NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

NBFC Policy Drafting Service: Build Strong Compliance, Governance & RBI Readiness

Running an NBFC in today’s regulatory environment is no longer just about lending or financial operations. The Reserve Bank of India (RBI) expects NBFCs to...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Most Non-Banking Financial Companies (NBFCs) don’t struggle because their business model fails.

They struggle because compliance is missed, delayed, or overlooked.

In ...

Running an NBFC? These 3 Compliance Gaps Can Put Your License at Risk

Running a Non-Banking Financial Company (NBFC) in India is not just about lending, growth, and profitability. In today’s tightly regulated environment, compliance failures...

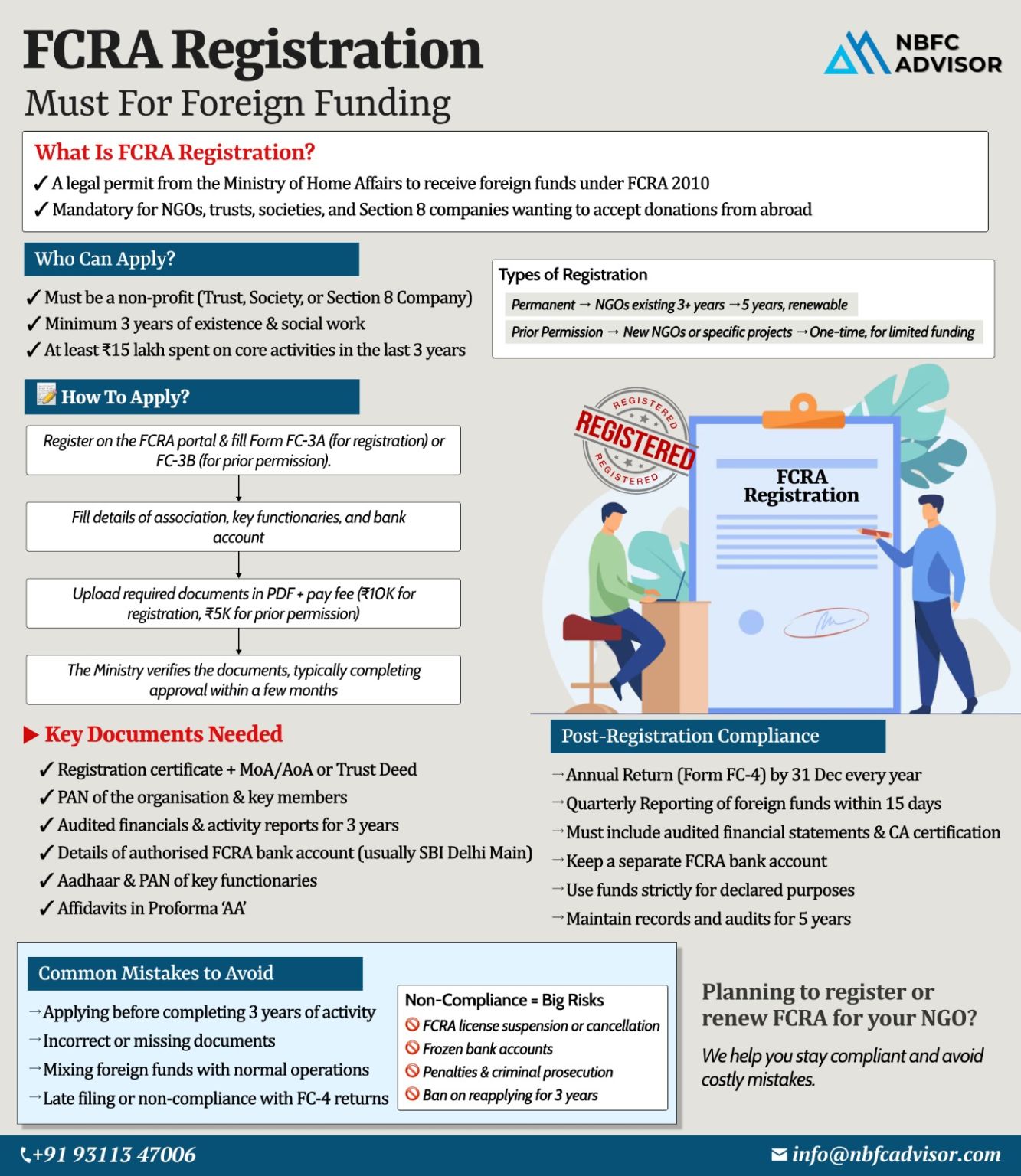

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

Foreign funding can be a lifeline for NGOs working in education, healthcare, human rights, environment, and social welfare. Yet every year, hundreds of NGOs in India lose their ability to ...

