NBFC Automation & Software Advisory: Transform Your NBFC with Smart Digital Solutions

In today’s fast-evolving financial ecosystem, Non-Banking Financial Companies (NBFCs) must embrace digital transformation to stay competitive, complian...

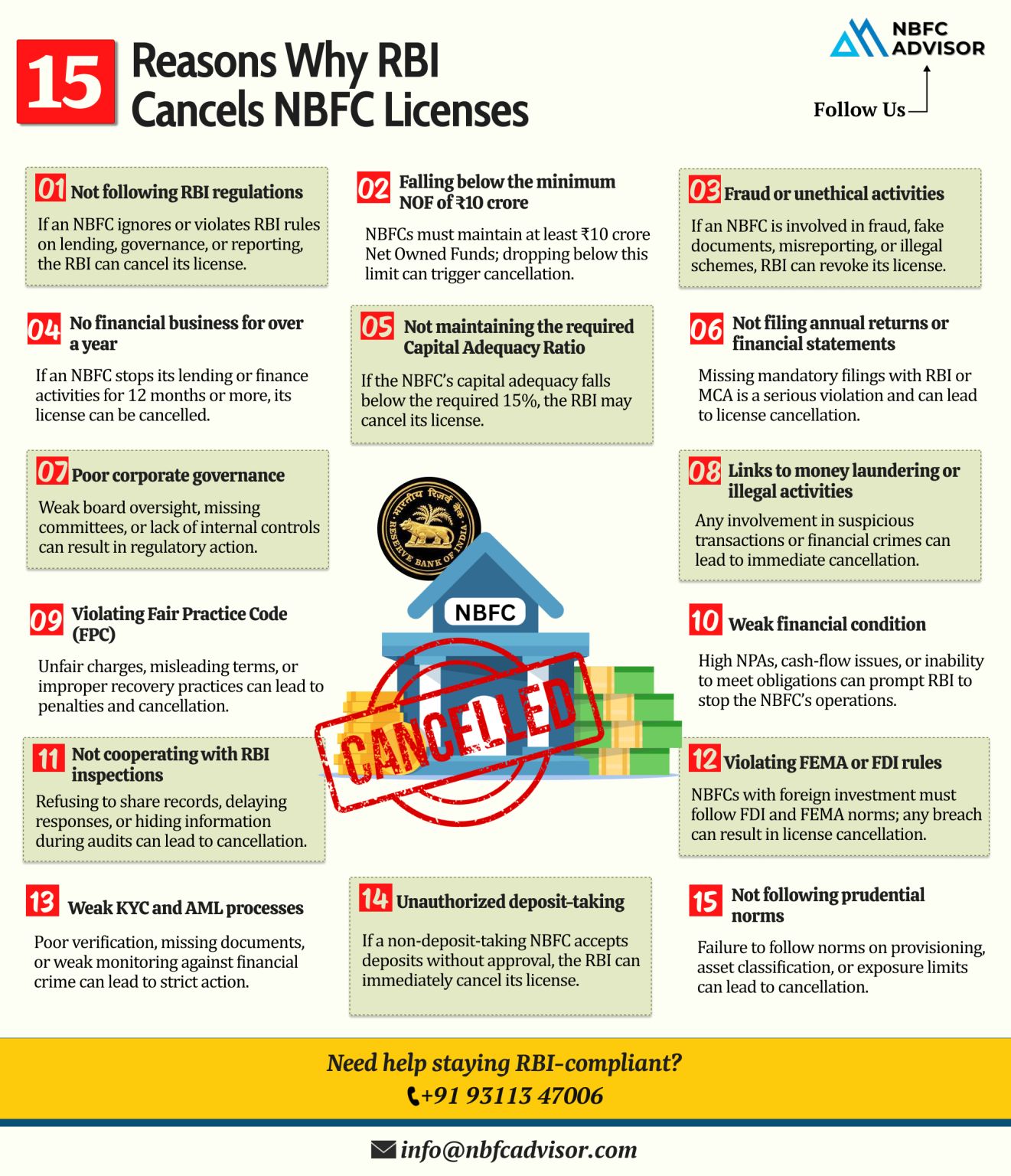

NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Running a Non-Banking Financial Company (NBFC) in India is not just about lending, growth, and profitability. In today’s tightly regulated environment, compliance failures...

