Thinking of Closing Your NBFC? Key Things You Must Know Before Surrendering Your RBI License

With rising regulatory compliance, increasing operational costs, and evolving business strategies, many Non-Banking Financial Companies (NBFCs) in India a...

Planning to Exit Your NBFC? Here’s What You Need to Know Before Making a Decision

Running a Non-Banking Financial Company (NBFC) is a long-term regulatory commitment. However, many NBFC promoters today are considering an exit due to changing...

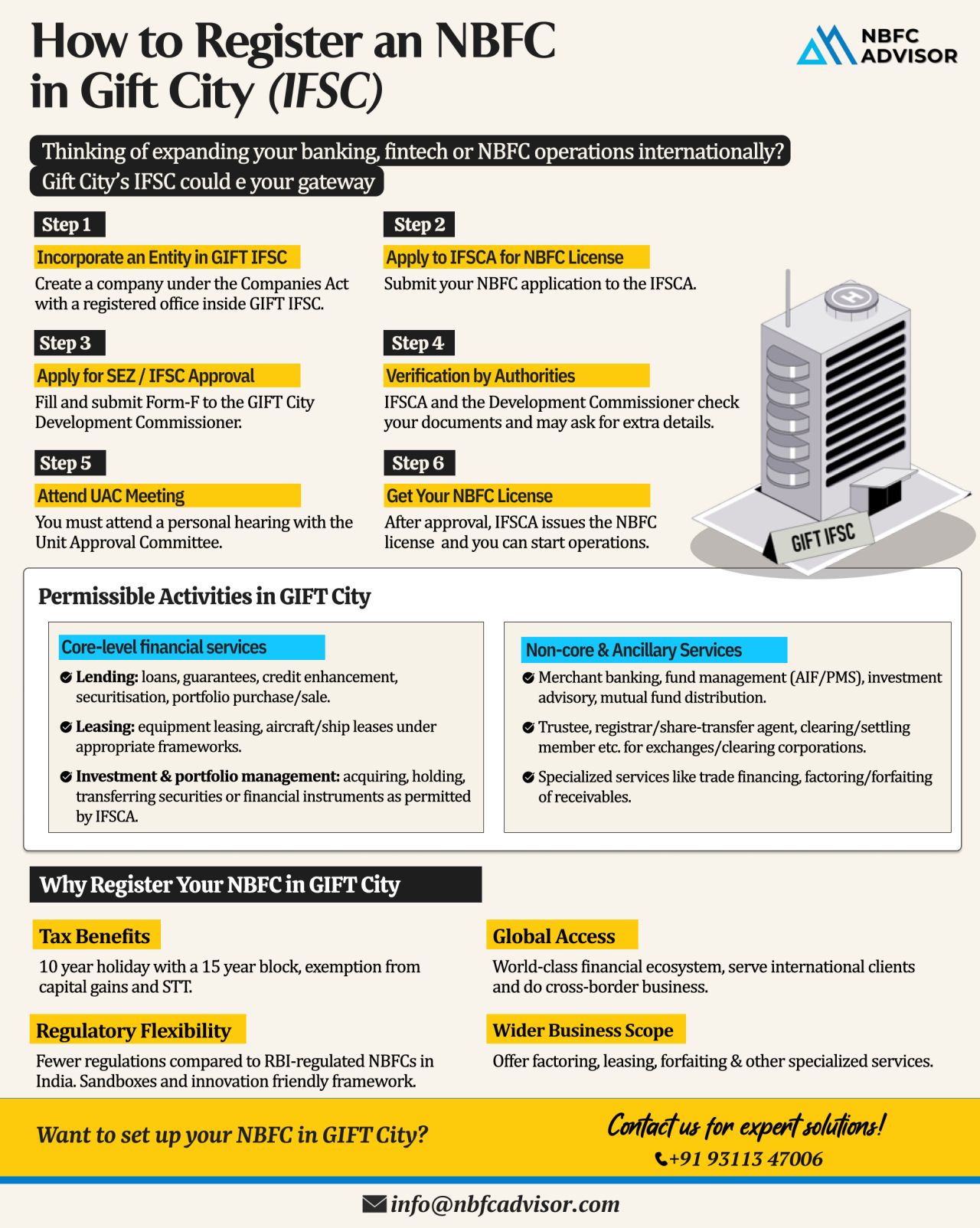

Why GIFT City? India’s Fastest-Growing Financial Gateway for NBFCs

India’s financial landscape is changing rapidly—and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Increasingly, NBFC...