One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

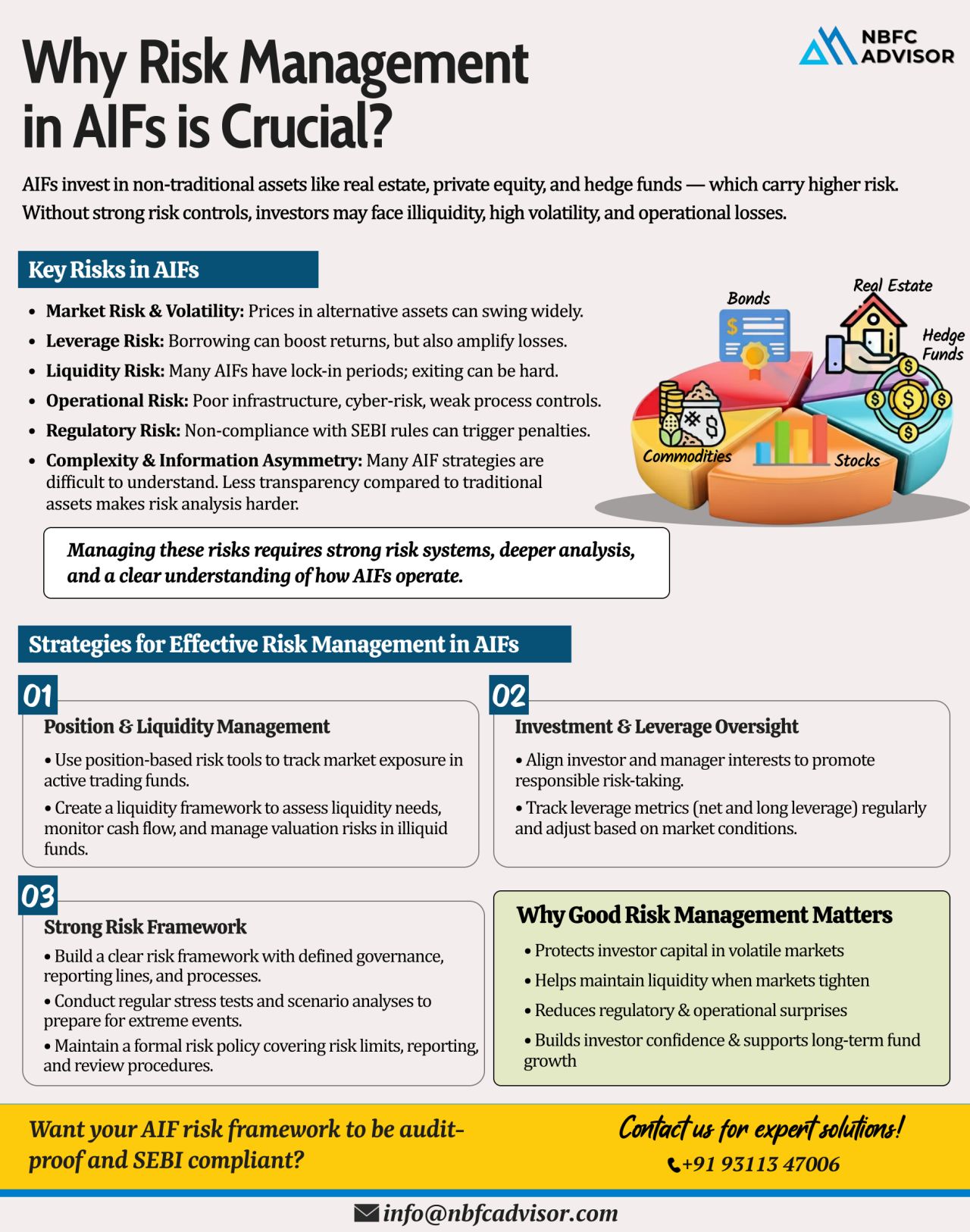

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

