NBFC Takeover Approval Service: RBI-Compliant Support for Smooth Ownership Transfers

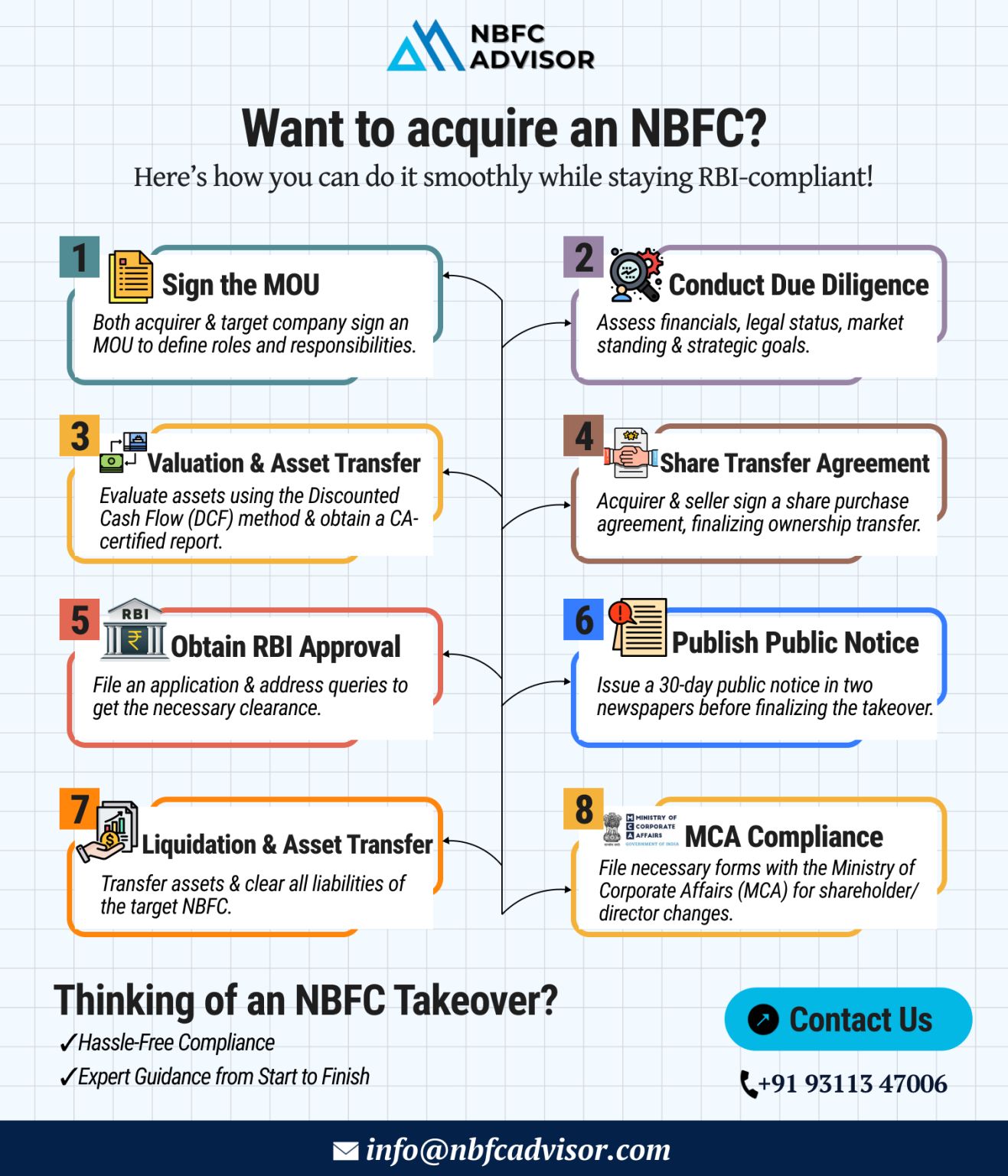

Acquiring or transferring control of an NBFC is a strategic move that can unlock rapid market entry, portfolio expansion, and operational scale. However, NBFC tak...

Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

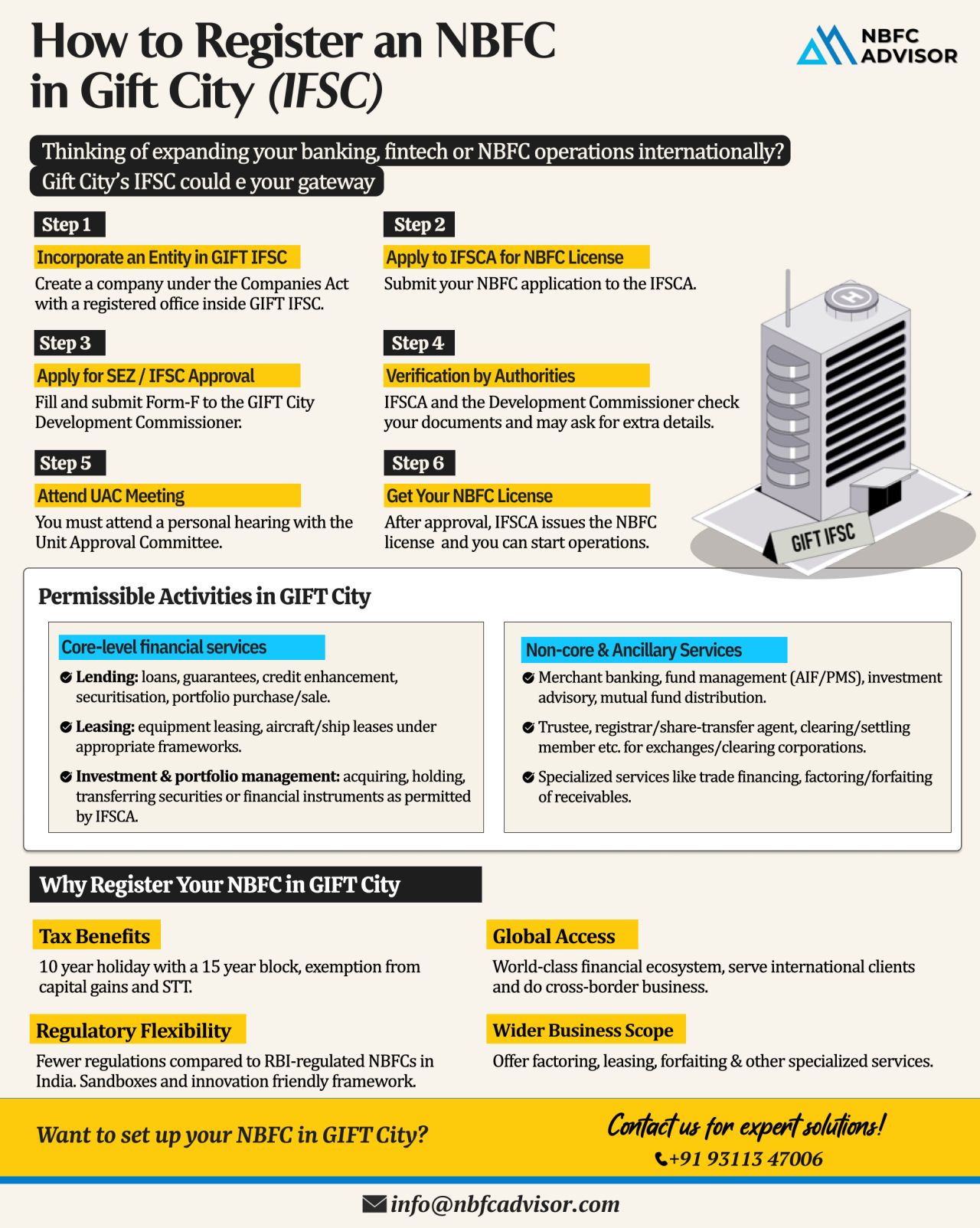

Why GIFT City? India’s Fastest-Growing Financial Gateway for NBFCs

India’s financial landscape is changing rapidly—and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Increasingly, NBFC...

Thinking of Entering India’s Fast-Growing NBFC Space? Choose an NBFC Takeover for Faster Market Entry

India’s Non-Banking Financial Company (NBFC) sector has emerged as one of the most dynamic segments of the financial market — o...

Getting an IRDAI Corporate Agency License? Don’t Make These Costly Mistakes

If your company, LLP, or bank is planning to sell or distribute insurance policies—whether it’s life, health, or motor insurance—you’ll...

