FinTech–NBFC Collaboration Service: Powering Scalable, RBI-Compliant Digital Lending Partnerships

The future of financial services lies in collaboration. FinTech companies bring technology, customer experience, and innovation, while NBFCs br...

One Missed FCRA Rule Can Cost NGOs Their Foreign Funding

For many NGOs in India, foreign contributions are critical to sustaining programs, expanding impact, and serving communities effectively. Yet every year, numerous NGOs lose access to foreign...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit landscape is undergoing a massive shift. Digital lending is expanding at a pace nearly 10 times faster than traditional banking, driven by technology, changi...

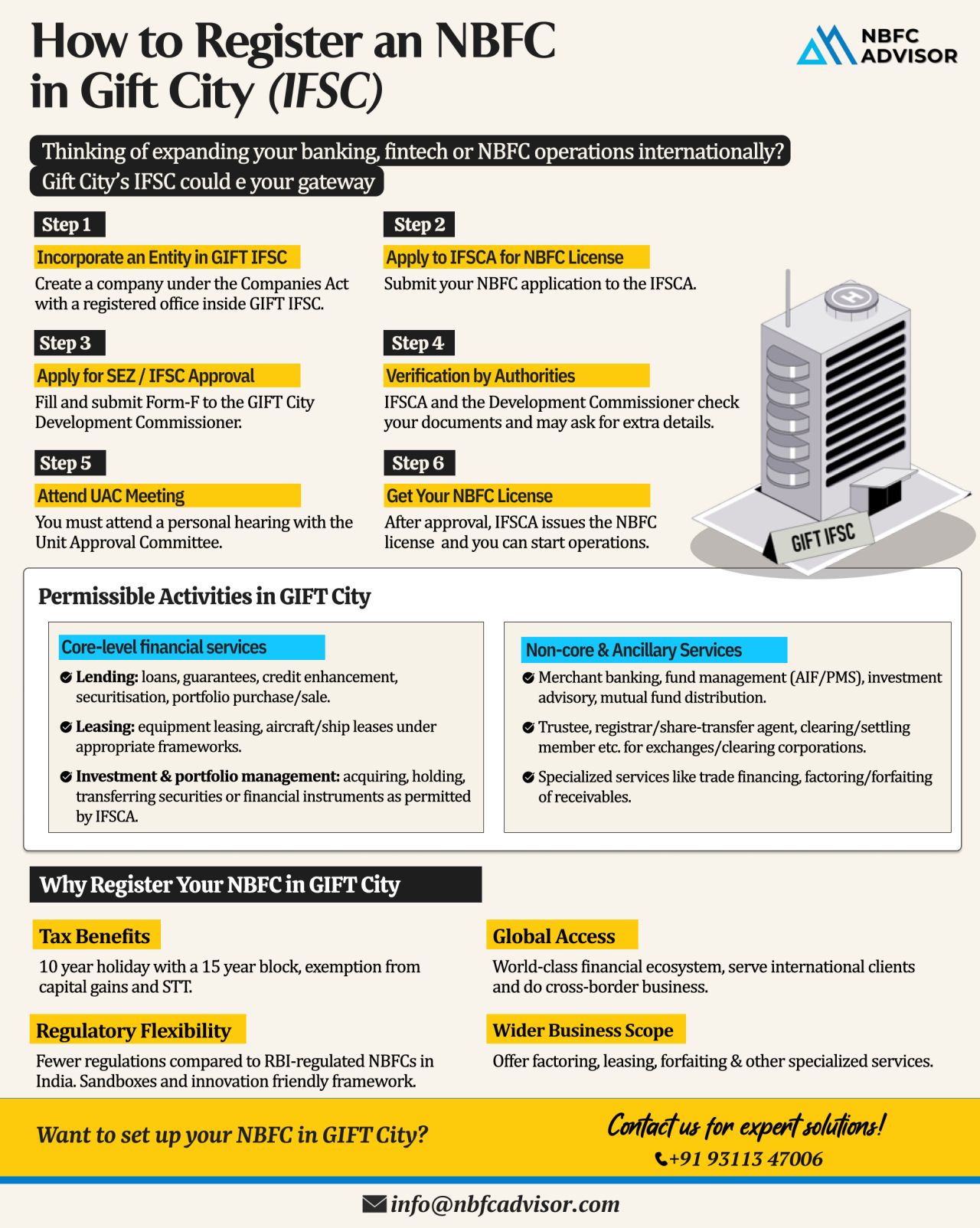

Why GIFT City? India’s Fastest-Growing Financial Gateway for NBFCs

India’s financial landscape is changing rapidly—and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Increasingly, NBFC...