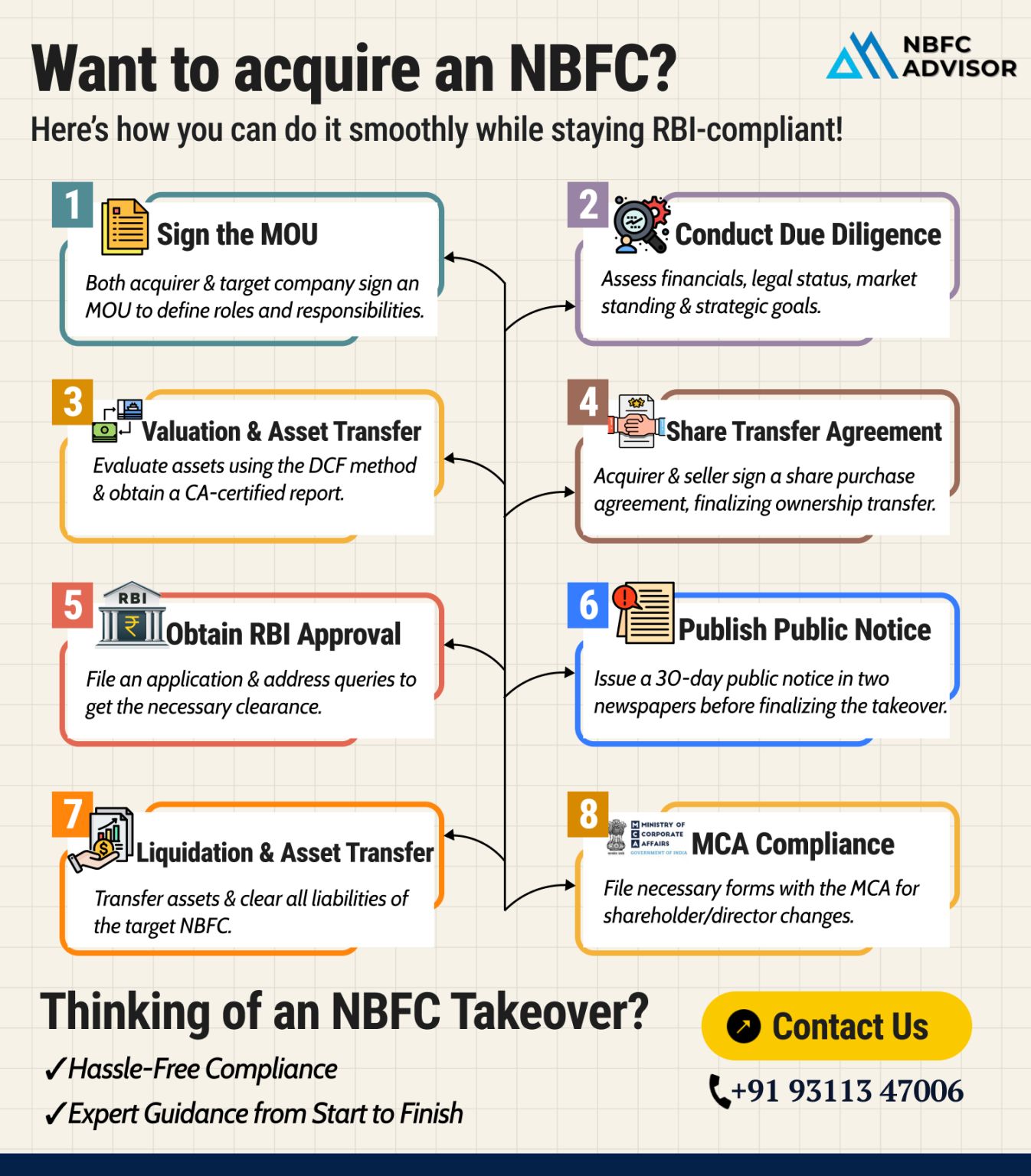

Buying an NBFC Is NOT as Simple as Signing a Deal

Buying a Non-Banking Financial Company (NBFC) may look like a shortcut into the financial sector—but in reality, an NBFC takeover is a highly regulated and detail-driven process. One small mi...