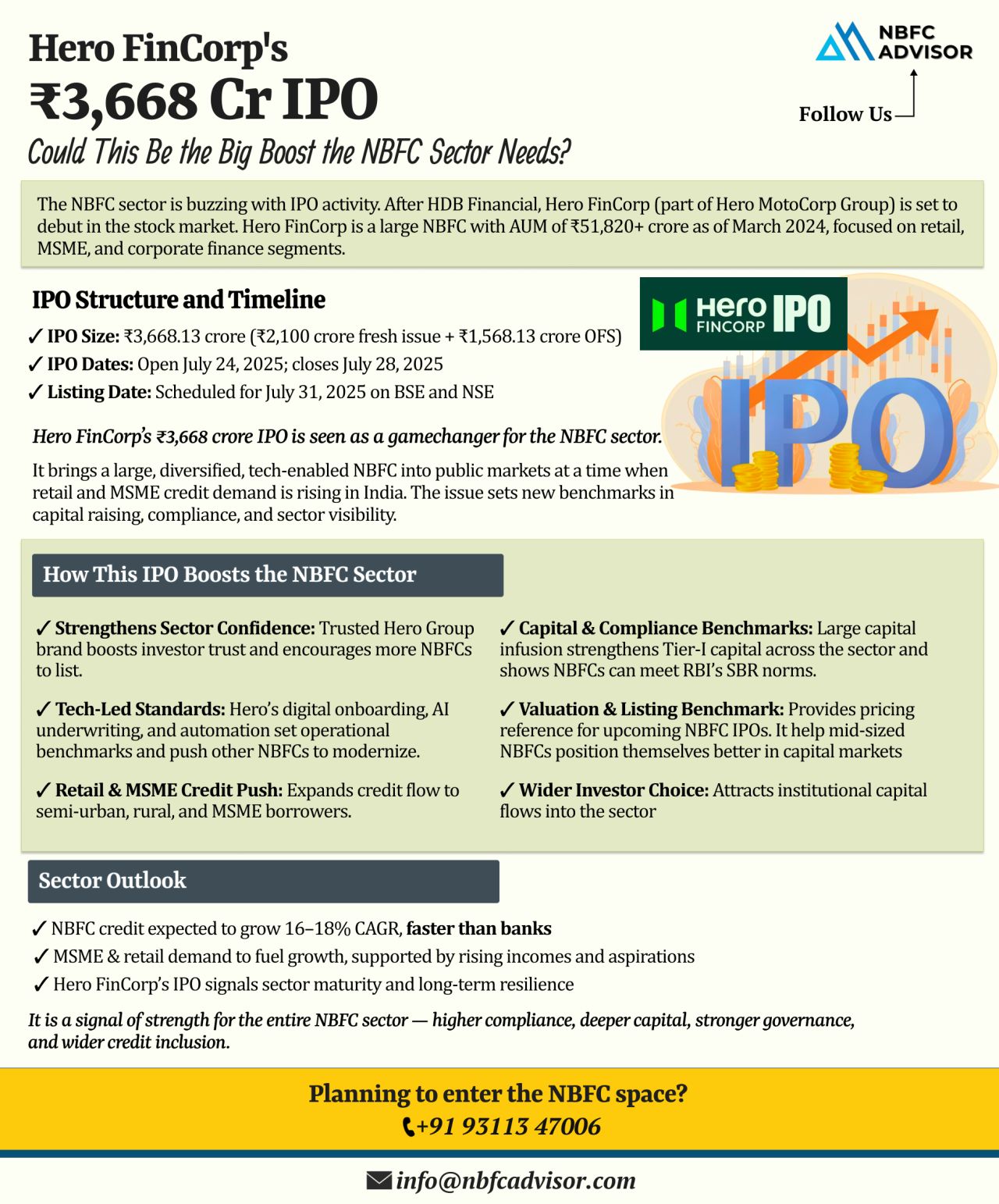

Hero FinCorp’s ₹3,668 Cr IPO: What It Means for the NBFC Sector

The Non-Banking Financial Company (NBFC) sector in India is witnessing a surge in Initial Public Offerings (IPOs), signaling a phase of growth and investor confidence. Following...

NBFC Takeovers: The Quickest Gateway to India’s Digital Lending Boom

India’s digital lending market is on a steep growth curve, projected to reach $515 billion by 2030. Innovative financial solutions such as peer-to-peer (P2P) lending,...