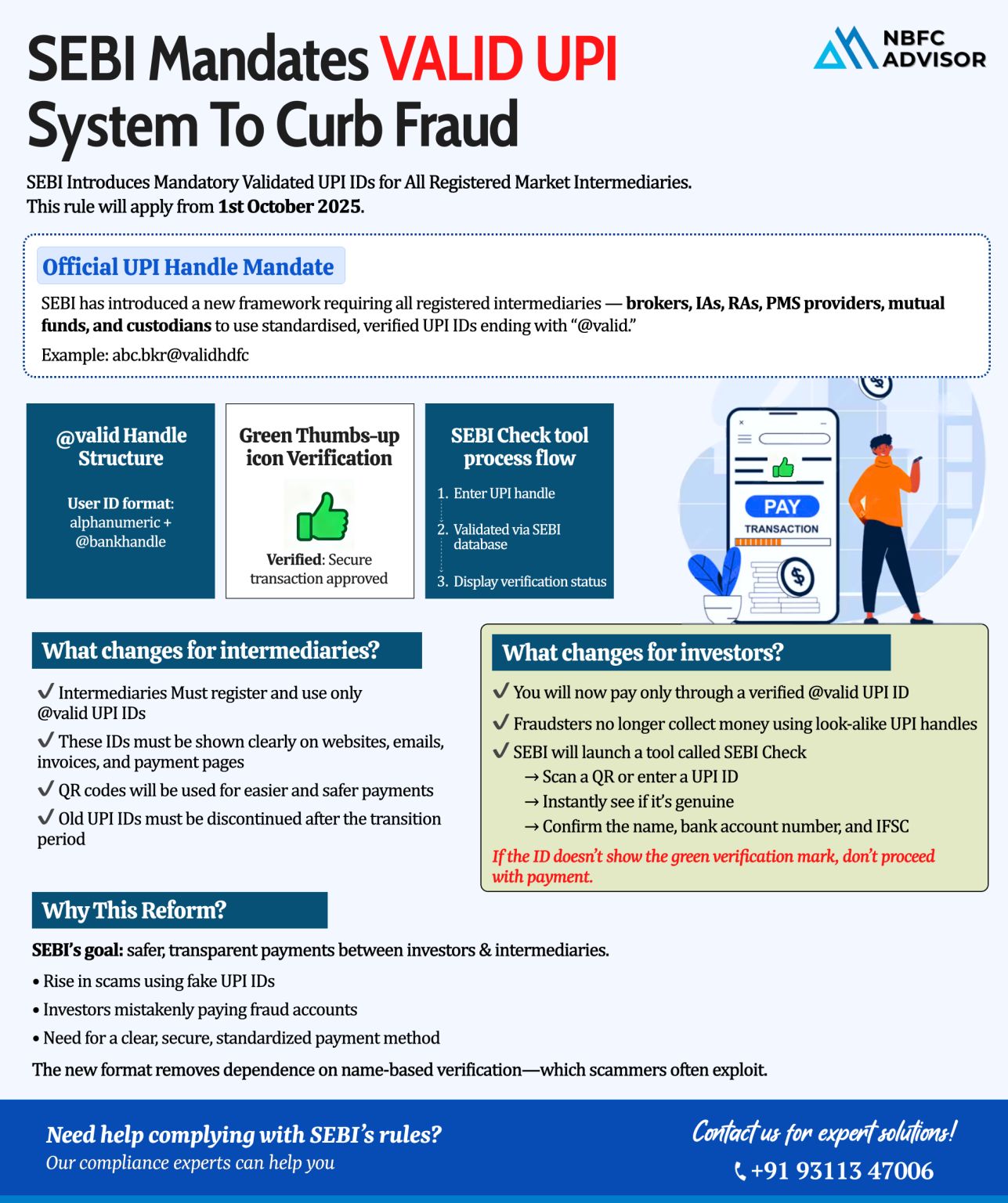

SEBI Introduces VALID UPI System: A Big Step Toward Safer Digital Payments!

The Securities and Exchange Board of India (SEBI) has rolled out a major reform to tighten digital payment security across the financial ecosystem. With rising cases of fa...