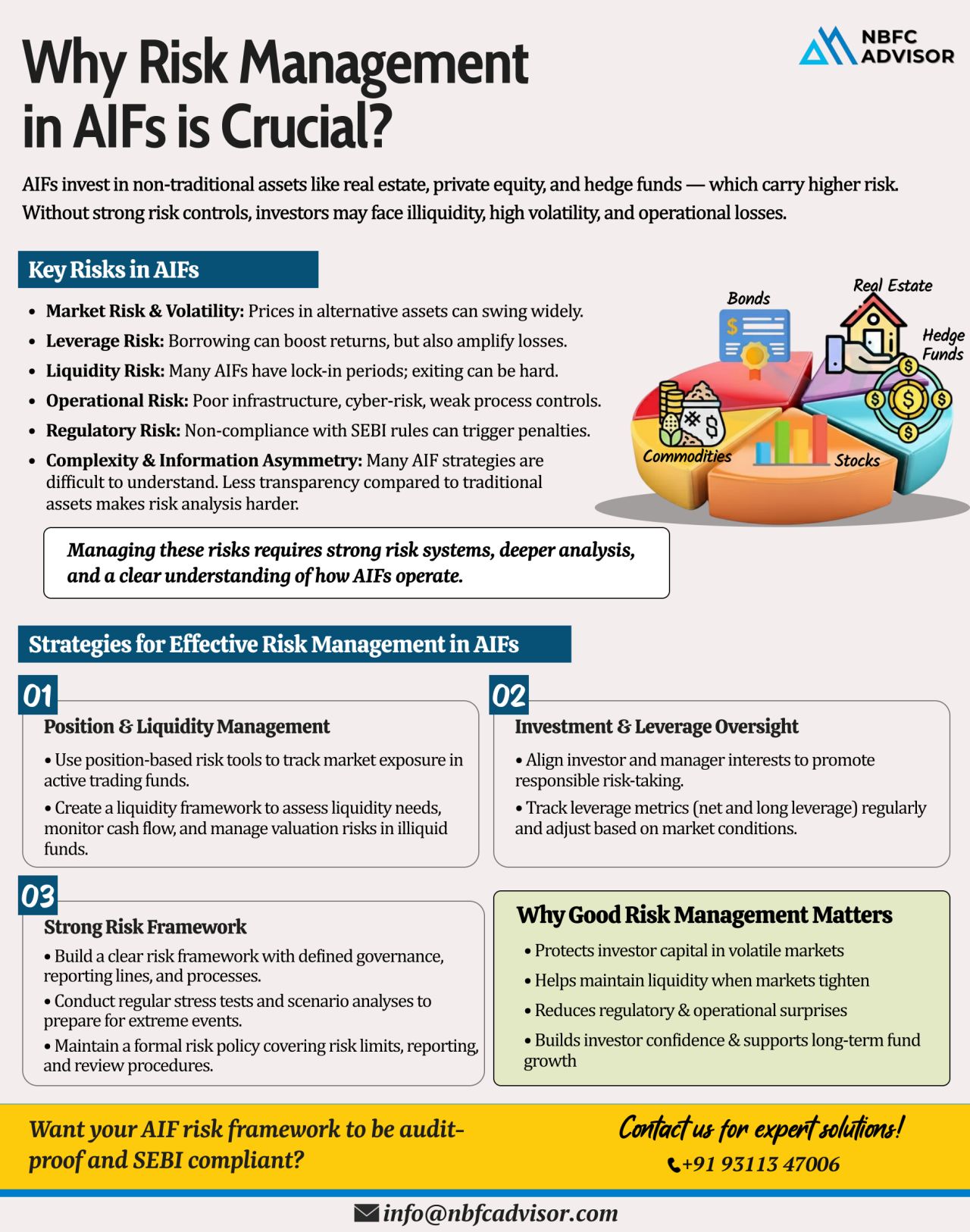

Ignoring Risk in AIFs? Even Small Market Shifts Can Create Big Losses

Alternative Investment Funds (AIFs) have become a powerful vehicle for private equity, venture capital, and high-growth investment strategies. But with higher returns come highe...

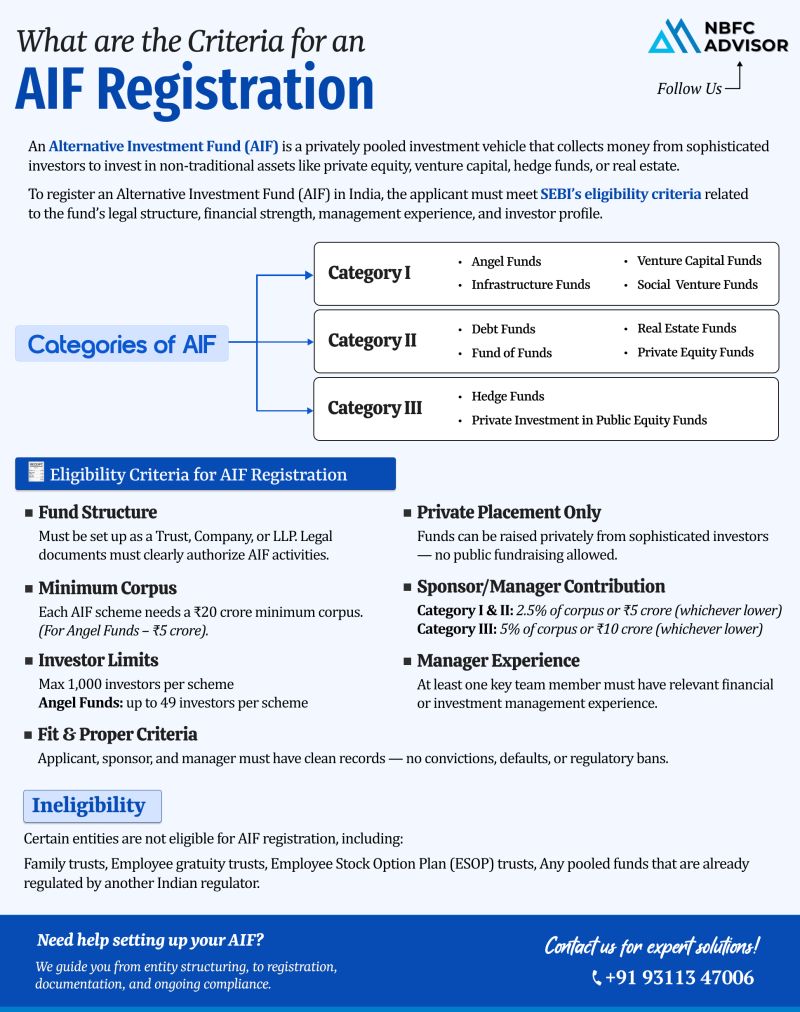

Thinking of Starting an Alternative Investment Fund (AIF)? Here’s What You Should Know

India’s financial landscape is rapidly evolving, and Alternative Investment Funds (AIFs) have emerged as one of the most attractive investment vehic...

