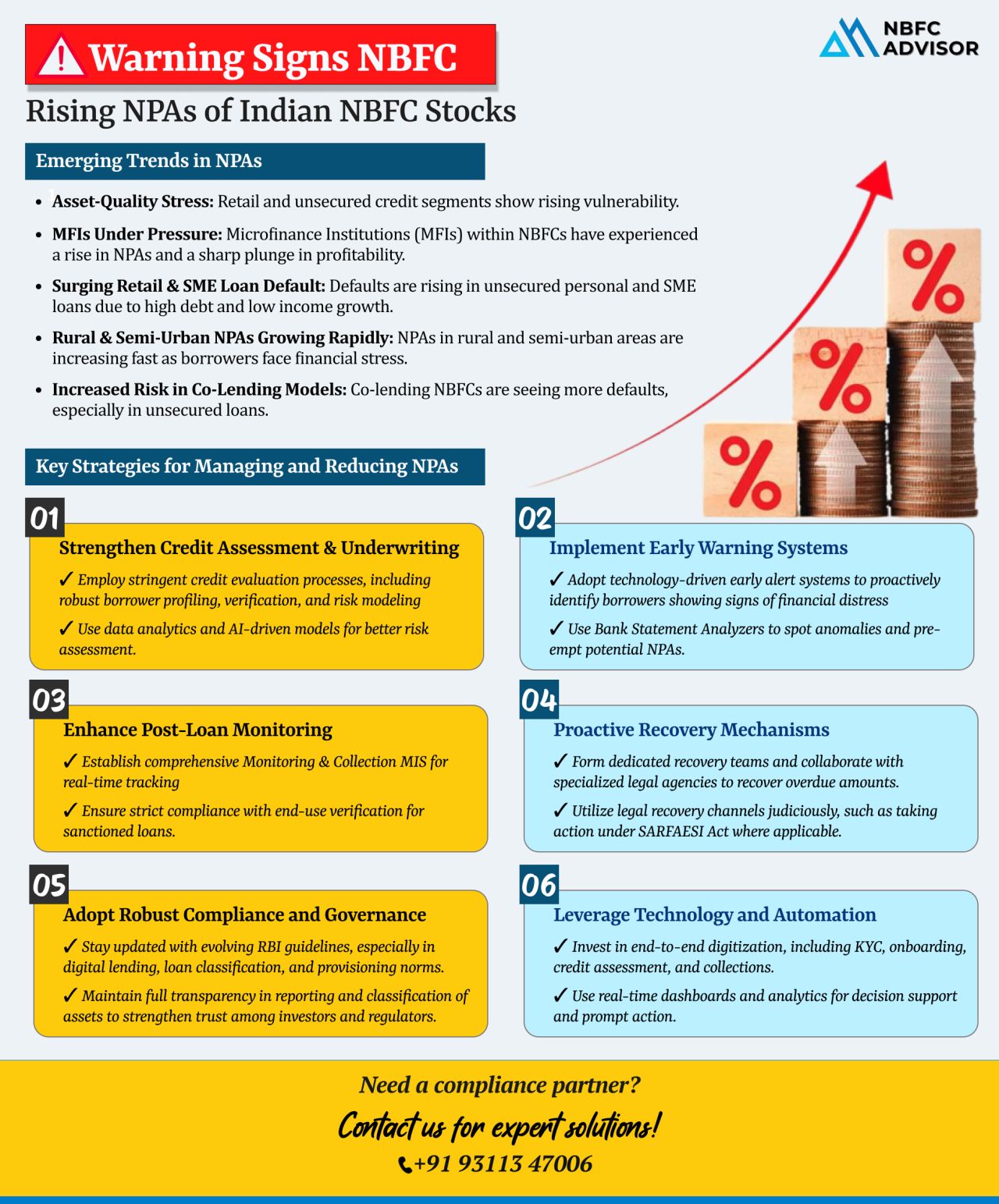

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

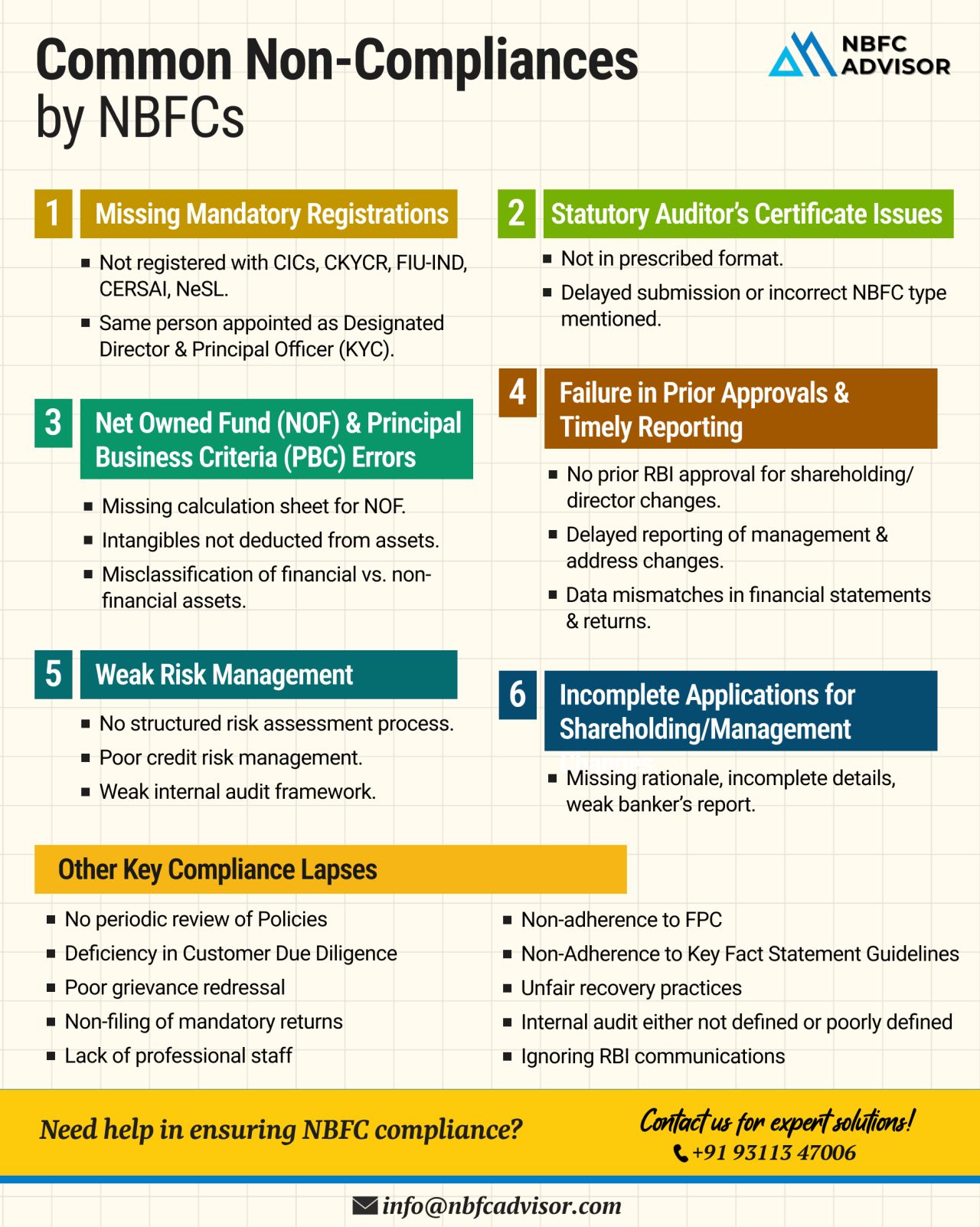

Are These Mistakes Putting Your NBFC at Risk?

India’s NBFC (Non-Banking Financial Company) sector continues to grow at a fast pace. But with greater opportunity comes increased regulatory oversight and risk. Many NBFCs run into serious issue...

Top 10 Mistakes to Steer Clear of During AIF Registration

Registering an Alternative Investment Fund (AIF) with SEBI is a critical step toward launching a compliant and successful investment vehicle in India. However, many fund managers and promot...

RBI's Training Push: A Wake-Up Call for NBFCs on Digital Compliance and Supervision

The Reserve Bank of India (RBI) is stepping into the future with purpose and precision. Through a newly launched officer training program in Hyderabad, the cen...