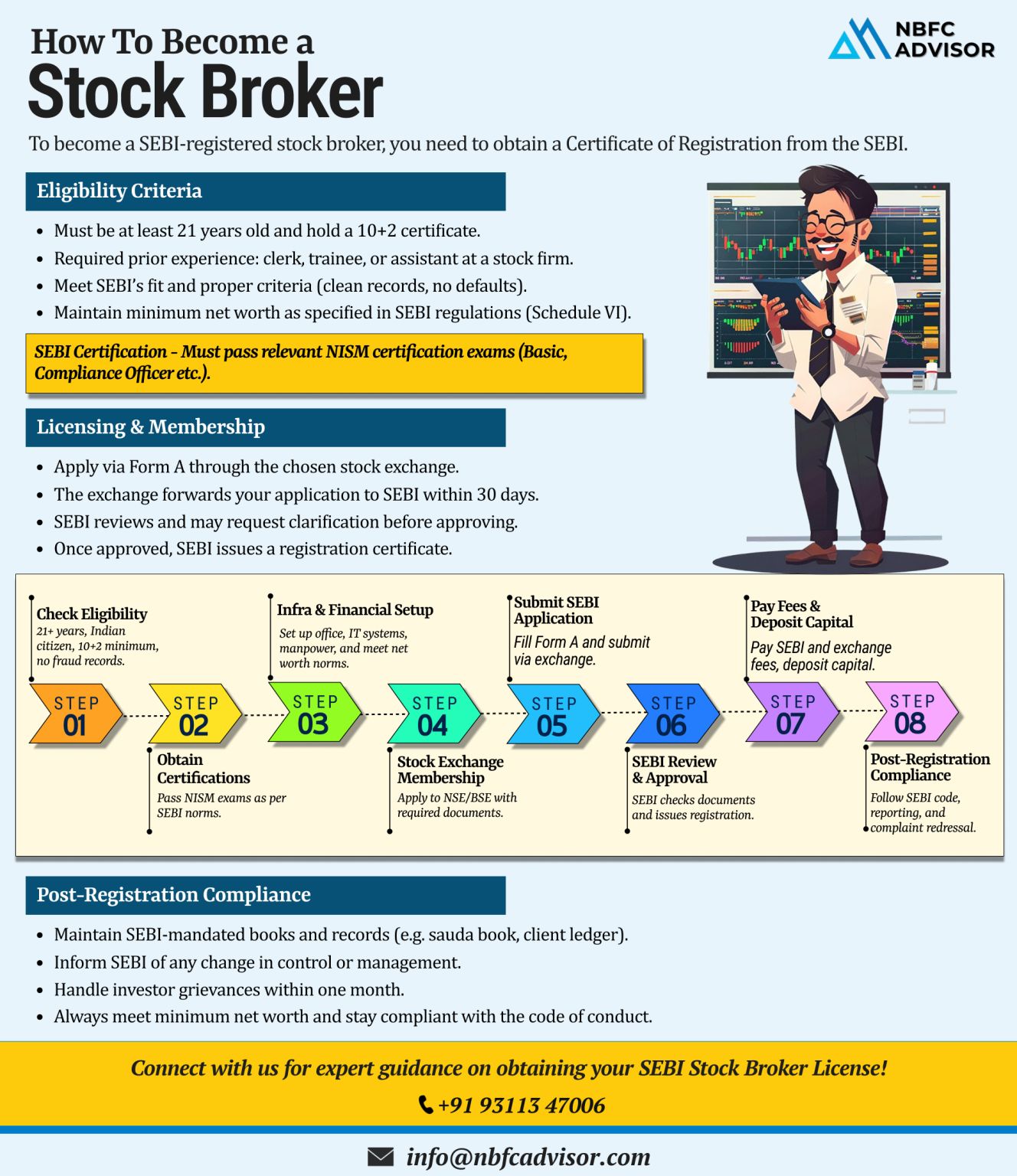

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

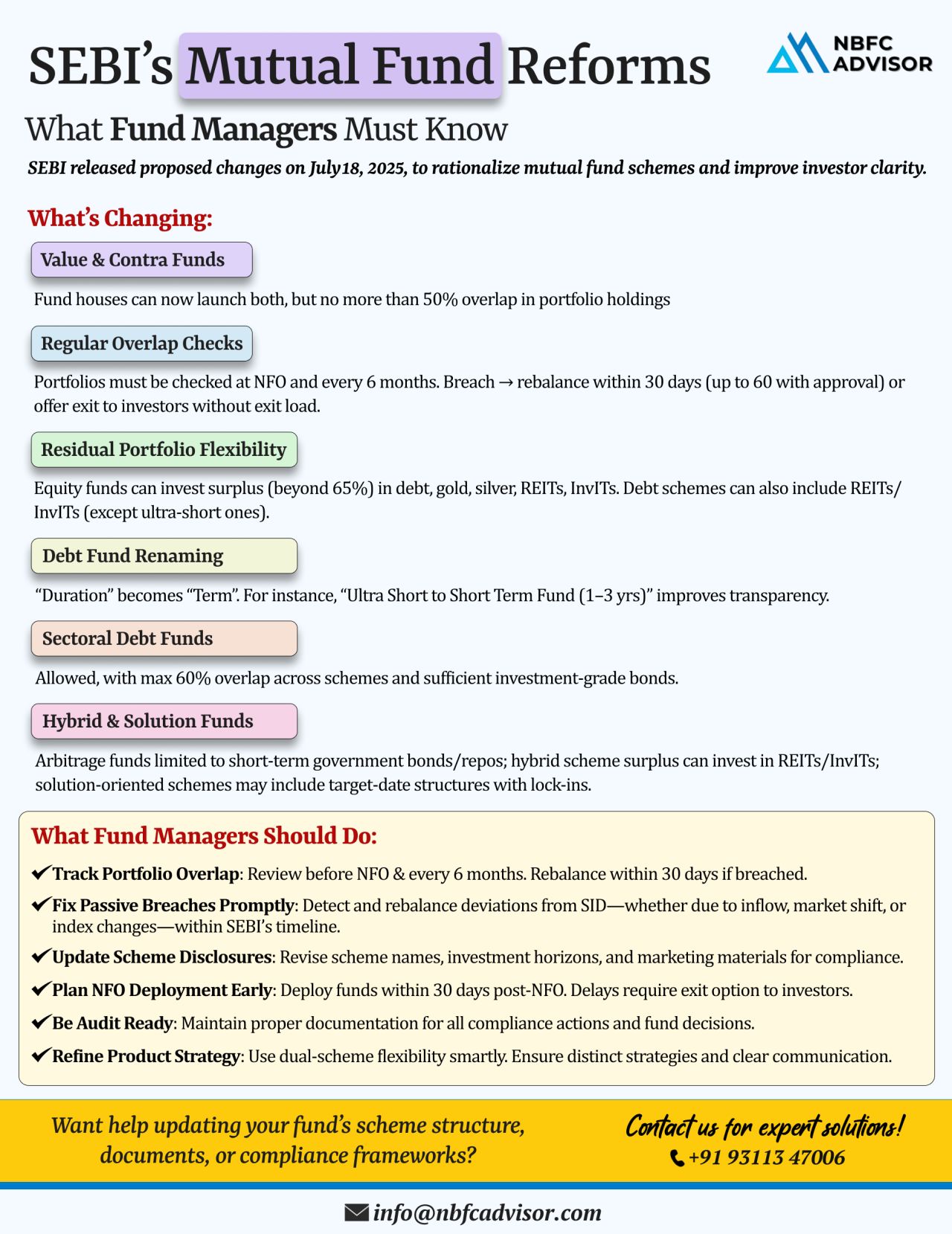

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