Thinking of Starting a Digital Lending Business? Here’s What You Should Know

India’s credit ecosystem is undergoing a digital revolution. By 2030, the country’s digital lending market is projected to reach $515 billion — al...

Comprehensive Financial & Tax Services for Non-Residents (NRIs & Foreign Nationals)

Meta Title: Expert Services for Non-Residents (NRIs & Foreign Nationals) | Tax, FEMA, and RBI Consultancy

Meta Description: Simplify your India-relate...

Thinking of Starting an NBFC? Here’s Why a Takeover Might Be Smarter Than a Fresh Registration

If you’re planning to enter the lending and finance industry, setting up a Non-Banking Financial Company (NBFC) can be a powerful way to gro...

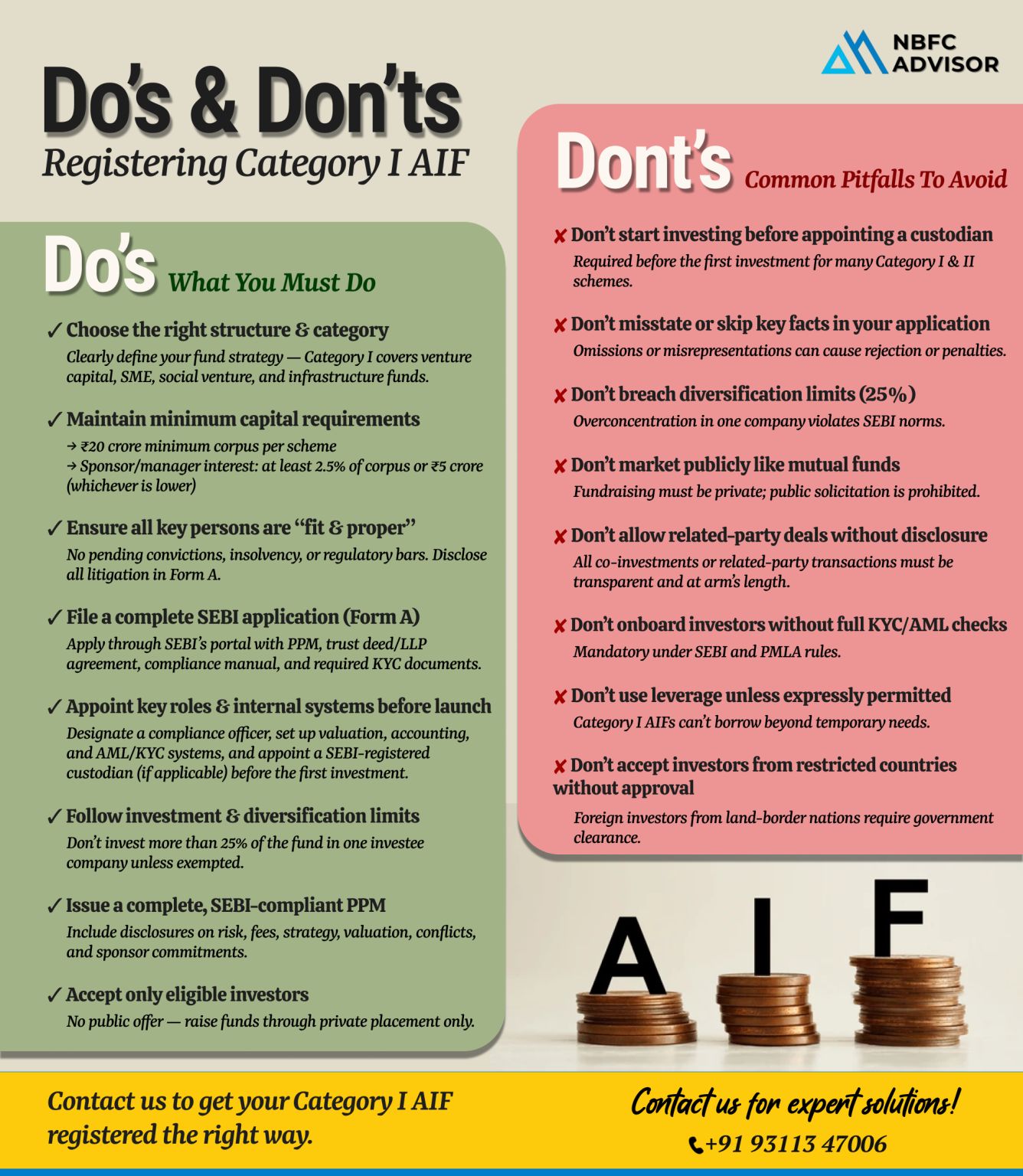

Top 10 Mistakes to Steer Clear of During AIF Registration

Registering an Alternative Investment Fund (AIF) with SEBI is a critical step toward launching a compliant and successful investment vehicle in India. However, many fund managers and promot...

🧭 SEBI’s New Mutual Fund Rules: A Shift Towards Clarity, Simplicity & Investor Confidence

To strengthen investor protection and simplify mutual fund structures, the Securities and Exchange Board of India (SEBI) has proposed a series of ...

