NBFC Compliance Services: Stay RBI-Compliant, Avoid Penalties & Build Long-Term Trust

In today’s regulated financial environment, compliance is the backbone of every successful NBFC. With increasing supervision by the Reserve Bank of Ind...

NBFC Automation & Software Advisory: Transform Your NBFC with Smart Digital Solutions

In today’s fast-evolving financial ecosystem, Non-Banking Financial Companies (NBFCs) must embrace digital transformation to stay competitive, complian...

NBFC Compliance Services: Stay RBI-Compliant, Reduce Risk & Build Regulatory Confidence

Compliance is no longer a back-office formality for NBFCs. With increasing scrutiny from the Reserve Bank of India (RBI), evolving regulatory frameworks, a...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

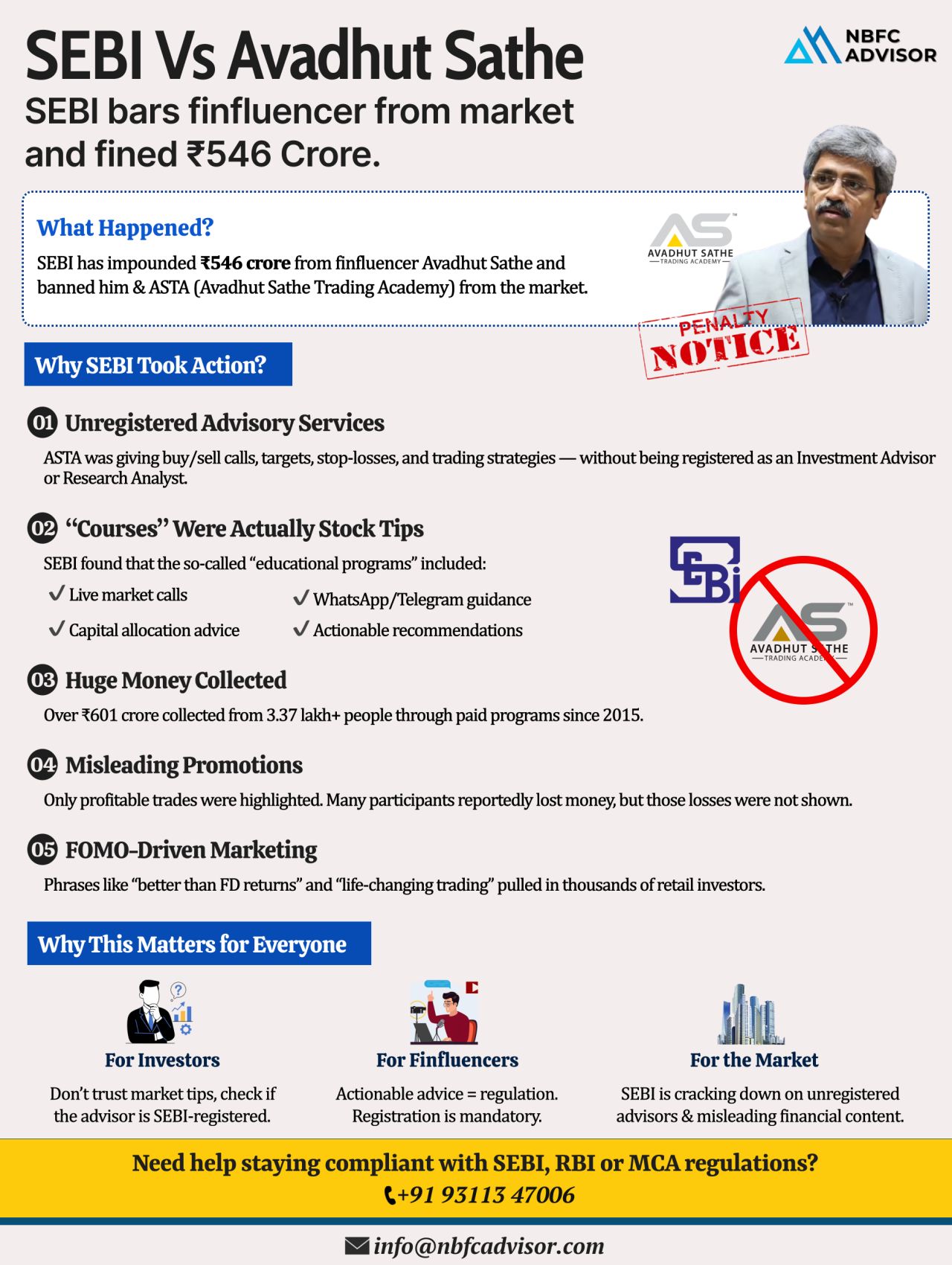

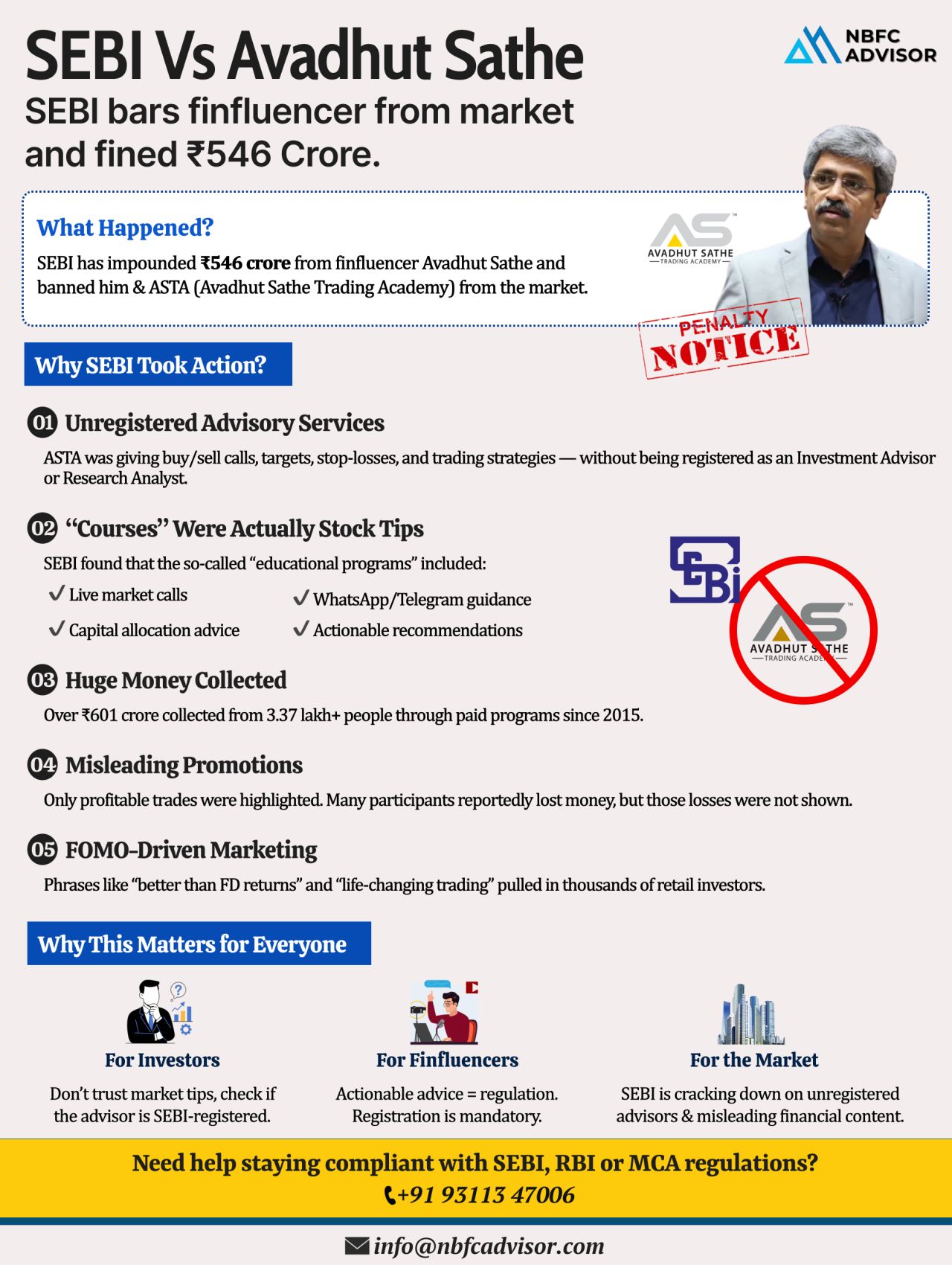

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from ...

SEBI Froze ₹546 Crore Overnight: A Wake-Up Call for the Financial Education Industry

In one of its strongest enforcement actions against a finfluencer, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore from Avadhut Sathe a...