Most NBFCs Are Not Ready for the ₹10 Crore NOF Deadline

The clock is ticking for Non-Banking Financial Companies (NBFCs) in India.

By 31 March 2027, the Reserve Bank of India (RBI) mandates that every NBFC must maintain a minimum Net Owned Fund...

One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

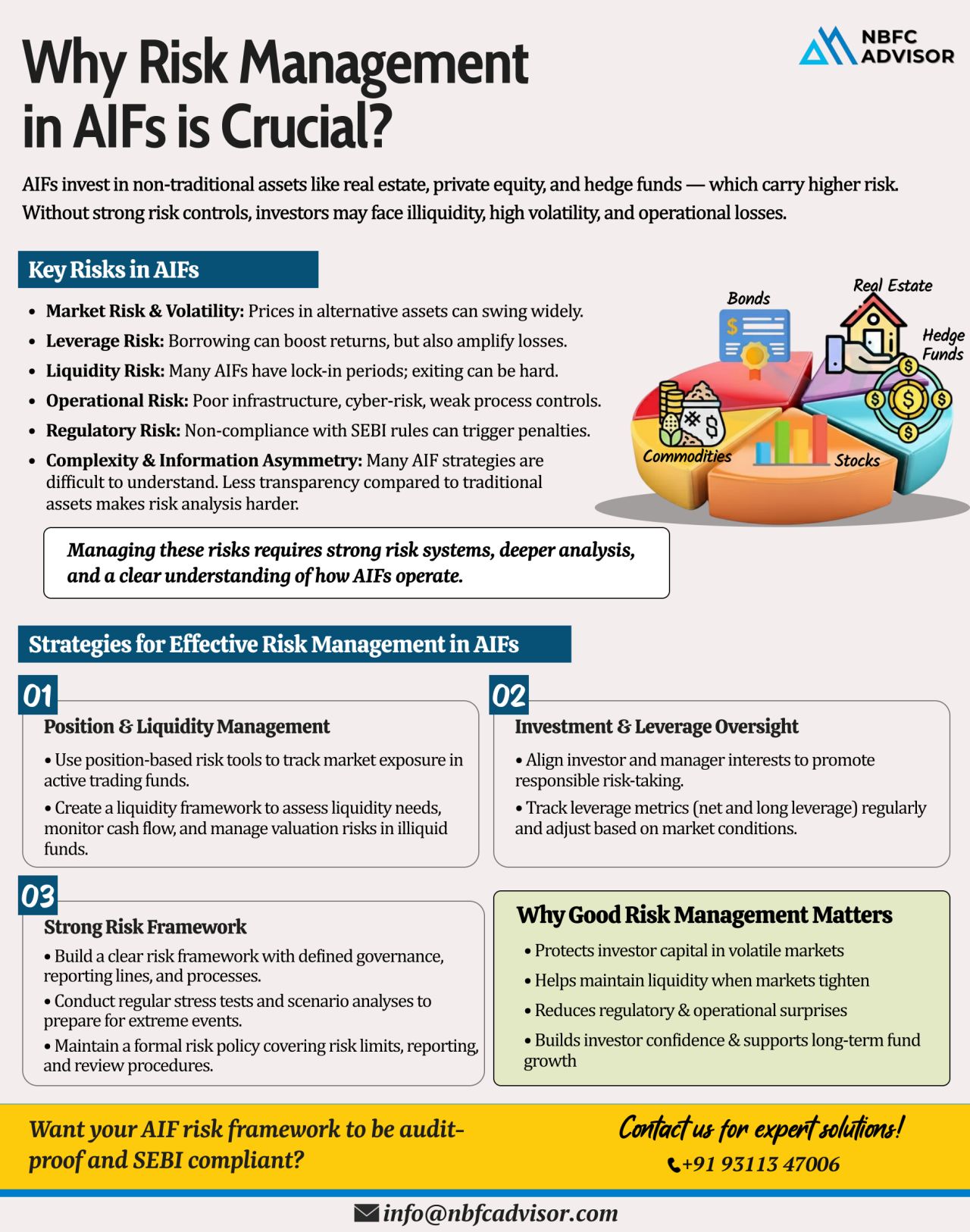