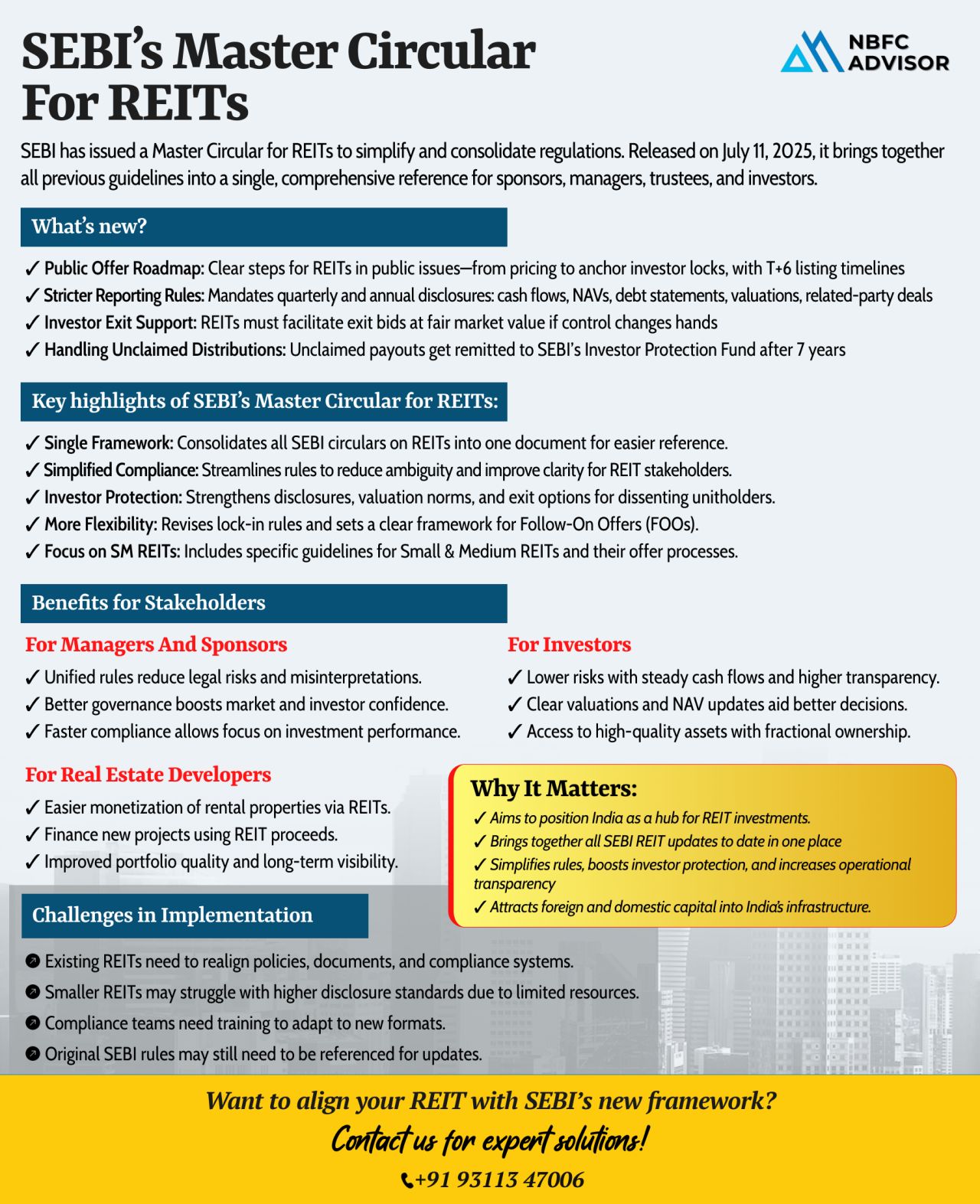

SEBI’s New Master Circular: A Landmark Move for India’s REIT Market

In a strategic step toward regulatory simplification and investor protection, the Securities and Exchange Board of India (SEBI) has released a comprehensive Master Cir...