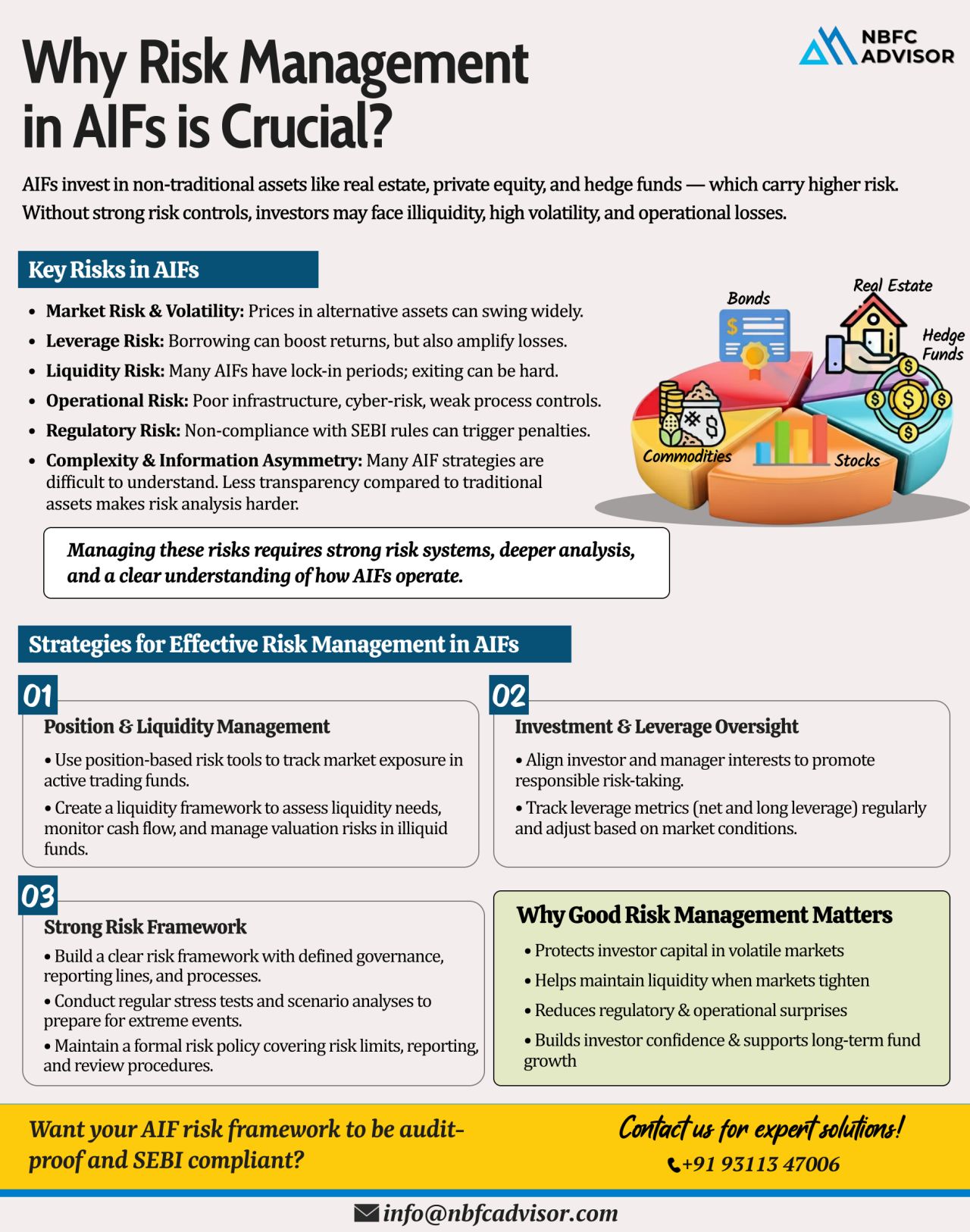

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

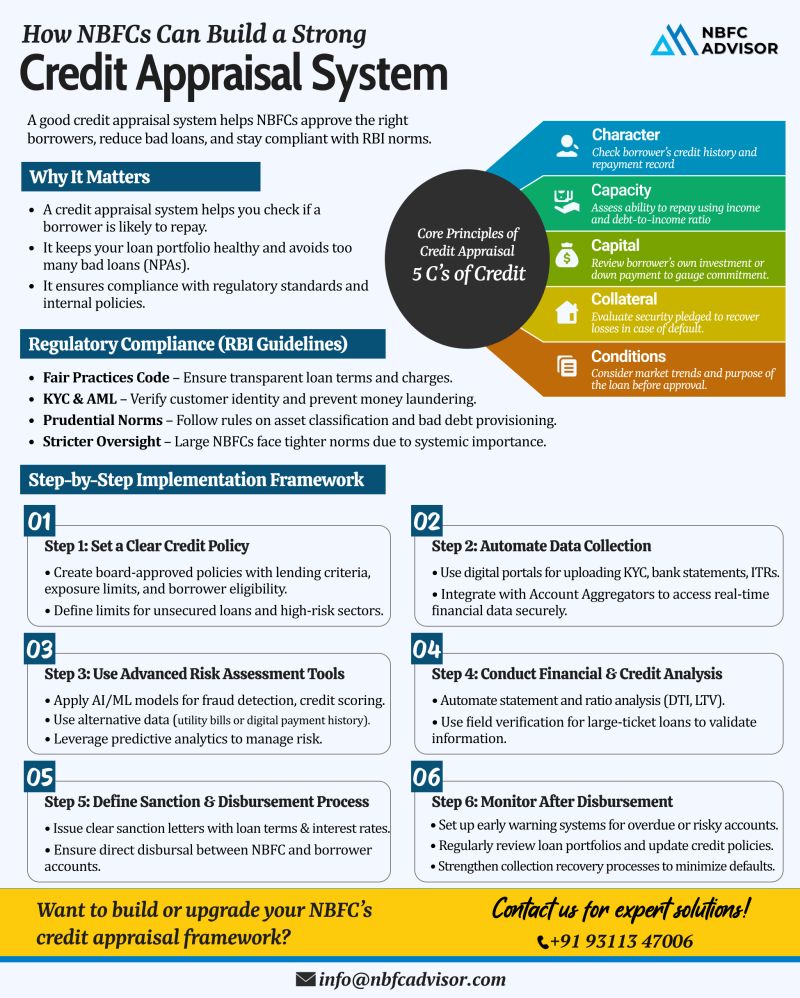

Want to Reduce Loan Defaults? Strengthen Your Credit Appraisal Process 💡

Smart Credit Assessment = Safer Lending

In today’s competitive lending environment, Non-Banking Financial Companies (NBFCs) face increasing pressure to maintain por...

Why Are NBFCs Turning to Loan Against Property (LAP)?

India’s Non-Banking Financial Companies (NBFCs) are entering a new growth phase — and Loan Against Property (LAP) is leading the way.

The Shift Toward Secure, Reliable, and Scala...