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

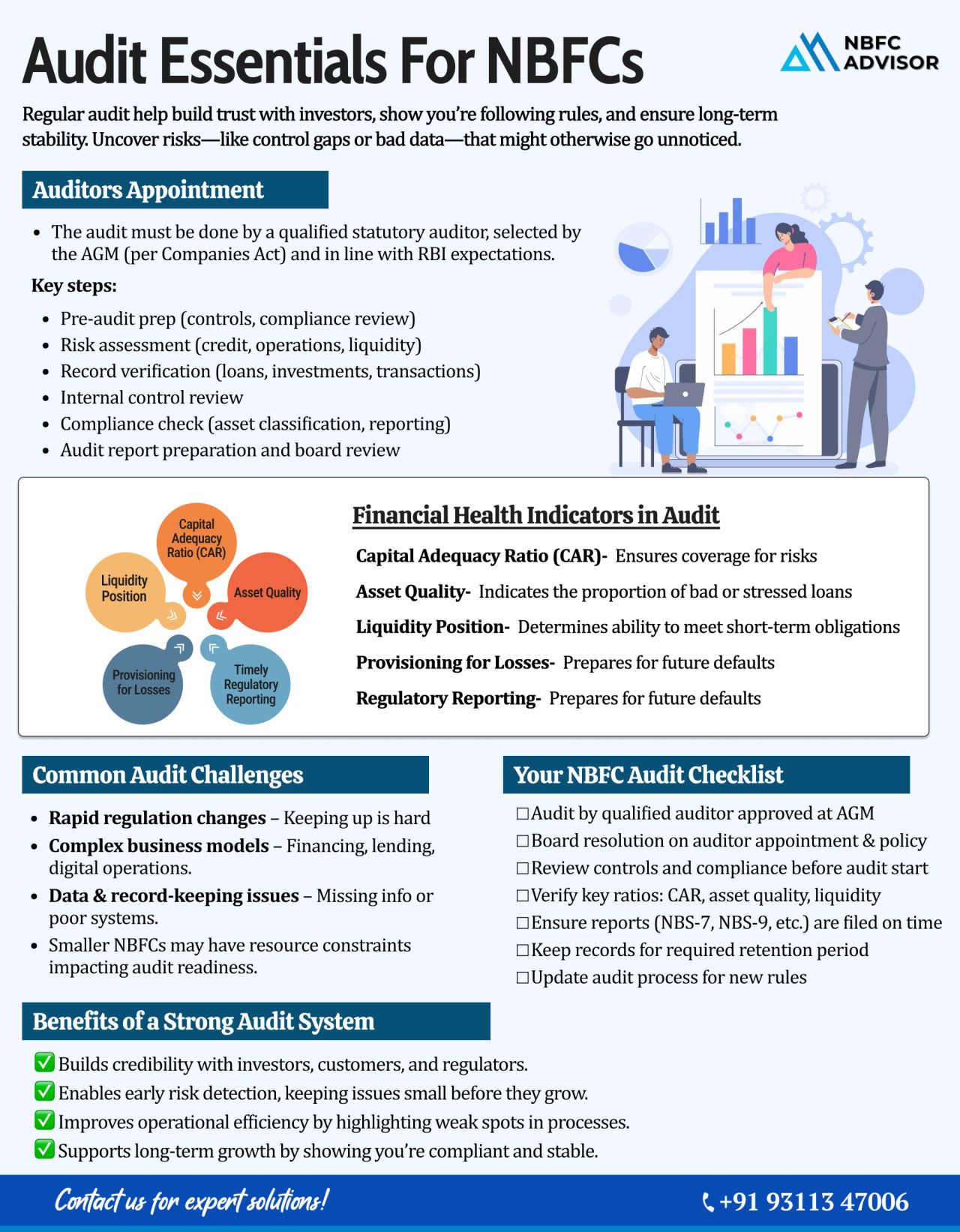

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

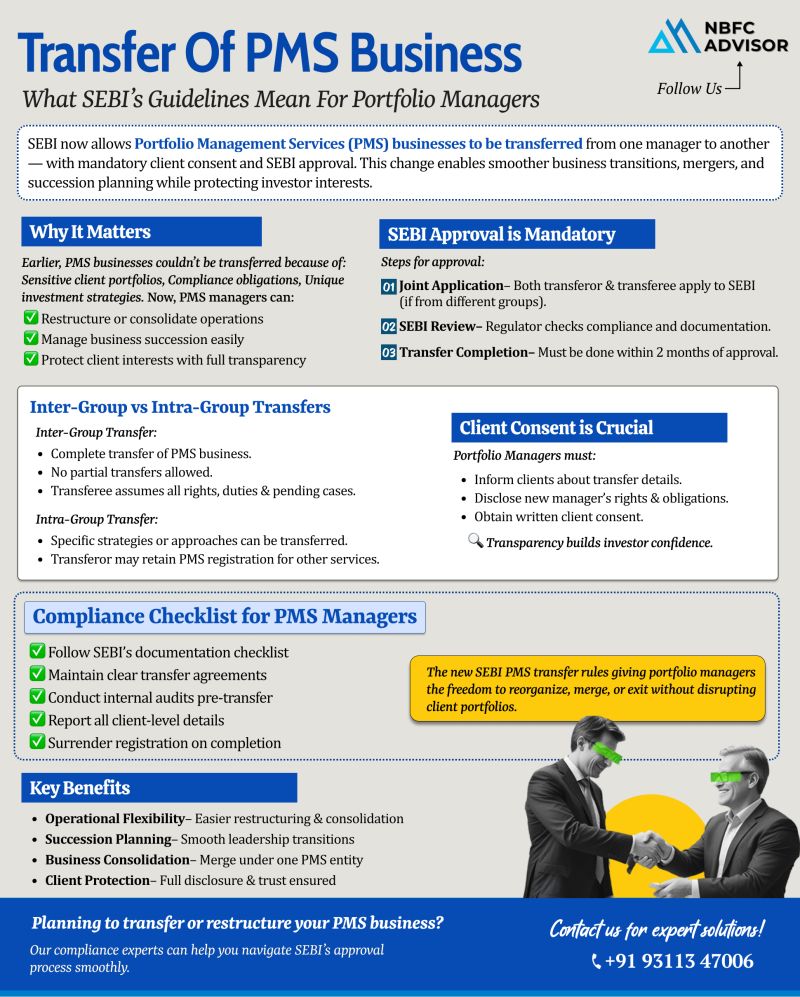

SEBI Eases the Way for PMS Transfers — A New Era of Flexibility and Transparency

Until recently, transferring a Portfolio Management Services (PMS) business in India was almost impossible.

However, with SEBI’s new framework, the proce...

NBFC Takeovers: The Quickest Gateway to India’s Digital Lending Boom

India’s digital lending market is on a steep growth curve, projected to reach $515 billion by 2030. Innovative financial solutions such as peer-to-peer (P2P) lending,...