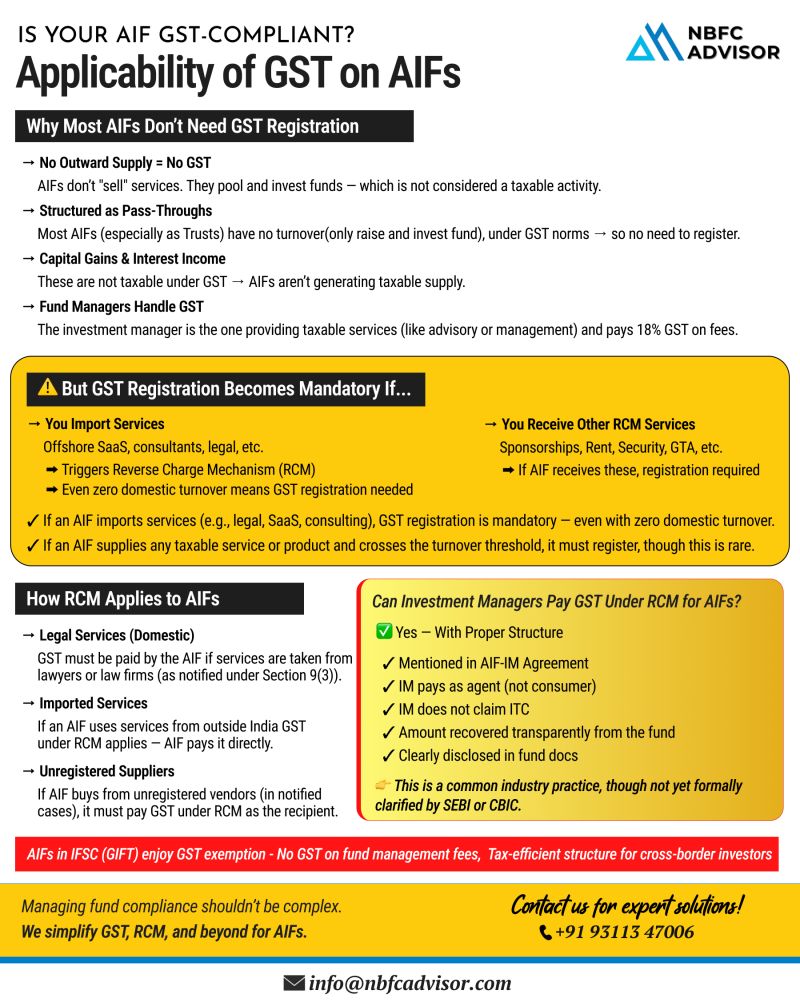

𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐑𝐞𝐪𝐮𝐢𝐫𝐞 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Understanding GST obligations for Alternative Investment Funds

As the Alternative Investment Fund (AIF) landscape continues to grow in India, so does the complexity a...

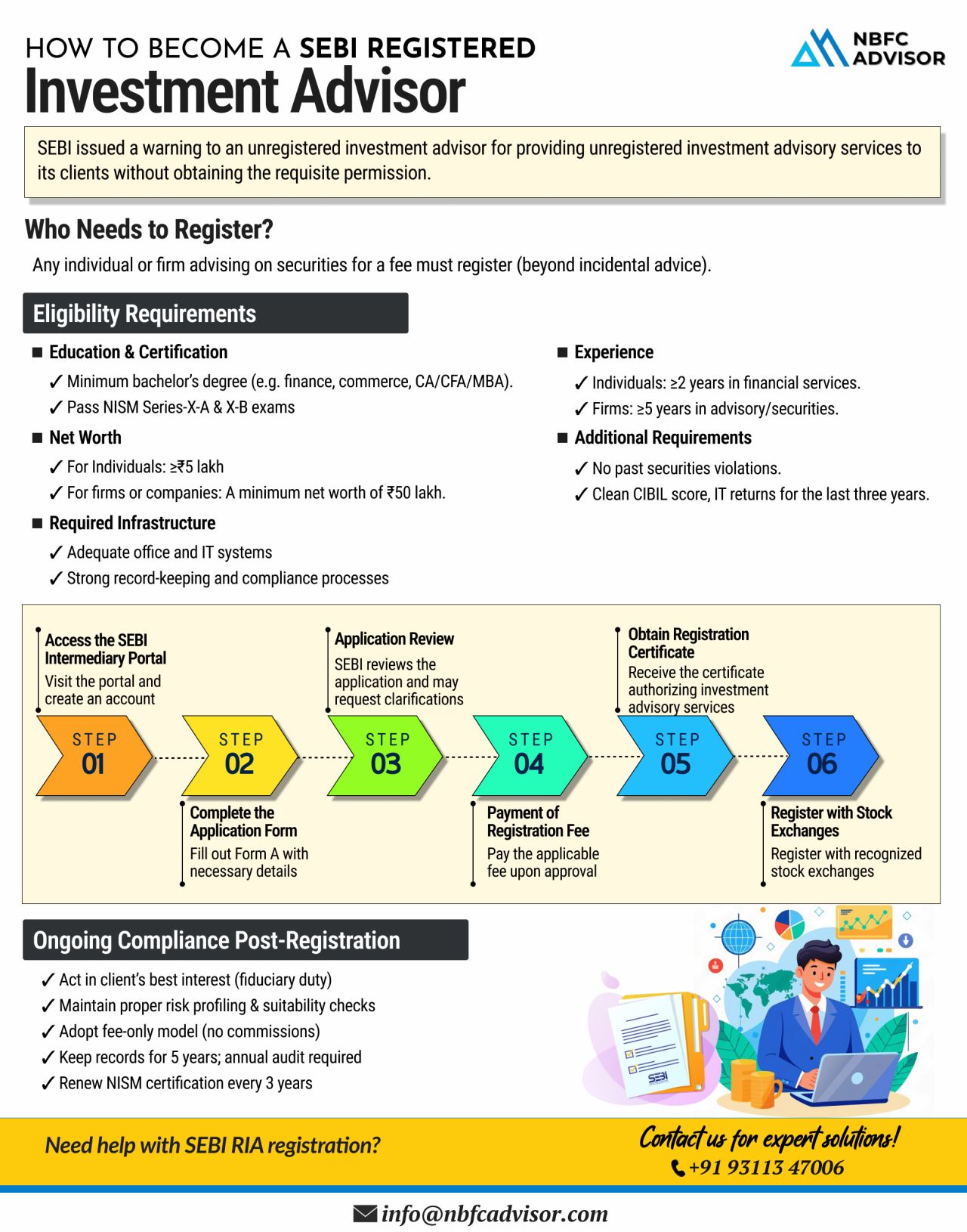

⚠️ SEBI Issues Stern Warning to Unregistered Investment Advisors – Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strong warning to unregistered investment advisors. If you're offering financia...