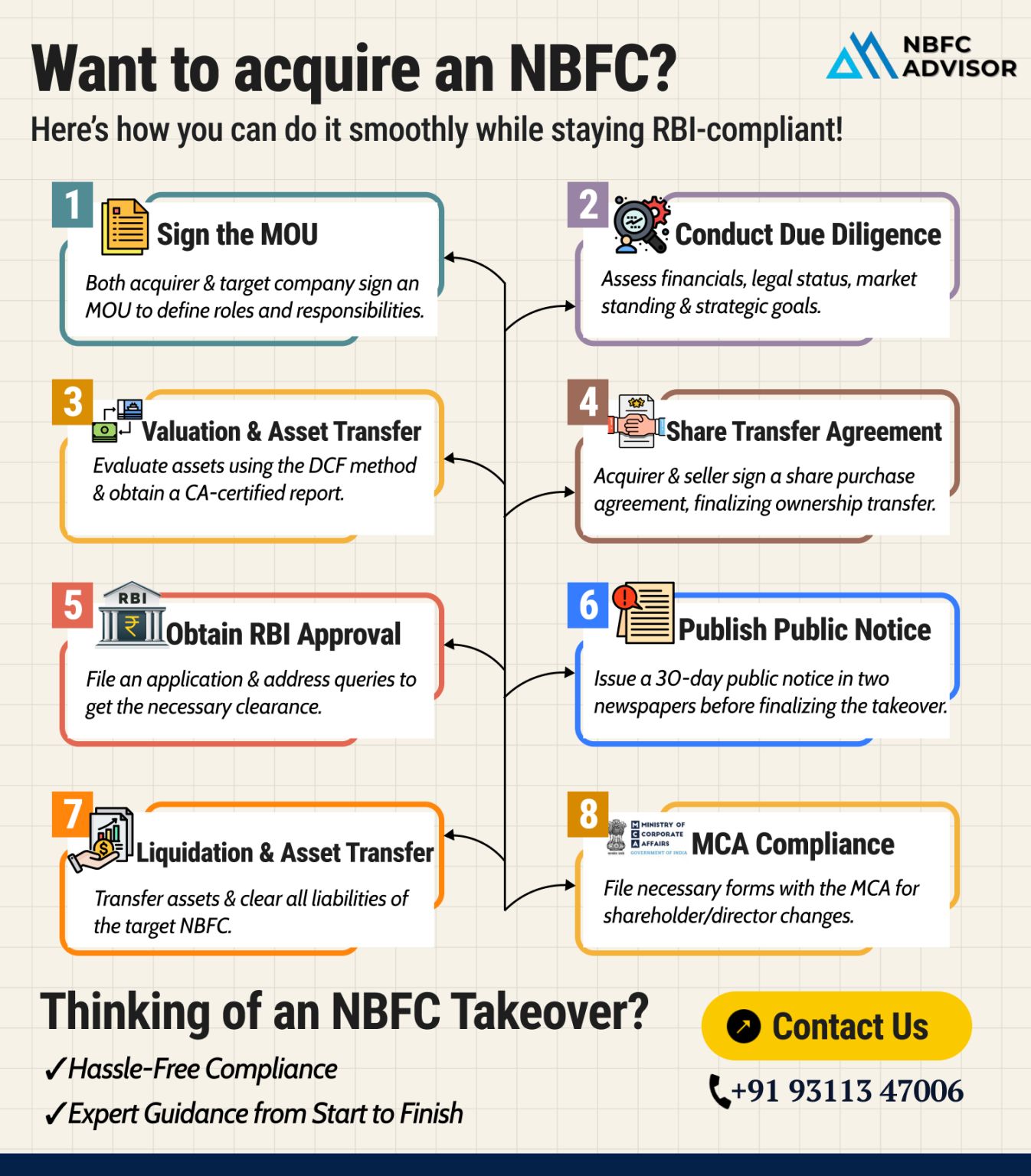

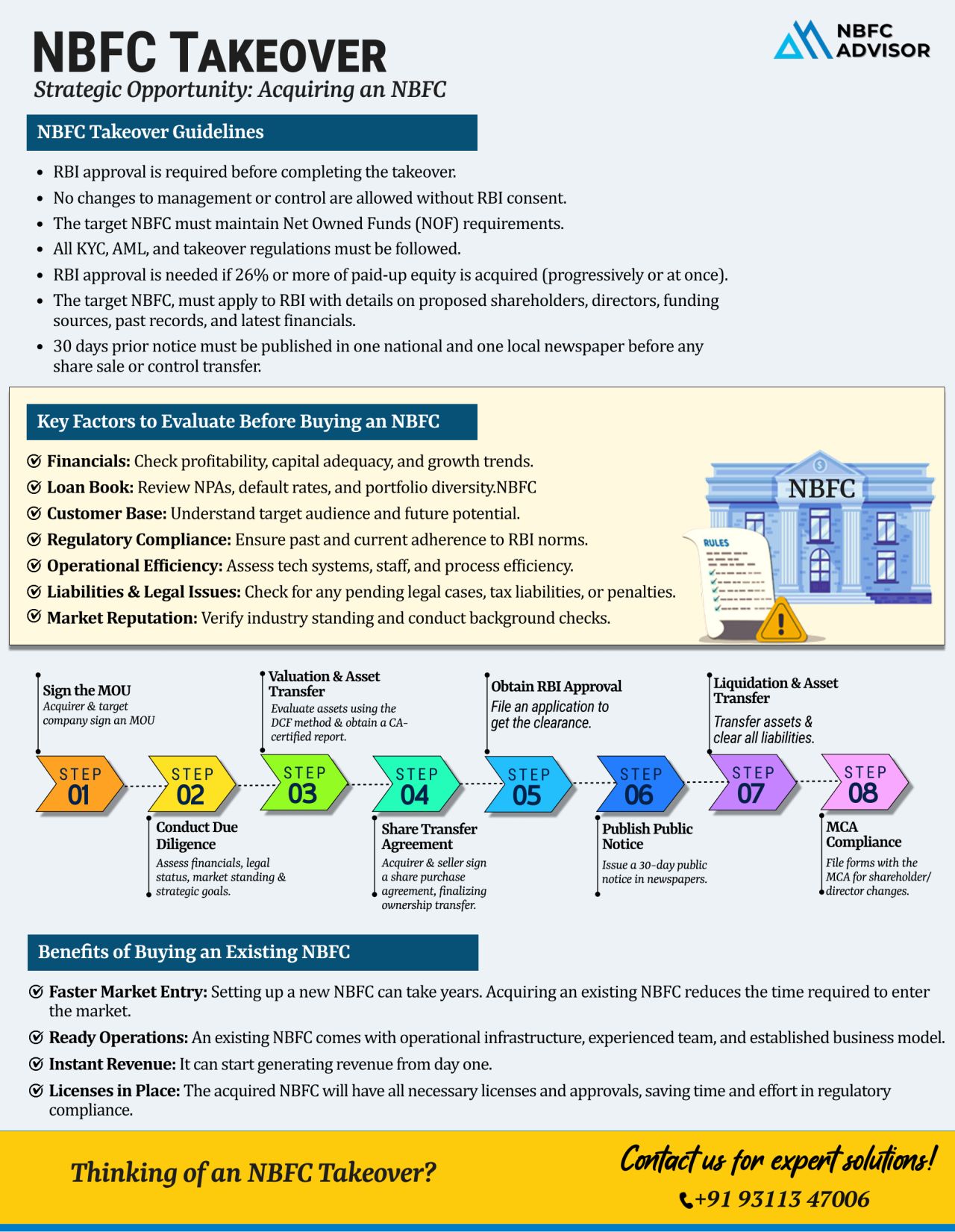

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

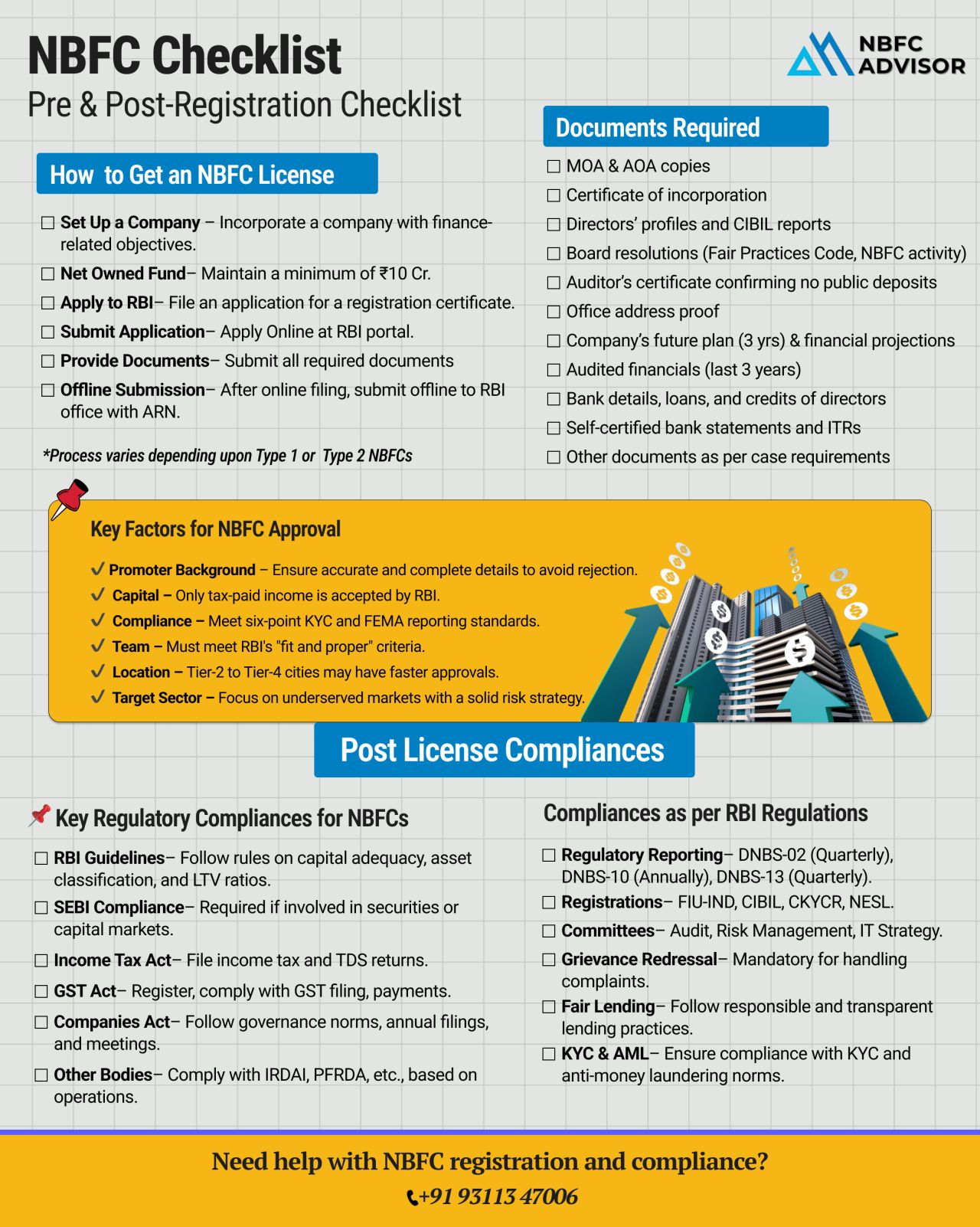

NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey wi...