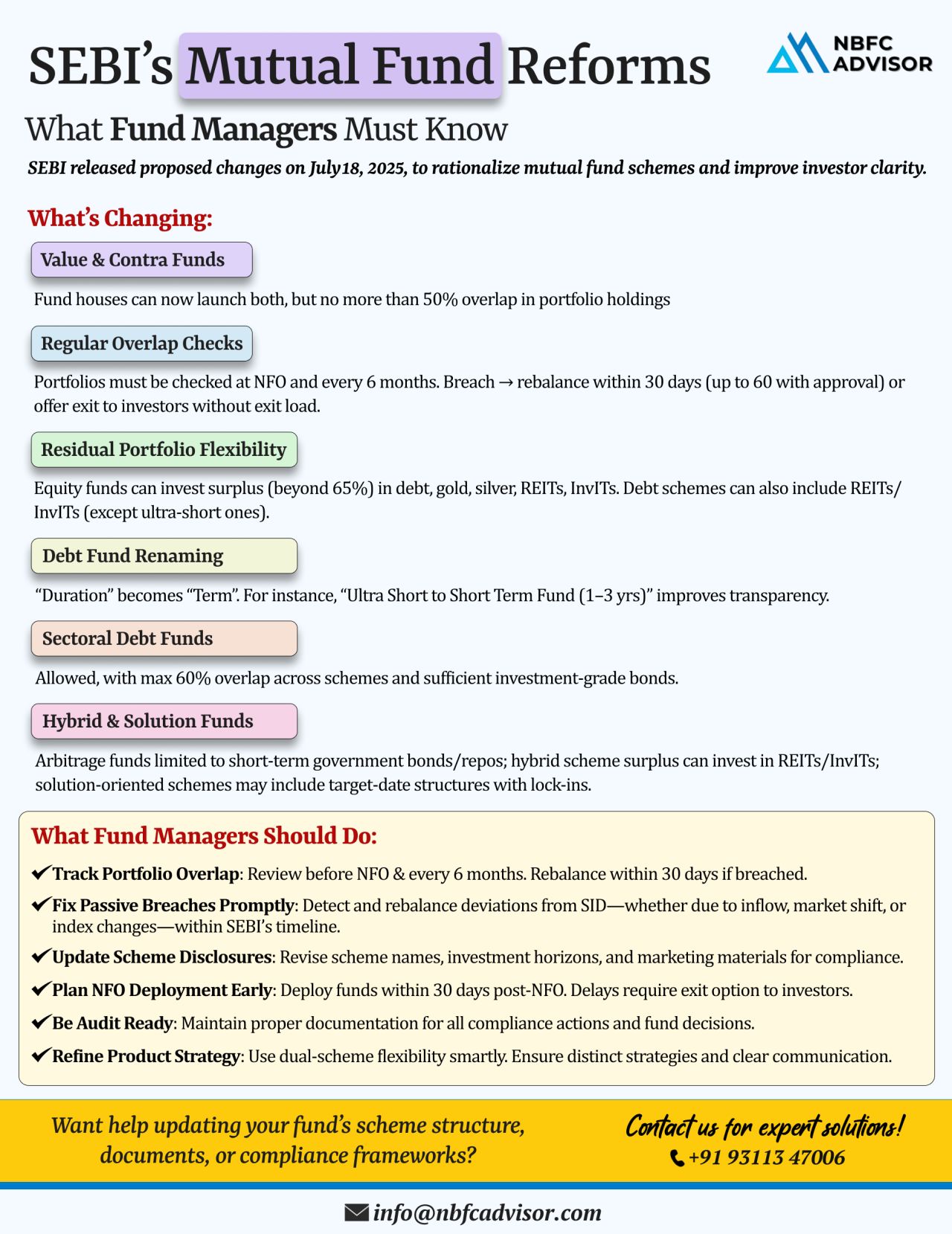

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

📰 SEBI’s Mutual Fund Reforms: Enhancing Clarity, Transparency & Flexibility

SEBI has rolled out a set of new proposals aimed at reshaping the mutual fund space with a focus on clarity, improved risk management, and smarter investment st...

RBI to Tighten Oversight of NBFCs in FY26: What You Need to Know

The Reserve Bank of India (RBI) is set to enhance regulatory scrutiny over Non-Banking Financial Companies (NBFCs) in the upcoming financial year, FY26. The focus will primarily be o...

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘶𝘭𝘦𝘴 𝘈𝘳𝘦 𝘊𝘩𝘢𝘯𝘨𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under an entirely new regulatory framework—and the implications are significant for startups, inves...