📉 Is Your NBFC at Risk of RBI Action?

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to lice...

RBI Is Cracking Down on NBFCs — Is Your Company Compliance-Ready?

The Reserve Bank of India (RBI) has intensified its scrutiny of Non-Banking Financial Companies (NBFCs)—and the message is loud and clear: compliance is no longer negoti...

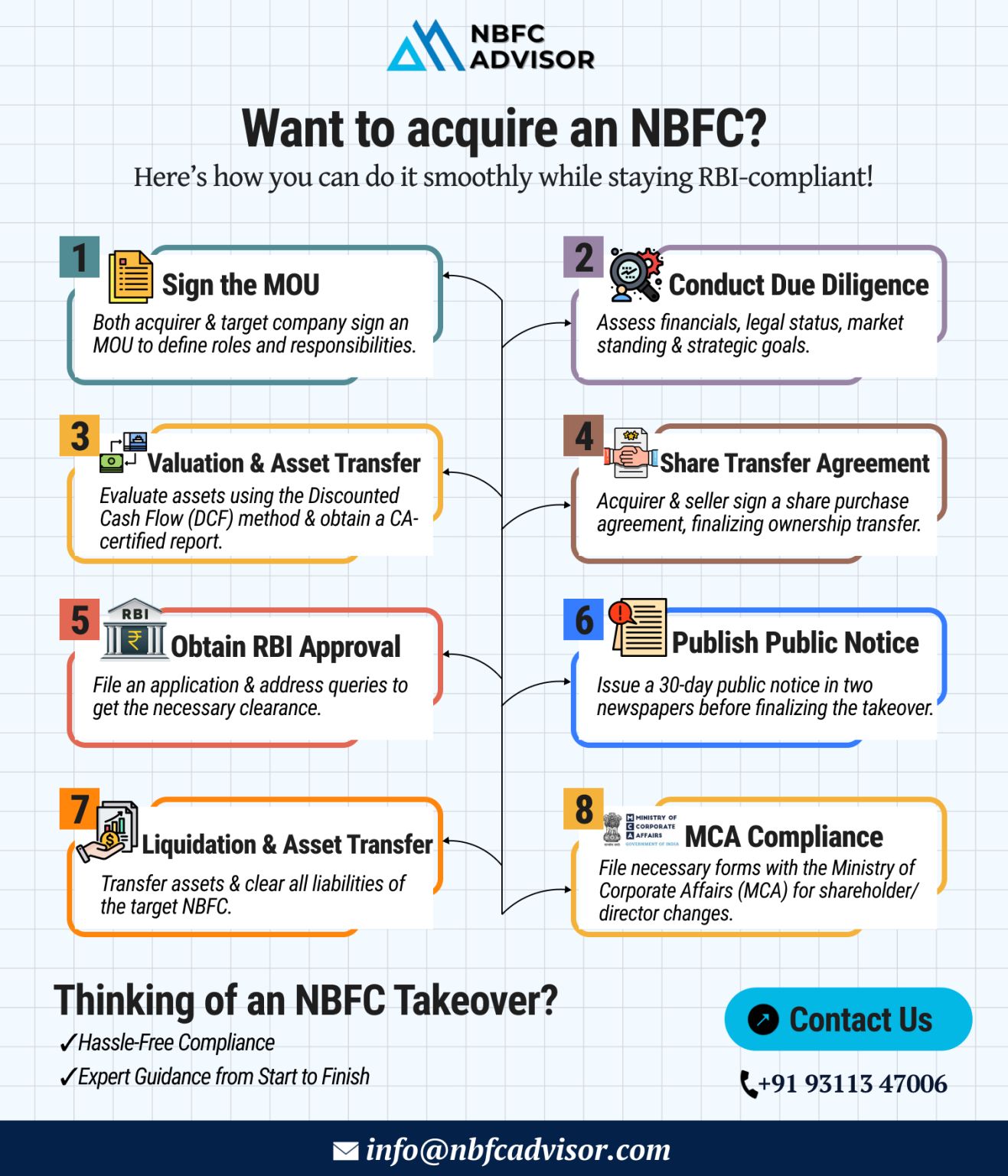

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐮𝐥𝐞𝐬 — 𝘈𝘳𝘦 𝘠𝘰𝘶𝘳 𝘖𝘱𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘴 𝘊𝘰𝘮𝘱𝘭𝘪𝘢𝘯𝘵?