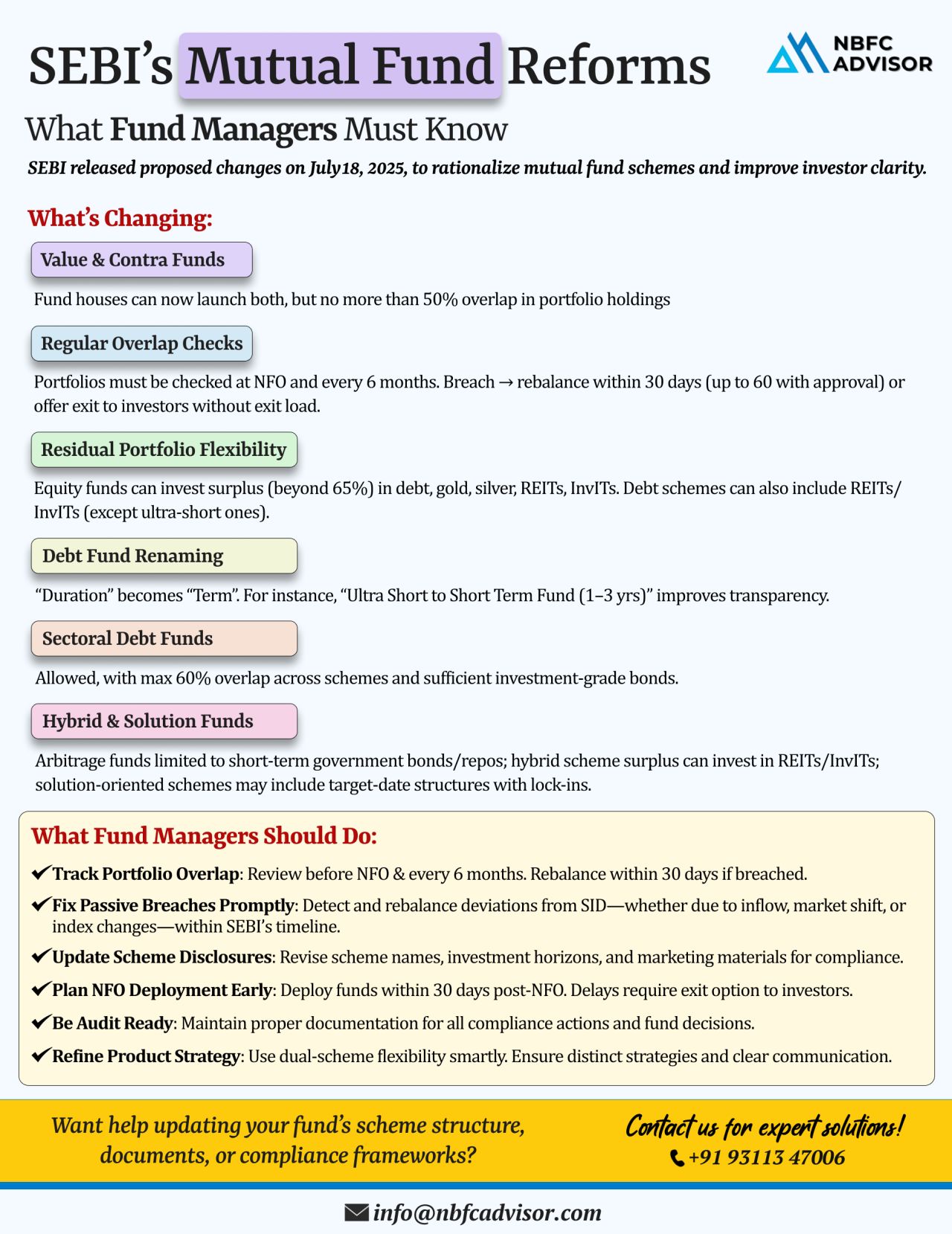

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

Digital Lending in India Is Skyrocketing — Are You Ready to Ride the Wave?

India’s digital lending sector is witnessing explosive growth — and it’s only getting started. With projections estimating the market to reach $1.3 ...

🚀 The NBFC Space in India is Booming! 🚀

Are You Ready to Leverage the Opportunity?

The Non-Banking Financial Company (NBFC) sector in India is experiencing rapid growth, driven by increasing demand for digital lending, microfinance solutions,...

𝐈𝐬 𝐘𝐨𝐮𝐫 𝐍𝐁𝐅𝐂 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

Compliance Isn’t Optional — It’s Essential.

It’s not just about following rules. Compliance is the foundation of trust, sustainable growth, and long-term success for every NBFC.

...