Want to Register Your NBFC Faster?

Starting a Non-Banking Financial Company (NBFC) is one of the most promising ventures in India’s growing financial ecosystem. However, most founders face one common hurdle — RBI registration delays du...

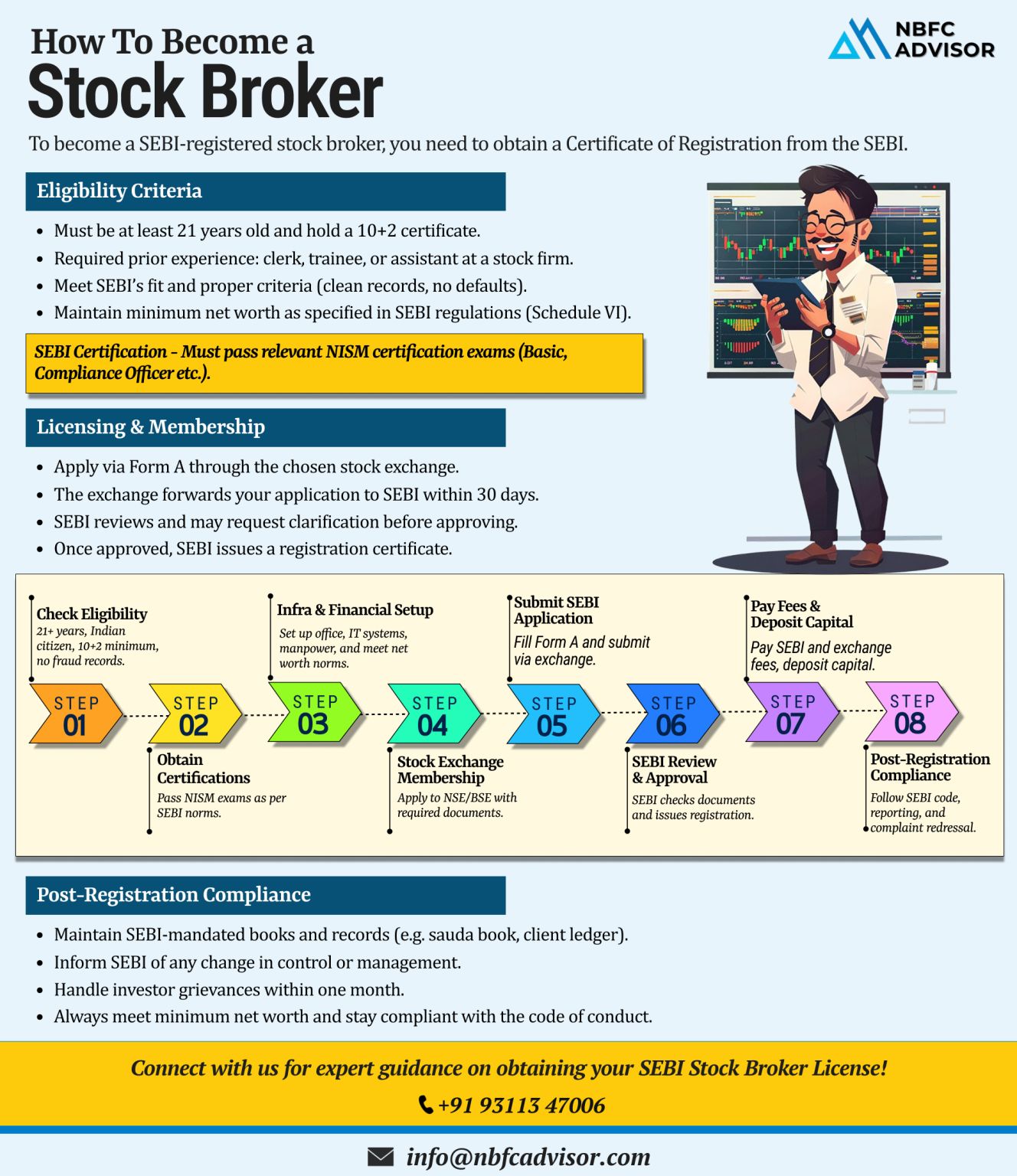

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI registration is your gateway to operating as a legitimate and trusted stock broker in India’s capital markets. From meeting eligibility norms to maintaining compliance, here’s...