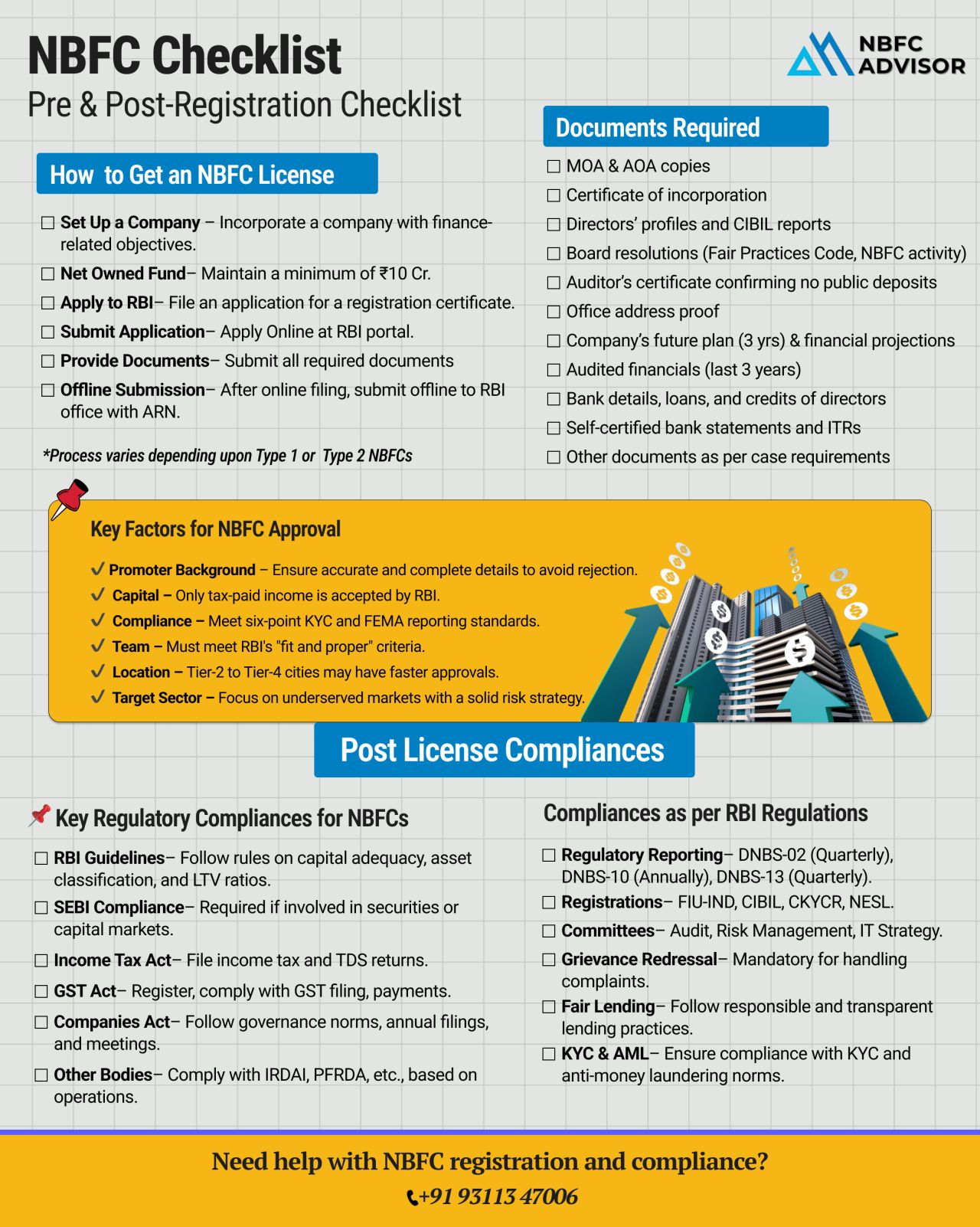

NBFC Registration Checklist: What Every Founder Must Know Before Applying for RBI Approval