India’s digital lending ecosystem is expanding at an unprecedented pace. But with rapid growth comes increasing...

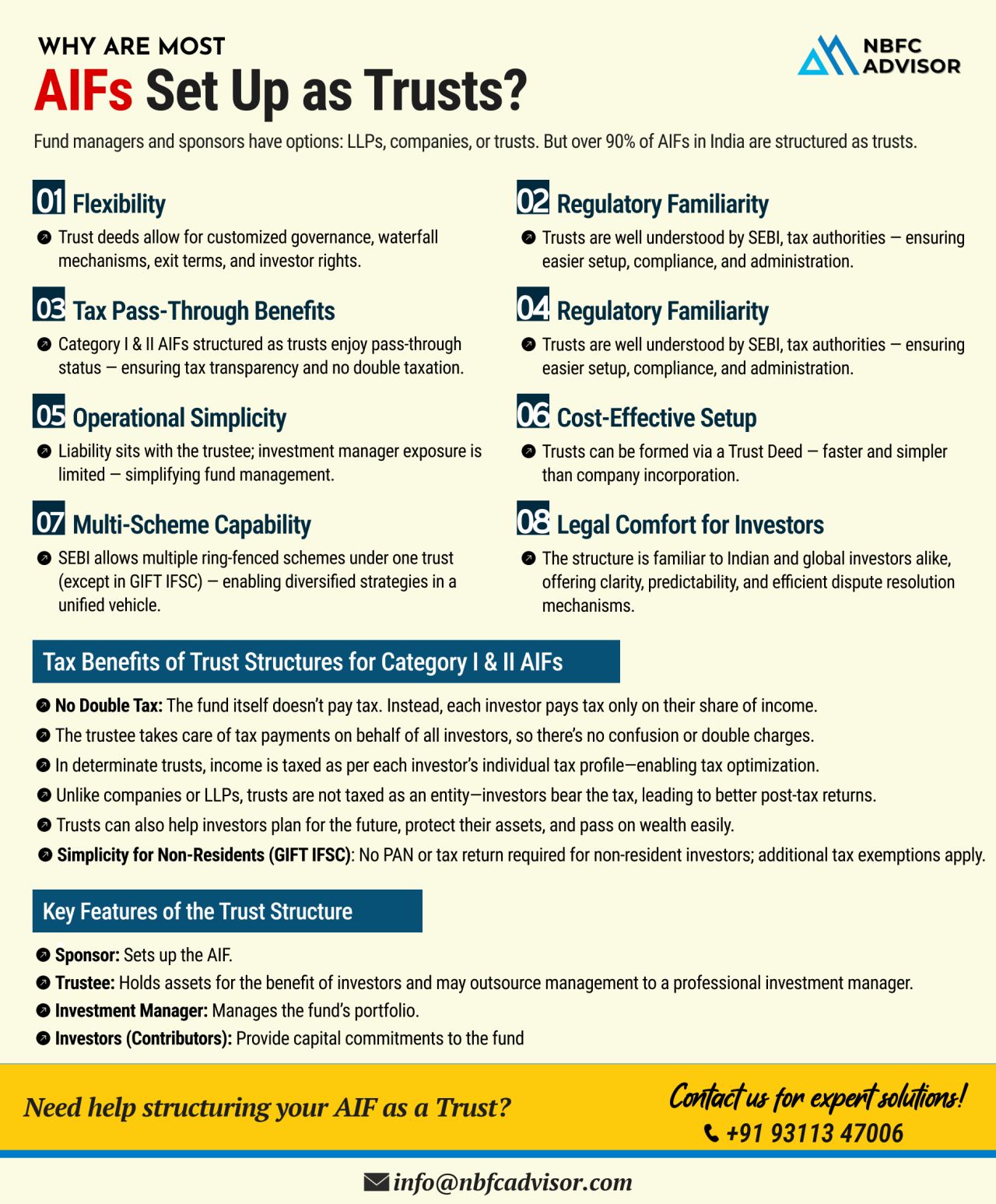

When setting up an Alternative Investment Fund (AIF), one of the most critical decisions is choosing the right legal structure. Should you go for an LLP, a Company, or a Trust?