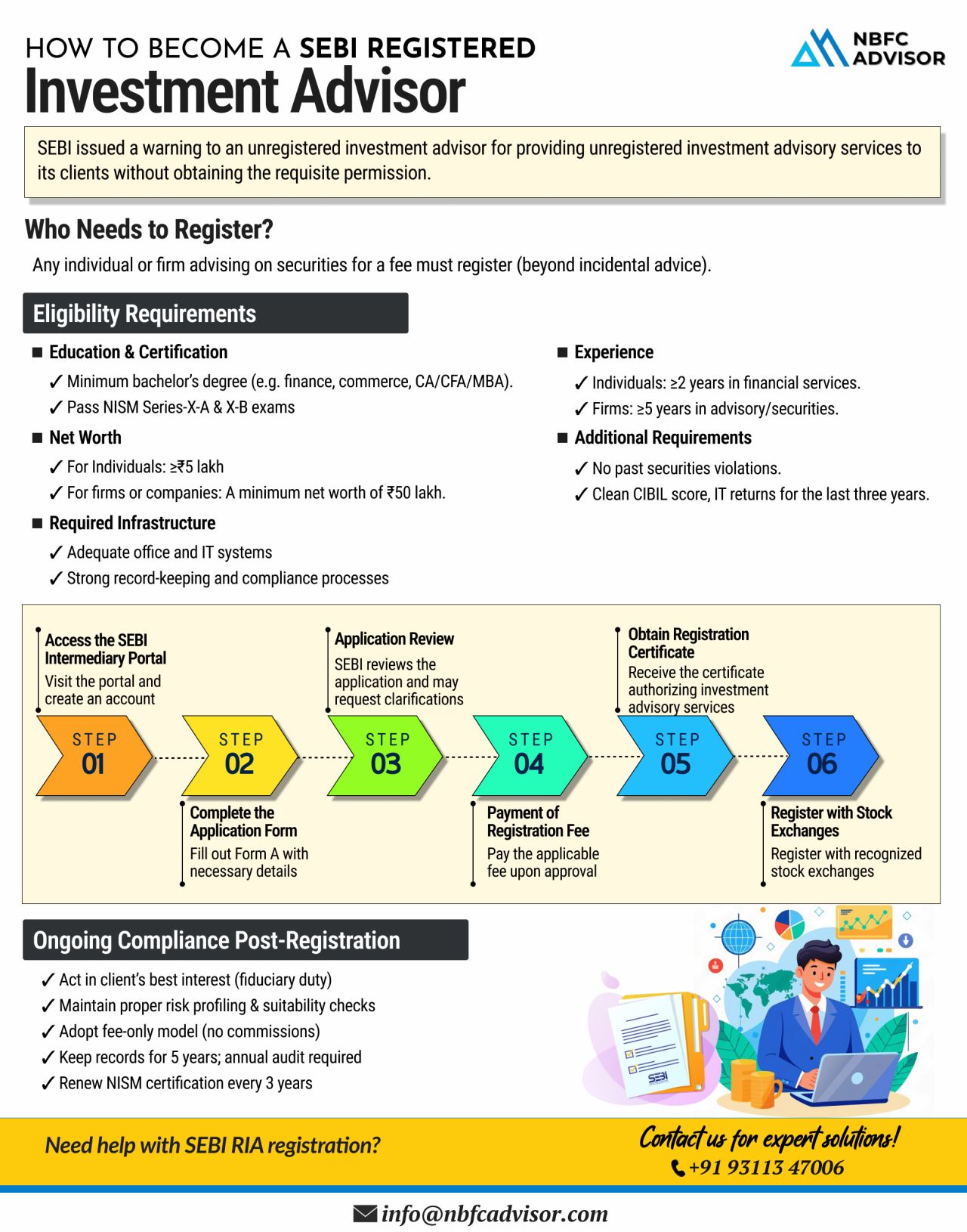

⚠️ SEBI Issues Stern Warning to Unregistered Investment Advisors – Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strong warning to unregistered investment advisors. If you're offering financia...