Starting an NBFC (Non-Banking Financial Company) is one of the most powerful ways to enter the financial sector—but many founders begin the journey wi...

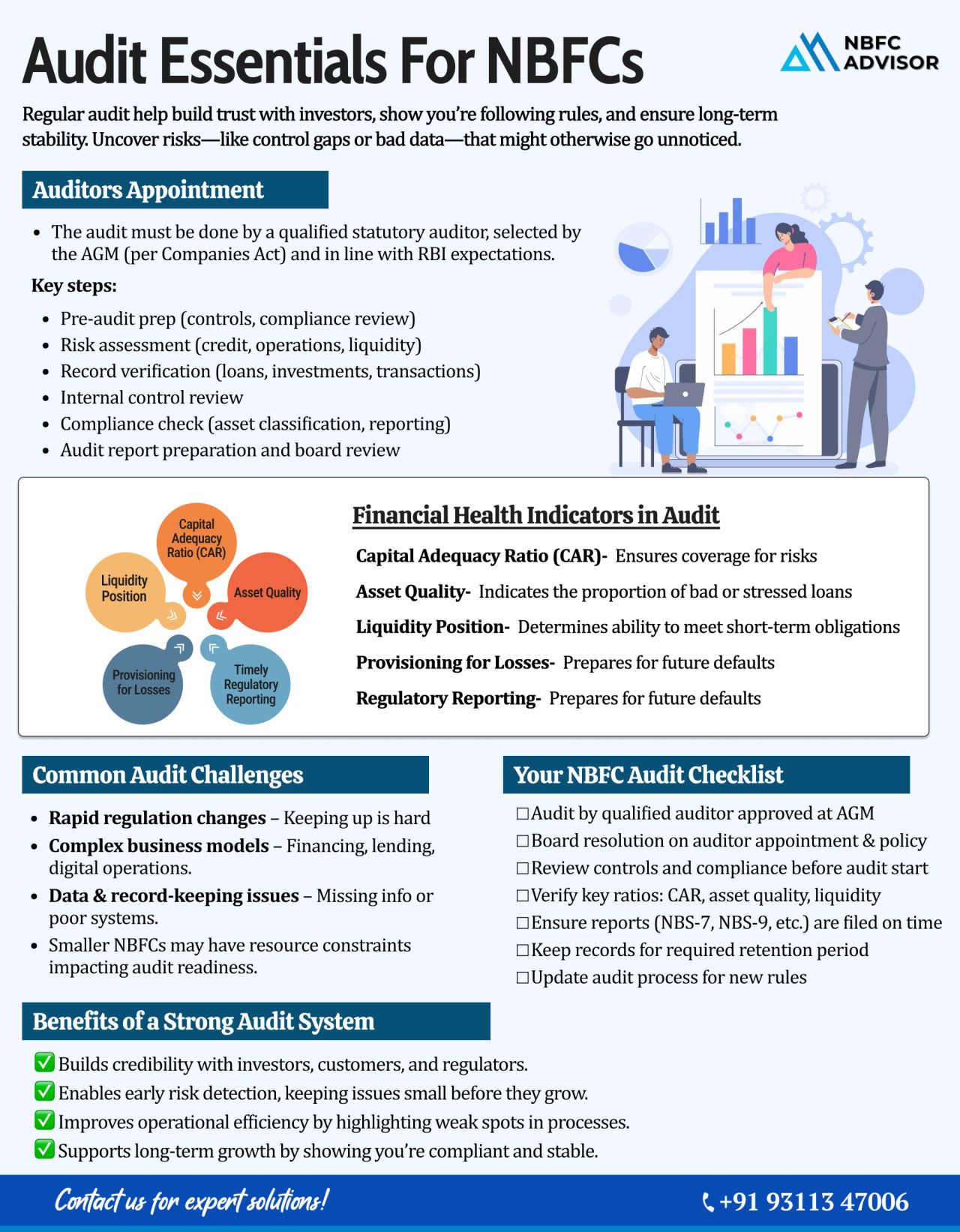

Is Your NBFC Audit-Ready? A Complete Guide for 2025

In recent years, the Reserve Bank of India (RBI) has significantly tightened its supervision over Non-Banking Financial Companies (NBFCs). Today, an NBFC audit is no longer a routine checklist &m...