Want to Enter India’s Thriving Lending Sector—Without the Long Wait?

India’s lending market is expanding rapidly, driven by digital innovation and growing credit demand. But setting up a new NBFC from scratch is often a long and ...

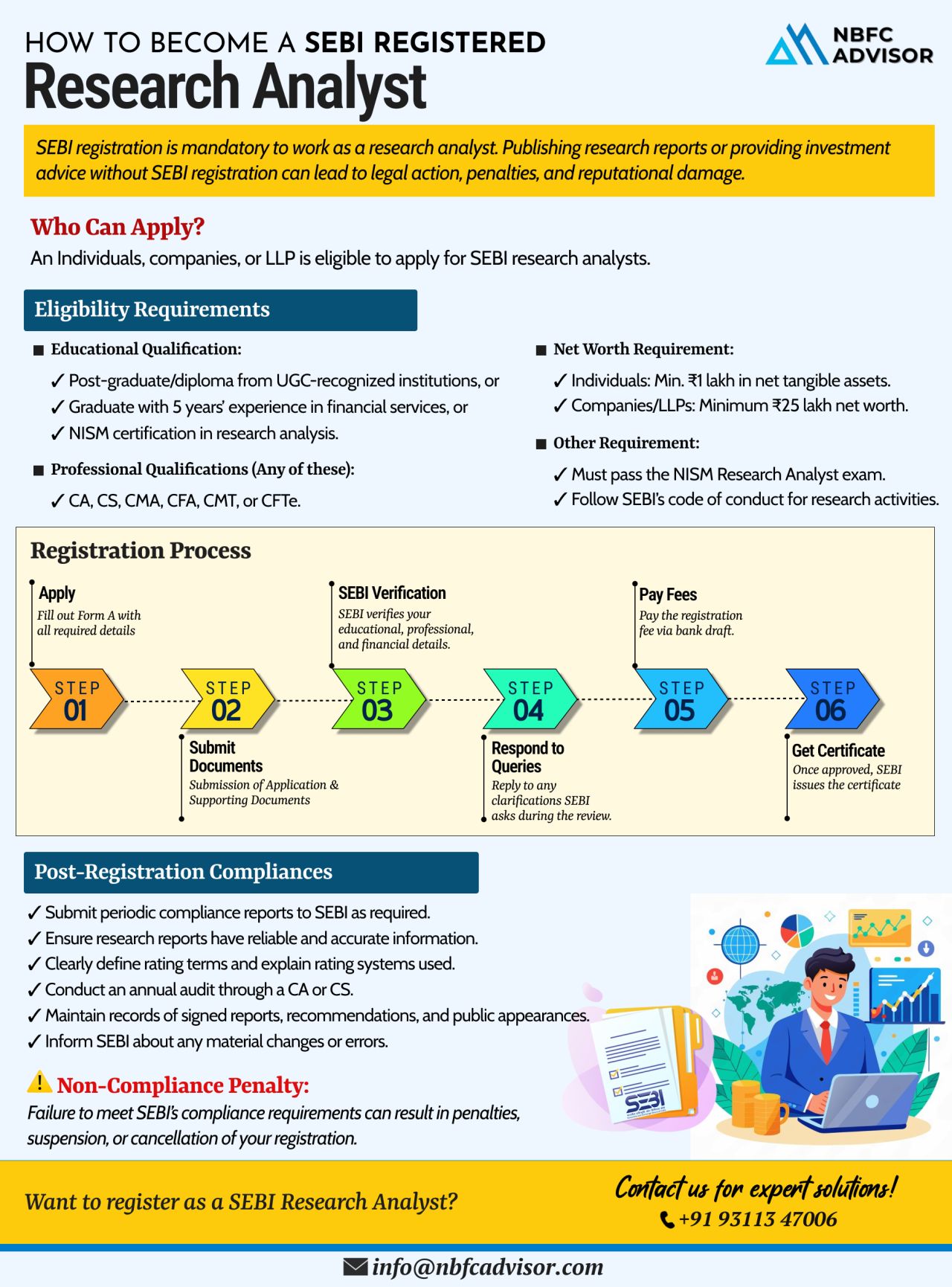

Publishing Research Reports Without SEBI Registration?

That’s a Shortcut to Penalties, Suspension & Reputational Damage

In India’s regulated financial ecosystem, publishing equity research or market analysis without SEBI registr...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘍𝘪𝘳𝘴𝘵 𝘚𝘵𝘦𝘱.

Many founders breathe a sigh of relief after receiving their NBFC license. But in reality, registration is just the beginning. The real challenge lies i...