NBFC Accounting Services by NBFC Advisor

Looking for accurate, reliable, and hassle-free financial management for your NBFC?

At NBFC Advisor, we specialize in providing comprehensive accounting solutions exclusively for Non-Banking Financial Comp...

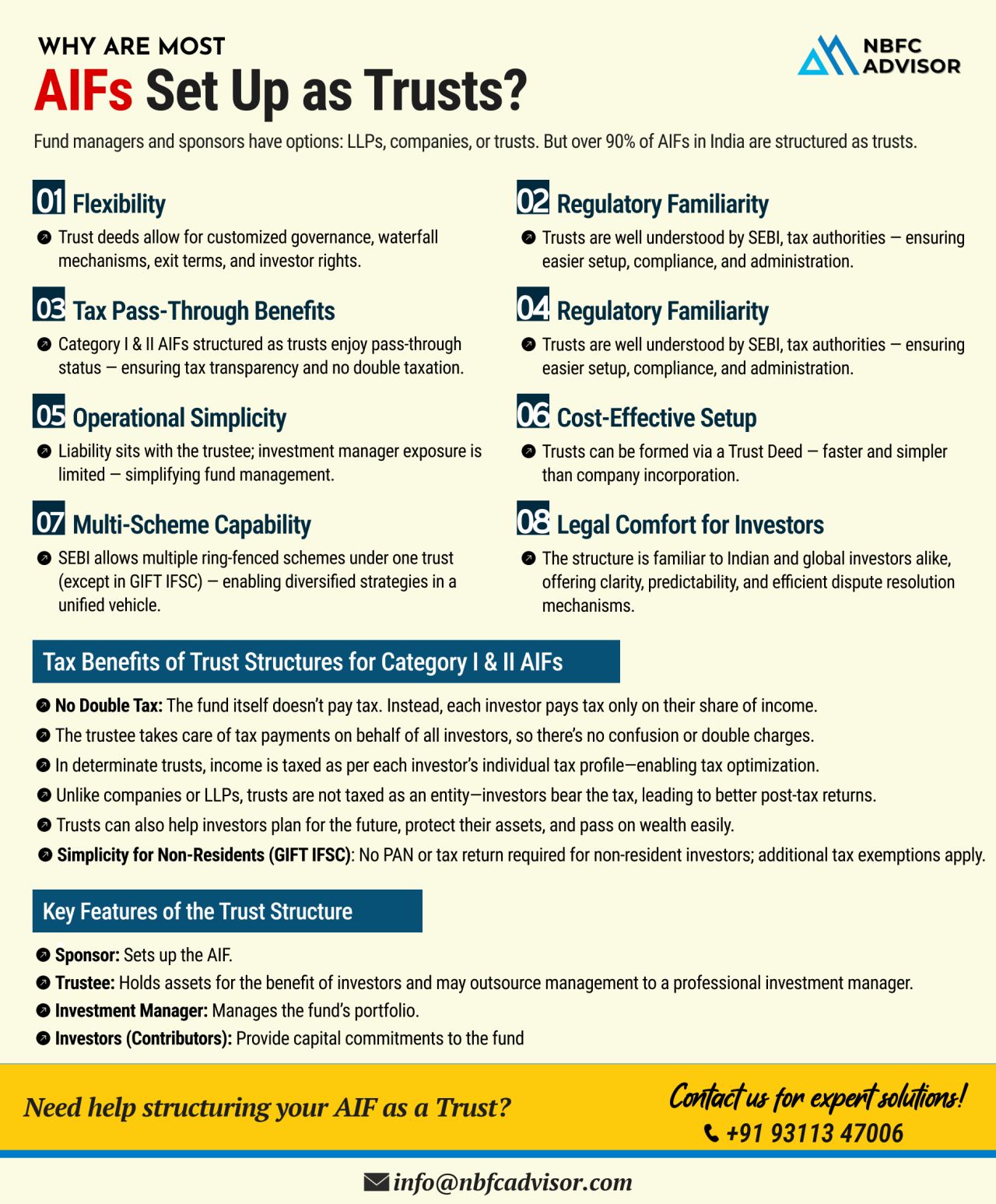

When setting up an Alternative Investment Fund (AIF), one of the most critical decisions is choosing the right legal structure. Should you go for an LLP, a Company, or a Trust?

Let’s break down why most AIFs prefer the Trust route.

Why Fu...

𝐈𝐬 𝐘𝐨𝐮𝐫 𝐍𝐁𝐅𝐂 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

Compliance Isn’t Optional — It’s Essential.

It’s not just about following rules. Compliance is the foundation of trust, sustainable growth, and long-term success for every NBFC.

...

If you’re passionate about guiding people toward better financial decisions, becoming a SEBI Registered Investment Advisor (RIA) is a smart and impactful career move.

India needs more qualified, ethical, and SEBI-recognized advisors—an...