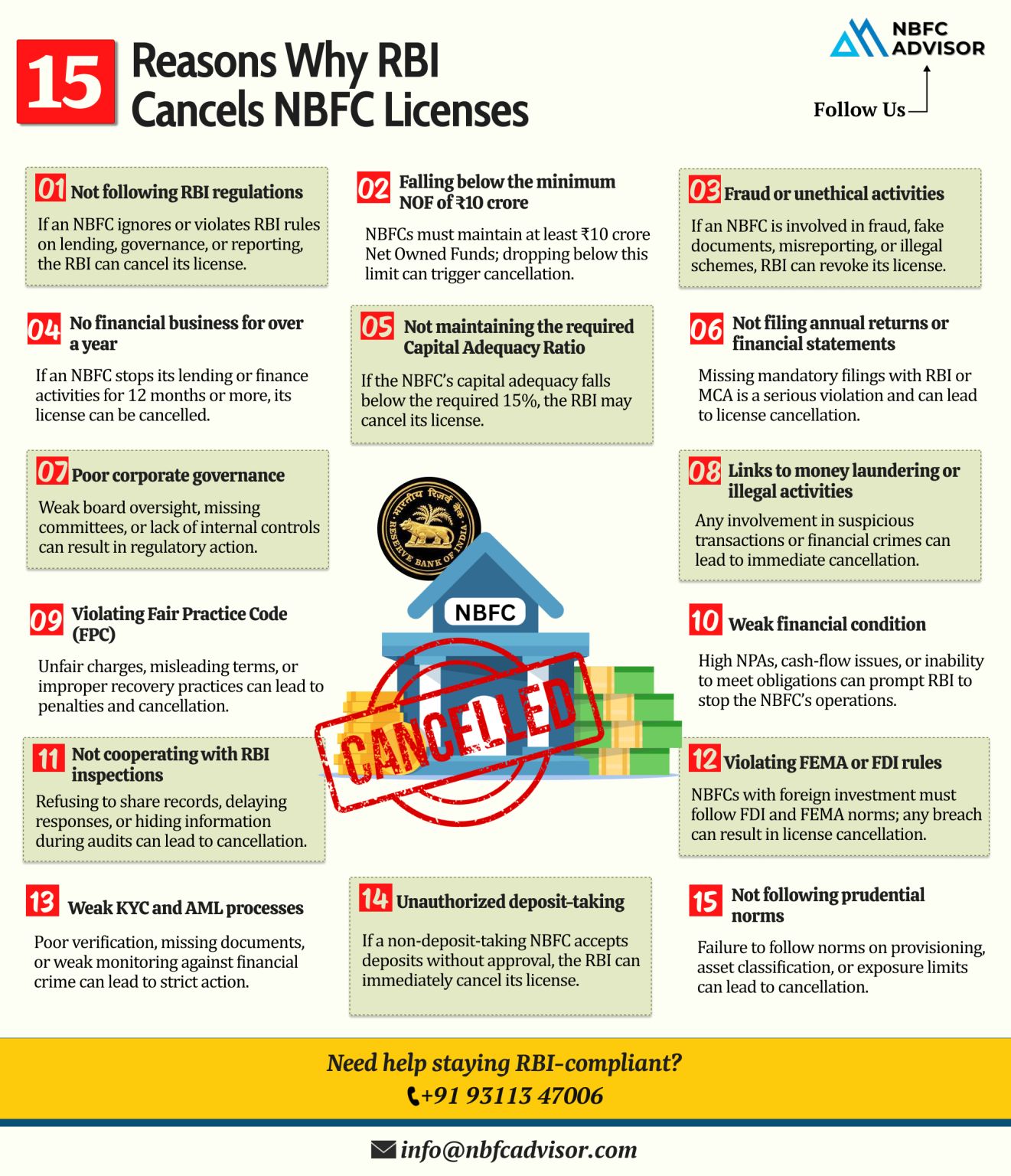

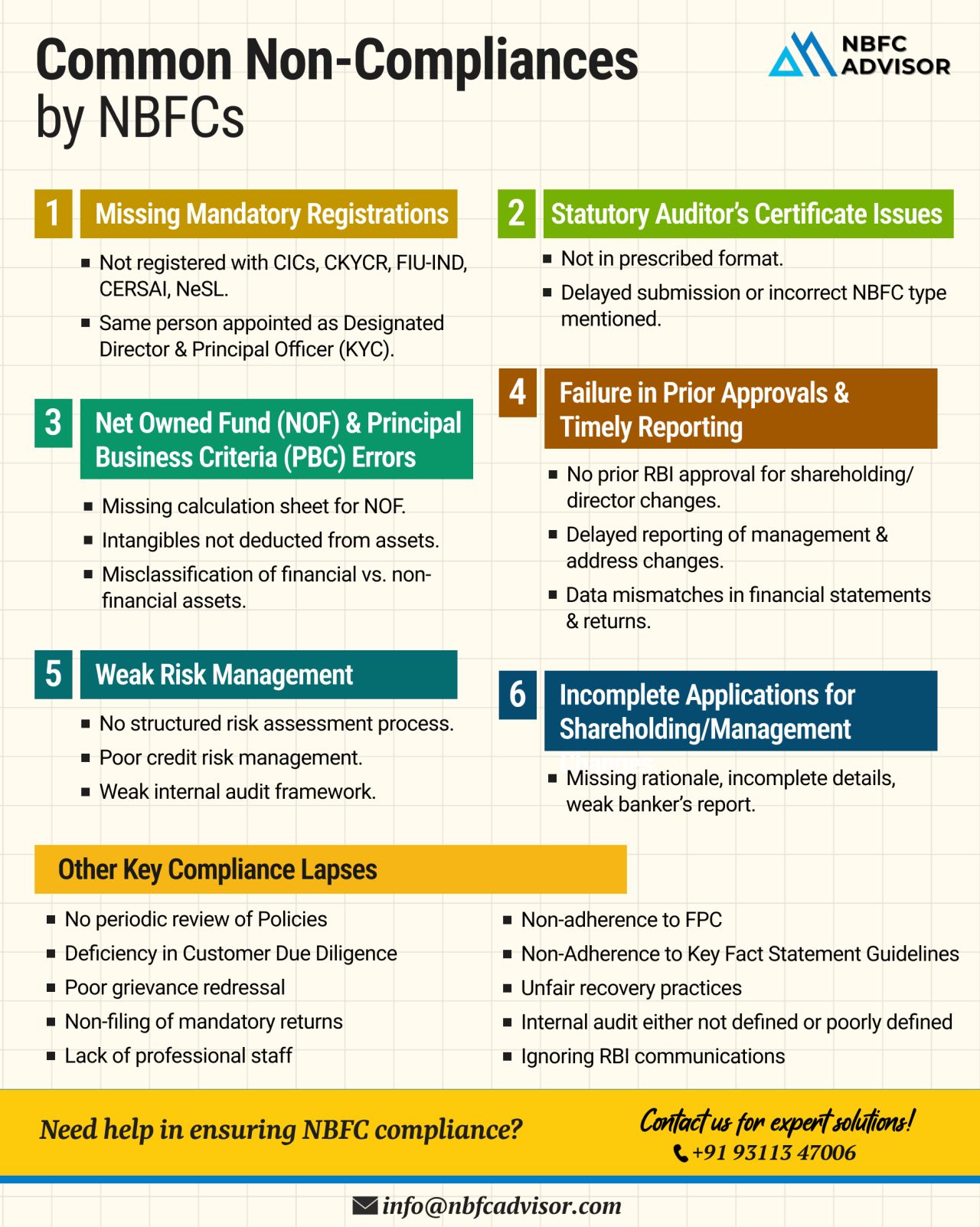

📉 Is Your NBFC at Risk of RBI Action?

The Reserve Bank of India (RBI) is tightening its oversight over Non-Banking Financial Companies (NBFCs), and the consequences for non-compliance are becoming increasingly severe. From hefty penalties to lice...