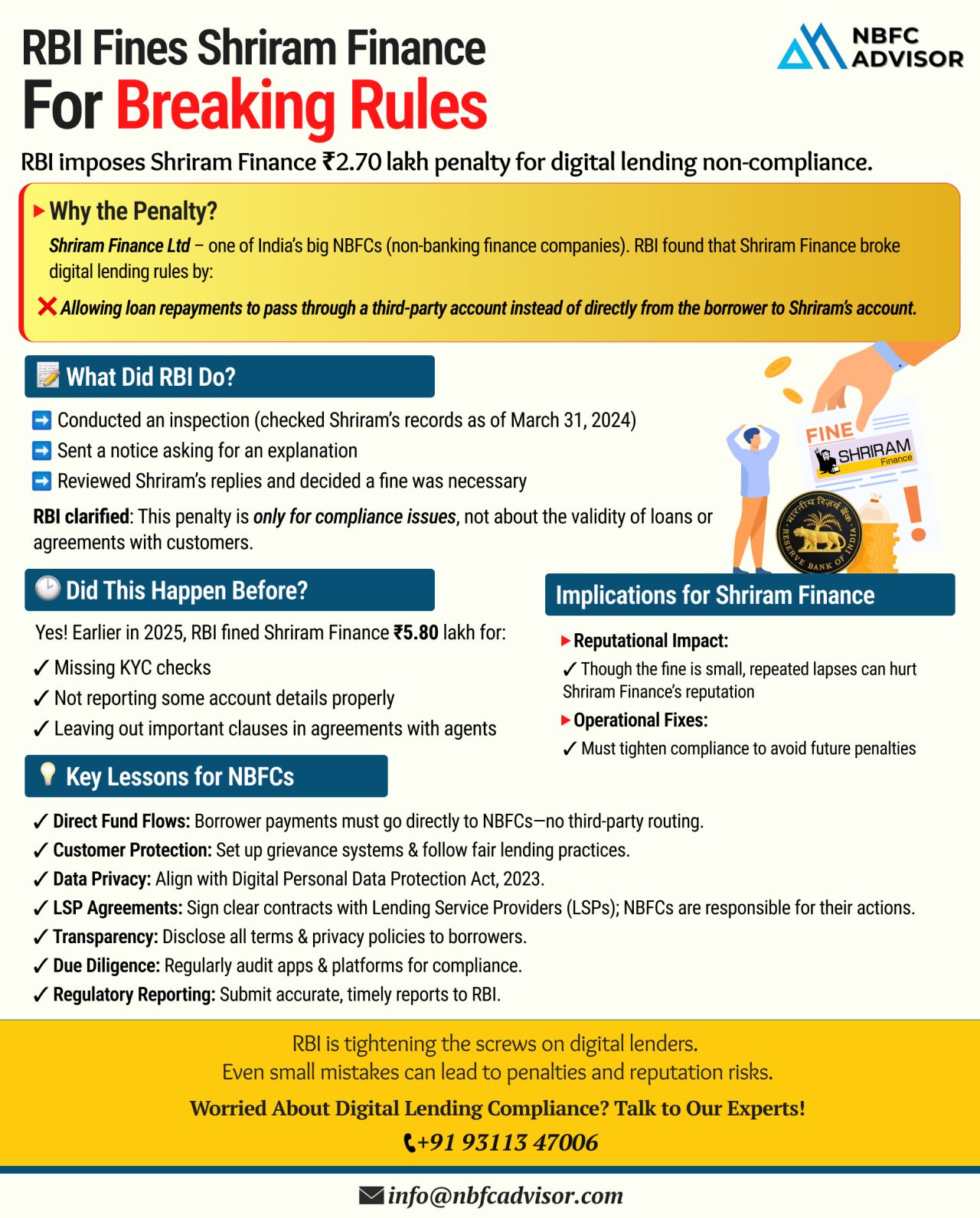

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. Thi...

Considering Buying an NBFC? Here's Your Step-by-Step Guide to a Successful Acquisition

Purchasing a Non-Banking Financial Company (NBFC) can open new doors for your business — offering access to lending operations, financial licenses, an...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