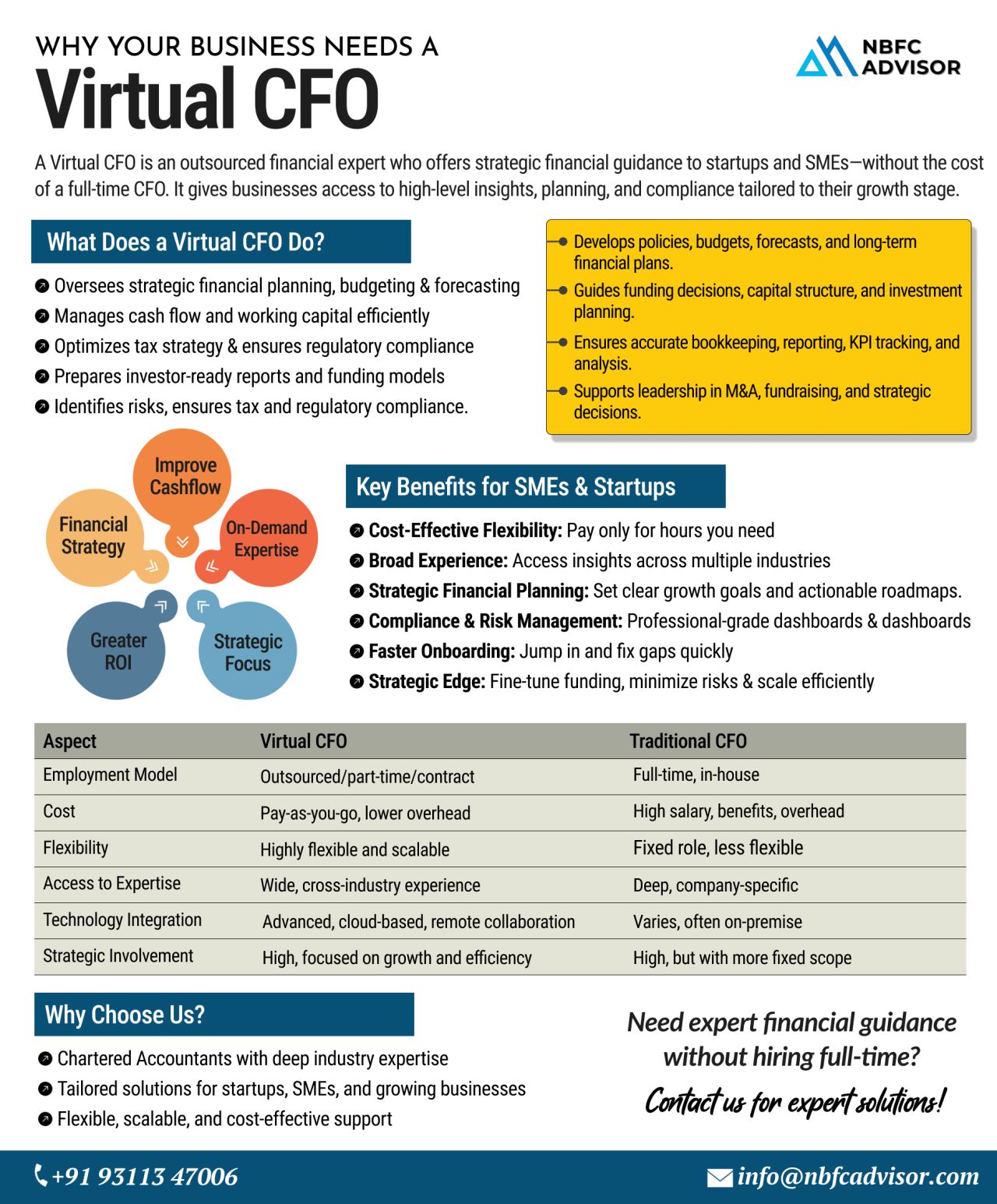

Struggling to Make Sense of Your Finances?