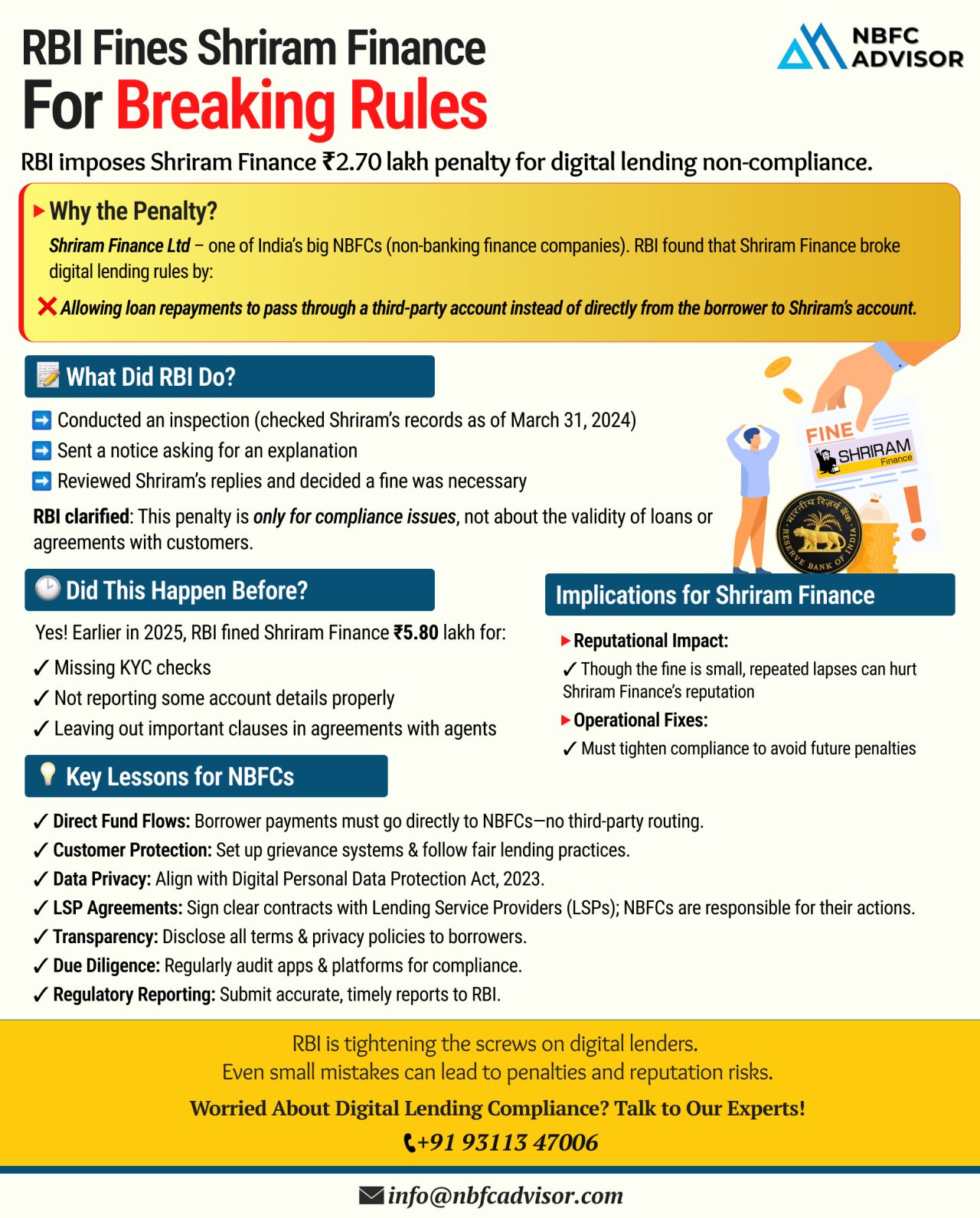

RBI Slaps Penalty on Shriram Finance: A Strong Signal to NBFCs and Fintechs

In a recent move, the Reserve Bank of India (RBI) fined Shriram Finance Limited, one of India’s major NBFCs, for violating digital lending regulations. Thi...

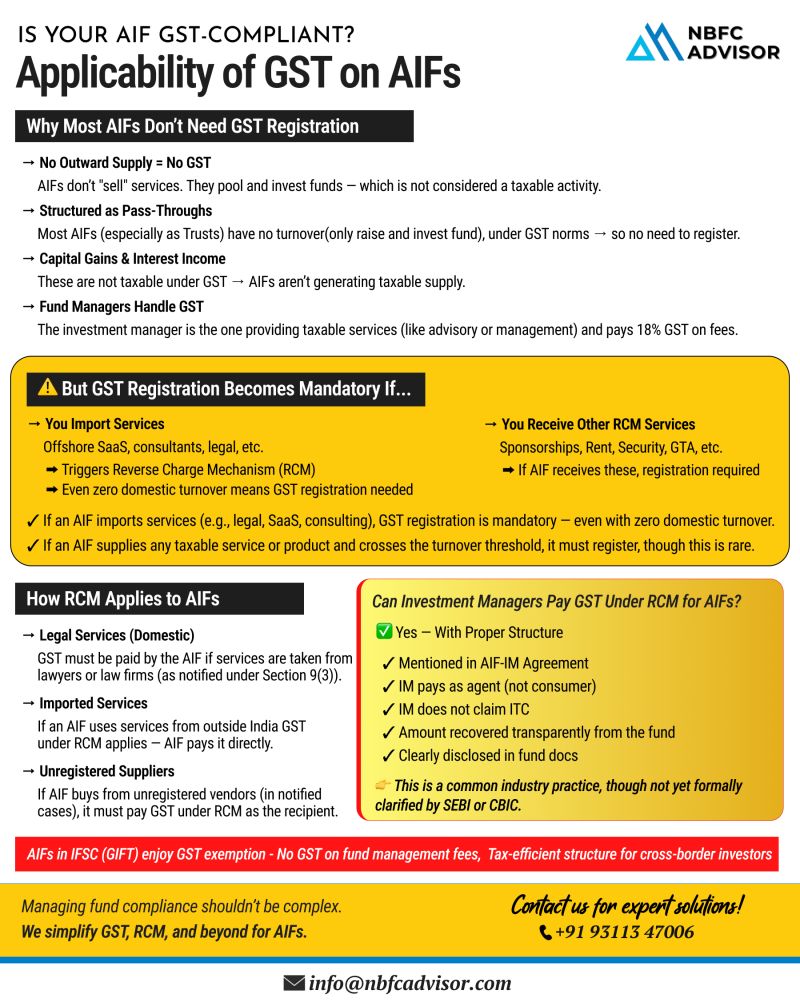

𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐑𝐞𝐪𝐮𝐢𝐫𝐞 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Understanding GST obligations for Alternative Investment Funds

As the Alternative Investment Fund (AIF) landscape continues to grow in India, so does the complexity a...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

The Reserve Bank of India recently announced major changes in the Non-Banking Financial Company (NBFC) sector. The RBI revealed that 15 NBFCs, including notable entities such as Tata Capital Financial Services and Revolving Investments, have voluntar...

.jpeg)