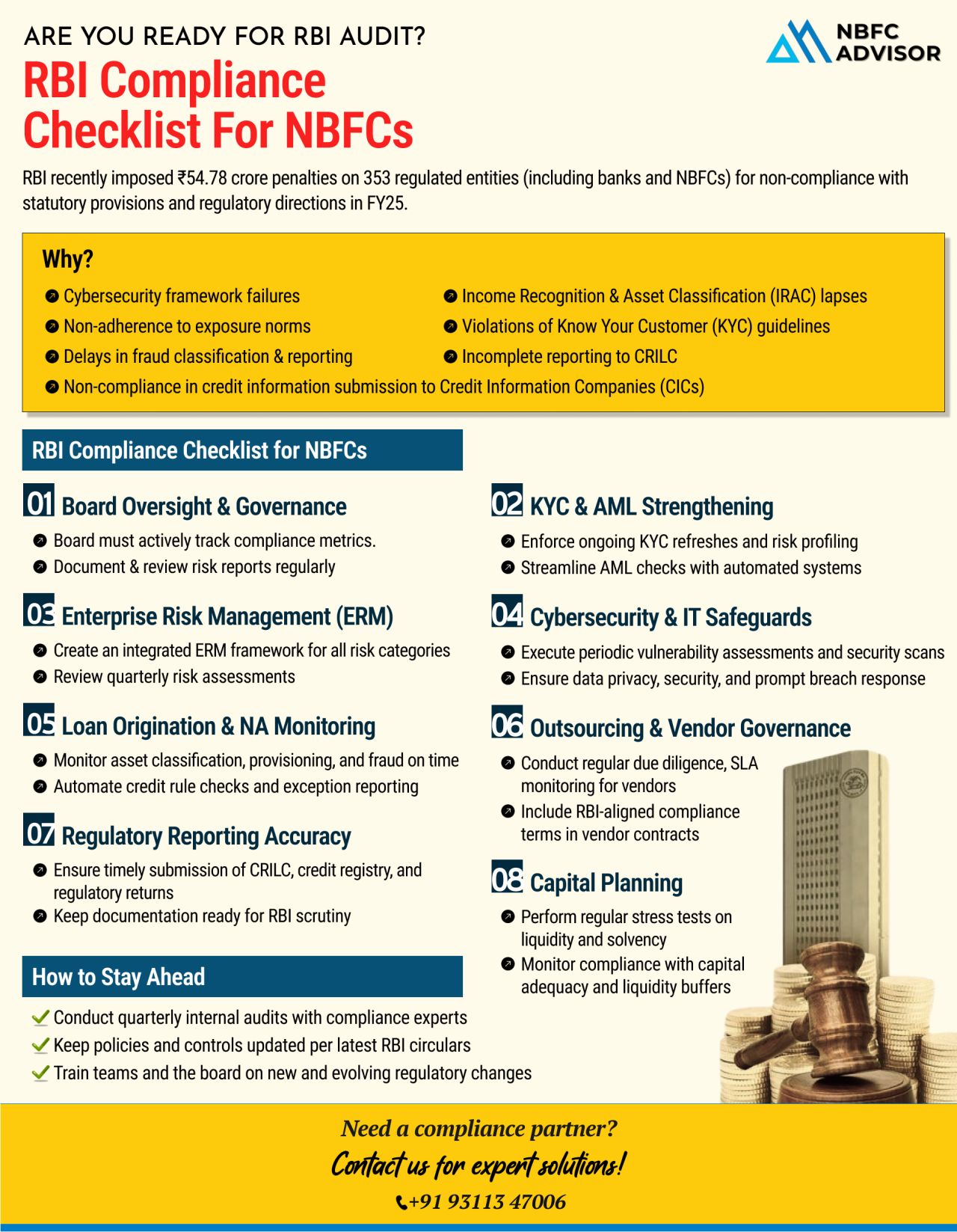

Are You Truly Ready for an RBI Audit?

In FY25 alone, over ₹54.78 crore in penalties were imposed on more than 350 regulated entities, including NBFCs.

Many of these penalties could have been avoided with stronger internal systems and proactive co...

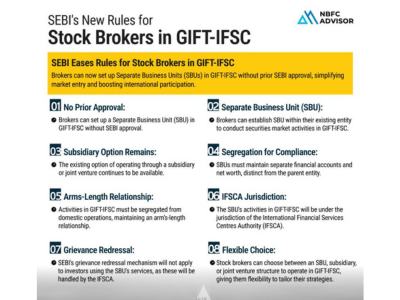

The Securities and Exchange Board of India (SEBI) has unveiled a progressive framework to ease the entry of Indian stock brokers into the GIFT-International Financial Services Centre (GIFT-IFSC). This move is set to simplify cross-border operations a...

The Reserve Bank of India (RBI) has introduced updated guidelines aimed at strengthening gold loan practices and enhancing the co-lending framework for better transparency, responsible lending, and financial inclusion.

Key Highlights:

✅ L...

The Reserve Bank of India (RBI) has launched the PRAVAAH Portal — a centralized online platform designed to streamline all regulatory approval processes.

What is PRAVAAH?

PRAVAAH (Platform for Regulatory Application, Validation, and Autho...

XBRL (Extensible Business Reporting Language) is a standardized format designed to enhance accuracy and efficiency in financial reporting.

As per RBI regulations, all NBFCs, particularly those classified under Non-Deposit Taking and Non-Systemical...

India’s fintech ecosystem has rapidly evolved into one of the most dynamic and innovative sectors in the world. While payments, digital banking, and other services have played an important role, lending has emerged as the primary driver of prof...

On August 16, 2024, the Reserve Bank of India (RBI) issued a notification announcing significant revisions to the Master Direction – Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017 (‘Dir...

Introduction

The Securities and Exchange Board of India (SEBI) has recently introduced significant amendments to the regulations governing Category I and Category II Alternative Investment Funds (AIFs), with a specific focus on borrowing provision...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