As businesses grow, it’s common to hit a point where spreadsheets, basic reports, and guesswork just aren’t enough. You need clarity, strategy, and confidence behind every financial decision &...

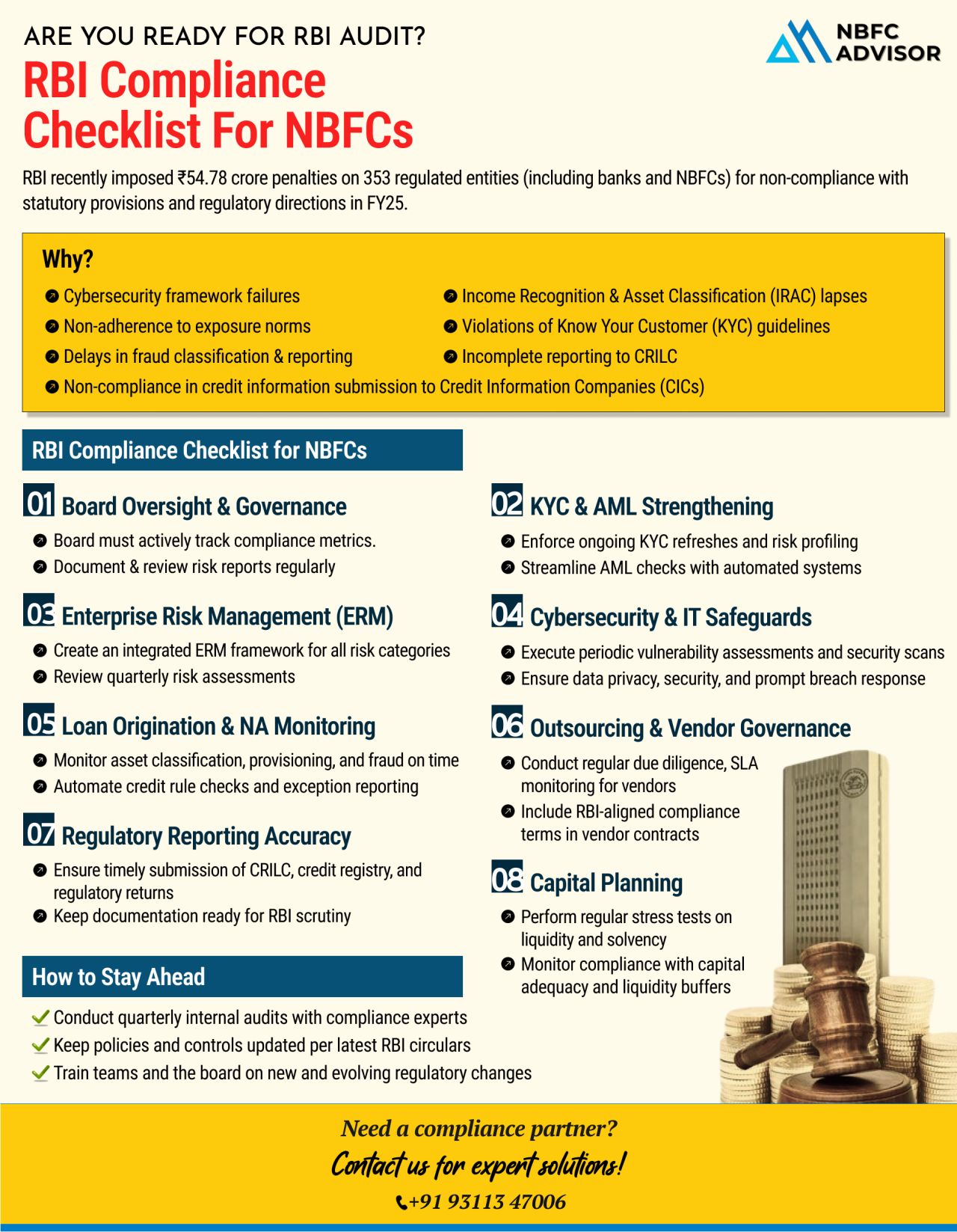

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

Are you planning to start your own Portfolio Management Service (PMS)? There’s never been a better time—especially if you leverage the exceptional advantages offered by GIFT City, India’s only International Financial Services Centre...