Let’s break down why most AIFs prefer the Trust route.

Why Fu...

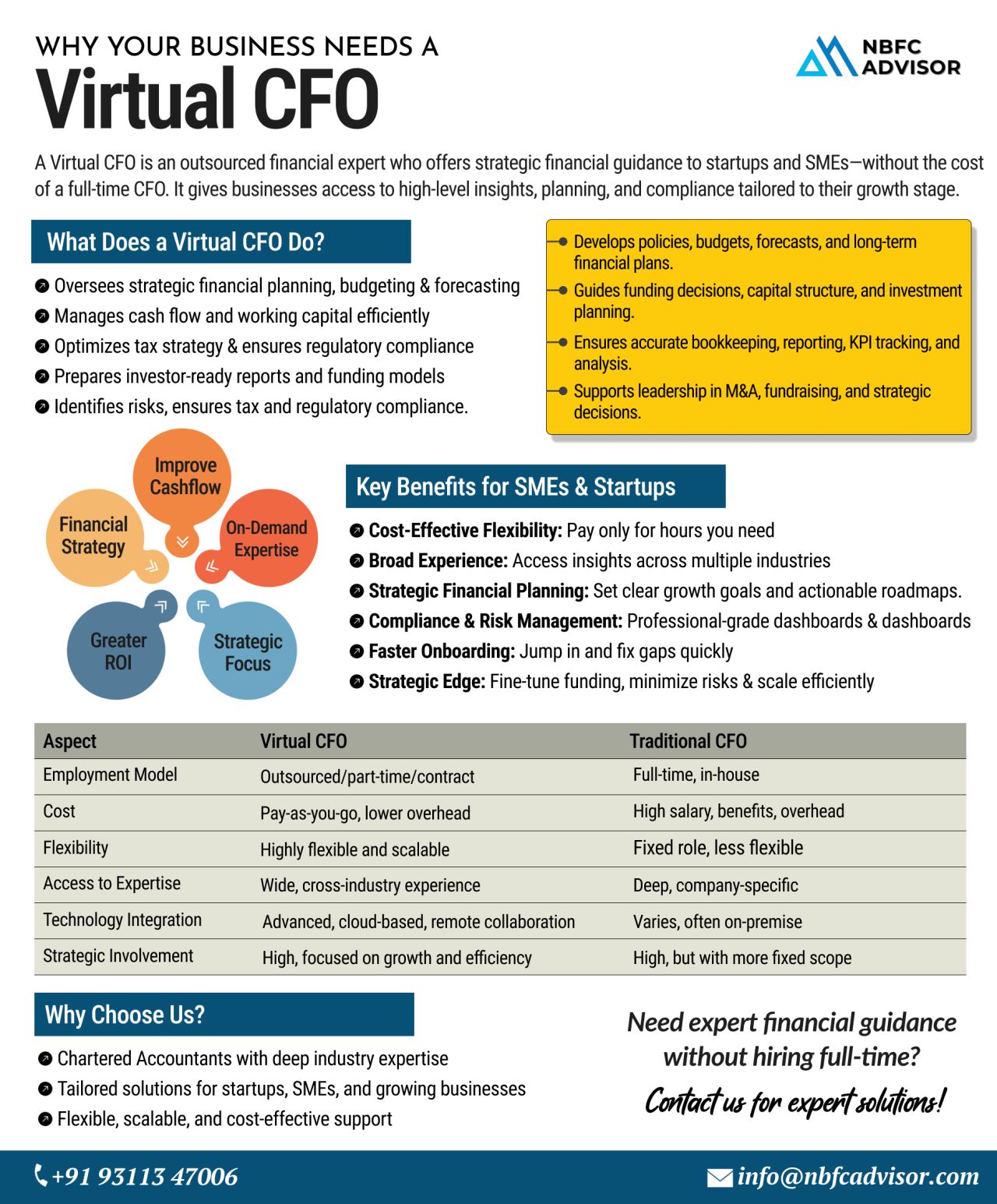

Struggling to Make Sense of Your Finances?

As businesses grow, it’s common to hit a point where spreadsheets, basic reports, and guesswork just aren’t enough. You need clarity, strategy, and confidence behind every financial decision &...