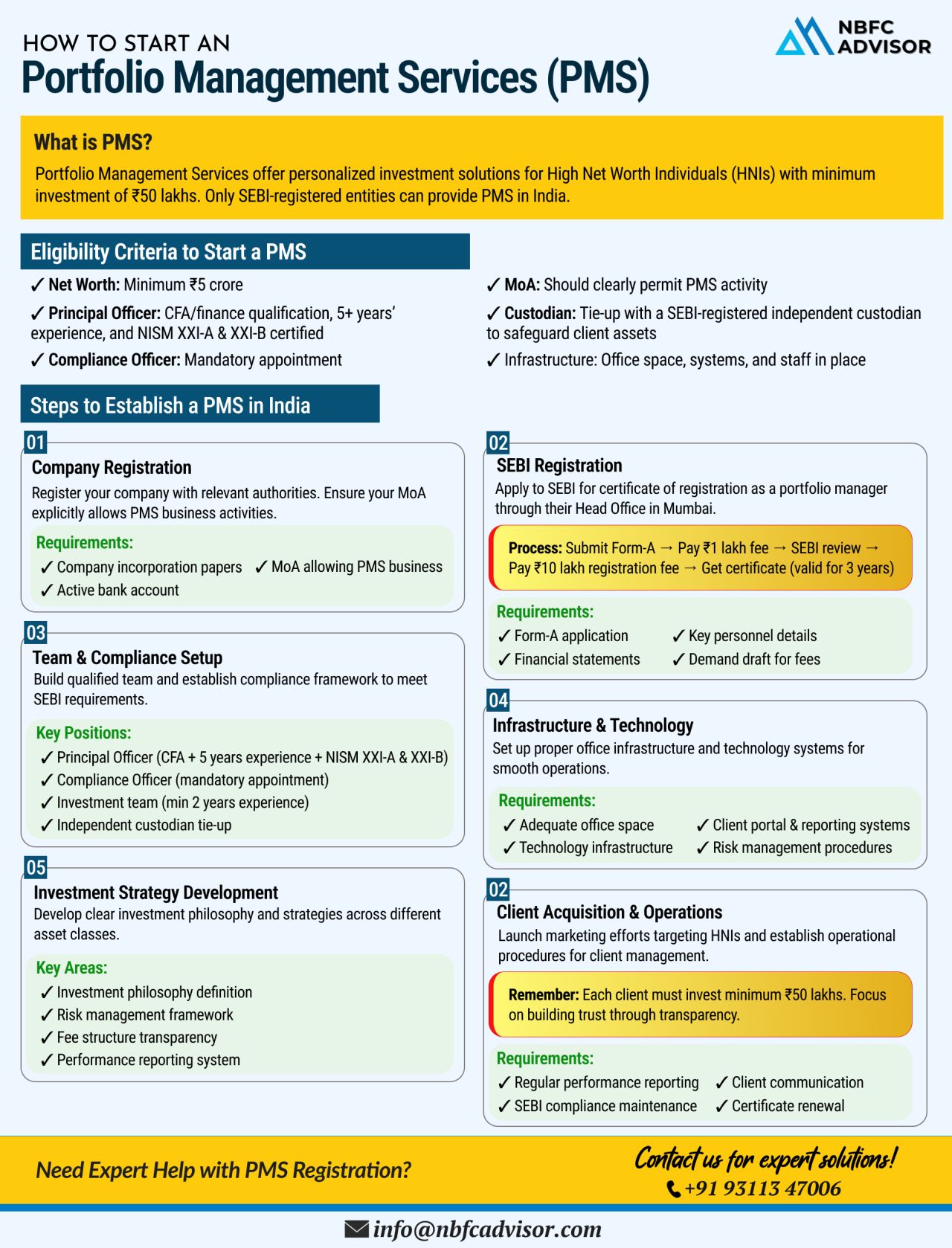

📈 India’s PMS Industry Is Booming – Here’s Why You Should Pay Attention

India’s Portfolio Management Services (PMS) industry is witnessing unprecedented growth — and it’s only just getting started. With total a...