In a landmark move towards enhancing transparency, efficiency, and digital convenience, the Securities and Exchange Board of India (SEBI) has made DigiLocker integration mandatory for all intermediaries.

This mandate is a significant step forward ...

India’s Non-Banking Financial Companies (NBFCs) are growing at a pace that’s outstripping the country’s GDP, signaling a major shift in the financial services landscape. This acceleration is powered by rapid credit expansion, digita...

With rising demand for digital lending, microfinance, and easier credit access across Tier 2 and Tier 3 cities, NBFCs (Non-Banking Financial Companies) are fast becoming engines of financial inclusion and fintech-driven innovation.

This momentum p...

The demand for digital credit in India is at an all-time high.

From MSMEs to individuals, the appetite for alternative financing is growing rapidly — and Non-Banking Financial Companies (NBFCs) are at the forefront of this revolution.

Wit...

If you're building in Fintech, Lending, or BFSI, obtaining an Account Aggregator (AA) License is your gateway to innovation and compliance.

An Account Aggregator is a platform regulated by the Reserve Bank of India (RBI) that enables users to ...

With over 190 million adults in India lacking a formal credit history, traditional credit scoring models fall short.

Alternative Credit Scoring taps into digital footprints—such as rent payments, utility bills, mobile transactions, and even ...

RBI Halts New Credit Lines & Renewals for Large NBFCs

The Reserve Bank of India (RBI) has directed large Non-Banking Financial Companies (NBFCs) to stop issuing new lines of credit and renewing existing ones for businesses.

Why?

NBFCs ha...

Become a Leader in the Financial Sector with Expert Guidance

Are you looking to start your own Non-Banking Financial Company (NBFC) or FinTech Lending Company?

Our team of Consultants & Ex-Bankers will guide you every step of the way!

CO...

Digital lending is set to hit ₹5 TRILLION by FY28! 📈

With a 40% CAGR growth, the industry is expected to double its market share in India’s retail loan space in just four years.

And the best part? It’s just getting started!

What...

Vehicle finance plays a critical role in enabling individuals and businesses to own vehicles through structured credit facilities. But have you ever wondered how lenders assess risk before approving a vehicle loan? Let’s break it down!

The ...

On August 16, 2024, the Reserve Bank of India (RBI) issued a notification announcing significant revisions to the Master Direction – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017 (‘Dir...

Introduction

Non-banking financial companies (NBFCs) play a quintessential role in bridging the credit gap within economies worldwide, especially in the dynamic financial background of 2024. The rapid development and diversification of NBFCs ensur...

Emerging technologies and strategic partnerships are crucial for Non-Banking Financial Companies (NBFCs) to thrive in an increasingly regulated and competitive financial landscape. By integrating advanced technologies and collaborating with FinTech c...

In the rapidly evolving financial services sector, Non-Banking Financial Companies (NBFCs) are experiencing a transformative shift, thanks to the advent of digital and AI-enabled tools. Systems such as Loan Origination Systems (LOS) and Loan Manageme...

The fintech industry is experiencing an unprecedented evolution, driven by groundbreaking innovations that are transforming how we manage, invest, and think about money. From artificial intelligence to blockchain, the financial landscape is being red...

In today's rapidly changing financial landscape, traditional credit scoring methods often fail to meet the needs of millions of people worldwide who are underserved by formal banking systems. Emerging economies, such as the Philippines, struggle ...

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...

In the intricate world of finance, regulatory compliance stands as the bedrock of stability and credibility. This blog explores the profound impact of NBFC Advisor, showcasing how its expert guidance has been instrumental in steering Non-Banking Fina...

In the intricate world of finance, Non-Banking Financial Companies (NBFCs) operate within a nuanced regulatory landscape. This blog offers an insightful exploration into the complexities, nuances and critical role of compliance in shaping the traject...

.png)

.png)

.jpeg)

.jpeg)

.jpeg)