Are you planning to start your own Portfolio Management Service (PMS)? There’s never been a better time—especially if you leverage the exceptional advantages offered by GIFT City, India’s only International Financial Services Centre...

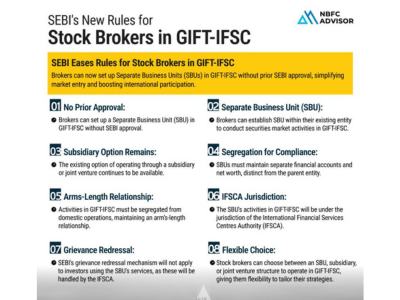

The Securities and Exchange Board of India (SEBI) has unveiled a progressive framework to ease the entry of Indian stock brokers into the GIFT-International Financial Services Centre (GIFT-IFSC). This move is set to simplify cross-border operations a...

India’s NBFC sector is projected to reach ₹60 trillion by FY26—now is the perfect time to enter the market.

Why Start an NBFC?

✔ Fintech NBFCs are growing rapidly

✔ Huge demand in credit-deprived sectors

✔ Faster loan disbursals t...

Non-Banking Financial Companies (NBFCs) are grappling with mounting defaults, prolonged legal processes, and tightening cash flows. In today’s landscape, debt recovery isn’t just about compliance—it’s about business continuity...

The Reserve Bank of India (RBI) has launched the PRAVAAH Portal — a centralized online platform designed to streamline all regulatory approval processes.

What is PRAVAAH?

PRAVAAH (Platform for Regulatory Application, Validation, and Autho...

The Reserve Bank of India (RBI) has imposed fines on six NBFCs for violating key regulatory norms under the RBI Act, 1934. These penalties, totaling over ₹60 lakh, highlight RBI’s tightening grip on governance and compliance.

Who Got Fined...

The Alternative Investment Fund (AIF) industry in India is booming, with a 35% CAGR over the last five years!

AIFs provide investors with an opportunity to diversify beyond traditional assets like stocks and bonds. With targeted investments in hig...

Become a Leader in the Financial Sector with Expert Guidance

Are you looking to start your own Non-Banking Financial Company (NBFC) or FinTech Lending Company?

Our team of Consultants & Ex-Bankers will guide you every step of the way!

CO...

India's lending sector is on a meteoric rise, fueled by an expanding middle class, fintech innovation, and strong regulatory support.

This growth presents a golden opportunity for foreign investors, fintech firms, and financial instituti...

When an ambitious NRI entrepreneur set out to acquire an NBFC in India, he faced a maze of consultants, delays, and false promises. Despite assigning the mandate to a consultant, he soon realized their approach wasn’t aligned with his vision.

...

₹12 lakh income? No tax.

₹12,10,000 income? ₹61,500 tax?

What happens if your income exceeds ₹12 lakh by just ₹1?

Did you know that earning just ₹1 extra above ₹12 lakh could shoot up your tax liability disproportionately?

That’s wh...

The alternative investment industry in India is experiencing a remarkable surge, outpacing traditional mutual funds at an unprecedented rate. Over the last five years, from June FY19 to June FY24, the industry has achieved a Compound Annual Growth Ra...

In a significant move reinforcing its commitment to maintaining financial stability and consumer protection, the Reserve Bank of India (RBI) recently canceled the licenses of two non-banking financial companies (NBFCs) - Polytex India Ltd, based in M...

Please remember the following information regarding Non-Banking Financial Companies (NBFCs):

NBFCs play a vital role in providing funding to the Indian economy, and the Reserve Bank of India (RBI) is responsible for regulating and supervising thes...

As regulatory expectations evolve, Non-Banking Financial Companies (NBFCs) face increasing demands to develop comprehensive policies ensuring compliance, effective risk management, and robust governance. This is particularly crucial for NBFCs in the ...

In the fast-paced world of finance, efficient loan management is crucial for lenders to stay competitive. A loan management system (LMS) is a digital platform designed to simplify and automate the entire loan lifecycle, from application to repayment....

A Comprehensive Guide to the Money Changer Business

In our increasingly globalized world, the demand for currency exchange services is on the rise. From tourists to business travelers, the need for quick and reliable money changing services is eve...

A Non-Banking Financial Company (NBFC) provides various financial services such as loan facilitation, stock acquisition, hire-purchase, and insurance, contributing significantly to the nation’s financial growth. To establish an NBFC in India, u...

The fintech industry has seen remarkable growth in recent years, reshaping how financial services are delivered and accessed. However, this rapid evolution has presented a plethora of regulatory challenges, given the intersection of finance and techn...

In today's dynamic financial landscape, small Non-Banking Financial Companies (NBFCs) and FinTech players face unique challenges and opportunities. While these entities strive to compete with larger institutions, they often encounter resource con...

In the intricate world of finance, regulatory compliance stands as the bedrock of stability and credibility. This blog explores the profound impact of NBFC Advisor, showcasing how its expert guidance has been instrumental in steering Non-Banking Fina...

In the intricate world of finance, Non-Banking Financial Companies (NBFCs) operate within a nuanced regulatory landscape. This blog offers an insightful exploration into the complexities, nuances and critical role of compliance in shaping the traject...

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)