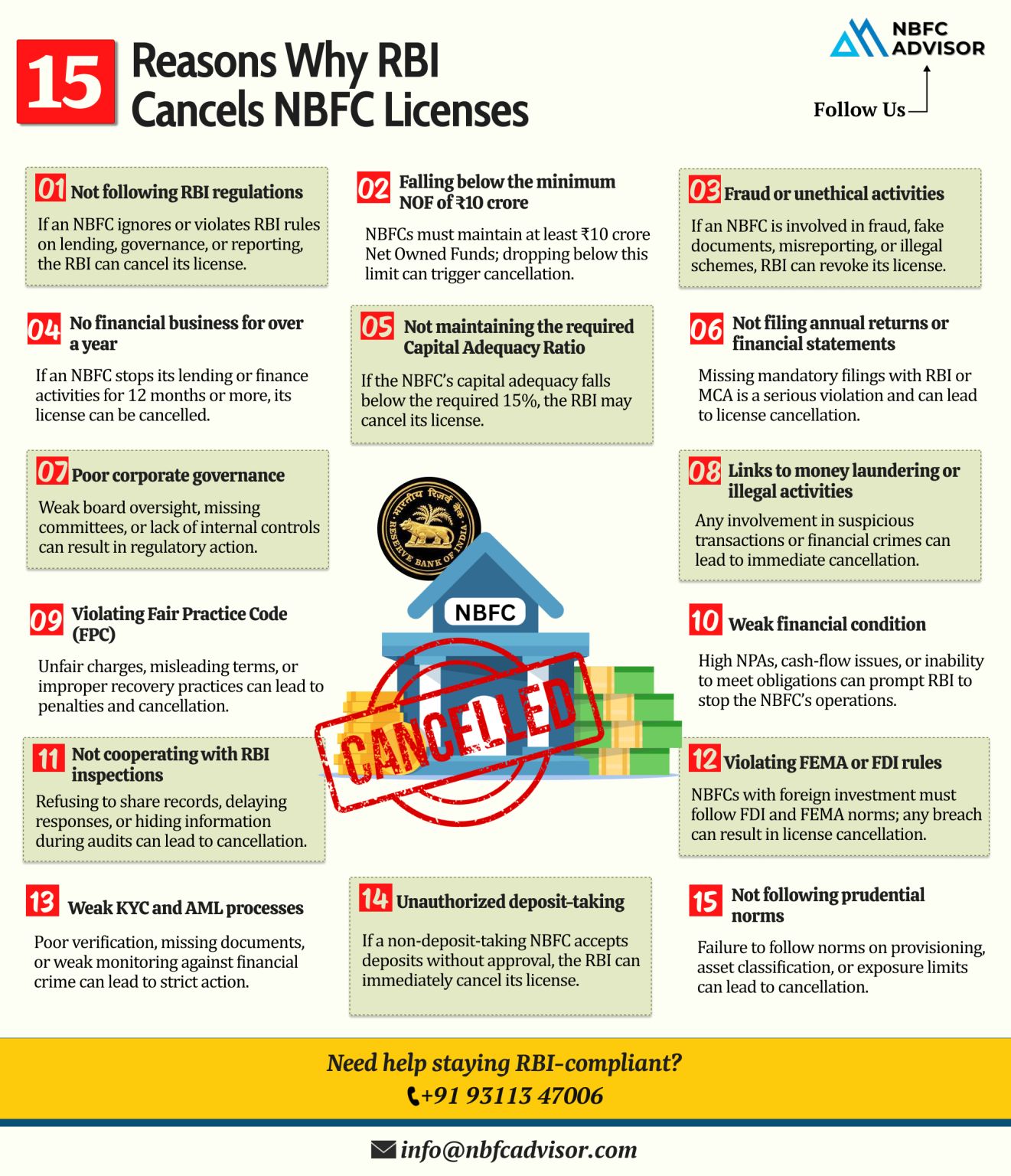

In a significant move reinforcing its commitment to maintaining financial stability and consumer protection, the Reserve Bank of India (RBI) recently canceled the licenses of two non-banking financial companies (NBFCs) - Polytex India Ltd, based in M...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

Imagine being able to withdraw cash from an ATM without using your card or deposit cash using only your smartphone. Thanks to the efforts of the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), this is now possible w...

The fintech landscape has undergone significant transformations in recent years, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for continue...

On May 28, 2024, Shri Shaktikanta Das, Governor of the Reserve Bank of India (RBI), inaugurated three significant initiatives to enhance regulatory processes and financial inclusivity. The launch event was attended by prominent figures, including Shr...

To bolster transparency and protect the interests of borrowers utilizing digital lending platforms, the Reserve Bank of India (RBI) has introduced guidelines aimed at regulating loan aggregators, now termed Lending Service Providers (LSPs).

These ...

The Reserve Bank of India (RBI) has introduced draft guidelines that aim to bring transparency and fairness to the digital lending space. These guidelines are specifically targeted at regulating Lending Service Providers (LSPs), previously known as l...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

In recent years, the fintech landscape in India has witnessed a remarkable evolution, with digital lending emerging as a disruptive force reshaping traditional financial models. As we look ahead to 2024, the digital lending industry is poised for con...

In today's rapidly evolving technological landscape, the financial industry has witnessed a significant transformation, with digital lending emerging as a promising avenue for entrepreneurs. This article serves as a comprehensive guide for aspiri...

In an era marked by rapid technological advancements, the landscape of digital inclusion is continually evolving. This blog explores the symbiotic relationship between technological progress and the pursuit of digital inclusion, shedding light on how...

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)