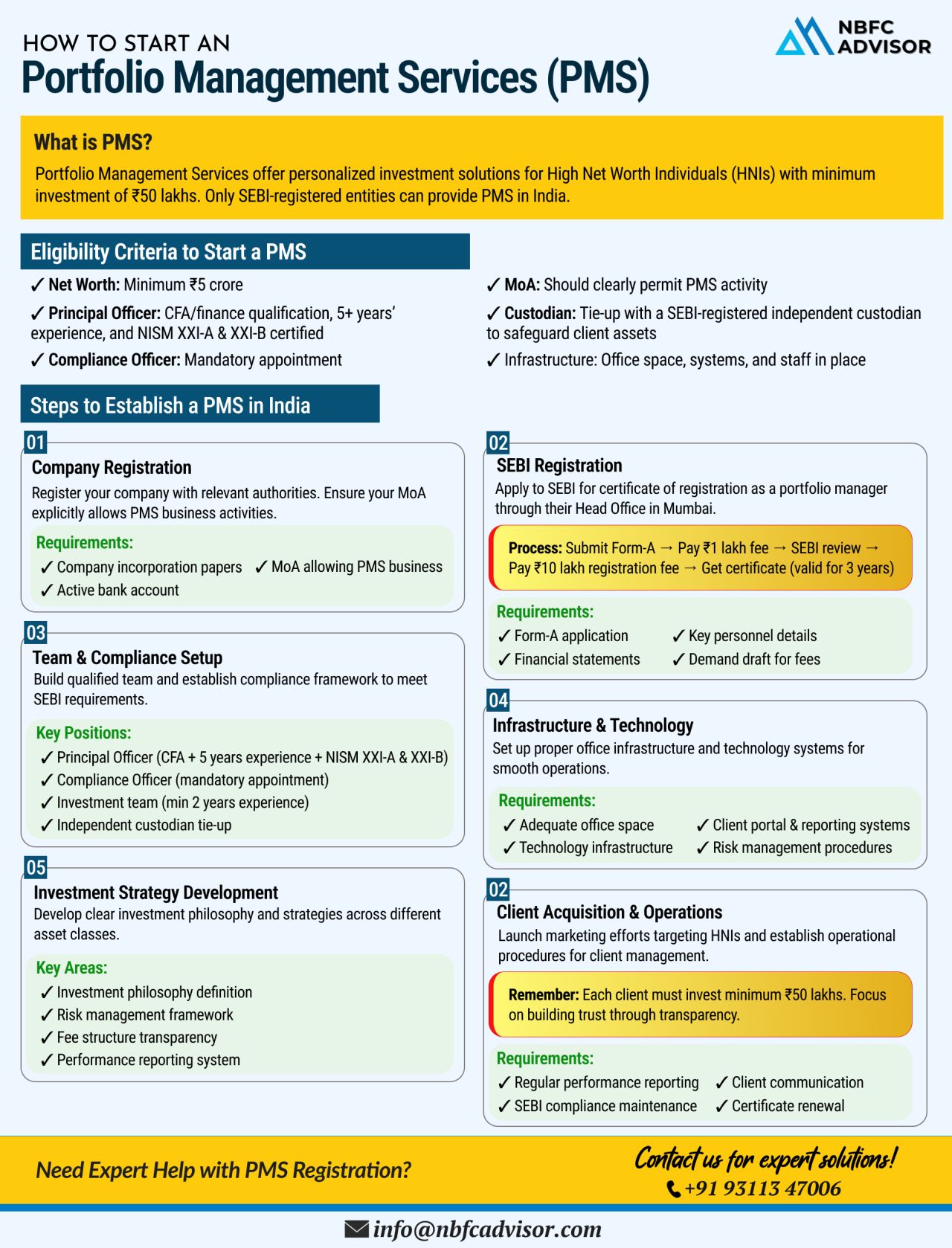

📈 India’s PMS Industry Is Booming – Here’s Why You Should Pay Attention

India’s Portfolio Management Services (PMS) industry is witnessing unprecedented growth — and it’s only just getting started. With total a...

Dreaming of Launching Your NBFC?

Avoid These Top 5 Pitfalls to Secure Your RBI License!

Setting up a Non-Banking Financial Company (NBFC) in India can be a game-changer—but getting the RBI license is where many dreams hit a wall. Each yea...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

The Reserve Bank of India (RBI) has issued a directive that could significantly reshape how Non-Banking Financial Companies (NBFCs) and fintechs collaborate in the digital lending space.

Key Update

NBFCs can no longer rely on Default Loss Guara...

Are you planning to start your own Portfolio Management Service (PMS)? There’s never been a better time—especially if you leverage the exceptional advantages offered by GIFT City, India’s only International Financial Services Centre...

India’s Non-Banking Financial Companies (NBFCs) are growing at a pace that’s outstripping the country’s GDP, signaling a major shift in the financial services landscape. This acceleration is powered by rapid credit expansion, digita...

India's digital transaction volume has skyrocketed from 2,071 crore in FY 2017–18 to a staggering 18,737 crore in FY 2023–24, reflecting a CAGR of 44%.

This rapid growth presents a massive opportunity for businesses looking to ente...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

The demand for digital credit in India is at an all-time high.

From MSMEs to individuals, the appetite for alternative financing is growing rapidly — and Non-Banking Financial Companies (NBFCs) are at the forefront of this revolution.

Wit...

If you're building in Fintech, Lending, or BFSI, obtaining an Account Aggregator (AA) License is your gateway to innovation and compliance.

An Account Aggregator is a platform regulated by the Reserve Bank of India (RBI) that enables users to ...

In today’s competitive market, delayed payments can create major cash flow challenges—especially for Micro, Small, and Medium Enterprises (MSMEs). That’s where factoring steps in as a powerful financial solution.

What is Factor...

This exponential growth is being fueled by:

→ Rapid internet penetration

→ A thriving fintech ecosystem

→ Increasing demand for credit

The opportunity is massive — but navigating the regulatory landscape demands strategic p...

Aditya Birla Capital has officially merged with its subsidiary, Aditya Birla Finance.

This isn’t just a merger—it’s a strategic move to simplify structure, enhance financial strength, and boost operational efficiency.

Why This...

Digital lending is set to hit ₹5 TRILLION by FY28! 📈

With a 40% CAGR growth, the industry is expected to double its market share in India’s retail loan space in just four years.

And the best part? It’s just getting started!

What...

India’s digital lending space has witnessed tremendous growth, making credit more accessible to individuals and MSMEs. However, with this growth has come a dark side—a rise in unregulated lenders engaging in:

❌ Predatory inte...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

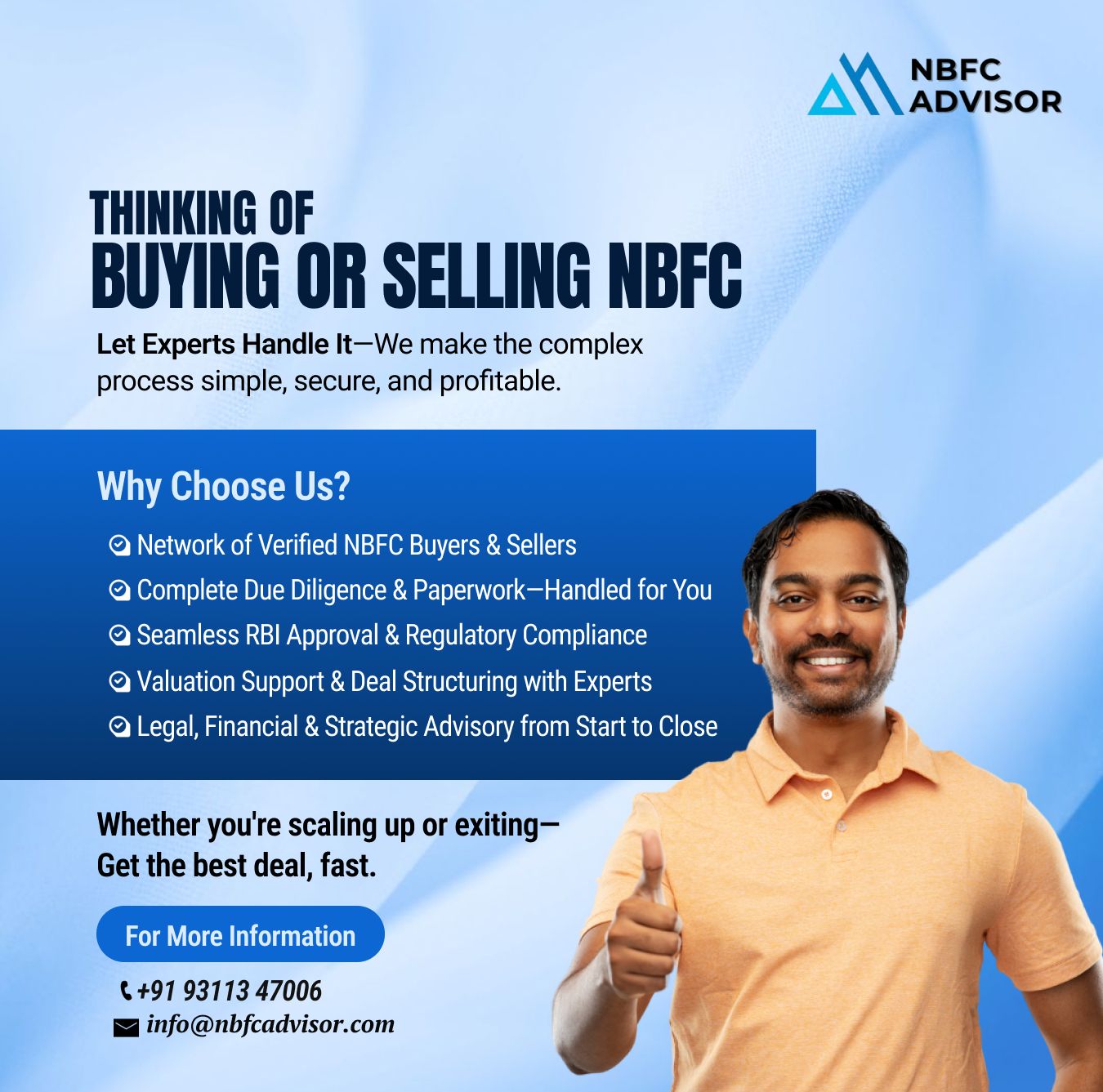

The fintech industry is witnessing rapid growth and innovation, with companies continuously seeking new avenues to expand their reach and improve their service offerings. One significant trend that has emerged is the acquisition of Non-Banking Financ...

Introduction

The financial technology (fintech) sector has been experiencing unprecedented growth, with companies continually seeking innovative ways to expand their reach and enhance their offerings. One significant trend is the acquisition of no...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

The Reserve Bank of India recently announced major changes in the Non-Banking Financial Company (NBFC) sector. The RBI revealed that 15 NBFCs, including notable entities such as Tata Capital Financial Services and Revolving Investments, have voluntar...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

The Reserve Bank of India (RBI) has introduced draft guidelines that aim to bring transparency and fairness to the digital lending space. These guidelines are specifically targeted at regulating Lending Service Providers (LSPs), previously known as l...

India is on the verge of a financial revolution, thanks to its growing economy and diverse demographics. However, there still exists a significant credit gap, especially among businesses and individuals. This gap is obstructing the country's econ...

Partnerships are often a catalyst for innovation and growth in the financial industry. One such collaborative model that has been gaining popularity in recent years is the Non-Banking Financial Company (NBFC) Co-Lending model. This innovative approac...

Rules.png)

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)