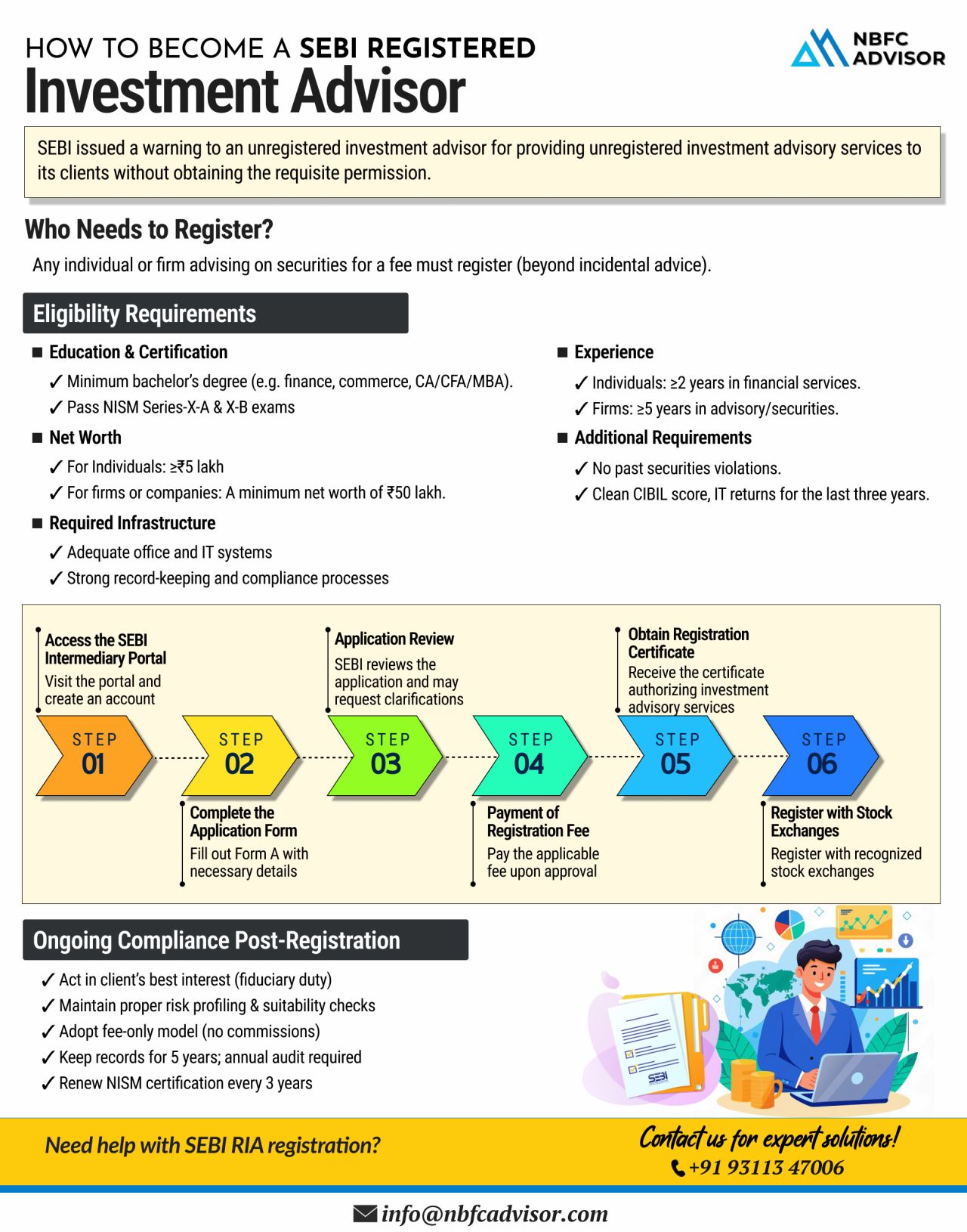

⚠️ SEBI Issues Stern Warning to Unregistered Investment Advisors – Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strong warning to unregistered investment advisors. If you're offering financia...

If you’re passionate about guiding people toward better financial decisions, becoming a SEBI Registered Investment Advisor (RIA) is a smart and impactful career move.

India needs more qualified, ethical, and SEBI-recognized advisors—an...

Here’s Your Complete Roadmap

India’s stock market is expanding rapidly, offering exciting opportunities for professionals looking to enter the financial sector. If you're aiming to become a SEBI-registered stock broker, you’l...

India's digital transaction volume has skyrocketed from 2,071 crore in FY 2017–18 to a staggering 18,737 crore in FY 2023–24, reflecting a CAGR of 44%.

This rapid growth presents a massive opportunity for businesses looking to ente...

The NBFC Account Aggregator (AA) framework is revolutionizing financial data sharing in India. An NBFC-AA is a regulated intermediary that allows individuals to securely consolidate and share their financial data—such as bank, insurance, mutual...

India’s NBFC sector is projected to reach ₹60 trillion by FY26—now is the perfect time to enter the market.

Why Start an NBFC?

✔ Fintech NBFCs are growing rapidly

✔ Huge demand in credit-deprived sectors

✔ Faster loan disbursals t...

India’s digital lending industry is on a rapid growth trajectory, projected to hit $1.3 trillion by 2030! With AI-powered risk assessment, fintech innovation, and RBI-backed policies, the sector is ripe with opportunities.

💰 Want to tap int...

The International Financial Services Centres Authority (IFSCA) has introduced key updates to its Fund Management Regulations, 2022, effective February 19, 2025. These revisions align with the December 2024 proposals and bring significant changes for ...

As the demand for credit surges across corporate and industrial sectors, Non-Banking Financial Companies (NBFCs) have become crucial players in the financial ecosystem. Unlike traditional banks, NBFCs offer easier access to credit, making them highly...

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

India’s Future of Financial Data Sharing.png)

.png)

.jpeg)

.jpeg)

.jpeg)