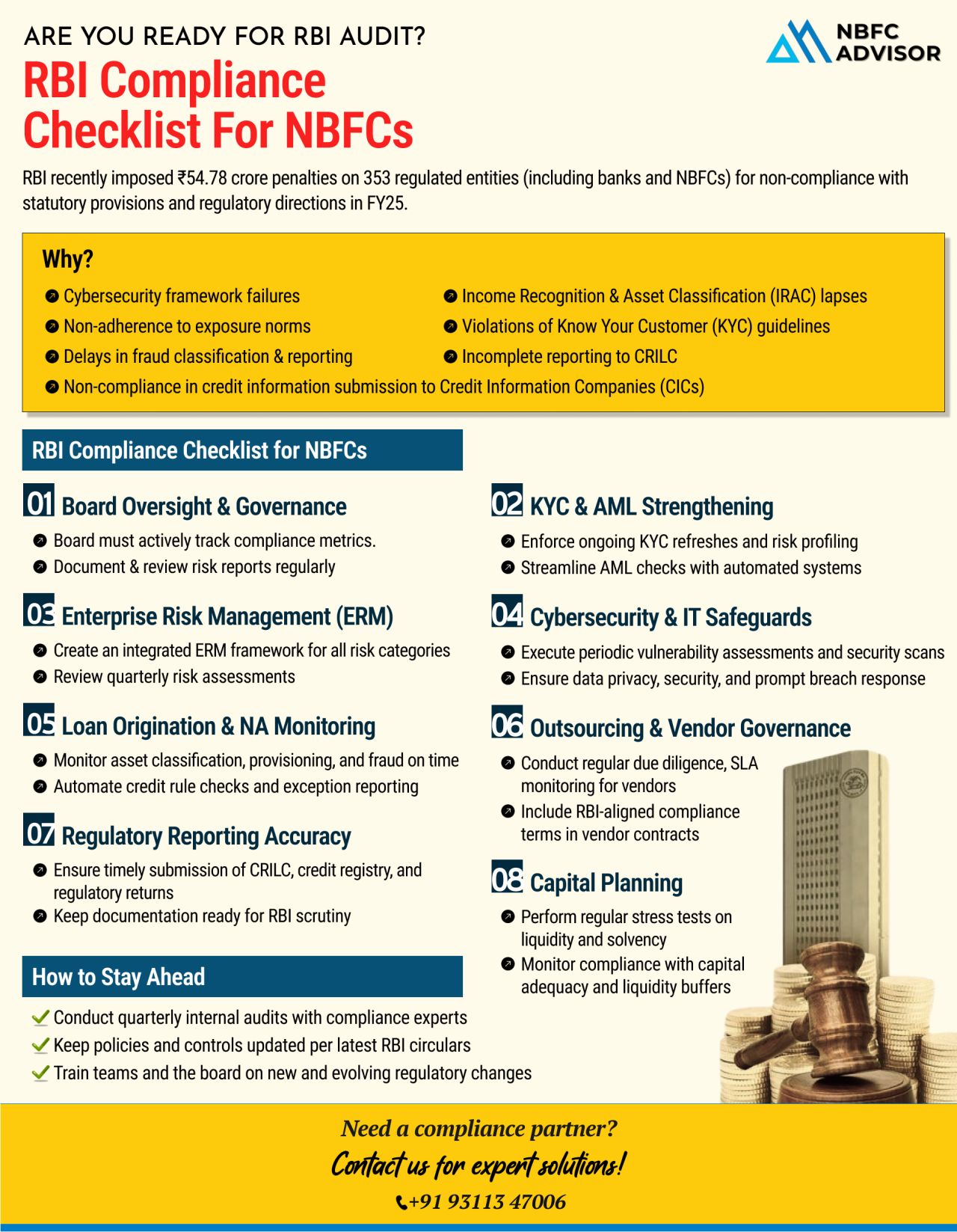

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

Flipkart Becomes the First Major Indian E-Commerce Platform to Secure an NBFC License

In a groundbreaking move, Flipkart has become the first large Indian e-commerce platform to receive a Non-Banking Financial Company (NBFC) license. This developm...

India’s MSME (Micro, Small, and Medium Enterprises) sector continues to expand rapidly, playing a vital role in the nation's economic growth. However, despite its potential, access to formal credit remains limited, particularly for loan amo...

The Reserve Bank of India (RBI) has released draft guidelines on gold loans, aimed at improving transparency and regulatory consistency in the sector. While these new norms bring much-needed clarity, they also introduce stricter compliance requiremen...

With over 190 million adults in India lacking a formal credit history, traditional credit scoring models fall short.

Alternative Credit Scoring taps into digital footprints—such as rent payments, utility bills, mobile transactions, and even ...

The Reserve Bank of India (RBI) has imposed fines on six NBFCs for violating key regulatory norms under the RBI Act, 1934. These penalties, totaling over ₹60 lakh, highlight RBI’s tightening grip on governance and compliance.

Who Got Fined...

NBFCs play a crucial role in India’s credit ecosystem, but non-compliance and operational missteps can lead to RBI penalties, financial losses, or even shutdowns!

Recently, RBI imposed penalties totaling ₹76.60 lakh on four NBFC-P2P lenders ...

Microfinance has long been a cornerstone of financial inclusion in India, supporting small businesses and underserved communities. However, the latest Micrometer Q3 FY 2024-25 report unveils alarming trends, raising concerns about the sector's st...

To combat rising cyber threats and protect consumers from online fraud, the Reserve Bank of India (RBI) has launched a dedicated domain—‘.bank.in’—exclusively for Indian banks. This initiative aims to establish a secure, relia...

India’s digital lending space has witnessed tremendous growth, making credit more accessible to individuals and MSMEs. However, with this growth has come a dark side—a rise in unregulated lenders engaging in:

❌ Predatory inte...

On October 4, 2024, the Reserve Bank of India (RBI) issued a Draft Circular titled "Forms of Business and Prudential Regulation for Investments" that seeks to amend the extant Master Direction—Reserve Bank of India (Financial Services...

In a significant move reinforcing its commitment to maintaining financial stability and consumer protection, the Reserve Bank of India (RBI) recently canceled the licenses of two non-banking financial companies (NBFCs) - Polytex India Ltd, based in M...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

Emerging technologies and strategic partnerships are crucial for Non-Banking Financial Companies (NBFCs) to thrive in an increasingly regulated and competitive financial landscape. By integrating advanced technologies and collaborating with FinTech c...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

In the rapidly evolving financial services sector, Non-Banking Financial Companies (NBFCs) are experiencing a transformative shift, thanks to the advent of digital and AI-enabled tools. Systems such as Loan Origination Systems (LOS) and Loan Manageme...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

The Reserve Bank of India recently announced major changes in the Non-Banking Financial Company (NBFC) sector. The RBI revealed that 15 NBFCs, including notable entities such as Tata Capital Financial Services and Revolving Investments, have voluntar...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

The Reserve Bank of India (RBI) has introduced draft guidelines that aim to bring transparency and fairness to the digital lending space. These guidelines are specifically targeted at regulating Lending Service Providers (LSPs), previously known as l...

In today's rapidly changing financial landscape, traditional credit scoring methods often fail to meet the needs of millions of people worldwide who are underserved by formal banking systems. Emerging economies, such as the Philippines, struggle ...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...

In the intricate ecosystem of finance, small Non-Banking Financial Companies (NBFCs) often find themselves navigating a landscape fraught with operational challenges. These hurdles, stemming from limited resources and scale, can impede growth and sus...

In the intricate world of finance, regulatory compliance stands as the bedrock of stability and credibility. This blog explores the profound impact of NBFC Advisor, showcasing how its expert guidance has been instrumental in steering Non-Banking Fina...

In the intricate world of finance, Non-Banking Financial Companies (NBFCs) operate within a nuanced regulatory landscape. This blog offers an insightful exploration into the complexities, nuances and critical role of compliance in shaping the traject...

Introduction: In the ever-evolving landscape of finance, Non-Banking Financial Companies (NBFCs) are emerging not just as financial entities but as true catalysts for transformative change. This blog delves into the profound impact of NBFCs, explorin...

In the dynamic landscape of Non-Banking Financial Companies (NBFCs), the right guidance can make all the difference. This blog unveils the comprehensive support and expertise offered by NBFC Advisor, empowering financial entities to not only thrive b...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)